Marine e-logs Software Market Size, Share, Trends, Industry Analysis Report, By Component (Software and Services), Deployment Mode, Location, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa)- Market Forecast, 2024- 2032

- Published Date:Oct-2024

- Pages: 115

- Format: PDF

- Report ID: PM5131

- Base Year: 2023

- Historical Data: 2019-2022

Marine E-logs Software Market Outlook

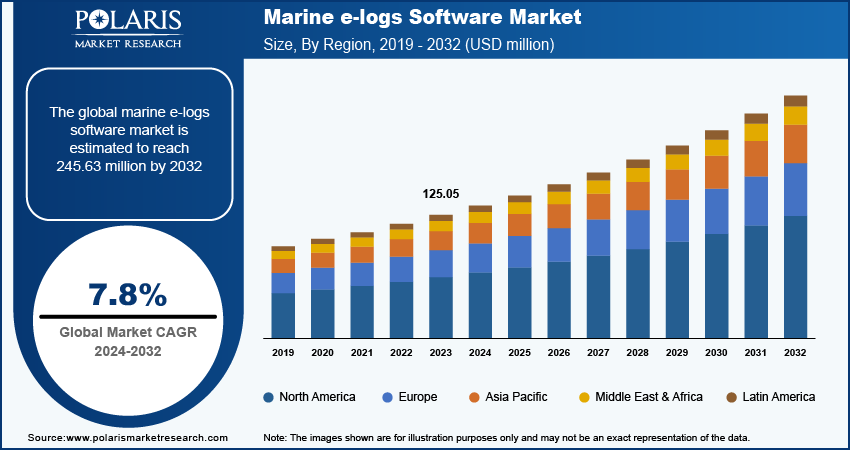

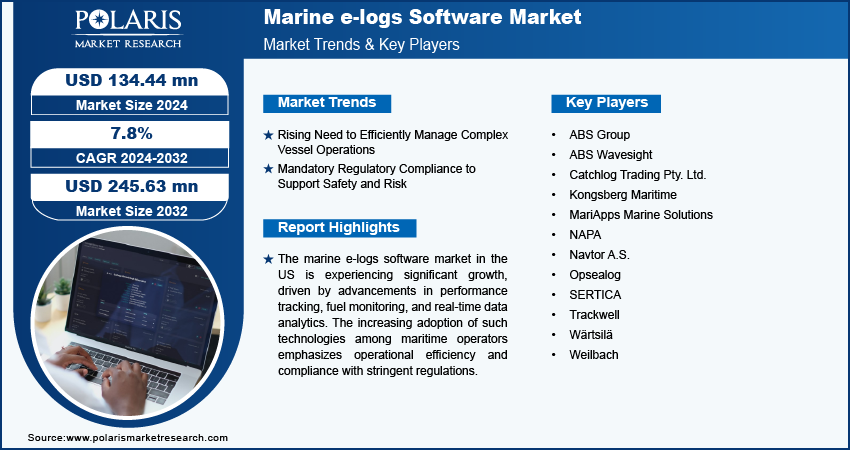

Marine e-logs software market size was valued at USD 125.05 million in 2023. The market is anticipated to grow from USD 134.44 million in 2024 to USD 245.63 million by 2032, exhibiting a CAGR of 7.8% during the forecast period

Marine e-logs Software Market Overview

Marine e-logs software, also known as electronic logbooks, are digital tools designed to streamline and automate the process of logging maritime activities and data aboard ships and vessels. These software solutions replace traditional paper logbooks with digital interfaces accessible via computers, tablets, and smartphones. It offers features such as real-time data entry, automatic calculations, compliance tracking with maritime regulations, voyage planning, maintenance scheduling, and reporting functionalities. In addition, marine e-logs software enhances efficiency, accuracy, and compliance for maritime operations while reducing paperwork and administrative freight for ship crews and operators.

To Understand More About this Research: Request a Free Sample Report

For instance, in June 2023, NAPA, a provider of maritime software and data solutions, and Finnlines, a cargo and passenger operator in the Baltic and North Seas, agreed to use NAPA's electronic logbooks technology. This will automate and streamline required reporting and record-keeping requirements, reducing the administrative burden for crews, saving time, and lowering the risk of errors.

The International Maritime Organization (IMO) sets various regulations and guidelines related to maritime safety, security, and environmental protection. Marine e-logs software assists ships in complying with IMO regulations by facilitating the electronic documentation and reporting of activities such as fuel consumption, emissions, ballast water management, and waste disposal. By maintaining accurate electronic records and generating compliance reports, the software helps mitigate risks associated with non-compliance and enhances environmental stewardship.

E-logs software reduces the administrative workload for the crew and minimizes the error rate through various automatic control and plausibility mechanisms. Thus, variations from vessel-specific constraints can be swiftly detected, and necessary measures can be implemented to avoid incorrect logbook entries. For instance, in July 2022, smartPAL, launched an app to deliver real-time data from vessels directly to the connected dashboard by providing flawless data transfer, which is updated every second between onshore and offshore, serves a unique digital portfolio in maritime industry.

Marine e-logs Software Market Dynamics

Marine E-logs Software Market Drivers

Rising Need to Efficiently Manage Complex Vessel Operations

Efficiently managing complex vessel operations is increasingly necessary due to the resource-intensive nature of ship management. The maritime industry faces constant changes, requiring companies to balance cost-effectiveness, operational efficiency, and staying updated with technological advancements. The implementation of established systems and procedures allows ship managers to enhance crew welfare, streamline maintenance, optimize procurement, and improve inventory management through refined operational workflows. These defined protocols result in reduced risks and more efficient operations. Moreover, applying cost-cutting strategies, guaranteeing compliance, and gaining access to advanced technologies improve the operational visibility and control factors driving the growth of the e-logs software market.

For instance, in January 2024, ZEABORN Ship Management collaborated with ShipIn Systems to gain access to marine ship to shore fleets through the use of AI-powered cameras and real-time visual analytics by proactively alerting shipowners, management, and seafarers about onboard route optimization and execution.

Mandatory Regulatory Compliance to Support Safety and Risk

Regulatory compliance is a fundamental aspect of maritime operations, essential for ensuring safety, security, and environmental protection. Several international conventions and regulations mandate accurate record-keeping and reporting by ships and vessels, with the aim of enhancing safety at sea, preventing pollution, and facilitating effective regulatory oversight. Marine e-logs software plays a crucial role in supporting compliance with these regulations by providing efficient, accurate, and auditable means of managing and documenting various operational activities and data offshore. Key regulations such as Safety of Life at Sea (SOLAS) and International Maritime Organization (IMO) Regulations, among others, support safety and risk management in association with the software.

For instance, SOLAS is among the important international treaties concerning the safety of merchant ships. Marine e-logs software helps ships comply with SOLAS requirements by enabling the digital recording and reporting of safety-related information such as navigation data, maintenance records, drills, and incidents. This facilitates better safety management practices and ensures that ships adhere to SOLAS standards for equipment, procedures, and operations.

Market Restraints

Integration Challenges such as Connectivity and Reliability

Constraints on coverage and the low bandwidth at sea operations have impeded connectivity and reliability in the maritime industry. Most distant places frequently have poor service and are unreliable sources of connection. The connectivity options come with a protracted setup, activation, and deployment process, large equipment requirements, and a long-term commitment which is difficult to access in remote areas. Systems that look for a suitable satellite for connectivity on the open sea frequently have unstable connections, poor coverage, and service outages.

For instance, in October 2023, to improve communications at sea, netTALK Maritime, a provider of marine communication intelligence products, and SpaceX's Starlink satellite internet network formed a strategic alliance by offering high-speed, low-latency internet solutions to cruise and commercial shipping clients worldwide, this cooperation hopes to reinvent maritime connection. Under this strategic agreement, the intelligence solutions will act as an account administrator, offering complete account management services together with end-to-end solutions from installation to network configuration and maintenance.

Report Segmentation

The market is primarily segmented based on component, deployment mode, location, end user, and region.

|

By Component |

By Deployment Mode |

By Location |

By End User |

By Region |

|

|

|

|

|

Marine E-logs Software Market Segmental Analysis

By Component Analysis

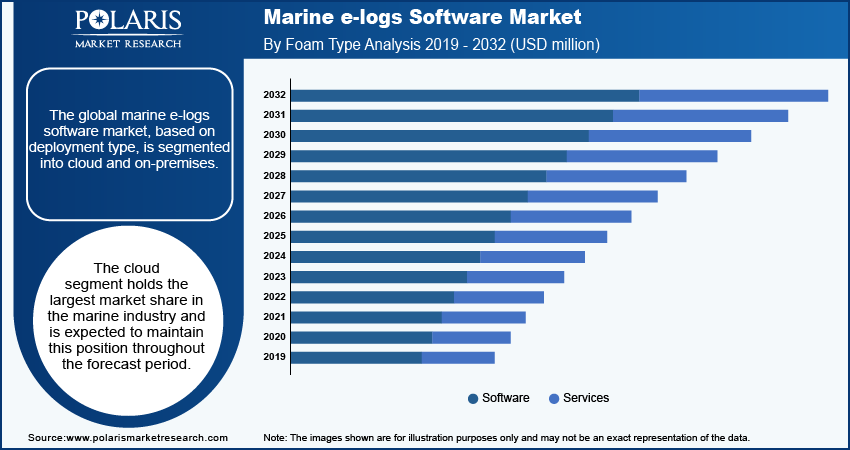

The software segment dominated the market with the highest market share, largely attributable to their quick, simple, and affordable way to increase the effectiveness of vessels related operations. The software offers a range of options, including simulation-driven design, ship and fleet management, and business decision tools for machinery and propulsion system optimization. It is applicable to both newly constructed ships and active vessels, thereby, enhancing operational efficiency in the modern maritime environment.

The services segment is projected to register a significant CAGR during the forecast period. It guarantees the full operation of the maritime industry. Numerous services are provided, including consulting, software, certification, classification, cyber security, data and analytics, inspection, verification and assurance, training, and testing. These services boost the effectiveness of work and drive better outputs. Sustainability and the environment are also included in these services, along with maritime operations, energy management, safety, risk, and dependability.

By Deployment Analysis

The cloud segment holds the largest market share in the marine industry and is expected to maintain this position throughout the forecast period. It provides a secure platform for maritime stakeholders to access essential technical services and information for informed decision-making, both onshore and onboard, while supporting critical functions such as identity management, authentication, encryption, and effective communication within a globally interoperable framework.

The on-premises segment is expected to grow at the highest growth rate over the next coming years. On-premises usually refers to the physical buildings, machinery, and infrastructure that are situated right at a port, shipyard, or maritime terminal. The application of the roadmap in docks, warehouses, ports, cranes, and storage facilities ensures tracking, monitoring, and developing safe and sustainable methods to handle increasing volume requirements while cutting costs associated with logistics procedures.

By End User Analysis

The commercial vessels segment dominated the market with a significant market share, highly accelerated due to a broad variety of cargo, including raw materials, completed commodities, consumer goods, machinery, and energy resources, that can be transported. A variety of vessel types are used, each intended for a particular type of cargo and a set of major trade routes such as the Suez Canal, the Panama Canal, and the Strait of Malacca. Commercial vessels play a crucial role in global trade in addition to being a major economic engine.

The naval vessels segment is anticipated to grow with the highest CAGR owing to their significantly higher payload capacities, better stability, more manoeuvrability, and fuel efficiency for military objectives. Numerous weaponry, sensors, and other systems for maritime security, attack, and defence are installed on these vessels. Naval vessels perform a variety of duties, such as participating in combat operations, conducting maritime patrols, enforcing maritime law, and safeguarding national interests at sea.

Marine e-logs Software Market Regional Insights

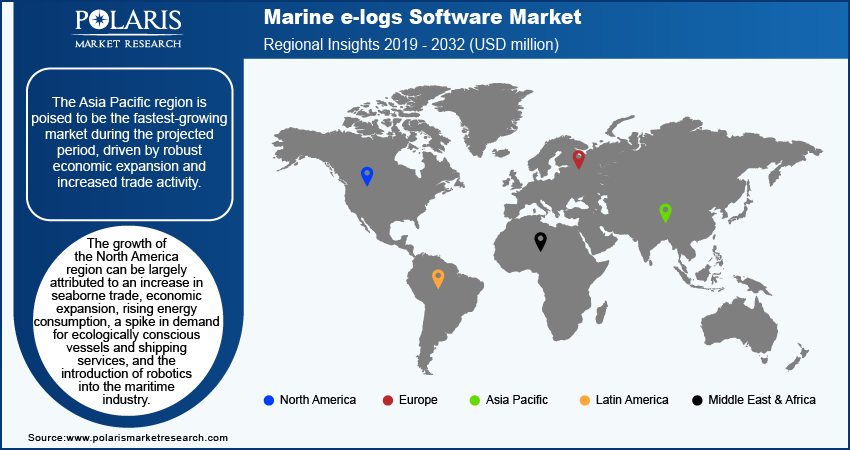

North America Dominated Market with Largest Share

The growth of the segment market can be largely attributed to an increase in seaborne trade, economic expansion, rising energy consumption, a spike in demand for ecologically conscious vessels and shipping services, and the introduction of robotics into the maritime industry. Multi-fuel engine technological developments, as well as the rising use of robots 3D printing in shipbuilding, is anticipated to open up profitable opportunities with the practice of including sustainability. For instance, in March 2024, in order to lower port emissions throughout North America, Wärtsilä worked with Elliott Bay Design Group (EBDG), a naval engineering company. The floating mobile power platform is made to operate in ports all over the country in compliance with the unique zero-emission plans and specifications set by regional authorities and to attain ecological concerns.

The Asia Pacific region is poised to be the fastest-growing market during the projected period, driven by robust economic expansion and increased trade activity. Strategic investments in port infrastructure, along with industrialization, manufacturing capabilities, and rising energy demands, further enhance the region's position in the industry. For instance, in November 2023, Thailand proposed a $28 million marine route in order to connect Asia Pacific to the Middle East, that would avoid the Malacca Strait and drastically reduce shipping times between the Indian and Pacific oceans.

Competitive Landscape

The marine e-logs software market is witnessing vast competition due to several players presence. These players are focusing on upgrading their technologies and implementing sustainability practices to enhance and boost the market by ensuring efficiency and safety. The adoption of cloud-based software has enabled real time monitoring providing better outcomes and accessibility. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over others and capture a significant market share.

Some of the major players operating in the global marine e-logs software market include:

- ABS Group

- ABS Wavesight

- Catchlog Trading Pty. Ltd.

- Kongsberg Maritime

- MariApps Marine Solutions

- NAPA

- Navtor A.S.

- Opsealog

- SERTICA

- Trackwell

- Wärtsilä

- Weilbach

Marine E-logs Software Market Recent Developments

- January 2024: The use of ABS Wavesight's eLogs software by US-flagged ships was officially certified by the United States Coast Guard (USCG), allowing digital copies of the included logs intended to assist crew members in managing recordkeeping on board. The system is developed to guarantee adherence to SOLAS, the BWM Convention, and requirements set forth by the IMO Marine Environmental Protection Committee.

- November 2023: Columbia Shipmanagement (CSM) incorporated the use of Software from Kaiko Systems to assist seafarers with routine inspections and to offer on-the-job training. This software makes it quick and simple for seafarers to gather data consistently and dependably, such as photos and functionality test results. Kaiko Systems' software uses AI algorithms to enable CSM to quickly obtain data-driven judgments from its onshore teams, allowing for instantaneous crucial decision-making.

Report Coverage

The marine e-logs software market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, deployment mode, location, End User, and their futuristic growth opportunities.

Marine E-logs Software Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 125.05 million |

|

Market Size Value in 2024 |

USD 134.44 million |

|

Revenue Forecast in 2032 |

USD 245.63 million |

|

CAGR |

7.8% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component By Deployment Mode By Location By End User |

|

Regional Scope |

North America Europe Asia Pacific Latin America Middle East & Africa |

|

Competitive Landscape |

Marine e-logs Software Industry Trends Analysis (2023) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global marine e-logs software market size was valued at USD 125.05 million in 2023 and is projected to grow to USD 245.63 million by 2032.

The global market is projected to grow at a CAGR of 7.8% during the forecast period.

North America accounted for the largest share of the global market in 2023 owing to the increasing seaborn strong and rising energy consumption industries in the region.

ABS Grou; ABS Wavesight; Catchlog Trading Pty. Ltd.; Kongsberg Maritime; MariApps Marine Solutions; NAPA; Navtor A.S.; Opsealog; SERTICA; Trackwell; Wärtsilä; and Weilbach are among the key players in the market

The software segment dominated the market in 2023 due to quick, simple, and affordable way to increase the effectiveness of the vessels.

The naval vessels segment is expected to record the highest CAGR during the forecast period owing to their significantly higher payload capacities, better stability, and fuel efficiency for military objectives.