Magneto Resistive RAM Market Size, Share, Trends, Industry Analysis Report: By Material (Toggle MRAM and Spin-Transfer Torque MRAM (STT-MRAM)), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5326

- Base Year: 2024

- Historical Data: 2020-2023

Magneto Resistive RAM Market Overview

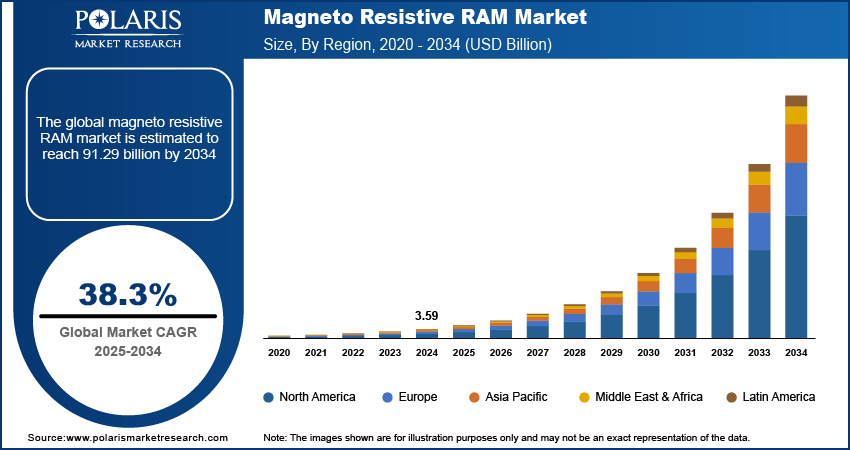

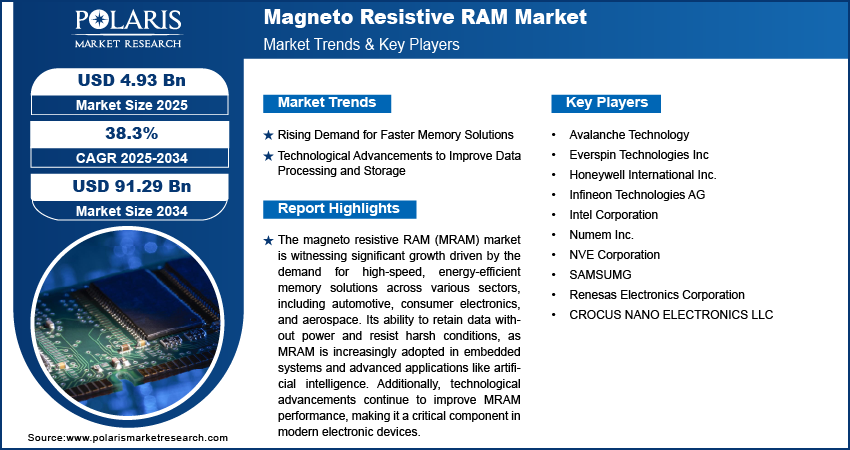

The magneto resistive RAM market size was valued at USD 3.59 billion in 2024. The market is projected to grow from USD 4.93 billion in 2025 to USD 91.29 billion by 2034, exhibiting a CAGR of 38.3% during the forecast period. Magneto resistive RAM (MRAM) is a type of non-volatile memory technology that uses magnetic states to store data, offering fast read/write speeds, high endurance, and data retention without power. It is used in applications where data persistence and speed are critical.

The MRAM market is experiencing significant growth due to its advantages of non-volatility, high speed, and low power consumption. Factors such as rising global demand for electronic device usage, advancements in robotics, and ongoing technological improvements in data processing and storage are effective drivers of industry growth. Additionally, MRAM technology is balanced to revolutionize data storage and access by offering faster, more efficient, and more reliable memory solutions that outperform traditional technologies, consuming less power and retaining data even during outages. For instance, in February 2024, Toshiba Electronic Devices & Storage Corporation started construction on a back-end production facility for power semiconductors at its Himeji Operations in Hyogo Prefecture, western Japan. The facility is expected to begin mass production in the spring of 2025.

To Understand More About this Research: Request a Free Sample Report

The aerospace and defense sectors, supported by increasing government investments, are particularly balanced to adopt MRAM due to its high radiation tolerance and resilience in extreme conditions. Its programmability in space facilitates necessary system reconfigurations, making MRAM essential for applications such as program storage and processor booting.

Magneto Resistive RAM Market Dynamics

Rising Demand for Faster Memory Solutions

The increasing dependence on artificial intelligence (AI) and machine learning (ML) in various industries necessitates the processing of vast amounts of data at high speeds. MRAM technology meets this demand due to its low latency and high endurance, making it suitable for real-time analytics where quick decision-making is critical. For instance, in autonomous vehicles, MRAM is used to process sensor data rapidly, enabling instant responses to dynamic driving conditions. Major companies such as Tesla and Waymo integrate advanced memory solutions into their AI systems, which continues to expand the demand for MRAM. Thus, this trend reflects the industry's shift toward more efficient memory technologies that can handle the complexities of modern data processing tasks.

Technological Advancements to Improve Data Processing and Storage

Technological advancements aimed at improving data processing and storage are a crucial driving force behind the magneto resistive RAM (MRAM) market growth. As industries increasingly rely on data intensive applications, there is a growing demand for memory solutions that offer faster access times, greater efficiency, and improved reliability. MRAM addresses these needs with its unique advantages, including high speed, low power consumption, and non-volatility, making it a suitable alternative to traditional memory technologies including DRAM and Flash. For instance, in October 2024, Kioxia and Hynix collaborated to develop the world's smallest 1Selector-1MTJ cell for 64Gb MRAM chips. This 1S1M cell features reliable read/write operations with a low read disturb rate of less than 1E-6 in a 64 Gb cross-point array, using a Half Pitch of 20.5 nm and a 20 nm MTJ contact diameter, incorporating As-doped SiO2 selectors and perpendicularly magnetized MTJs.

Magneto Resistive RAM Market Segment Insights

Magneto Resistive RAM Market Assessment by Material Outlook

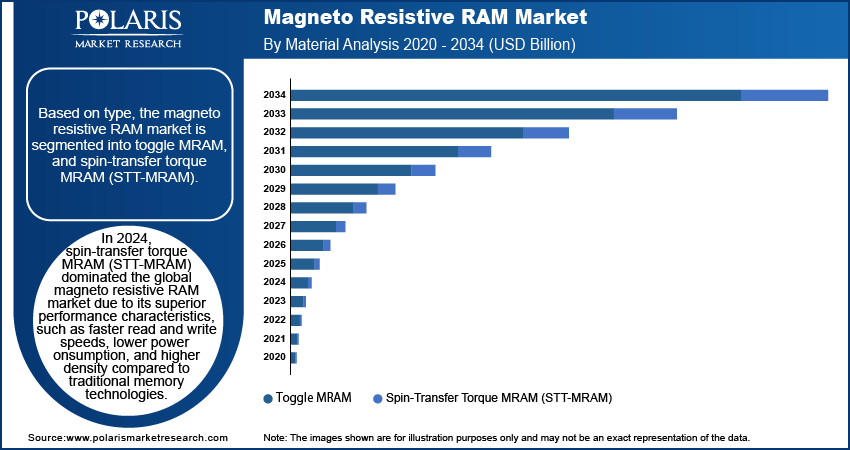

The global magneto resistive RAM market segmentation, based on material, includes toggle MRAM and spin-transfer torque MRAM (STT-MRAM). In 2024, spin-transfer torque MRAM (STT-MRAM) sector dominated the global MRAM market due to its superior performance characteristics, such as faster read and write speeds, lower power consumption, and higher density compared to traditional memory technologies. STT-MRAM’s ability to retain data without power, combined with its non-volatile nature, makes it particularly appealing for applications in data centers, automotive, and IoT devices. Additionally, advancements in fabrication techniques have improved the scalability and reliability of STT-MRAM, further solidifying its position in the market.

Magneto Resistive RAM Market Assessment by Application Outlook

The global magneto resistive RAM market segmentation, based on application, includes automotive, consumer electronics, robotics, enterprise storage, aerospace & defense, and others. The aerospace and defense sector is expected to experience the fastest growth in the global magneto resistive RAM (MRAM) market during the forecast period due to the increasing demand for advanced, reliable memory solutions that can withstand harsh environmental conditions. MRAM's non-volatility, high-speed performance, and durability make it ideal for critical applications in aircraft, satellites, and military systems, where data integrity and resilience are crucial. Additionally, as aerospace and defense programs increasingly incorporate advanced computing capabilities, the need for efficient and robust memory solutions as MRAM will become essential, driving the sector's growth in the coming years.

Magneto Resistive RAM Market Regional Outlook

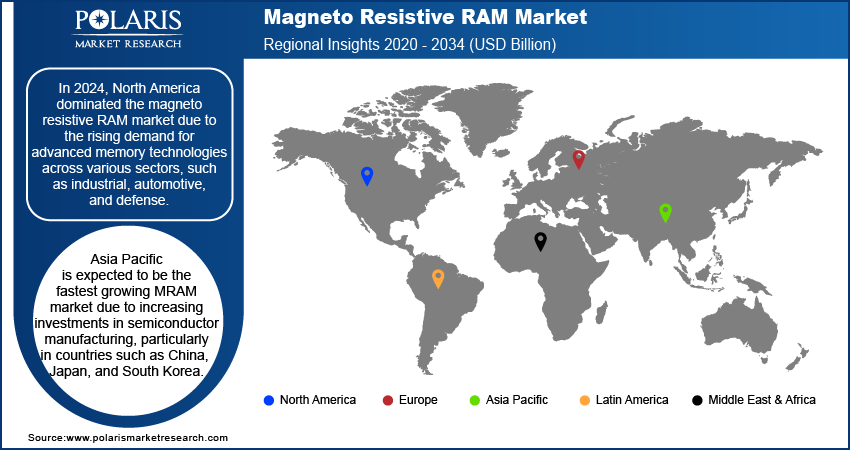

By region, the study provides magneto resistive RAM market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to the rising demand for advanced memory technologies across various sectors, such as industrial, automotive, and defense. For instance, In October 2023, the US government launched a $21 million project led by Purdue University to advance AI hardware, focusing on energy-efficient CMOS+MRAM technology. The four-year initiative involves collaborations with key partners, including Everspin Technologies, Northrop Grumman, and major research institutions. This demand is fueled by the need for faster computational capabilities, improved scalability, and lower power consumption in devices and applications. Additionally, the presence of several major companies in the US and Canada has boosted competition, resulting in the frequent launch of innovative MRAM products tailored to meet the unique requirements of end-users. In 2024, the US held a significant share of the regional market, driven by growth in robotics, consumer electronics, and automotive industries, along with increased investments in defense and aerospace for modernization. These factors are expected to boost the MRAM market demand in the region.

Asia Pacific is expected to be the fastest growing market due to increasing investments in semiconductor manufacturing, particularly in countries such as China, Japan, and South Korea. The region's expanding consumer electronics and automotive industries are driving demand for advanced memory solutions, including MRAM, to improve device performance and efficiency. Government support for technology innovation and the presence of leading memory manufacturers further contribute to growth. Additionally, the rising adoption of AI, IoT, and industrial automation technologies in the region boosts the need for reliable, energy-efficient memory solutions as MRAM.

Magneto Resistive RAM Market – Key Players and Competitive Insights

The competitive landscape of the magneto resistive RAM industry features a mix of global leaders and regional players aiming for market share through innovation, strategic partnerships, and geographic expansion. Major companies such as Everspin Technologies, Honeywell International Inc., and others leverage their extensive R&D capabilities and strong distribution networks to offer advanced MRAM solutions across various sectors, including automotive, consumer electronics, industrial, and aerospace & defense.

These leading players prioritize product innovation, focusing on improving memory performance, energy efficiency, and scalability to meet the growing demands of applications such as AI, IoT, and data storage. Meanwhile, smaller regional firms are emerging with specialized MRAM products that cater to local markets, providing unique solutions for specific needs. Competitive strategies include mergers and acquisitions, collaborations with technology companies, and expanding product lines to strengthen market presence globally. A few key major players are Avalanche Technology, Everspin Technologies Inc, Honeywell International Inc., Infineon Technologies AG, Intel Corporation, Numem Inc., NVE Corporation, Samsung, Renesas Electronics Corporation, and Crocus Nano Electronics LLC.

Samsung Electronics Co., Ltd. is a South Korean multinational electronics company and a flagship subsidiary of the Samsung Group, headquartered in Suwon. Established in 1969, the company operates in the manufacturing of consumer electronics, semiconductors, and telecommunications equipment. Samsung's diverse product portfolio includes smartphones, televisions, home appliances, and various electronic components such as memory chips and displays. Samsung operates on a global scale, with a presence in numerous countries across all continents. In January 2022, Samsung Electronics showcased the first MRAM-based in-memory computing system developed by the Samsung Advanced Institute of Technology (SAIT). With this technological advancement, Samsung aims to integrate storage and computing within AI processors, positioning itself to expand its market share in the AI semiconductor industry.

Everspin Technologies, Inc., headquartered in Chandler, Arizona, specializes in the design, manufacturing, and supply of Spin-Transfer Torque MRAM (STT-MRAM), embedded Magnetoresistive RAM (MRAM), and discrete. The company targets sectors that demand high data persistence, low latency, and robust security features, including data centers, cloud storage solutions, energy, industrial applications, automotive, and transportation. The company has over 120 billion MRAM and STT-MRAM devices deployed globally. Everspin has cultivated the largest and rapidly expanding user base for MRAM technology worldwide. On May 3, 2022, Everspin Technologies, Inc. began customer sampling for its EMxxLX series MRAM products with SPI/QSPI/xSPI interfaces. This series delivers 400 MB/s read and write speeds per the JEDEC xSPI standard, with memory densities from 8 Mbit to 64 Mbit, making it ideal for industrial IoT and embedded systems applications.

Key Companies in Magneto Resistive RAM Market

- Avalanche Technology

- Everspin Technologies Inc

- Honeywell International Inc.

- Infineon Technologies AG

- Intel Corporation

- Numem Inc.

- NVE Corporation

- SAMSUMG

- Renesas Electronics Corporation

- CROCUS NANO ELECTRONICS LLC

Magneto Resistive RAM Industry Developments

In March 2024, Avalanche Technology, an innovator of MRAM, launched two new densities of its 3rd generation space-grade parallel asynchronous x32-interface high-reliability P-SRAM (Persistent SRAM) memory devices. These products leverage its advanced Spin Transfer Torque Magneto-resistive RAM (STT-MRAM) technology to improve performance and reliability for space applications.

In November 2022, South Korea’s Netsol developed the nation's first STT-MRAM, a next-generation memory chip utilizing the magnetism of electron spin for non-volatile storage. The chips were manufactured by Samsung Electronics’ foundry, signaling a trend of increasing collaboration between large corporations and smaller firms in the semiconductor industry.

Magneto Resistive RAM Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Toggle MRAM

- Spin-Transfer Torque MRAM (STT-MRAM)

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Consumer Electronic

- Robotics

- Enterprise Storage

- Aerospace & Defense

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Magneto Resistive RAM Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.59 billion |

|

Market Size Value in 2025 |

USD 4.93 billion |

|

Revenue Forecast by 2034 |

USD 91.29 billion |

|

CAGR |

38.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global magneto resistive RAM market size was valued at USD 3.59 billion in 2024 and is projected to grow to USD 91.29 billion by 2034.

The global market is projected to register a CAGR of 38.3% during the forecast period.

In 2024, North America held the largest magneto resistive RAM market share.

A few key players in the market are Avalanche Technology, Everspin Technologies Inc, Honeywell International Inc., Infineon Technologies AG, Intel Corporation, Numem Inc., NVE Corporation, Samsung, Renesas Electronics Corporation, Crocus Nano Electronics LLC.

In 2024, spin-transfer torque MRAM (STT-MRAM) dominated the global magneto resistive RAM market.

The aerospace and defense segment is expected to experience the fastest growth in the global magneto resistive RAM (MRAM) market during the forecast period