Material Handling Equipment Market Size, Share, Trends, Industry Analysis Report

: By Equipment Type (Transport Equipment, Positioning Equipment, Storage Equipment, and Others), Industry, and Region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 117

- Format: PDF

- Report ID: PM1397

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

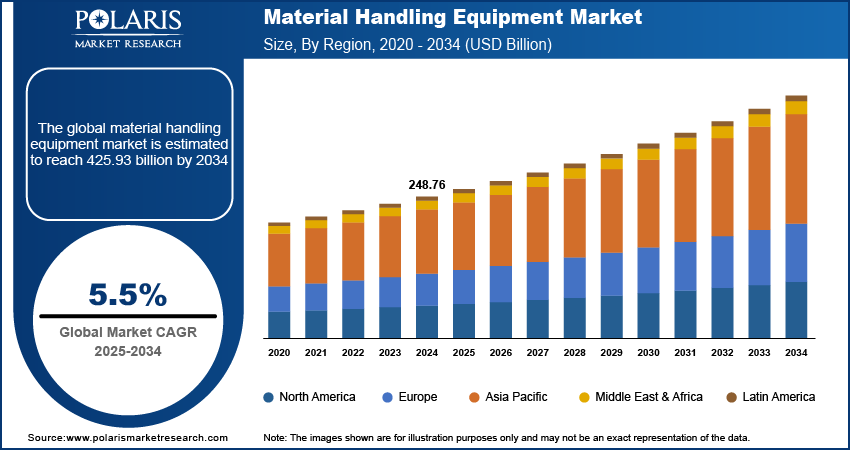

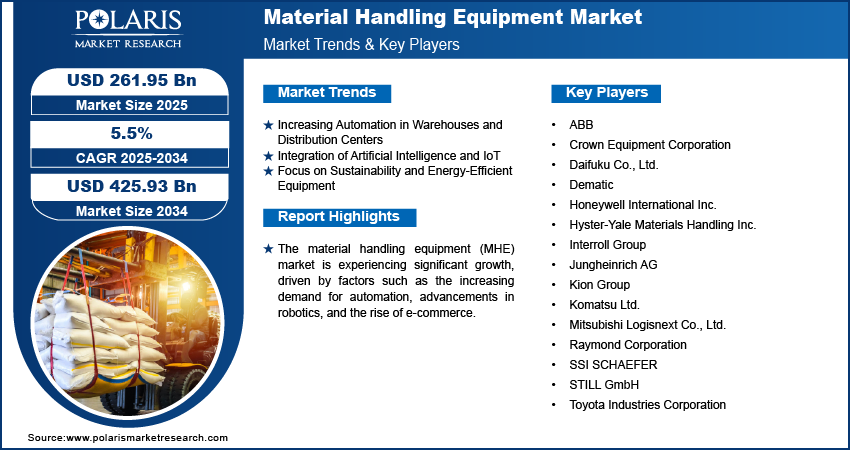

The material handling equipment market size was valued at USD 248.76 billion in 2024, exhibiting a CAGR of 5.5% during 2025–2034. The market is fueled by growing automation in warehouses, the growth of e-commerce, the convergence of AI and IoT technologies, and an escalating concern for sustainability and energy-efficient solutions.

Key Insights

- The transportation equipment industry leads the market due to its central role in the movement of products, with growth spurred by mounting automation and the need for faster, more efficient logistics.

- The food & beverages industry is experiencing high growth, fueled by the need to conserve time and resources used in processing, packaging, and transportation while maintaining strict security precautions.

- It is led globally by North American revenue, powered by growing automation adoption, high-end infrastructure, and the highest concentration of high-value industries, including consumer goods, automotive, and e-commerce.

- Europe is a leading revenue generator in the market, driven by the resilience of its industrial foundation and investments in automation solutions.

- Asia Pacific is expanding at the fastest pace, led by China and India's growing emphasis on automation, regional urbanization, and industrialization, as well as the increasing role of e-commerce in China, India, and Japan.

Industry Dynamics

- The growing emphasis on sustainability and energy-efficient machinery is likely to promote the growth of the material handling equipment market over the next few years.

- One of the main restraints in the market is the exorbitant initial cost and maintenance charges for cutting-edge automation technology.

- The growing emphasis on energy efficiency and sustainability is likely to fast-track growth in the material handling equipment market over the next few years.

- One major restraint in the market is that high-end automation technologies have high initial costs and maintenance expenses.

Market Statistics

2024 Market Size: USD 248.76 billion

2034 Projected Market Size: USD 425.93 billion

CAGR (2025-2034): 5.5%

North America: Largest Market Share

AI Impact on Material Handling Equipment Market

- AI enhances predictive maintenance by monitoring equipment performance data, thereby reducing downtime and increasing operational efficiency.

- The technology of automation and robotics, fueled by AI, simplifies processes such as stock management, order picking, and sorting, making them more efficient.

- Machine learning algorithms optimize material flow, route planning, and the allocation of storage space, thereby lowering costs.

- AI integration enables real-time decision-making and analytics, providing enhanced visibility and control over supply chain activities.

To Understand More About this Research:Request a Free Sample Report

The material handling equipment (MHE) market focuses on the manufacturing, distribution, and use of equipment designed to move, store, control, and protect materials throughout the manufacturing, distribution, and disposal stages of the supply chain. This market offers products such as conveyors, cranes, forklifts, automated storage systems, and robotic systems. The increasing demand for automation in warehouses and distribution centers, growing adoption of e-commerce, and the rising need for improved operational efficiency and safety in industrial operations boost the market growth. MHE market trends include the adoption of Industry 4.0 technologies, such as robotics and the Internet of Things (IoT), and the integration of AI for predictive maintenance and optimization. Additionally, the growing focus on sustainability and energy-efficient solutions is contributing to market growth.

Market Dynamics

Increasing Automation in Warehouses and Distribution Centers

One of the major trends in the Material Handling Equipment (MHE) market is the increasing automation in warehouses and distribution centers. Automation is being adopted to improve efficiency, reduce labor costs, and enhance safety in operations. Technologies such as automated guided vehicles (AGVs), robotic arms, and conveyor systems are being integrated to optimize material handling processes. In the US, over 50% of warehouses have implemented some form of automation, with this number expected to grow as businesses seek ways to streamline operations and meet the growing demand for faster delivery times in e-commerce. The adoption of robotic systems has allowed for more efficient inventory management, order picking, and packaging. Hence, the increasing adoption of automation in warehouses and distribution centers drives the material handling equipment market development.

Integration of Artificial Intelligence and IoT

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) technology is transforming material handling operations. AI technologies are being utilized to enhance predictive maintenance, analyze data for operational optimization, and improve decision-making processes. IoT-enabled devices help track materials in real time, providing greater visibility and control over inventory management. According to a report by the International Federation of Robotics (IFR), the number of industrial robots installed in warehouses has increased by approximately 30% in recent years, showcasing the growing importance of AI in automation. These advancements enable companies to reduce downtime, enhance productivity, and better manage supply chains, resulting in cost savings and improved efficiency. Thus, the integration of AI and IoT in material handling equipment is expected to propel the material handling equipment market growth during the forecast period.

Focus on Sustainability and Energy-Efficient Equipment

The push toward sustainability is becoming increasingly significant in the MHE market. Companies are focusing on adopting energy-efficient equipment and environmentally friendly solutions in response to stricter regulations and growing environmental concerns. Electric-powered forklifts and other material handling equipment are becoming more common as businesses aim to reduce their carbon footprint and energy consumption. According to the Electric Power Research Institute (EPRI), electric forklifts can reduce energy consumption by up to 30% compared to their internal combustion counterparts. This trend aligns with the broader corporate push for sustainability, as companies seek to improve both their environmental impact and operational efficiency through cleaner technologies. Therefore, the rising focus on sustainability and energy-efficient equipment is projected to boost the material handling equipment market expansion in the coming years.

Segment Insights

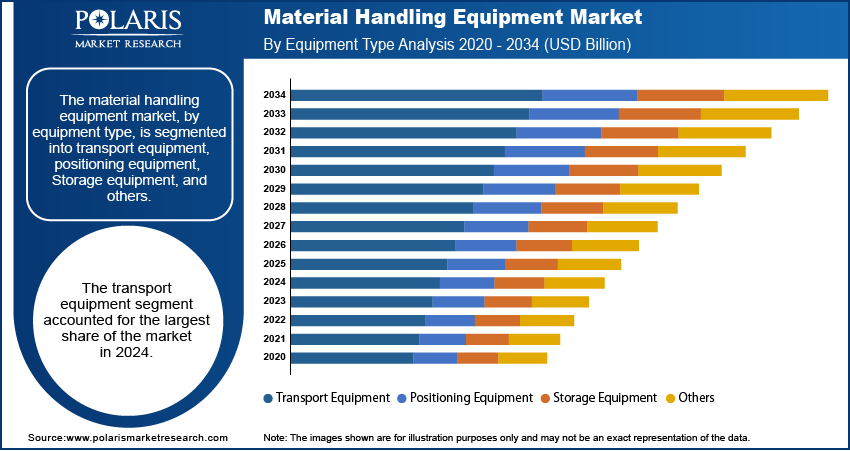

Market Outlook – Equipment Type-Based Insights

The MHE market, by equipment type, is segmented into transport equipment, positioning equipment, storage equipment, and others. The transport equipment segment holds the largest market share. Transport equipment, which includes forklifts, conveyors, and cranes, plays a critical role in the movement of materials across manufacturing and warehouse facilities. This segment benefits from the growing demand for automation in logistics and the increasing need for faster and more efficient movement of goods. Additionally, positioning equipment, which includes products such as hoists and manipulators, is witnessing strong growth due to its importance in ensuring the precise handling and placement of materials. The demand for such equipment is expected to rise with the expanding trend of automation in various industries such as manufacturing, automotive, and e-commerce, where precision in material handling is essential.

The storage equipment segment is another key segment showing robust growth. The segment includes racks, shelving, and automated storage/retrieval systems. The segment growth is driven by the increasing need for optimized storage solutions in warehouses and distribution centers to manage the rising volume of goods, particularly in e-commerce. Automated storage systems, in particular, are gaining traction due to their ability to improve storage management and operational efficiency. The other segment includes miscellaneous handling equipment such as pallets and bins, which contributes to the overall market but remains relatively smaller in comparison to the major equipment types. As automation and e-commerce continue to expand, the demand for all these equipment types is expected to increase, with transport and storage equipment leading the material handling equipment market share and growth.

Market Assessment – Industry-Based Insights

The MHE market, based on industry, is segmented into consumer goods & electronics, automotive, food & beverages, pharmaceutical, construction, mining, semiconductors, and others. The market is experiencing significant growth across various industries, with the consumer goods and electronics segment holding the largest market share. The increasing demand for consumer goods, particularly in e-commerce, has driven the need for more efficient material handling solutions. The electronics segment also contributes significantly to this sector, where fast-paced production lines and the need for precise handling of delicate components require specialized equipment. Both these industries are experiencing rapid digitalization and automation, leading to the growing adoption of automated material handling systems to meet the rising demand for faster delivery times and enhanced operational efficiency.

The food & beverage segment is registering strong growth in the MHE market, driven by the need for efficient processing, packaging, and distribution of goods under stringent safety standards. The pharmaceutical sector follows closely, with a growing demand for specialized material handling equipment designed to meet regulatory compliance and ensure the integrity of products during handling. The construction and mining sectors, while traditionally slower in adopting automation, are experiencing a shift toward more efficient material handling to reduce operational costs and improve safety in challenging environments. Additionally, sectors such as compound semiconductors and others are gradually adopting automated handling solutions to address the need for precision and scalability in their operations.

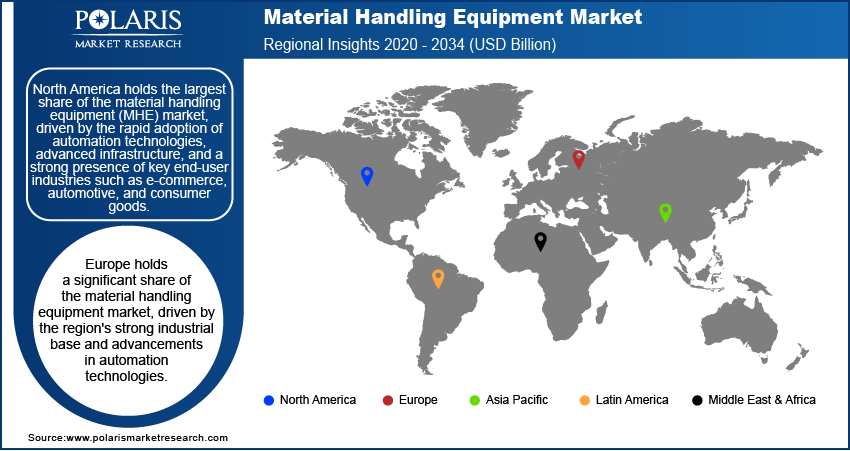

Regional Insights

By region, the study provides material handling equipment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global MHE market revenue, driven by the rapid adoption of automation technologies; advanced infrastructure; and a strong presence of key end-user industries such as e-commerce, automotive, and consumer goods. The US, in particular, leads in the implementation of automated material handling solutions, with major companies investing heavily in robotics, artificial intelligence (AI), and IoT to enhance supply chain efficiency. The region's well-established logistics networks and ongoing technological advancements further support its dominance.

Europe holds a significant share of the material handling equipment (MHE) market revenue, driven by the region's strong industrial base and advancements in automation technologies. The automotive, pharmaceutical, and food & beverage industries are a few key sectors driving demand for material handling equipment. Countries such as Germany, the UK, and France are leading in the adoption of automated systems due to the presence of large manufacturing hubs and high labor costs, which encourage companies to invest in efficiency-enhancing solutions. Additionally, the European Union's focus on sustainability and energy efficiency is pushing the development of eco-friendly material handling equipment. The increasing integration of Industry 4.0 technologies in logistics and manufacturing further supports market growth in the region.

The Asia Pacific material handling equipment market is witnessing the highest growth, primarily due to increasing focus on automation in countries such as China and India; rapid industrialization and urbanization; and the rising adoption of e-commerce in countries such as China, India, and Japan. The region’s manufacturing and logistics sectors are undergoing significant transformations with the adoption of automation and smart technologies. China, being the manufacturing powerhouse, is experiencing high demand for material handling equipment, especially in the automotive and electronics industries. India is also emerging as a key market, with increasing investments in automation and infrastructure improvements. The expansion of e-commerce in Asia Pacific is driving the need for more efficient and scalable material handling solutions to manage the growing volumes of goods. The region's cost advantages, large labor pool, and shifting focus on technology adoption contribute to the Asia Pacific MHE market expansion.

Key Market Players and Competitive Insights

A few key players in the material handling equipment market include Toyota Industries Corporation, Kion Group, Jungheinrich AG, Honeywell International Inc., and Dematic. These companies manufacture a variety of equipment, including forklifts, automated storage systems, conveyors, and other handling solutions. Additionally, companies such as Mitsubishi Logisnext Co., Ltd.; Crown Equipment Corporation; and Hyster-Yale Materials Handling Inc. are significant contributors, offering products designed for a wide range of industries. Other notable companies include Daifuku Co., Ltd.; SSI SCHAEFER; ABB; and Interroll Group. These organizations are actively involved in developing and providing innovative solutions to meet the growing demand for efficiency and automation in material handling.

In terms of competitive dynamics, the market is characterized by players focused on offering customized and automated solutions to enhance operational efficiency. Companies are increasingly integrating technologies such as AI, robotics, and deep learning into their material handling systems to stay competitive. Toyota Industries and Kion Group are heavily investing in expanding their automation portfolios, while Honeywell and Dematic focus on advanced robotics and digital solutions to support warehouse operations. Additionally, players such as Jungheinrich and Crown Equipment are exploring partnerships and acquisitions to strengthen their positions and expand their technological capabilities. Cost optimization, product innovation, and geographical expansion are among the key strategies being employed by these players to maintain their market presence.

The competitive landscape witnesses increasing mergers and acquisitions. Kion Group’s acquisition of Dematic in 2016 enhanced its ability to offer automated solutions, providing a broader range of products and services in the MHE market. In addition, players such as Mitsubishi Logisnext are advancing their portfolios through technological collaborations and product development to cater to industries such as automotive and food processing. As material handling requirements evolve, companies must adapt by integrating automation technologies and sustainability solutions into their product offerings to remain competitive in the growing market.

Toyota Industries Corporation is a key player in the material handling equipment market, known for manufacturing a wide range of equipment, including forklifts, automated storage systems, and other material handling solutions. Toyota focuses on integrating advanced technologies such as robotics and automation to improve operational efficiency.

Kion Group is a major player in the market, primarily known for its forklifts, automated guided vehicles, and warehouse automation systems. The company offers solutions for various sectors, including e-commerce, automotive, and manufacturing, focusing on improving logistics operations.

List of Key Companies

- ABB

- Crown Equipment Corporation

- Daifuku Co., Ltd.

- Dematic

- Honeywell International Inc.

- Hyster-Yale Materials Handling Inc.

- Interroll Group

- Jungheinrich AG

- Kion Group

- Komatsu Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Raymond Corporation

- SSI SCHAEFER

- STILL GmbH

- Toyota Industries Corporation

Material Handling Equipment Industry Developments

- In October 2023, Kion Group launched a new generation of automated forklift systems designed to work seamlessly with other automated equipment. This product release underscores Kion’s commitment to advancing automation in material handling and enhancing its technological offerings to meet the evolving needs of industries worldwide.

- In June 2023, Toyota Industries announced its collaboration with Idemitsu to deploy more automated material handling systems in warehouses across Japan, aiming to improve speed and reduce labor costs. This collaboration highlights Toyota's continued efforts to enhance its automation capabilities and support the growing demand for efficient logistics solutions.

Material Handling Equipment Market Segmentation

By Equipment Type Outlook

- Transport Equipment

- Positioning Equipment

- Storage Equipment

- Others

By Industry Outlook

- Consumer Goods & Electronics

- Automotive

- Food & Beverages

- Pharmaceutical

- Construction

- Mining

- Semiconductors

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Material Handling Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 248.76 billion |

|

Market Size Value in 2025 |

USD 261.95 billion |

|

Revenue Forecast by 2034 |

USD 425.93 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The material handling equipment market has been broadly segmented on the basis of equipment type and industry. Moreover, the study provides the reader with a detailed understanding of the different segments at global and regional levels.

Growth/Marketing Strategy: The material handling equipment market growth and marketing strategy focuses on expanding product offerings, enhancing automation, and addressing industry-specific needs. Companies are investing in research and development to create advanced, energy-efficient solutions that integrate robotics, AI, and IoT technologies. Additionally, strategic partnerships, acquisitions, and geographic expansion are key approaches to gaining market share. Firms are also focusing on sustainability by offering eco-friendly equipment and solutions that help reduce energy consumption. Marketing efforts emphasize product innovation, cost savings, and efficiency improvements to appeal to industries such as e-commerce, automotive, and manufacturing.

FAQ's

? The material handling equipment market size was valued at USD 248.76 billion in 2024 and is projected to grow to USD 425.93 billion by 2034.

? The market is projected to register a CAGR of 5.5% during 2024–2034.

? North America had the largest share of the market in 2024.

? A few key players in the material handling equipment market are Toyota Industries Corporation, Kion Group, Jungheinrich AG, Honeywell International Inc., and Dematic. These companies manufacture a variety of equipment, including forklifts, automated storage systems, conveyors, and other handling solutions.

? The transport equipment segment accounted for the largest share of the market in 2024.

? The consumer goods & electronics segment accounted for the largest share of the market in 2024.

? Material Handling Equipment (MHE) refers to the machinery, tools, and systems used to transport, store, control, and protect materials or goods during manufacturing, distribution, and disposal processes. This equipment is essential for managing materials across various stages of the supply chain and can include devices such as forklifts, cranes, conveyors, automated guided vehicles (AGVs), storage racks, and robotic systems. MHE helps improve operational efficiency, reduce manual labor, enhance safety, and optimize space utilization in warehouses, factories, and distribution centers.

? A few key MHE market trends are described below: Increasing Automation: Growing adoption of automated systems, including robotics and automated guided vehicles (AGVs), to enhance efficiency and reduce labor costs in warehouses and manufacturing facilities. Integration of AI and IoT: Incorporating artificial intelligence (AI) and Internet of Things (IoT) technologies for real-time data tracking, predictive maintenance, and operational optimization. Sustainability and Energy Efficiency: A focus on eco-friendly solutions, such as electric-powered material handling equipment, to meet sustainability goals and reduce energy consumption. E-commerce Growth: The rise of e-commerce demands more efficient material handling systems to manage high volumes of orders and fast-paced logistics.

? A new company entering the material handling equipment market must focus on leveraging emerging technologies such as automation, robotics, and IoT to provide innovative solutions that enhance efficiency and reduce costs. Developing eco-friendly and energy-efficient equipment would also appeal to companies focused on sustainability. Additionally, offering customizable solutions tailored to specific industries such as e-commerce, pharmaceuticals, or food processing could differentiate the company. Focusing on smart warehousing and digitalization trends will help meet the growing demand for data-driven, optimized operations. Building strategic partnerships and offering excellent after-sales support can further strengthen the company’s competitive position.

? Companies manufacturing, distributing, or purchasing material handling equipment and related products, and other consulting firms must buy the report.