Mammography Market Size, Share, Trends, Industry Analysis Report: By Modality (Multimodal and Standalone), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 119

- Format: PDF

- Report ID: PM2597

- Base Year: 2024

- Historical Data: 2020-2023

Mammography Market Overview

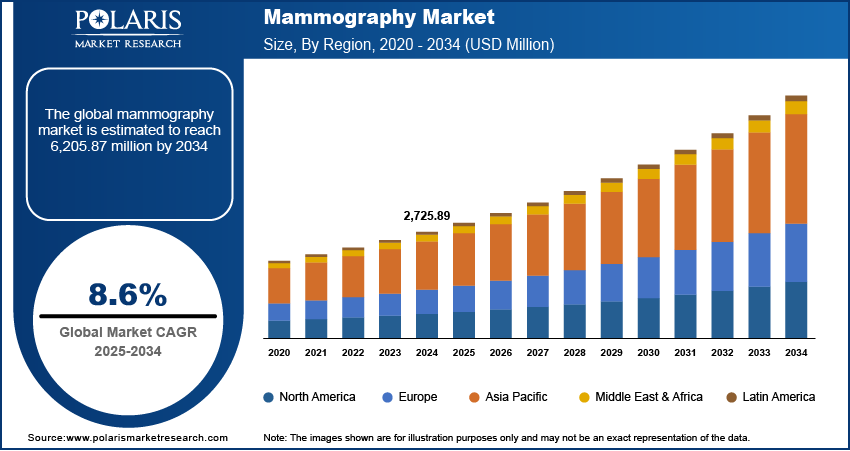

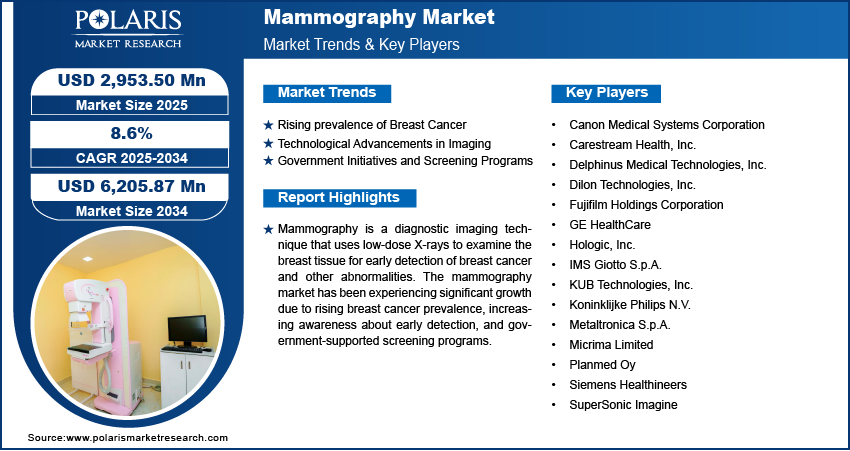

The mammography market size was valued at USD 2,725.89 million in 2024. The market is projected to grow from USD 2,953.50 million in 2025 to USD 6,205.87 million by 2034, exhibiting a CAGR of 8.6% during 2025–2034.

The mammography market encompasses medical imaging technologies used for breast cancer screening and diagnosis. It includes digital mammography, 3D tomosynthesis, and analog systems. Key drivers of market growth include the rising prevalence of breast cancer, increasing awareness of early detection, and government initiatives for screening programs. Technological advancements, such as artificial intelligence integration and digital breast tomosynthesis, are improving diagnostic accuracy and efficiency. Additionally, the growing adoption of portable and mobile mammography units is expanding access to screening services. The market is also influenced by regulatory approvals and reimbursement policies, which impact the adoption of advanced imaging solutions.

To Understand More About this Research: Request a Free Sample Report

Mammography Market Dynamics

Rising Prevalence of Breast Cancer

The increasing prevalence of breast cancer significantly propels the mammography market demand. According to the World Health Organization, in 2022, breast cancer had the highest proportion in India, with 192,020 new cases, accounting for 13.6% of all cancer patients and over 26% of women. This increasing number of breast cancer cases highlights the critical need for early detection and diagnosis along with breast cancer therapy, thereby driving the mammography market growth.

Technological Advancements in Imaging

Innovations in imaging technology have enhanced the effectiveness of mammography. The transition from analog to digital systems, including the adoption of 3D mammography or breast tomosynthesis, has improved image clarity and diagnostic accuracy. These advancements facilitate the early detection of breast cancer, thereby increasing the demand for advanced mammography equipment. Hence, the technological advancements in imaging are expected to boost the mammography market opportunities during the forecast period.

Government Initiatives and Screening Programs

Government-led initiatives and screening programs play a crucial role in promoting regular breast cancer screenings. For instance, the National Breast Cancer Foundation in the US spends over USD 60 million annually to support breast cancer research, education, and screening programs. Such efforts aim to enhance public awareness and accessibility to mammography services. Thus, government initiatives and screening programs contribute to the mammography market demand.

Mammography Market Segment Insights

Mammography Market Assessment by Modality

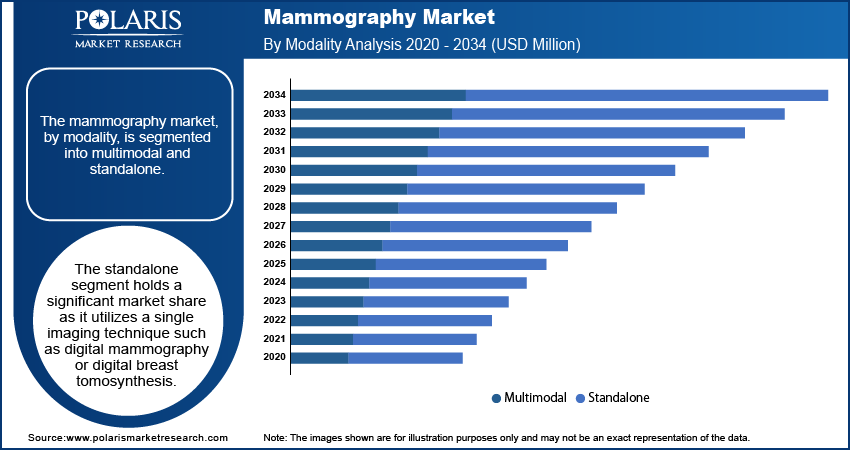

The mammography market, by modality, is segmented into multimodal and standalone. The standalone modality, which utilizes a single imaging technique such as digital mammography or digital breast tomosynthesis, held a larger market share in 2024. This prominence is attributed to its widespread adoption in routine breast cancer screening programs, owing to its established efficacy and accessibility. Standalone systems are integral in early detection efforts, particularly in regions with established healthcare infrastructures.

The multimodal segment, which combines multiple imaging modalities such as mammography and ultrasound, is experiencing a higher growth rate. This surge is driven by the increasing recognition of the limitations inherent in standalone systems, especially in detecting cancers in dense breast tissues. Multimodal approaches enhance diagnostic accuracy by providing complementary information, thereby improving sensitivity and specificity in breast cancer detection. Studies have demonstrated that integrating mammography with ultrasound significantly improves diagnostic performance, particularly in differentiating benign from malignant lesions.

Mammography Market Assessment by Application

The mammography market, by application, is segmented into diagnostic screening, advance imaging, and clinical review. The diagnostic screening segment dominated the market share due to widespread government-funded breast screening programs aimed at early cancer detection.

The advance imaging segment is experiencing substantial growth. This trend is driven by the increasing adoption of advanced imaging technologies, which offer enhanced diagnostic capabilities. These technologies provide clearer visualization of breast tissue, thereby improving the accuracy of cancer detection and diagnosis.

Mammography Market Assessment by End Use

The mammography market, based on end use, is segmented into hospitals, breast care centers, and academia. The hospitals segment held the largest share in 2024. This dominance is attributed to the high volume of breast cancer screenings conducted in hospital settings and the continuous technological advancements in mammography workstations adopted by these institutions. Hospitals are equipped with advanced imaging technologies and have the infrastructure to support comprehensive breast cancer diagnostic services, contributing to their significant market share.

Mammography Market by Regional Outlook

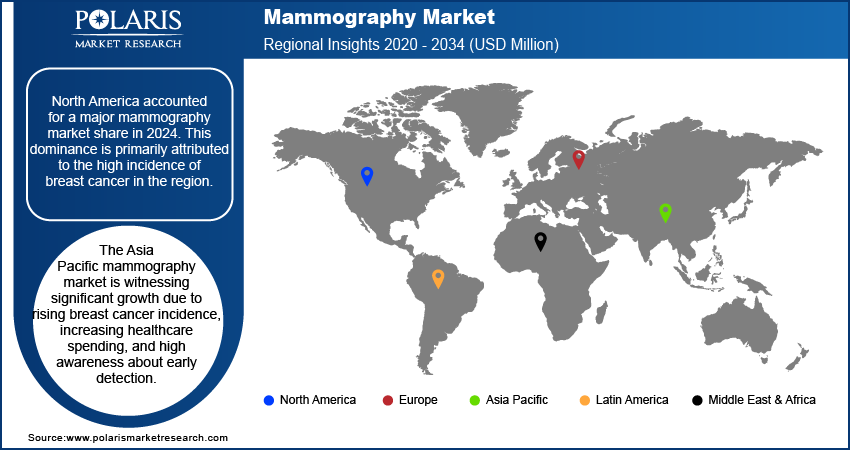

By region, the study provides mammography market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for a major mammography market share in 2024. This dominance is primarily attributed to the high incidence of breast cancer in the region. Additionally, the presence of advanced healthcare infrastructure and widespread awareness programs promoting early detection contribute to the substantial adoption of mammography services in North America.

The Europe mammography market is experiencing growth driven by the increasing incidence of breast cancer and advancements in breast imaging technologies. According to a report by the European Commission's Joint Research Centre, breast cancer was the most commonly diagnosed cancer in Europe in 2021, with over 355,000 new cases. This high prevalence has led to greater demand for early detection methods, thereby boosting the adoption of mammography systems. Additionally, government initiatives and awareness campaigns, such as the 'Breast Cancer Affects Us All' campaign in Germany, aim to promote regular screenings and early diagnosis, further propelling the regional market growth. Technological advancements, including the shift from analog to digital systems and the introduction of 3D mammography, have enhanced diagnostic accuracy and efficiency, contributing to the mammography market expansion in Europe.

The Asia Pacific mammography market is witnessing significant growth due to rising breast cancer incidence, increasing healthcare spending, and high awareness about early detection. According to the Centers for Disease Control and Prevention (CDC), breast cancer is one of the most common cancers among women in Asia, with incidence rates increasing faster than in Western countries due to lifestyle and dietary changes. Governments in countries such as Japan and Australia have implemented national screening programs to encourage regular mammograms among women aged 50 to 74, contributing to increased adoption of mammography services. Technological advancements, such as digital mammography and breast tomosynthesis, are also gaining traction in the region, offering improved imaging capabilities and early detection of breast cancer.

Mammography Market – Key Players and Competitive Insights:

In the mammography market, several key players remain active and independent, contributing significantly to advancements in breast imaging technologies. Hologic, Inc. is renowned for its innovative 3D mammography systems, enhancing early cancer detection. Siemens Healthineers offers a comprehensive portfolio of digital mammography solutions, focusing on patient comfort and diagnostic precision. GE HealthCare provides advanced imaging technologies, including digital mammography and breast tomosynthesis systems. Fujifilm Holdings Corporation has developed digital mammography systems emphasizing image quality and dose efficiency. Koninklijke Philips N.V. delivers mammography solutions designed to improve workflow and patient experience. Canon Medical Systems Corporation offers a range of imaging solutions, including digital mammography systems. Planmed Oy specializes in mammography and orthopedic imaging equipment, focusing on ergonomics and design. Metaltronica S.p.A. provides analog and digital mammography systems with a focus on reliability and performance.

Market players are actively engaged in research and development to enhance imaging technologies, improve diagnostic accuracy, and increase patient comfort. Their efforts are instrumental in advancing breast cancer detection and treatment, contributing to better patient outcomes.

Hologic, Inc. is a medical technology company specializing in women's health, with a focus on breast health, diagnostics, and surgical solutions. The company offers a range of products, including mammography systems, biopsy devices, and imaging software, aimed at improving early detection and treatment of breast cancer.

Siemens Healthineers AG is a global medical technology firm that provides a wide array of healthcare solutions, including advanced imaging systems, laboratory diagnostics, and digital health services. Their mammography offerings are designed to enhance diagnostic accuracy and patient comfort.

List of Key Companies in Mammography Market

- Canon Medical Systems Corporation

- Carestream Health, Inc.

- Delphinus Medical Technologies, Inc.

- Dilon Technologies, Inc.

- Fujifilm Holdings Corporation

- GE HealthCare

- Hologic, Inc.

- IMS Giotto S.p.A.

- KUB Technologies, Inc.

- Koninklijke Philips N.V.

- Metaltronica S.p.A.

- Micrima Limited

- Planmed Oy

- Siemens Healthineers

- SuperSonic Imagine

Mammography Industry Developments

- November 2024: GE HealthCare launched the Pristina Via mammography system, designed to improve the breast screening experience for both patients and technologists. Pristina Via represents a major advancement in the Senographe Pristina platform, offering vendor-neutral prior image comparison and reduced radiation doses across all breast thicknesses.

- September 2024: Siemens Healthineers AG announced that it received premarket approval from the US Food and Drug Administration (FDA) for the 3D imaging technology of its Mammomat B.brilliant mammography system. This system features new 3D image acquisition and reconstruction technology aimed at improving patient comfort and user ergonomics.

Mammography Market Segmentation

By Modality Outlook (Revenue – USD Million, 2020–2034)

- Multimodal

- Standalone

By Application Outlook (Revenue – USD Million, 2020–2034)

- Diagnostic Screening

- Advance Imaging

- Clinical Review

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals

- Breast Care Centers

- Academia

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Mammography Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2,725.89 million |

|

Market Value in 2025 |

USD 2,953.50 million |

|

Revenue Forecast by 2034 |

USD 6,205.87 million |

|

CAGR |

8.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The mammography market has been broadly segmented on the basis of modality, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy

The mammography market growth and marketing strategies are focused on technological innovation, expanding geographic reach, and enhancing patient experience. Key players are investing in research and development to introduce advanced imaging technologies, such as 3D mammography and artificial intelligence-driven diagnostic tools. Additionally, companies are expanding their presence in emerging markets through partnerships, collaborations, and the establishment of distribution networks. Awareness campaigns and government screening programs further drive the adoption of mammography systems, emphasizing the importance of early cancer detection. Companies are also focusing on improving patient comfort and diagnostic accuracy, positioning themselves as reliable solutions in breast cancer detection.

FAQ's

The market size was valued at USD 2,725.89 million in 2024 and is projected to grow to USD 6,205.87 million by 2034.

The market is projected to register a CAGR of 8.6% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the market include Canon Medical Systems Corporation; Carestream Health, Inc.; Delphinus Medical Technologies, Inc.; Dilon Technologies, Inc.; Fujifilm Holdings Corporation; GE HealthCare; Hologic, Inc.; IMS Giotto S.p.A.; KUB Technologies, Inc.; and Koninklijke Philips N.V.

The standalone segment accounted for a larger share of the market in 2024.

Mammography is a medical imaging technique used to examine the breasts for signs of cancer or other abnormalities. It involves the use of low-dose X-rays to create detailed images of the breast tissue. These images, called mammograms, help healthcare professionals detect early signs of breast cancer, such as lumps, tumors, or calcifications. Mammography is commonly used for routine screening in women, especially those aged 40 and above, and is an essential tool in the early detection and diagnosis of breast cancer. It can also be used to investigate symptoms such as breast pain, changes in size or shape, or the presence of a lump.

A few key trends in the market are described below: Adoption of 3D Mammography (Tomosynthesis): Increasing use of 3D mammography systems for enhanced imaging and more accurate detection of breast cancer. Integration of Artificial Intelligence (AI): AI-based solutions are being integrated to improve diagnostic accuracy, speed up image interpretation, and reduce human error. Shift Toward Digital Mammography: The transition from analog to digital mammography systems offers better image quality, faster results, and improved patient outcomes.

A new company entering the market must focus on developing innovative technologies, such as AI-driven diagnostic tools and advanced 3D mammography systems, to enhance accuracy and reduce diagnostic time. Additionally, creating solutions that prioritize patient comfort, such as lower-dose radiation and faster imaging, could differentiate the company. Expanding into emerging markets with affordable, mobile mammography units or establishing partnerships with healthcare providers for early detection initiatives would also be valuable. Furthermore, offering personalized services and training programs for healthcare professionals could help build brand loyalty and establish a strong market presence.