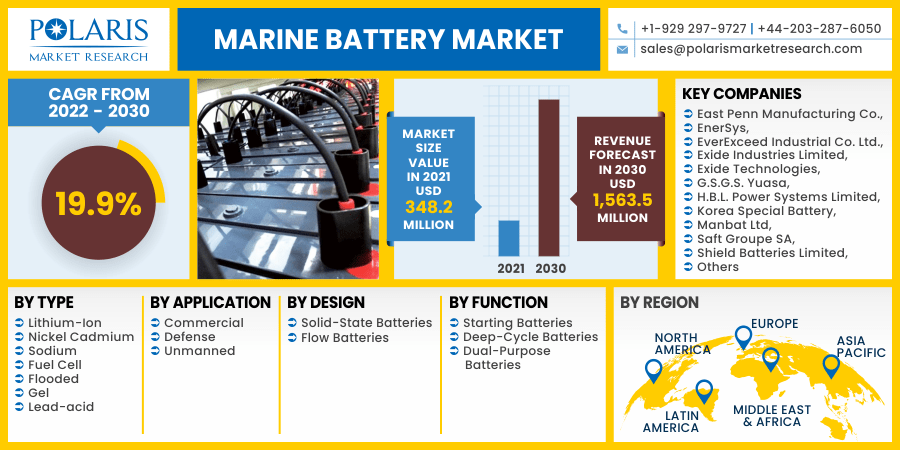

Marine Battery Market Share, Size, Trends, Industry Analysis Report, By Type (Lithium-Ion, Nickel Cadmium, Sodium, Fuel Cell, Flooded, Gel, Lead-acid); By Application (Commercial, Defense, Unmanned); By Design (Solid-State Batteries, Flow Batteries); By Function; By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 118

- Format: PDF

- Report ID: PM2277

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

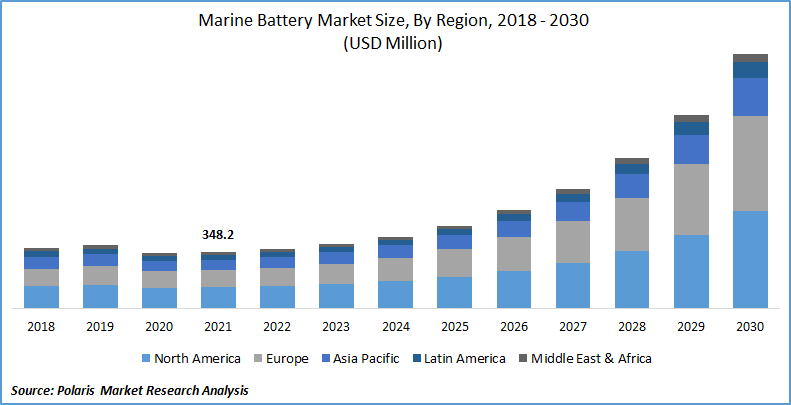

The global marine battery market was valued at USD 348.2 million in 2021 and is expected to grow at a CAGR of 19.9% during the forecast period. Adoption of advanced technology, and increased demand for renewable energy, boost the market growth during the forecast period. Smaller vessels, such as ferries and cruise ships, are best suited for hybrid propulsion. However, as marine electric propulsion technology and alternative fuels like fuel cells advance, manufacturers will have a significant potential to work on electric propulsion systems for larger ships.

Know more about this report: request for sample pages

One of the significant potential prospects for manufacturers and key players in the worldwide marine battery market is the increased use of renewable energy for marine battery charging. Furthermore, as hybrid propulsion technology advances, the marine battery market will have more potential opportunities.

Moreover, one of the primary drivers for the worldwide marine battery market is the expanding water sports industry and public interest in leisure boating. People nowadays prefer to spend their leisure time at the beach, thereby increasing the adoption of marine vehicles in sea and water bodies. The market demand for novel marine battery designs and technologies is growing as global concern about dangerous air emissions increases, resulting in cleaner sea transportation, both commercial and passenger.

However, full-electric ships have significant trip area and capacity limitations. On average, these ships can go 80 kilometers on a single charge. The range that electric ships can travel before the batteries need to be recharged is a significant limitation. Hybrid ships can relieve this constraint by installing power stations that can charge and move the ship when the batteries are exhausted or when extra power is required. This, however, does not address the issue of a "zero-emission" shipping and transportation industry strategy.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The marine battery market has observed extensive developments in the last few decades, supported by factors such as the growing market demand for electric and hybrid passenger vessels and the launch of a marine battery. For instance, in November 2021, at the METSTRADE 2021 event, Electric Fuel introduced 48 V high-energy Li-ion marine batteries. Denmark has around 52 operational ferries, as per Siemens, a global hybrid and fully electric ship propulsion and energy storage system. Of those, 39 ferries can be more productive following battery-driven/electric propulsion transformation. Denmark has a target to be fossil-fuel-free by 2050.

Operators can benefit from the electrification of these 39 electric ferries in a way such as every year, operating and maintenance costs are cut by USD 12 million (DKK 81 million), and fuel consumption has been cut from 19,000 tonnes per year to 0 tonnes per year. In addition, an electric ferry requires an additional expenditure of around USD 1.4 million, which is higher than the cost of a regular ferry. Such investment accounts for the value of additional batteries, the cost of connecting to the existing system locally to the port mooring, and the cost of transformers to construct charging stations at the port.

Further, as per Siemens, 43 of Norway's 180 ferries can be turned into hybrid solutions and profitably operate. As there is an excellent demand for hybrid and completely electric passenger vessels in North American and European countries, such as the U.S. and Norway, these changes to inland transportation have already been implemented. These countries' governments are likewise working for more environmentally friendly water transportation. Furthermore, the operating costs of an electric vessel are significantly cheaper than those of a diesel-powered vessel which in turn is expected to increase demand for electric ships, which will increase the demand for marine batteries to power these ships.

Report Segmentation

The market is primarily segmented based on type, application, design, function, and region.

|

By Type |

By Application |

By Design |

By function |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Application

Based on the application segment, the commercial segment was the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. Low-cost shipping, passenger transportation boats, ro-ro boats, and barges use marine batteries. They're also making an appearance on leisure boats.

Commercial vessels' jobs are needed to accomplish as diverse as the vessels themselves. Passenger vessels, cargo vessels, and other commercial vessels exist, depending on their purpose. Passenger's vessels are further divided into yachts, ferries, cruise ships, and others. Passenger and cargo vessels will see the most growth in this category because they are short-range vessels that require less electricity to function efficiently.

Geographic Overview

In terms of geography, Europe had the highest share in 2021. The manufacturing landscape of Europe and the marine battery manufacturers substantially influence the region's growth. The existence of some of the market's top firms, such as Wartsila, Akasol AG, Enchandia AB, Saft Total, and Leclanché SA, as well as the growing demand for electric boats. These companies are working on R&D to expand their product lines and are constructing electric ships with technologically improved systems, subsystems, and other components.

Moreover, Latin America witness a high CAGR in the global market in 2021. Due to Brazil's increased naval spending on upgraded and modern naval vessels, Latin America is expected to have the highest CAGR throughout the projected period. Furthermore, the Middle East and Africa are experiencing strong market growth due to increased defense spending in Israel, the United Arab Emirates, and Saudi Arabia.

Competitive Insight

Some of the major players operating in the global marine battery market include East Penn Manufacturing Co., EnerSys, EverExceed Industrial Co. Ltd., Exide Industries Limited, Exide Technologies, G.S.G.S. Yuasa, H.B.L. Power Systems Limited, Korea Special Battery, Manbat Ltd, Saft Groupe SA, Shield Batteries Limited, Staab Battery Mfg. Co., Inc., Systems Sunlight S.A., and Zibo Torch Energy.

Marine Battery Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 348.2 million |

|

Revenue forecast in 2030 |

USD 1,563.5 million |

|

CAGR |

19.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Function, By Design, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

East Penn Manufacturing Co., EnerSys, EverExceed Industrial Co. Ltd., Exide Industries Limited, Exide Technologies, G.S.G.S. Yuasa, H.B.L. Power Systems Limited, Korea Special Battery, Manbat Ltd, Saft Groupe SA, Shield Batteries Limited, Staab Battery Mfg. Co., Inc., Systems Sunlight S.A., and Zibo Torch Energy. |