Manual Resuscitators Market Size, Share, Trends, Industry Analysis Report: By Type (Self-Inflating, Flow Inflating, and T-Piece), Modality, Material, Technology, Patient Type, Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5495

- Base Year: 2024

- Historical Data: 2020-2023

Manual Resuscitators Market Overview

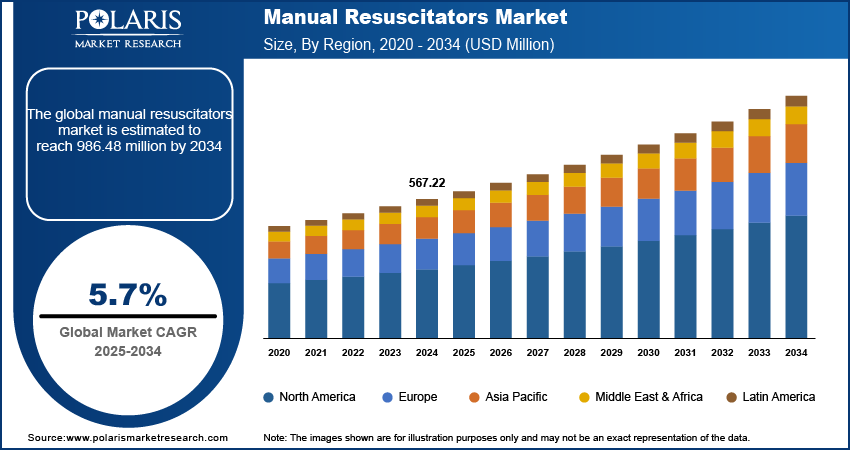

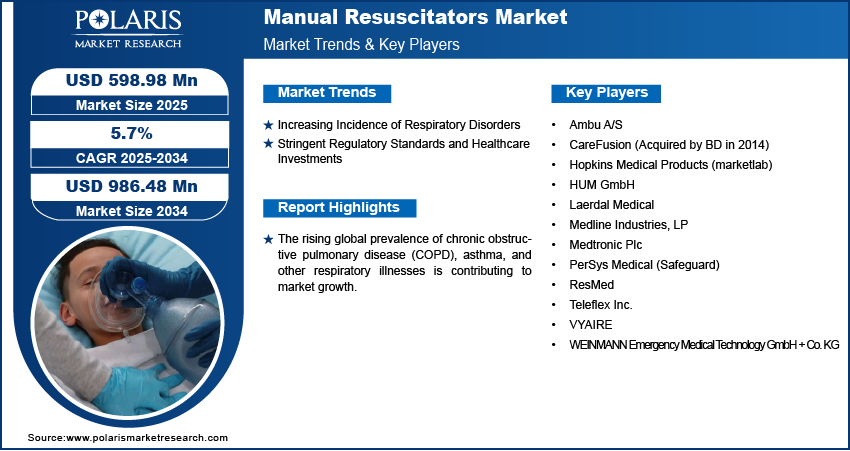

The global manual resuscitators market size was valued at USD 567.22 million in 2024. The market is expected to grow from USD 598.98 million in 2025 to USD 986.48 million by 2034, exhibiting a CAGR of 5.7% during 2025–2034.

The manual resuscitators market focuses on the production, distribution, and advancement of handheld, self-inflating, and flow-inflating artificial respiration devices used in emergency and critical care settings. These devices, commonly known as bag-valve masks (BVMs), are essential for providing positive pressure ventilation to patients experiencing respiratory failure, cardiac arrest, or inadequate breathing.

Continuous innovations in manual resuscitator design, such as improved materials, integrated pressure-limiting valves, and single-use components to reduce cross-contamination risks, are reshaping the manual resuscitators market dynamics. Manufacturers are focusing on ergonomic designs, lightweight materials, and enhanced safety features, driving demand for technologically advanced recovery solutions. These advancements are also enhancing compliance with global healthcare safety standards, further driving market growth.

To Understand More About this Research: Request a Free Sample Report

The expanding role of emergency response teams and pre-hospital care in critical care management is fueling market expansion. The increasing adoption of manual resuscitators by EMS providers, military medical units, and disaster response teams is strengthening market momentum. The demand for portable and easy-to-use resuscitation devices in out-of-hospital cardiac arrest (OHCA) scenarios is further propelling manual resuscitators market growth, encouraging manufacturers to invest in product innovation.

Manual Resuscitators Market Dynamics

Increasing Incidence of Respiratory Disorders

The rising global prevalence of chronic obstructive pulmonary disease (COPD), asthma, and other respiratory illnesses is driving market growth. For instance, according to the Centers for Disease Control and Prevention, in 2023, the prevalence of chronic obstructive pulmonary disease (COPD), including emphysema and chronic bronchitis, among adults was ~4.3%. The growing burden of these conditions necessitates effective emergency ventilation solutions, driving demand for advanced manual resuscitators. Hospitals, emergency medical services (EMS), and home healthcare providers are increasingly adopting these devices to improve patient outcomes, thereby enhancing overall manual resuscitators market value.

Stringent Regulatory Standards and Healthcare Investments

Global healthcare regulatory bodies emphasize patient safety and quality assurance, influencing market dynamics. Stringent guidelines from organizations like the FDA, European Medicines Agency (EMA), and WHO ensure high-quality resuscitation devices. Additionally, rising healthcare expenditures and government investments in emergency medical infrastructure are driving market expansion, creating significant opportunities for manufacturers and healthcare providers. For instance, in January 2025, New York Governor announced a preliminary investment of up to USD 188 million as part of the Healthcare Safety Net Transformation Program. This funding aims to enhance seven hospitals, including a new Comprehensive Cancer Care Center of Queens at Jamaica Hospital and Memorial Sloan Kettering, to improve cancer care delivery in the region. Thus, the introduction of stringent regulatory standards and healthcare investments is driving the manual resuscitators market development.

Manual Resuscitators Market Segment Insights

Manual Resuscitators Market Assessment by Type Outlook

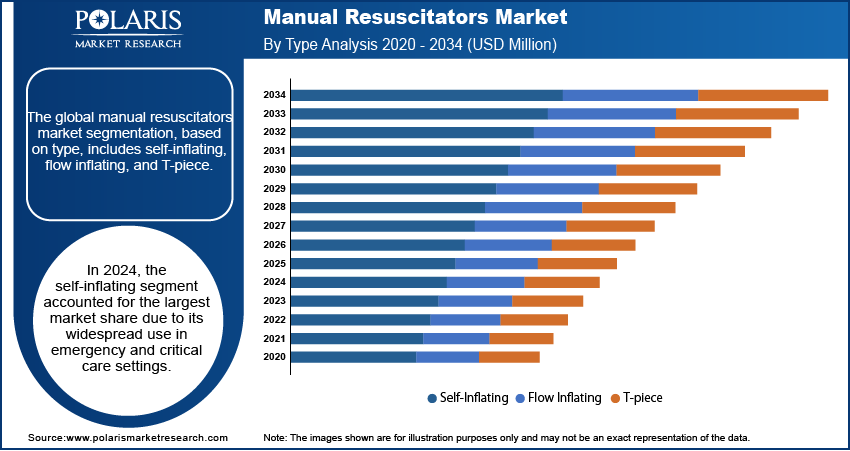

The global manual resuscitators market segmentation, based on type, includes self-inflating, flow inflating, and T-piece. In 2024, the self-inflating segment accounted for the largest market share due to its widespread use in emergency and critical care settings. The ability to function without an external gas source enhances its utility across pre-hospital care, EMS, and intensive care units. The integration of safety features such as pressure-limiting valves and bacterial filters is improving patient outcomes. Continuous advancements in material design, ensuring lightweight, single-use, and disposable options, are driving market demand while aligning with infection control protocols, further contributing to the segment’s leading position.

The flow inflating segment is expected to witness the highest CAGR during the forecast period, driven by its precision in controlled ventilation, making it highly preferred in neonatal intensive care units (NICUs) and anesthesia administration. The growing emphasis on neonatal resuscitation protocols and increasing preterm birth rates are driving market demand for advanced, adjustable resuscitation solutions. The segment's growth is also supported by technological advancements that enhance operator control over tidal volume and pressure, improving clinical outcomes. Rising adoption in pediatric and specialized care settings is further contributing to the segment’s robust growth.

Manual Resuscitators Market Evaluation by End Use Outlook

The global manual resuscitators market segmentation, based on end use, includes hospital, ASC, military, and others. In 2024, the hospital segment accounted for the largest market share due to the high volume of emergency and critical care procedures requiring resuscitation. The increasing prevalence of respiratory failure, cardiac arrest, and trauma cases has led to a significant increase in the demand for manual resuscitators. The availability of trained medical personnel, advanced ICU infrastructure, and integrated emergency response systems has also contributed to the segment’s leading position. Additionally, stringent hospital protocols focusing on patient safety and infection control have fueled the adoption of high-quality, disposable manual resuscitators.

The ASC segment is expected to witness significant growth during the forecast period due to the rising shift toward outpatient surgical procedures and ambulatory emergency care. The increasing demand for cost-effective, efficient, and patient-centric care models is accelerating the adoption of manual resuscitators in these settings. The emphasis on minimally invasive surgeries and post-anesthesia recovery care is further driving demand. The growing presence of ASCs, supported by favorable regulatory policies and healthcare investments, is shaping market dynamics, positioning this segment for robust market growth.

Manual Resuscitators Market Regional Analysis

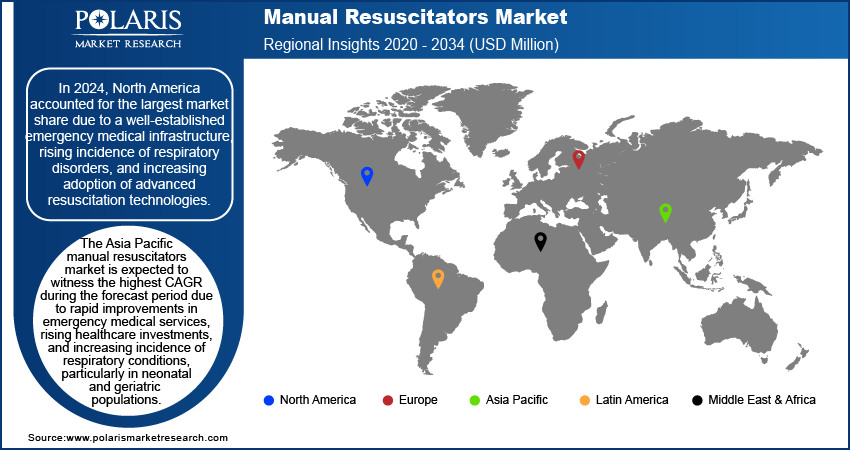

By region, the study provides the manual resuscitators market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to a well-established emergency medical infrastructure, rising incidence of respiratory disorders, and increasing adoption of advanced resuscitation technologies. The growing prevalence of cardiopulmonary arrest, chronic obstructive pulmonary disease (COPD), and acute respiratory distress syndrome (ARDS) is fueling demand across hospitals, ambulatory surgical centers (ASCs), and emergency medical services (EMS). For instance, according to the American Heart Association’s 2022 Heart and Stroke Statistics, cardiac arrest remains a serious public health issue, with over 356,000 out-of-hospital cardiac arrests (OHCA) annually in the US, nearly 90% of which are fatal. Regulatory mandates by organizations such as the FDA and AHA are strengthening market value by enforcing stringent quality and safety standards for resuscitation devices. The presence of leading medical device manufacturers and ongoing product innovations, including disposable, self-inflating, and pressure-limiting valve resuscitators, is accelerating market expansion. Increasing healthcare expenditure, advancements in pre-hospital care, and rising awareness regarding early intervention in respiratory emergencies further drive the region’s leading position in the market.

The Asia Pacific manual resuscitators market is expected to witness the highest CAGR during the forecast period due to rapid improvements in emergency medical services, rising healthcare investments, and increasing incidence of respiratory conditions, particularly in neonatal and geriatric populations. Expanding government-led healthcare initiatives in countries like China, India, and Japan are driving market demand for cost-effective, high-performance resuscitation solutions. The rising burden of preterm births, pediatric respiratory distress, and chronic pulmonary diseases is prompting the widespread adoption of flow-inflating and self-inflating resuscitators in neonatal intensive care units (NICUs) and emergency departments. The growing presence of local and international medical device manufacturers, along with strategic partnerships to enhance distribution networks, is fueling market expansion. Increasing focus on training programs for healthcare professionals and first responders is further influencing market dynamics, ensuring greater accessibility and usage of manual resuscitators across hospitals, ambulatory centers, and rural healthcare facilities.

Manual Resuscitators Market – Key Players and Competitive Insights

The competitive landscape features global leaders and regional players competing for manual resuscitators market share through product innovation, strategic alliances, and regional expansion. Global players leverage strong R&D capabilities, technological advancements, and regulatory compliance to deliver high-performance resuscitation solutions, meeting the growing market demand for portable, disposable, and advanced manual resuscitators. Market trends indicate a surge in self-inflating and T-piece resuscitators, driven by increasing emergency medical needs, neonatal care advancements, and the rising prevalence of respiratory conditions. Strategic investments, mergers and acquisitions, and joint ventures remain crucial for market expansion, enabling firms to enhance competitive positioning and broaden distribution networks. Post-merger integration and partnership ecosystems are key to unlocking market opportunities and addressing evolving healthcare demands. Regional companies focus on cost-effective and regulatory-compliant resuscitation solutions, leveraging localized healthcare policies and growing investments in emergency care infrastructure to cater to industry-specific demands. Competitive benchmarking involves market entry strategies, technological advancements, and regulatory landscape assessments to align with the evolving healthcare ecosystem.

The market is witnessing technological advancements such as AI-integrated respiratory monitoring, single-use antimicrobial resuscitators, and lightweight, ergonomic designs, reshaping emergency medical response and critical care procedures. Companies are heavily investing in manufacturing automation, supply chain optimization, and sustainable medical device solutions to align with market trends and evolving patient care standards. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying scalability opportunities and long-term profitability. In conclusion, the manual resuscitators market is driven by technological innovation, healthcare infrastructure modernization, and increasing regulatory mandates. Major players focus on strategic developments, product differentiation, and expansion into emerging healthcare markets to navigate economic and geopolitical shifts, ensuring sustained market growth in a highly competitive global landscape.

Medtronic is a developer, manufacturer, and seller of device-based medical therapies. The company's business operations are divided into four segments: cardiovascular portfolio, medical surgical portfolio, neuroscience portfolio, and diabetes operating unit. Medtronic's cardiovascular portfolio segment specializes in implantable cardiac devices such as defibrillators, pacemakers, and resynchronization therapy devices. Additionally, the company offers insertable cardiac monitor systems, cardiac ablation products, TYRX products, and remote patient-centered and monitoring software. Medtronic's cardiovascular segment also includes manual resuscitators, which are essential in emergency and critical care settings. The medical surgical portfolio segment provides a range of surgical products, including vessel sealing instruments, surgical stapling devices, wound closure and electrosurgical devices, hernia mechanical devices, surgical artificial intelligence and robotic-assisted surgery products, mesh implants, lung products, gynecology, and various therapies to treat diseases. The company also offers products in the fields of minimally invasive gastrointestinal and hepatologic diagnostics and therapies.

Teleflex Inc. is engaged in the development and manufacturing of specialty medical devices for critical care and surgical applications. Teleflex Inc. was founded in 1943 and is headquartered in Pennsylvania, US. Teleflex's product portfolio includes a wide range of single-use medical devices, particularly focusing on airway management, vascular access, and surgical instrumentation. The services provided encompass the supply of these devices to hospitals, healthcare providers, and home care markets across various regions, including North America, Europe, and Asia-Pacific. Additionally, Teleflex is engaged in producing manual resuscitators, such as the Lifesaver Disposable Manual Resuscitator. This device is designed for emergency resuscitation, featuring a nonslip grip and quick rebound functionality to ensure reliability in critical situations. Teleflex operates in over 40 countries.

List of Key Companies in Manual Resuscitators Market

- Ambu A/S

- CareFusion (Acquired by BD in 2014)

- Hopkins Medical Products (marketlab)

- HUM GmbH

- Laerdal Medical

- Medline Industries, LP

- Medtronic Plc

- PerSys Medical (Safeguard)

- ResMed

- Teleflex Inc.

- VYAIRE

- WEINMANN Emergency Medical Technology GmbH + Co. KG

Manual Resuscitators Industry Developments

In February 2025, Archeon Medical and Ambu partnered to distribute their innovative medical devices, EOlife and EOlifeX, enhancing accessibility within the healthcare sector.

Manual Resuscitators Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Self-Inflating

- Flow Inflating

- T-Piece

By Modality Outlook (Revenue, USD Million, 2020–2034)

- Disposable

- Reusable

By Material Outlook (Revenue, USD Million, 2020–2034)

- Silicon

- PVC

- Rubber

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Pop-Off valve

- PEEP Valve

- Others

By Patient Type Outlook (Revenue, USD Million, 2020–2034)

- Adult

- Pediatric

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Chronic Obstructive Pulmonary Disease

- Cardiopulmonary Arrest

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospital

- ASC

- Military

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Manual Resuscitators Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 567.22 million |

|

Market Size Value in 2025 |

USD 598.98 million |

|

Revenue Forecast in 2034 |

USD 986.48 million |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global manual resuscitators market size was valued at USD 567.22 million in 2024 and is projected to grow to USD 986.48 million by 2034.

The global market is projected to register a CAGR of 5.7% during the forecast period.

In 2024, North America manual resuscitators market accounted for the largest market share due to a well-established emergency medical infrastructure, rising incidence of respiratory disorders, and increasing adoption of advanced resuscitation technologies.

Some of the key players in the market are Ambu A/S; CareFusion (Acquired by BD in 2014); Hopkins Medical Products (marketlab); HUM GmbH; Laerdal Medical; Medline Industries, LP; Medtronic Plc; PerSys Medical (Safeguard); ResMed; Teleflex Inc.; VYAIRE; and WEINMANN Emergency Medical Technology GmbH + Co. KG.

In 2024, the self-inflating segment accounted for the largest market share due to its widespread use in emergency and critical care settings.

In 2024, the hospital segment accounted for the largest market share due to the high volume of emergency and critical care procedures requiring resuscitation.