Marine and Marine Management Software Market Share, Size, Trends, Industry Analysis Report, By Component (Software, Services); By Deployment; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 115

- Format: PDF

- Report ID: PM2232

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

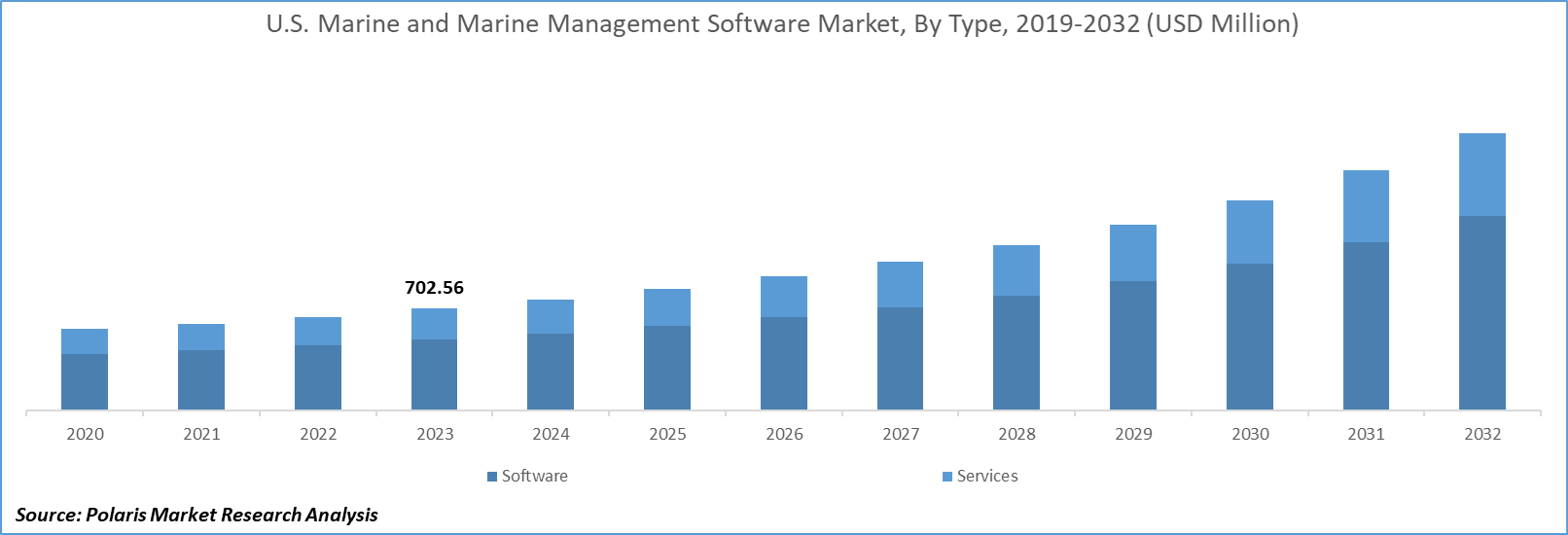

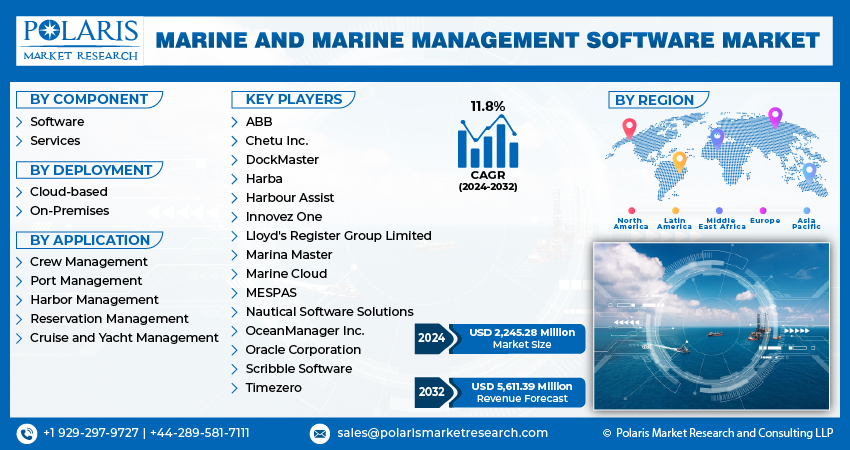

Marine and marine management software market size was valued at USD 2,055.9 million in 2023. The market is anticipated to grow from USD 2,245.28 million in 2024 to USD 5,611.39 million by 2032, exhibiting the CAGR of 11.8% during the forecast period.

Industry Trends

Marine management software monitors complex logistics operations and maintains customer and product information from the database, which may be accessed before beginning export and import operations from one country to another.

Advanced maritime fleet management software is installed on the fleet employed in export and import operations. The projected rise in sea fleets looking to expand their business globally through export and import activities is expected to boost the global marine and marine management software market. The growth in the industry is being driven by the rising demand for the maritime managing system, and major players focus on various strategies such as collaborations, partnerships, and launches with advanced technology.

To Understand More About this Research:Request a Free Sample Report

The pandemic put the shipping and maritime industries in the worst possible position since their workforces were shut down for the sake of safety and preventing the spread of COVID-19. According to the European Maritime Safety Agency (EMSA), 53,035 ships were called at EU ports in January 2020, up from 49,908 in January 2021. Compared to the previous year, the number of calls dropped by 6%. The pandemic sent shockwaves across supply chains, transportation networks, and ports, causing cargo volumes to plunge. In response to pandemic-related interruptions, players in this sector modified their operations, budgets, hygienic and safety measures, and working methods and processes. With the rise of digitization, there is a rise in cybersecurity concerns, as well as disruptions in supply chains and services throughout the global maritime sector.

Key Takeaways

- North America dominated the market and contributed over 37% market share of the marine and marine management software market size in 2023

- By component category, the software segment dominated the global marine and marine management software market size in 2023

- By application category, the cruise and yacht management segment is projected to grow with a significant CAGR over the marine and marine management software market forecast period

What are the market drivers driving the demand for market?

Growing Emphasis on Safety and Regulatory Compliance

The maritime industry, a cornerstone of global trade and transportation, has seen a notable shift in recent years, with an increasing emphasis on safety and regulatory compliance. This shift is having profound effects on the marine sector and, by extension, on the development and adoption of advanced marine management software.

The safety of human lives at sea and the protection of the marine environment have long been at the forefront of maritime concerns. Recent high-profile accidents, such as oil spills and shipwrecks, have served as stark reminders of the potential consequences of inadequate safety measures and non-compliance with environmental regulations. These incidents have not only triggered public outcry but have also resulted in tighter regulations and a heightened collective commitment to maritime safety. Recognizing the critical role of the human element in maritime safety, there has been a heightened focus on training and certification of seafarers. Crew competence and their familiarity with safety procedures and equipment are central to preventing accidents and incidents. Training and certification processes ensure that seafarers are well-prepared to handle emergencies and navigate vessels safely. Many marine management software solutions now incorporate training modules and simulations to enhance the skills and preparedness of seafarers, thus contributing to safer maritime operations.

Which factor is restraining the demand for the market?

High Implementation Costs for Marine and Marine Management

While the adoption of marine and marine management software brings many benefits to the maritime industry, one significant restraint is the high implementation costs associated with these solutions. The investment required to acquire, implement, and maintain comprehensive software systems can be substantial, posing challenges for both large shipping companies and smaller operators. Marine management software is a complex and specialized technology that encompasses a wide range of functionalities, from navigation and safety features to crew management, compliance monitoring, and data analytics. The cost of acquiring the software itself can be substantial, especially for more advanced and integrated solutions. Smaller operators may find it particularly challenging to allocate the necessary budget for purchasing these systems.

In addition to the initial acquisition cost, there are significant implementation costs to consider. Implementing marine management software often requires specialized hardware, such as sensors, monitoring devices, and communication equipment, to ensure seamless integration and data collection. The installation of this hardware can be costly and may involve retrofitting existing vessels, which can be a time-consuming and expensive process.

Report Segmentation

The market is primarily segmented based on component, deployment, application, and region.

|

By Component |

By Deployment |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Component Insights

Based on component category analysis, the market has been segmented on the basis of software and services. The software segment held significant revenue share in the global marine and marine management software market in 2023 and is expected to retain its dominance in the foreseen period. The adoption of the software is becoming increasingly important for the shipping sector since it allows enterprises to automate and track vessel performance while increasing overall productivity. On a consolidated dashboard, the maritime program enables administrators to generate and track orders, shipping supply chain bottlenecks, performance statistics, and fore-seeing new business opportunity potentials to generate positive profit margins.

By Application Insights

Based on application category analysis, the market has been segmented on the basis of crew management, port management, harbor management, reservation management, and cruise and yacht management. The cruise and yacht management segment is poised for significant growth within the global market due to the increasing demand for luxury cruising experiences and private yacht ownership among affluent consumers worldwide is driving the need for efficient and sophisticated management solutions to enhance vessel operations, guest services, and crew management.

Moreover, as the maritime industry adopts digitalization and automation to streamline processes and improve safety and efficiency, there is a growing recognition of the value of specialized software solutions tailored to the unique requirements of cruise liners and yacht owners. These solutions offer features such as itinerary planning, maintenance scheduling, crew management, guest experience enhancement, and regulatory compliance, thus empowering operators to optimize their operations, reduce costs, and deliver exceptional service standards. With the ongoing expansion of the global cruise tourism market and the rising popularity of luxury yacht charters, the demand for advanced marine management software is expected to rise, propelling significant growth in the cruise and yacht management segment over the forecast period.

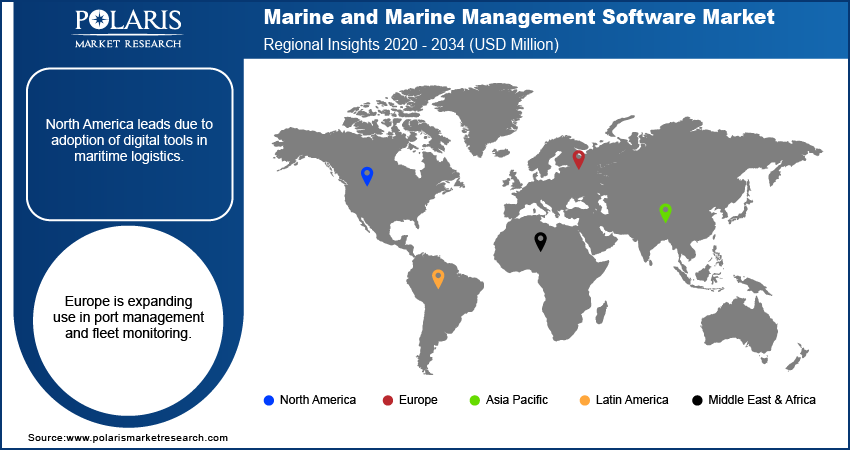

Regional Insights

North America

North America had the highest share in the global market in 2023 due to the rising technological advancements in the region. Technological advancements in shipbuilding, propulsion, smart shipping, innovative materials, big data and analytics, robots, sensors, and communications, as well as an increasingly skilled workforce, are all affecting how the business approaches new prospects.

Asia Pacific

APAC is anticipated to witness a high CAGR in the global market over the forecast period. Smaller market companies now have greater options to sell their products to a wider range of shipping companies. Companies in the region are working to improve their shipping operations to increase market competitiveness and revenue growth. China, India, and Singapore have shown tremendous growth potential in the region.

Competitive Landscape

The marine software market is highly competitive and features key players such as ABB, Oracle Corporation, Harba, Nautical Software Solutions, OceanManager Inc., Harbour Assist, and Marina Master. These companies employ various strategies, such as acquisitions, launches, collaborations, and partnerships, to develop new software with enhanced speed and features. Additionally, they invest in research and development to introduce innovative technologies, thereby solidifying their positions in the market.

Some of the major players operating in the global market include:

- ABB

- Chetu Inc.

- DockMaster

- Harba

- Harbour Assist

- Innovez One

- Lloyd's Register Group Limited

- Marina Master

- Marine Cloud

- MESPAS

- Nautical Software Solutions

- OceanManager Inc.

- Oracle Corporation

- Scribble Software

- Timezero

Recent Developments

- In September 2023, Lloyd's Register merges software platforms into OneOceanLR, integrating products from OneOcean, Hanseaticsoft, and ISF Watchkeeper, offering unified data-driven solutions for maritime challenges.

- In June 2023, ABB introduced OCTOPUS Operational Planner for increased uptime and safety of offshore wind farm operations. The predictive software allows users ashore to plan offshore support vessel performance based on expected conditions.

- In May 2023, MESPAS introduced a business intelligence API empowering maritime managers to enhance data analysis and informed decision-making by seamlessly integrating their MESPAS data into their business intelligence systems, offering customizable dashboards and reports to improve maritime business efficiency.

- In March 2023, The Port of Cork has entered into a partnership with Innovez One to implement an innovative AI-powered port system. As part of this collaboration, Innovez One will deploy its flagship software, marineM, to digitally transform and optimize essential marine services for vessels entering and leaving Ireland's second-largest port to enhance vital services such as port operations, tug assistance, and pilotage, all of which are integral to ensuring efficient and effective maritime operations.

Report Coverage

The marine and marine management software market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, deployment, application, and their futuristic growth opportunities.

Marine and Marine Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2,245.28 million |

|

Revenue forecast in 2032 |

USD 5,611.39 million |

|

CAGR |

11.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Deployment, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Marine and Marine Management Software Market report covering key segments are component, deployment, application, and region.

Marine and Marine Management Software Market Size Worth USD 5,611.4 Million by 2032

Marine and marine management software market exhibiting the CAGR of 11.8% during the forecast period

North America is leading the global market.

The key driving factors in Marine and Marine Management Software Market are Growing Emphasis on Safety and Regulatory Compliance