Manufacturing Operations Management Software Market Share, Size, Trends, Industry Analysis Report, By Component (Software and Services); By Deployment; By Application; By End-Use; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3316

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

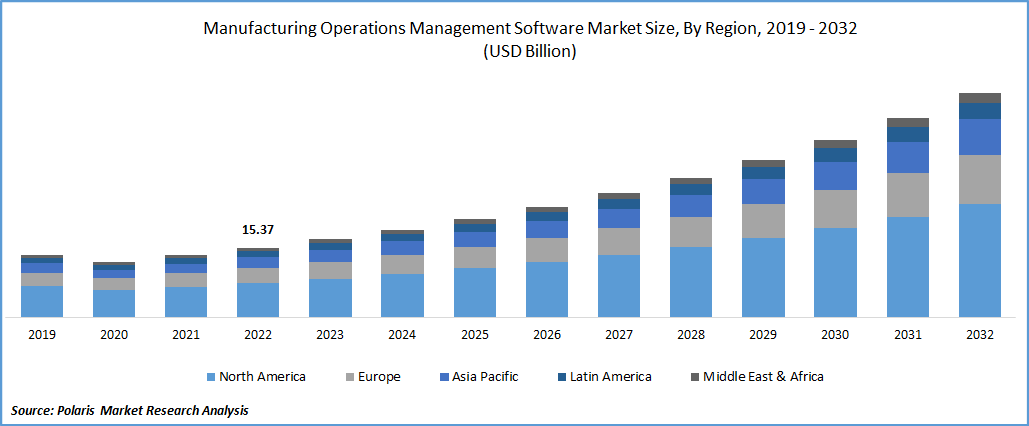

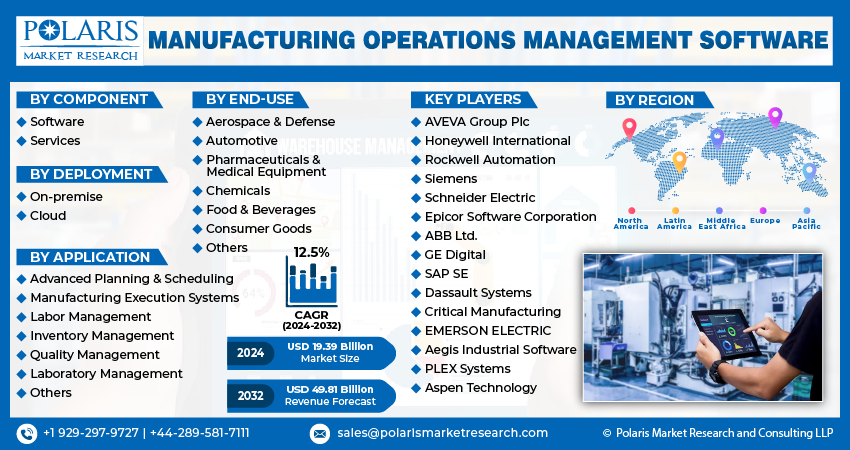

The global manufacturing operations management software market was valued at USD 17.26 billion in 2023 and is expected to grow at a CAGR of 12.5% during the forecast period. The rising need for monitoring and tracking manufacturing operations in real-time, along with the growing prevalence of various notable technological tools, including advanced analytics, artificial intelligence, machine learning, and cloud computing, among others, are major factors propelling the global market growth. Moreover, the rising implementation of innovative technological solutions across several manufacturing processes helps in improving the overall production efficiency, streamlining processes, and increasing the time to market coupled with a high focus of market players on introducing new solutions to the market with improved features are creating significant growth opportunities for the market.

To Understand More About this Research: Request a Free Sample Report

For instance, in January 2023, Dixit Systems introduced ‘Innovana3D’, a quote generation & order management software for manufacturing industry players. The new SaaS system could be easily integrated with the manufacturer's website while transforming the quote generation and order management process.

In recent years, solution software has gained significant traction and popularity, as it promotes the ease of operations by using data, several advanced tools, and human intelligence and further helps in driving meaningful insights and improving the decision-making ability in organizations. However, keeping personal and crucial data safe is a major challenge for organizations, as several data theft, cyberattacks, and privacy concerns are growing rapidly.

The research report offers a quantitative and qualitative analysis of the Manufacturing Operations Management Software Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the manufacturing operations management software market. The emergence of the deadly virus across the globe resulted in the temporary closure of many manufacturing facilities due to imposed lockdowns and various other restrictions on trade activities by government bodies to control the spread of coronavirus. The closure and halt in manufacturing facilities severely impacted the demand for these solutions during the pandemic.

Industry Dynamics

Growth Drivers

The advent of Industry 4.0 has compelled various manufacturers across the globe to adopt highly digitalized technologies, which enabled manufacturing and operational efficiencies and a high prevalence of real-time data monitoring, which leads to decisions that help operations run more efficiently, smoothly, and cost-effectively, prominent factors projected to boost the global manufacturing operations management software market growth over the forecast period. Furthermore, manufacturers' growing adoption of AR and IoTs helps them get their work done faster and more accurately while enabling them to easily view task instructions, troubleshooting procedures, and checklists and get real-time video assistance from remote experts. These are a few factors expected to drive the demand and growth of the market.

Report Segmentation

The market is primarily segmented based on component, deployment, application, end-use, and region.

|

By Component |

By Deployment |

By Application |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Software segment held the largest market share in 2022

The software segment accounted for the largest market share and will likely retain its position over the projected period. The growth of the segment market can be largely attributed to its simplified and enhanced decision-making process by enabling a single view of the complete process and its capabilities to remove the need to switch applications for gathering the data easily.

The services segment is expected to grow significantly over the coming years because of the growing prevalence of SaaS for offering comparatively easier and more simplified application distribution to customers across the globe over the internet. Additionally, the installation and deployment of SaaS take less time and are easier than traditional software deployment, resulting in higher service adoption and influencing segment growth.

Cloud segment is expected to hold highest market share during projected period

The cloud segment is anticipated to account for the highest market share in revenue during the projected period, mainly driven by its various beneficial features, including offering greater flexibility to a large range of organizations without any need to be installed at the user premises. It provides several other advantageous features, such as cost-effectiveness, ease of access, and higher scalability, which would further drive the demand and growth of the segment market.

The on-premises segment led the industry market in 2022 with significant market share, owing to its widespread adoption due to data protection and greater security, as the software is installed at the user's premises and provides better control and convenient access over the applications.

Quality management segment dominated the global market in 2022

The quality management segment dominated the global market in 2022 and is expected to maintain its dominance throughout the forecast period. The segment market growth can be attributable to the growing prevalence of these solutions, as it offers greater quality products, increased customer satisfaction, and reduced wastage during several industrial operations. Moreover, quality management solutions support advanced planning, control processes, and quality monitoring within the organizations, which ensures continuous improvements and improves operational efficiency. Thus, all these factors are anticipated to fuel the demand and adoption of these solutions significantly over the coming years.

Automotive segment is expected to witness fastest growth during forecast period

The automotive segment is expected to grow at the fastest CAGR throughout the anticipated period, which is highly accelerated by increased awareness of the automotive manufacturers on building smart manufacturing facilities with the help of connecting people, technology, machines, and systems. Additionally, increasing demand for automobiles across both developed and developing economies due to increased consumer disposable income and higher spending capacity on tourism has encouraged major automotive manufacturers to opt for effective manufacturing management solutions and adopt business-generating strategies to meet the rising demand from all over the world. For instance, in August 2022, Siemens entered into a strategic partnership with Nissan intending to install a new production line to manufacture their all-electric car segment called Nissan Ariya.

North America region held the majority market revenue share in 2022

North America region held the majority market share in 2022 and will likely continue its market position over the coming years. The robust presence of major market manufacturers in developed countries of the region, including the US and Canada, offers improved and advanced planning & scheduling, labor management, inventory management, performance analysis, manufacturing intelligence, and manufacturing execution systems, among others, and early adoption of newly developed technologies introduced key players of the market are among the major factors driving the growth of the regional market.

Asia Pacific region is anticipated to emerge as the fastest growing region over the course of the study period, which is highly attributable to an extensive rise in the industrial sector and large manufacturing industry in countries like India and China due to the availability of cheap labor, presence of various resources, and increased government support towards the establishment of innovative or smart manufacturing facilities in the region.

Competitive Insight

Some of the major players operating in the global manufacturing operations management software market include AVEVA Group Plc, Honeywell International, Rockwell Automation, Siemens, Schneider Electric, Epicor Software Corporation, ABB Ltd., GE Digital, SAP SE, Dassault Systems, Critical Manufacturing, EMERSON ELECTRIC, Aegis Industrial Software, PLEX Systems, & Aspen Technology.

Recent Developments

- In March 2022, Cyient, a leading global technology solution company, announced that it has entered into a strategic partnership with iBASEt, intending to develop purpose-built software products to help manufacturers ease their digital operations management solutions.

- In April 2022, TrendMiner introduced a new production client for industrial analytics. The new software solution provides an enhanced user experience & and a dedicated pool of operational experts to effectively manage data-driven decisions to optimize the performance of industrial operations further.

Manufacturing Operations Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 19.39 billion |

|

Revenue forecast in 2032 |

USD 49.81 billion |

|

CAGR |

12.5% from 2024-2032 |

|

Base year |

2023 |

|

Historical data |

2019–2022 |

|

Forecast period |

2024–2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Deployment, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

AVEVA Group Plc, Honeywell International Inc., Rockwell Automation Inc., Siemens AG, Schneider Electric, Epicor Software Corporation, ABB Ltd., GE Digital, SAP SE, Dassault Systems, Critical Manufacturing S.A., EMERSON ELECTRIC Co., Aegis Industrial Software Corporation, PLEX Systems, and Aspen Technology Inc. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of trade management market. Besides, we have stringent data-quality checks in place to enable manufacturing operations management software market for you.

FAQ's

The global manufacturing operations management software market size is expected to reach USD 49.81 billion by 2032.

Key players in the manufacturing operations management software market are AVEVA Group Plc, Honeywell International, Rockwell Automation, Siemens, Schneider Electric, Epicor Software Corporation, ABB Ltd., GE Digital.

North America contribute notably towards the global manufacturing operations management software market.

The global manufacturing operations management software market expected to grow at a CAGR of 12.5% during the forecast period.

The manufacturing operations management software market report covering key segments are component, deployment, application, end-use, and region.