Master Alloy Market Share, Size, Trends, Industry Analysis Report, By Application (Die Casting, Powder Metallurgy, Galvanizing, Electroplating, Others), By End-Use; By Type; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 115

- Format: PDF

- Report ID: PM2121

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

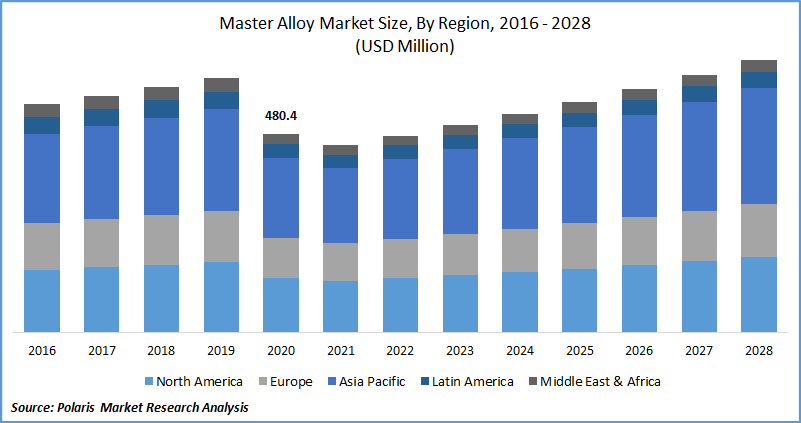

The global master alloy market was valued at USD 480.4 million in 2020 and is expected to grow at a CAGR of 5.5% during the forecast period. Increasing usage of aluminum in the automotive sector with rising demand for lightweight vehicles is likely to augment the market growth substantially. Expanding the automotive industry with growing automobile production, particularly in the developing countries, is likely to propel the master alloy market growth at a significant rate during the review period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The outbreak of COVID-19 has significantly impacted the chemicals & materials supply chains, international trade, and manufacturing operations across the world. The production of master alloy has declined amidst the COVID-19 pandemic as the market players had to shut production facilities or operate the facilities below the optimal production capacities to avoid the spread of the coronavirus. Further, the limited availability of raw materials due to supply disruptions has led to a decline in production.

Industry Dynamics

Growth Drivers

The market is primarily driven by increasing demand for titanium alloy production. In 2020, South Korea mined the largest volume of 1.12 million tons of titanium in Asia Pacific region. Titanium alloys are predominated used in the aerospace & military sectors.

A broad range of master alloy such as vanadium aluminum (VAl), molybdenum aluminum (MoAl), chromium aluminum (CrAl), and military grade are used as mixing elements for the manufacturing of titanium-based mixtures. The titanium master alloy market growth is driven by increasing demand from the aerospace & military sector.

Thus, the optimistic market for titanium alloys on the backdrop of the growing aerospace market is expected to witness subsequent demand for master alloy. Surging demand for high-performance master alloys in the end-use industries, including aerospace & defense and marine, due to their superior properties such as high-temperature resistance, corrosion resistance, and good surface stability is likely to bolster the industry growth during the review period.

Know more about this report: request for sample pages

The different types of master metal mixtures such as ferroniobium (FeNb), nickel niobium (NiNb), nickel tantalum (NiTa), nickel zirconium (NiZr) and nickel-vanadium are used as a mixing element in the production of superalloys.

Report Segmentation

The market is primarily segmented on the basis of type, application, end-use, and region.

|

By Type |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

The aluminum segment held the largest share in the global market in 2020. This is mainly ascribed to its widespread use in the end-use industries. It helps in achieving proper casting structure, quicker dispersion of additives, and enhancing the microstructural properties, thereby increasing the strength, ductility, and machinability of metals. Aluminum-based master metal mixtures are primarily used as grain refiners, modifiers, and hardeners.

Grain refining is a key factor in the melting and solidification process of aluminum alloy products. Vanadium master alloy segment is expected to register healthy CAGR during the review period due to its growing use in high-end applications such as aircraft manufacturing, medical implants, and consumer goods where the integrity of metals cannot be jeopardized.

Insight by End-Use

The aerospace & defense segment is estimated to register the highest CAGR during the forecast period. Master alloy are extensively used in the manufacturing of civil, military aircraft, and space programs.

Master alloy are used for controlling chemistry in the melting of superalloys and titanium, used in engines and airframes; metal powder coatings; precision tubing for fuel lines, high-pressure tubes, and instrumentation applications in the aerospace market. Significant growth of the aerospace & defense market with expanding demand for aircraft across geographies is driving the industry growth.

Geographic Overview

Asia Pacific accounted for the largest share in the global market in 2020 and is expected to register the highest CAGR during the review period. The strong presence of aerospace & defense, marine, and automotive industries are the prime factors fueling the demand for such elements in China. In 2021, the Chinese government proposed an annual defense budget of USD 209 billion, a 6.8% increase from 2020.

Additionally, increased spending on aerospace & defense equipment in India to bolster military power is likely to drive the region’s growth. The North American market is proliferated by the strong presence of major aerospace & defense companies such as Boeing, Northrop Grumman Corporation, and GE. Also, the established presence of the automotive sector is another key factor contributing to market growth.

Furthermore, increasing environmental regulations pertaining to carbon emissions have mandated the usage of lightweight materials in automobiles and related auto components, likely to fuel the demand for aluminum in the automotive industry.

Competitive Landscape

Some of the major players operating the global market include Advanced Metallurgical Group, Aleastur, ALUMETAL S.A., Asturiana de Aleaciones, Avon metals, Belmont Metals, CERAFLUX, Heraeus Holding, KBM Affilips, Milward, Minex Metallurgical Co. Ltd., N.V. MMTC-PAMP, Silicor Materials, Yamato Metal, and Zimalco.

The Market Players are adopting various strategies such as acquisition, expansion, and agreements to gain a competitive edge in the market. For instance, in 2016, AMG Advanced Metallurgical Group N.V. signed an agreement to acquire the products of International Specialty Alloys (ISA) based in US, from Kennametal, Inc. ISA is a leading manufacturer of master alloy.

Master Alloy Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 480.4 million |

|

Revenue forecast in 2028 |

USD 657.6 million |

|

CAGR |

5.5% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2016 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Segments covered |

By Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Advanced Metallurgical Group, Aleastur, ALUMETAL S.A., Asturiana de Aleaciones, Avon metals, Belmont Metals, CERAFLUX, Heraeus Holding, KBM Affilips, Milward, Minex Metallurgical Co. Ltd., N.V. MMTC-PAMP, Silicor Materials, Yamato Metal, Zimalco |