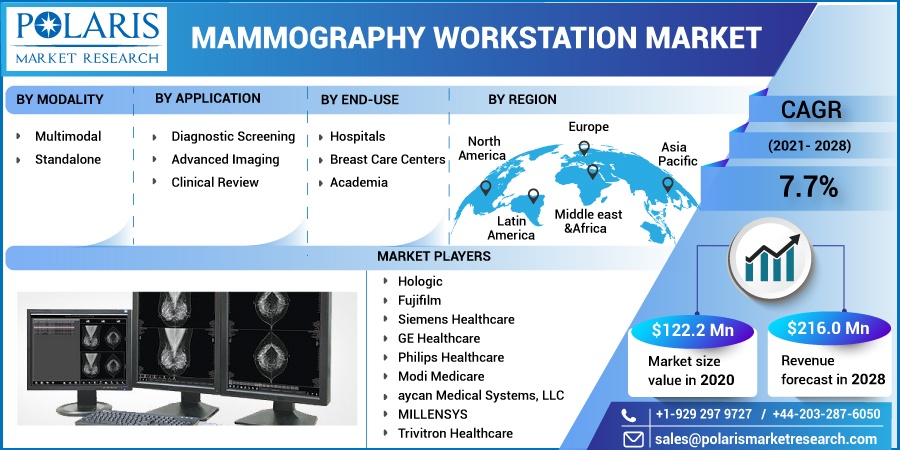

Mammography Workstation Market Share, Size, Trends, Industry Analysis Report, By Modality (Multimodal, Standalone); By Application (Diagnostic Screening, Advance Imaging, Clinical Review); By End-Use (Hospitals, Breast Care Centers, Academia), By Regions; Segment Forecast, 2021 - 2028

- Published Date:Jan-2021

- Pages: 124

- Format: PDF

- Report ID: PM1781

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

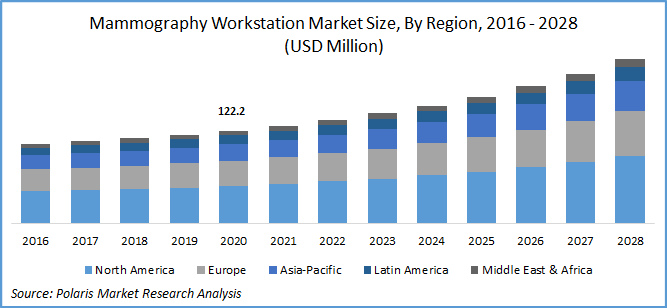

The global mammography workstation market was valued at USD 122.2 million in 2020 and is expected to grow at a CAGR of 7.7% during the forecast period. The rising prevalence of breast cancers, innovations in mammography, strategic investments, and technical advances in terms of image workflow solutions by software solutions providers are the few pivotal factors responsible for mammography workstation market growth.

According to the market statistics published by the World Health Organization (WHO), in 2018, approximately 0.6 million women have died of breast cancer, accounting for over 15 percent of cancer cases. Breast cancer mortality rate could be brought down in the emerging countries by increasing mammography workstation installations, and women’s awareness about its ill effects.

The awareness among women and high female employment rate in developed economies, translates into a higher system penetration rate, contributing significantly to the market growth. As per the Breast Cancer Surveillance Consortium, the share of mammography in breast cancer detection has increased to 34.7 per 100 examinations.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

High prevalence of breast cancer across the globe, advancements in mammography techniques driving the uptake of mammography workstation. Breast cancer is more common in older-aged women. According to the market statistics done by the World Health Organization (WHO), the proportion of the old age population is expected to rise in coming years. Moreover, technological advancements in mammography workstations have also increased the adoption among consumers and resulted in a higher detection rate. Early breast cancer detection is key in increasing the survival rate, which might become lethal, if not diagnosed on time.

Know more about this report: request for sample pages

Rising product approvals in the market from the USFDA is also driving the market for mammography workstations. FDA to modernized breast screening has taken key steps to empower consumers such as advancements in the tissue density standards, new assessment methods, and protocol guidelines. Rising market investments in newer workstation technology, to make it more affordable and has also risen in past few years. Moreover, private software service providers also introducing IT solutions, which ultimately increasing the adoption of mammography workstations.

Mammography Workstation Market Report Scope

The market is primarily segmented on the basis of modality, application, end-use, and region.

|

By Modality |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Modality

Based on the type, the global mammography workstation industry is categorized into multimodal, and standalone. The multi-modal market segment accounted for the largest share in 2020. Segment’s high share is attributed to its increased usage of such systems in hospitals, and the specialty breast cancer centers. Moreover, its technical superiority of having a high-resolution display is well suited to compare 2D and tomosynthesis images also favoring the segment’s market growth driving the demand for mammography workstation industry.

The standalone workstation market segment is anticipated to grow at a significant pace over the forecast period. Growth at this pace is primarily due to its user-friendliness, and high adoption among end-users. Moreover, these devices can integrate data of the multiple modalities at a single location, which automatically examiners time and money.

Insight by Application

Based upon application, the global mammography workstation industry is categorized into diagnostic screening, advanced imaging, and clinical review. In 2020, the diagnostic screening market segment accounted for the majority of the mammography workstation industry share during the assessment period. Segment’s market growth is due to compulsory breast screening programs sponsored by the government authorities. For instance, BreastScreen South Korea is the compulsory nationwide breast screening program, which invites women aged above 50 years for free mammography once every two years.

The advanced imaging market segment is projected to grow at a significant pace over the assessment period. The projected growth is expected to its high efficiency, and growing adoption among end-users. Recent product launches also favoring the segment’s market growth prospects. For instance, in November, Candelis Inc. introduced an advanced breast screening workstation.

Geographic Overview

North America mammography workstation industry accounted for the largest share in the among all, in 2020, and is likely to maintain its dominance over the forecast period. The higher female employment rate in the U.S. and Canada, robust distribution network, and awareness among the women of early breast cancer screening are the few primary drivers responsible for the region’s market growth.

According to the market statistics published by the U.S.-based, National Breast Cancer Foundation Inc., in 2020, there is an estimated 276,480 breast cancer cases diagnosed in the U.S. alone, with 64 percent of the cases, being diagnosed at the localized stage, with more than 99 percent of the survival rate. It is also being estimated that around 42,170 women would die from breast cancer in the country.

In the Asia Pacific, the mammography workstation industry is projected to register the highest growth over the projected period. Rising awareness among women about the ill effects of breast cancer, government-sponsored breast screening programs, and rise in disposable income of women coupled with improving insurance penetration rate are the key reasons driving the market for mammography workstation. China and Japan market comprise over 24 percent of breast cancer cases in the region. In 2015, there were around 268,600 new breast cancer cases and 69,500 deaths occurred due to breast cancer in China. Though, the mortality in China is lower than in the South Asian countries.

Competitive Insight

The prominent market players operating in the mammography workstation industry are Hologic, Fujifilm, Siemens Healthcare, GE Healthcare, Philips Healthcare, Modi Medicare, aycan Medical Systems, LLC, MILLENSYS, and Trivitron Healthcare.