Marine Lubricants Market Share, Size, Trends, Industry Analysis Report

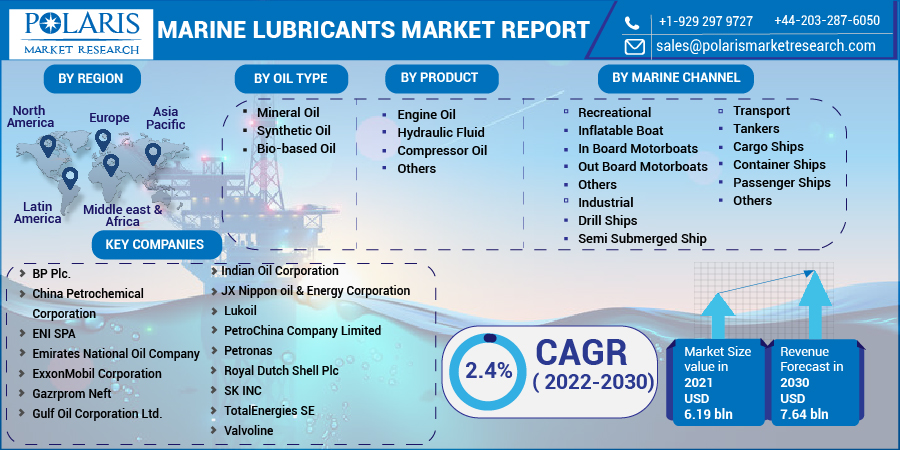

By Oil Type; By Product Type (Engine Oil, Hydraulic Fluid, Compressor Oil, Others); By Marine Channel (Recreational, Industrial, Transport); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 112

- Format: PDF

- Report ID: PM2495

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

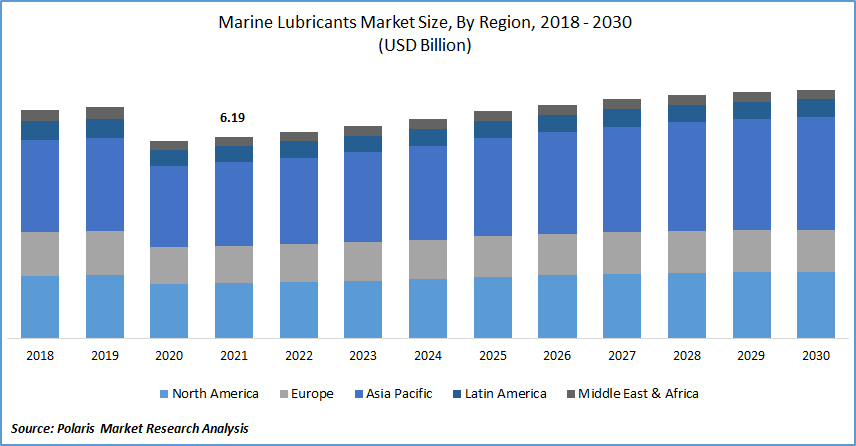

The global marine lubricants market was valued at USD 6.19 billion in 2021 and is expected to grow at a CAGR of 2.4% during the forecast period. An increase in marine trade due to low transportation and maintenance costs and the presence of a large number of shipping industries are the key factors driving the market forward. Mineral oils can be supplemented with various additives to improve their performance. Mineral oil is also compatible with a wide range of grease thickener systems. The marine lubricants market revenue is accelerating due to high performance, easy availability, and low cost. Mineral oil flows more slowly through engine circuits than synthetic oil, resulting in increased fuel consumption and performance degradation.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Additionally, synthetic marine lubricants are made up of modified chemicals and petroleum components that have been synthesized artificially. These lubricants perform better, have more features, and can operate in extreme temperatures. Compared to mineral oil greases, they are frequently considered higher quality. Due to their superior properties, these lubricants can extend the average drain interval in end-use industries like automotive, marine, and industrial.

According to industry experts, synthetic lubricants can increase drain intervals by up to three times. This will reduce the number of lubricants used in the marine market. As a result, each ship that uses synthetic has a lower demand, which reduces the overall demand for lubricants. Although synthetic lubricants are still more expensive than mineral oil-based lubricants, the growth of synthetic and bio-based lubricants will eventually force mineral oil-based lubricants to phase out. This will affect lubricant consumption, lowering the volume of marine lubricants used per ship.

Industry Dynamics

Growth Drivers

Slow steaming, low sulfur fuel, catalytic reduction, on-time lubrication, exhaust gas re-circulation, and blending are examples of newer technologies in the market. During the global recession of 2009, when fuel prices were significantly higher, and there was a need to reduce fuel consumption, slow steaming was the technology of choice. It allows large cargo ships to travel at a much slower speed, extending voyage duration and reducing fuel consumption. Furthermore, all these technological advancements in the maritime industry are helping drive the marine lubricants market forward. Reduced harmful emissions from ships will improve the performance and durability of marine lubricants, extending the service life of ships' mechanical equipment.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on oil type, product, marine channel, and region.

|

By Oil Type |

By Product |

By Marine Channel |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by marine channel

Based on the marine channel segment, the transport segment is expected to be the most significant revenue contributor in the global market. Increased foreign trade due to various bilateral trade treaties and the development of a considerable number of ports, water networks, and navigation facilities may contribute significantly to the marine lubricants market share. Furthermore, the European Commission is working to promote and strengthen inland waterways' role in regional transportation. Inland waterway transportation has emerged as a cost-effective and competitive alternative to rail and road transportation, as it is both environmentally friendly and energy-efficient. The demand for ships is expected to rise in Europe as trade and transportation via inland waterways expand.

Geographic Overview

In terms of geography, North America had the largest revenue share. The market is driven by the shipping market's development and growth. The U.S. Department of Transportation, in November 2021, announced to speed up the country's waterways, ports, rivers, and freight transport with the country action plan with increased budget and resources. Also, Idemitsu Lubricants established a new plant in South America to provide customized lubrication services to its dedicated set of customers.

Moreover, Asia Pacific is projected to register a high CAGR in the global market. Increased globalization, trading activities, and expanding imports and exports favor the ship-building market, thereby creating a lucrative market opportunity for the marine lubricant players.

Competitive Insight

Some major market players operating in the worldwide market include BP Plc., China Petrochemical Corporation, ENI SPA, ENOC (Emirates National Oil Company), ExxonMobil Corporation, Gazrprom Neft, Gulf Oil Corporation Ltd., Idemitsu Kosan Co. Ltd, Indian Oil Corporation, JX Nippon oil & Energy Corporation, Lukoil, PetroChina Company Limited, Petronas, Royal Dutch Shell Plc, SK INC, TotalEnergies SE, and Valvoline.

Marine Lubricants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 6.19 billion |

|

Revenue forecast in 2030 |

USD 7.64 billion |

|

CAGR |

2.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Oil Type, By Product, By Marine Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

BP Plc., China Petrochemical Corporation, ENI SPA, ENOC (Emirates National Oil Company), ExxonMobil Corporation, Gazrprom Neft, Gulf Oil Corporation Ltd., Idemitsu Kosan Co. Ltd, Indian Oil Corporation, JX Nippon oil & Energy Corporation, Lukoil, PetroChina Company Limited, Petronas, Royal Dutch Shell Plc, SK INC, TotalEnergies SE, and Valvoline. |