Maleic Anhydride Market Share, Size, Trends, Industry Analysis Report: By Application , By Raw Material (Benzene and N-Butane), By End User , and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Aug-2024

- Pages: 117

- Format: PDF

- Report ID: PM2395

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

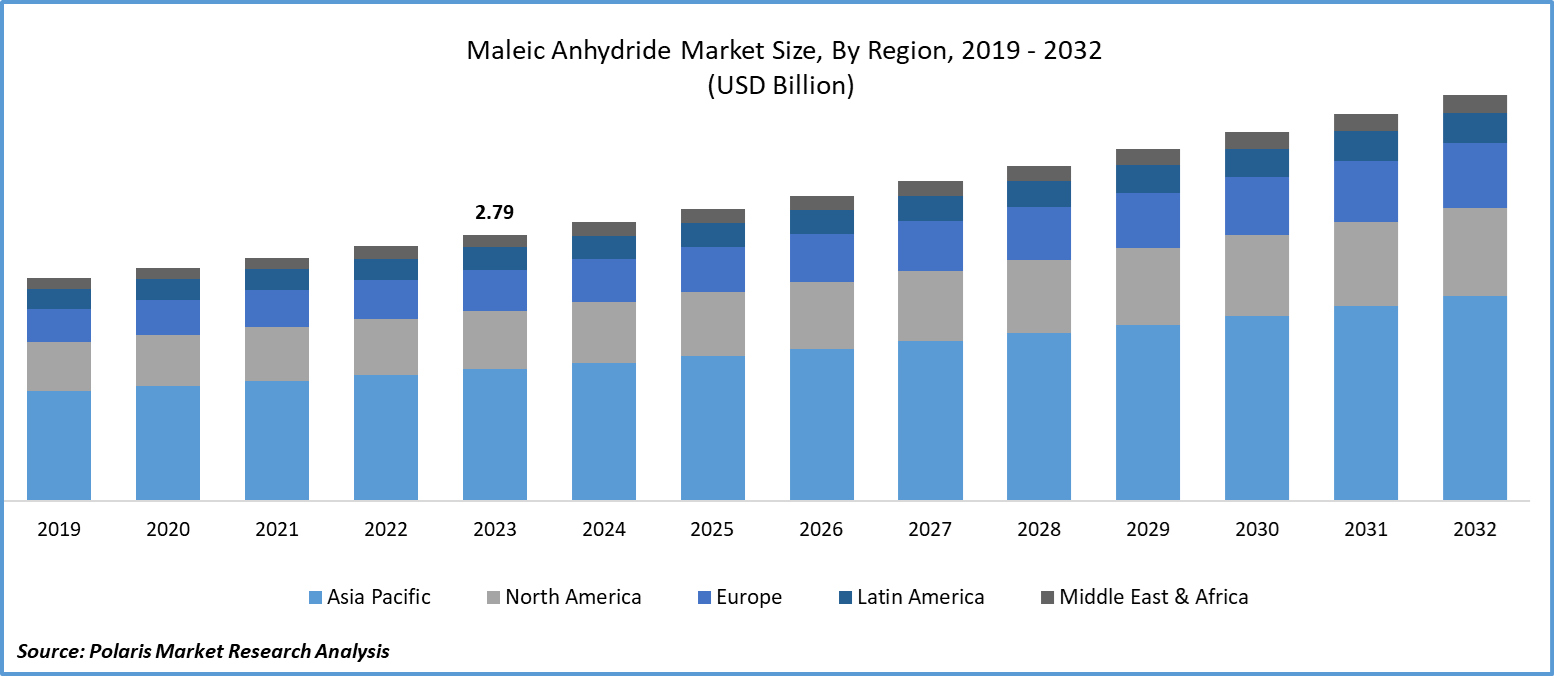

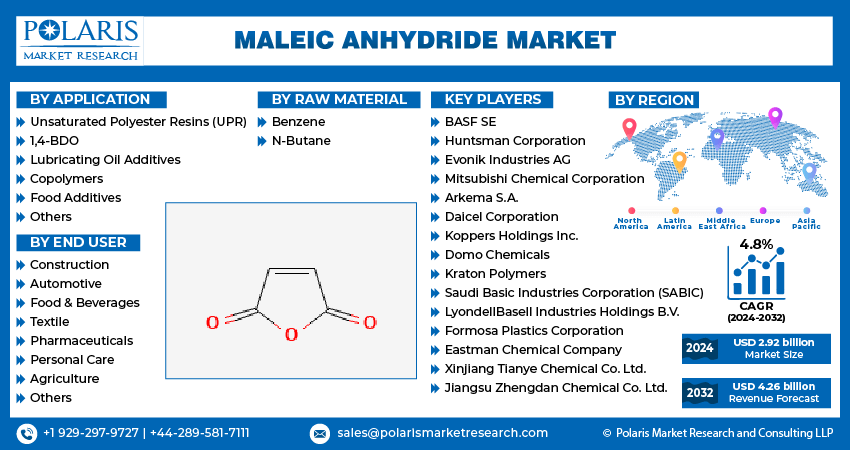

The global maleic anhydride market size was valued at USD 2.79 billion in 2023. The market is projected to grow from USD 2.92 billion in 2024 to USD 4.26 billion by 2032, exhibiting a CAGR of 4.8% during forecast period.

The maleic anhydride market involves the production and use of maleic anhydride, a versatile chemical intermediate. It is widely used in manufacturing resins, plasticizers, and coatings. Market dynamics are driven by its applications across various industries, including chemicals, automotive, construction, and agriculture.

The market growth is attributed to the increasing demand from various end-use industries, including automotive, construction, and textiles. Key drivers include the rising use of maleic anhydride in the production of unsaturated polyester resins, which are crucial for lightweight and high-strength composites in automotive and construction applications. Additionally, the growing trend toward sustainability and the rising demand for eco-friendly materials are boosting the adoption of maleic anhydride in the production of green and recyclable materials. Innovations in production processes and the expansion of manufacturing capacities in emerging economies fuel the market growth. Overall, the market is poised to benefit from technological advancements and expanding application scope of maleic anhydride.

To Understand More About this Research: Request a Free Sample Report

Maleic Anhydride Market Trends

Growing Demand for Unsaturated Polyester Resins

Unsaturated polyester resins (UPRs) use maleic anhydride as a key raw material. The resins are integral in the production of lightweight and high-strength composites widely utilized in automotive, construction, and aerospace industries. The automotive sector, in particular, is driving this trend due to the rising need for fuel-efficient vehicles, which often incorporate composites to reduce weight and enhance performance. Additionally, the increasing focus of the construction industry on using durable and high-performance materials drives the demand for UPRs. Thus, the increasing demand for UPRs propels the growth of the maleic anhydride market.

Emphasis on Sustainable and Eco-Friendly Materials

As industries across the world shift toward greener practices, the demand for environmentally friendly alternatives has risen. Maleic anhydride is increasingly being used in the production of bio-based resins and recyclable materials, aligning with global sustainability goals. This shift is driven by stringent environmental regulations and consumer preferences for products with lower environmental footprints. Further, the market is witnessing an upsurge in innovations aimed at enhancing the sustainability of maleic anhydride applications. Therefore, the rising focus on sustainable and eco-friendly materials supports the maleic anhydride market growth.

Technological Advancements in Production Processes

Innovations in production techniques, such as the development of efficient and cost-effective catalytic processes, have led to increased production capacities and improved product quality. These advancements are enabling manufacturers to meet the rising demand for maleic anhydride while optimizing resource utilization and reducing operational costs. Furthermore, the adoption of advanced technologies in emerging economies is contributing to market expansion by enhancing production efficiency and fostering competitive pricing. As a result, the market for maleic anhydride is benefiting from technological progress and the increased availability of maleic anhydride.

Maleic Anhydride Market Segment Insights

Maleic Anhydride Market – Application Insights

In the global maleic anhydride market, the unsaturated polyester resins (UPR) segment holds the largest share due to its extensive use in various industries, including automotive, construction, and aerospace. UPRs are preferred for their strength, durability, and lightweight properties, making them ideal for composite materials used in these sectors. This widespread application ensures that the UPR segment remains the dominant force in the market, consistently driving high demand for maleic anhydride.

The fastest-growing segment is 1,4-butanediol (1,4-BDO), driven by its increasing use in the production of polybutylene terephthalate (PBT) and other engineering plastics. The rise in demand for high-performance materials in automotive and electronics applications is fueling this growth. Additionally, the food additives segment, though smaller, is witnessing steady growth due to rising consumer preference for food products with extended shelf life and improved quality. While lubricating oil additives, copolymers, and others contribute to the market, their growth rates are comparatively moderate, with 1,4-BDO standing out as the most dynamic segment in recent years.

Maleic Anhydride Market – Raw Material Insights

The global maleic anhydride market, by raw materials, is bifurcated into benzene and n-butane. The n-butane segment dominates the market, due to its cost-effectiveness and efficiency in the production of maleic anhydride through the catalytic oxidation process. N-butane-derived maleic anhydride is preferred for its higher yield and lower production costs compared to benzene, making it a widely adopted choice in the various industry such chemical, plastic industry etc. This dominance is further supported by the growing adoption of n-butane in emerging economies, where its availability and lower price contribute to its widespread use.

The benzene segment is witnessing a higher growth rate during forecast period. Although benzene is more expensive and less efficient than n-butane, its use is gaining traction due to advancements in production technologies and increasing demand in specific high-performance applications. The growing emphasis on specialty chemicals and high-quality resins is driving the demand for benzene-based maleic anhydride. Despite its higher cost, benzene's unique properties make it suitable for certain applications where performance criteria are critical, thus propelling its growth in the market. Overall, while n-butane remains the dominant segment, benzene is emerging as the fastest-growing segment due to evolving market needs and technological advancements.

Maleic Anhydride Market – End User Insights

In the global maleic anhydride market, the construction and automotive sectors are the leading end users, with the construction segment being the most dominant due to the extensive use of maleic anhydride in unsaturated polyester resins for durable and high-strength composites. The automotive industry also contributes significantly, driven by the demand for lightweight materials to enhance fuel efficiency and performance. However, food & beverages is the fastest-growing segment as maleic anhydride is increasingly used in the production of food additives and preservatives. This growth is attributed to rising consumer demand for processed and packaged foods, which boosts the need for efficient food preservation solutions. Additionally, the personal care and pharmaceuticals segments are witnessing steady growth as maleic anhydride finds applications in various cosmetic formulations and drug delivery systems. Overall, while the construction sector maintains dominance, the food & beverages segment is emerging as the highest growth area, reflecting shifting consumer preferences and industry demands.

Maleic Anhydride Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Maleic Anhydride Market – Regional Insights

By region, the study provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominates the global maleic anhydride market, driven by its robust industrial base and rapidly expanding end-use sectors, particularly in construction, automotive, and textiles. This dominance is fueled by the region's high manufacturing capacities, cost-effective production processes, and increasing infrastructure development, which amplifies the demand for maleic anhydride in unsaturated polyester resins. Additionally, the region benefits from favorable government policies, low production costs, and a growing consumer base, contributing to its leading market position. North America and Europe also play significant roles but report slowest growth than Asia Pacific due to mature markets and higher production costs. Latin America and the Middle East & Africa are emerging markets with potential growth, but they lag behind in terms of market share and growth rate.

Maleic Anhydride Market, Regional Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

In Europe, the maleic anhydride market is characterized by a mature and stable environment with steady demand from key end-use industries such as construction, automotive, and textiles. The region's advanced infrastructure and stringent regulatory standards drive the adoption of high-quality, eco-friendly maleic anhydride products. Germany, France, and the UK are major contributors, leveraging their strong manufacturing bases and technological expertise to meet regional demands. However, Europe faces challenges such as higher production costs and regulatory constraints, which impact market growth. The focus on sustainability and innovation in production processes is shaping the market, with increasing investments in research and development to enhance product applications and environmental performance.

Asia Pacific dominated the global maleic anhydride market in 2023, driven by its rapid industrial growth and extensive end-use applications. Countries such as China, India, and Japan are leading the charge, supported by their expansive manufacturing capabilities and significant investments in infrastructure development. The region's booming construction and automotive sectors are major consumers of maleic anhydride, owing to their need for high-performance materials and cost-efficient production. Additionally, the growing middle-class population and rising consumer demand in various industries are fueling market expansion. The relatively lower production costs and favorable government policies further boost the region's leading position, making it a hotspot for market growth and innovation.

Maleic Anhydride Market – Key Market Players and Competitive Insights

BASF SE, Huntsman Corporation, Mitsubishi Chemical Corporation, Arkema S.A., Saudi Basic Industries Corporation (SABIC), Evonik Industries AG, LyondellBasell Industries Holdings B.V., Formosa Plastics Corporation, Daicel Corporation, Koppers Holdings Inc., Domo Chemicals, Kraton Polymers, Eastman Chemical Company, Xinjiang Tianye Chemical Co. Ltd., and Jiangsu Zhengdan Chemical Co. Ltd. are among the key players in the global maleic anhydride market. These companies are prominent due to their extensive production capabilities, technological advancements, and strong global presence.

The competitive landscape in the maleic anhydride market is shaped by several factors, including production capacity, technological innovation, and market reach. Major players are focusing on expanding their manufacturing facilities and enhancing their production processes to meet the growing demand for maleic anhydride across various industries. BASF and Huntsman are investing in advanced technologies to improve efficiency and reduce costs, while Mitsubishi Chemical and Arkema are leveraging their extensive R&D capabilities to develop new applications and products. Strategic partnerships and mergers and acquisitions are also prevalent, as companies seek to strengthen their market position and broaden their product portfolios.

Competitive insights reveal that while established players dominate the market, there is significant potential for emerging companies to capture market share through innovation and regional expansion. Companies are increasingly adopting sustainability practices to align with global environmental standards, which is becoming a critical differentiator. Additionally, the focus on enhancing product quality and developing eco-friendly solutions is driving competition. The market is expected to witness continued growth as leading players and new entrants invest in technological advancements and strategic initiatives to address evolving industry needs and capture emerging opportunities.

BASF SE is a major global player in the maleic anhydride market, renowned for its extensive chemical production capabilities and innovative solutions. The company leverages advanced technologies and strong R&D efforts to enhance the efficiency and sustainability of its maleic anhydride production processes. BASF's global footprint and diverse application portfolio across automotive, construction, and industrial sectors strengthen its market position.

Huntsman Corporation is another major player in the maleic anhydride industry, known for its broad range of chemical products and solutions. The company's maleic anhydride offerings are integral to various industries, including automotive, construction, and consumer goods. Huntsman's focus on innovation and high-quality production drives its competitive edge in the market.

Key Companies in Maleic Anhydride Market

- BASF SE

- Huntsman Corporation

- Mitsubishi Chemical Corporation

- Arkema S.A.

- Saudi Basic Industries Corporation (SABIC)

- Evonik Industries AG

- LyondellBasell Industries Holdings B.V.

- Formosa Plastics Corporation

- Daicel Corporation

- Koppers Holdings Inc.

- Domo Chemicals

- Kraton Polymers

- Eastman Chemical Company

- Xinjiang Tianye Chemical Co. Ltd.

- Jiangsu Zhengdan Chemical Co. Ltd.

Maleic Anhydride Industry Developments

- In August 2024, Huntsman announced the expansion of its maleic anhydride production capacity in the US to meet growing demand and enhance its supply chain resilience. This expansion underscores Huntsman's commitment to scaling operations and supporting market growth.

- In April 2024, BASF announced the launch of a new, more efficient maleic anhydride production process that is aimed at reducing environmental impact and operational costs, further solidifying its commitment to sustainability and technological advancement.

Maleic Anhydride Market Segmentation

Maleic Anhydride – Application Outlook

- Unsaturated Polyester Resins (UPR)

- 1,4-BDO

- Lubricating Oil Additives

- Copolymers

- Food Additives

- Others

Maleic Anhydride – Raw Material Outlook

- Benzene

- N-Butane

Maleic Anhydride – End User Outlook

- Construction

- Automotive

- Food & Beverages

- Textile

- Pharmaceuticals

- Personal Care

- Agriculture

- Others

Maleic Anhydride – Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Maleic Anhydride Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2.79 billion |

|

Market size value in 2024 |

USD 2.92 billion |

|

Revenue Forecast in 2032 |

USD 4.26 billion |

|

CAGR |

4.8% from 2024 to 2032 |

|

Base year |

2023 |

|

Historical data |

2019–2022 |

|

Forecast period |

2024–2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive landscape |

|

|

Report format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

How the report is valuable for an organization?

Workflow/Innovation Strategy: The maleic anhydride market has been segmented on the basis of application, raw materials, and end users. Moreover, the study provides the reader with a detailed understanding of the different segments at regional and global level.

Growth/Marketing Strategy: Growth and marketing strategies in the global maleic anhydride market are increasingly focused on expanding production capacities, enhancing technological innovation, and diversifying applications. Companies are investing in advanced production techniques to improve efficiency and reduce costs while also exploring new markets and applications to drive demand. Strategic partnerships, mergers, and acquisitions are common as firms aim to strengthen their market presence and leverage complementary strengths. Additionally, there's a growing emphasis on sustainability, with players developing eco-friendly products and processes to meet evolving regulatory standards and consumer preferences. This multi-faceted approach supports market expansion and competitive positioning.

FAQ's

The global maleic anhydride market size was valued at USD 2.79 billion in 2023 and is projected to grow to USD 4.26 billion by 2032.

The global market is projected to register a CAGR of 4.8% during 2023–2032.

Asia Pacific held the largest share of the market in 2023

BASF SE, Huntsman Corporation, Mitsubishi Chemical Corporation, Arkema S.A., Saudi Basic Industries Corporation (SABIC), Evonik Industries AG, LyondellBasell Industries Holdings B.V., Formosa Plastics Corporation, Daicel Corporation, Koppers Holdings Inc., Domo Chemicals, Kraton Polymers, Eastman Chemical Company, Xinjiang Tianye Chemical Co. Ltd., and Jiangsu Zhengdan Chemical Co. Ltd are among the key players in the global maleic anhydride industry.

In the global maleic anhydride market, the unsaturated polyester resins (UPR) segment holds the largest share due to its extensive use in various industries, including automotive, construction, and aerospace

The n-butane segment dominates the market, due to its cost-effectiveness and efficiency in the production of maleic anhydride through the catalytic oxidation process

The maleic anhydride market involves the production, distribution, and consumption of maleic anhydride, a key chemical compound used in various industrial applications. Maleic anhydride is a versatile chemical with several significant applications, including the production of unsaturated polyester resins (UPRs), which are crucial for lightweight and high-strength composites in automotive and construction industries.

A few key trends in the global maleic anhydride market are described below: Increasing Demand for Unsaturated Polyester Resins (UPRs): Growing use of UPRs in automotive, construction, and aerospace industries due to their lightweight and high-strength properties. Shift Toward Sustainable and Eco-Friendly Materials: Rising adoption of maleic anhydride in producing bio-based resins and recyclable materials to meet environmental regulations and consumer preferences. Technological Advancements in Production Processes: Innovations in catalytic processes and production efficiency, leading to cost reductions and enhanced product quality. Growing Application of 1,4-Butanediol (1,4-BDO): Increased use of 1,4-BDO in manufacturing polybutylene terephthalate (PBT) and other high-performance plastics.

For a new company entering the maleic anhydride market, focusing on innovation and sustainability can provide a competitive edge. Emphasizing advancements in production technology to enhance efficiency and reduce costs will help capture market share, particularly in the growing segment of 1,4-butanediol. Additionally, investing in the development of eco-friendly and bio-based applications can align with the increasing demand for sustainable materials. Building strong relationships with key end-use industries such as automotive and construction and leveraging emerging markets with expanding industrial capacities can position the company as a forward-thinking player in the market.

Companies manufacturing and distributing maleic anhydride and its application products, firms in the construction and food industries, and other consulting firms must buy the report.