Magnet Wire Market Size, Share & Trends Analysis Report By Material (Copper, Aluminum), By Product (Round, Flat), By End Use (Energy, Automotive, Industrial, Residential), By Region, And Segment Forecasts, 2023 - 2032

- Published Date:May-2023

- Pages: 116

- Format: PDF

- Report ID: PM3248

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

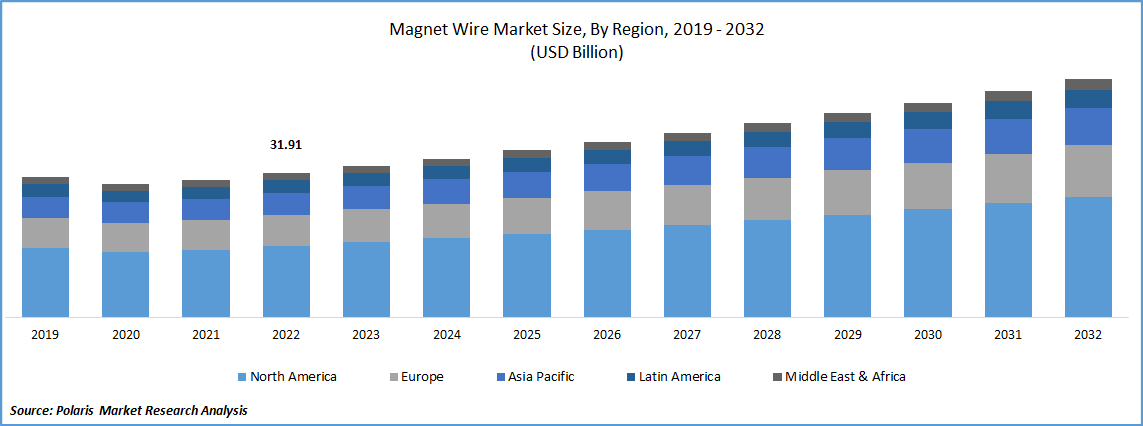

The growth of the global magnet wire market was estimated at USD 31.91 billion in 2022, and from 2023 to 2032, it is anticipated to grow at a revenue based CAGR of 5.2%. The primary reason propelling the market for magnet wire is the increasing demand for the product from the energy sector.

Know more about this report: Request for sample pages

An insulated electrical conductor known as magnet wire, also known as winding wire, is wound around a coil and energized to produce an electromagnetic field for uses involving the transformation of energy. The product, which is used in transformers, motors, and other electromagnetic machinery, is typically made of copper or aluminum.

In emerging countries of the Asia Pacific, such as India, China, and Southeast Asia, the demand for electricity has increased as a result of rising consumer disposable income and rising population. High-capacity additions for electrification in the Asia Pacific are predicted by a recent pattern. The market for magnet wire is anticipated to be driven by the substantial demand for power transformers that will result from this upward trajectory in electricity demand.

One of the main uses of the merchandise in the energy industry is wind turbines. Rising use of renewable energy is anticipated to open profitable possibilities for magnet wire market expansion. The Global Wind Energy Council (GWEC) predicts that the cumulative wind power capacity will grow by 22.5% from 2018 to 731.9 GW by 2020.

Electric vehicle adoption in the automotive sector is predicted to be a major market growth driver. The product is utilized in electric car traction engines, belt started generators, and regenerative braking systems. The market for magnet wire is anticipated to benefit from the strict government regulations concerning CO2 emissions, particularly in Europe and North America.

The primary raw substance used to make magnet wire is copper rod. Manufacturing activities that are integrated define major companies. For their magnet wire business, companies like LS Group and Sumitomo Electric Industries, Ltd. make copper rods on-site. By doing this, businesses can preserve the quality of their raw materials and lower production expenses.

In wind tunnels, which can also be powered by magnetic wires, vehicles and aircraft are evaluated. They enable engineers to assess the effectiveness of novel military and civil car and aircraft designs, as well as to find and fix flaws, without endangering the safety of a test pilot or pricey aircraft. The biggest wind tunnel in the world is located at NASA's Ames Research Center. It is over 180 feet high and 1,400 feet long, and it can hold aircraft with wingspans up to 100 feet.

Industry Dynamics

Growth Drivers

Reducing environmental effects, such as resource depletion and air pollution, as well as CO2 emissions to prevent global warming, is essential to address environmental issues. The industrial, energy conversion (such as electricity plants), and transportation industries are the top emitters of CO2. To satisfy regulatory requirements, which are responsible for most CO2 emissions, the number of electric vehicles (EVs), such as HEV, PHEV, and BEV, has been rapidly rising. Future development rates are probably going to rise as well.

Global EV sales increased by 108% from 2020 to 2021, hitting 6.75 million units. This volume covers passenger automobiles, light trucks, and light commercial vehicles. In comparison to 4.2% in 2020, EV sales (BEV and PHEV) accounted for 8.3% of all light vehicle sales globally. BEVs made up 71% of these sales, while PHEVs made up 29%. Only 4.7% more cars were sold globally in 2020, the crisis year. Magnet wire demand is rising in tandem with EV demand, so large quantities of magnet wire are needed for all types of EVs.

Report Segmentation

The market is primarily segmented based on material, product type, end-use, and region.

|

By Material |

By Product |

By End-use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The Copper Segment is Witnessed to Gain Significant Share During Forecast Period

The copper segment dominated the market in 2022. Due to copper's superior overall mechanical, physical, and chemical properties when compared to aluminum, this large share can be attributed to those factors. Copper, for example, conducts electricity more effectively than metal. Motor manufacturers favor using copper magnet wire because it increases the electrical energy efficiency of motors.

The Round Wire Segment will Account for a Higher Share of the Market During Forecast Period

In 2022, the round wire had the highest income share. The product is widely used in residential uses, including electronics and electric motors for home appliances. The key element influencing the product's higher market share is its wide availability combined with the cheaper price when compared to flat wrapping wire.

Residential Sector is Expected to Dominate the Market During Forecast Period

The residential sector dominated the magnet wire market in 2022. This market share dominance is due to a wide variety of product applications, including heating pumps, hermetic motors for HVAC and refrigeration, home appliances, lighting, and electronics like cell phones, computers, and television.

The Demand in North America is Expected to Witness Significant Growth During Projected Timeframe

In 2022, the Asia Pacific region gained a sizeable market share. China, one of the region's biggest manufacturing hubs, held a sizable portion of the magnet wire market. In the upcoming years, it is anticipated that the relocation of end-product manufacturing businesses to developing nations like China and India due to their cheap labor and manufacturing costs will have a significant impact on regional development.

From 2023 to 2032, North America is anticipated to experience a CAGR of 3.2% in terms of income. High rates of transformer replacement in the U.S. and Mexico's flourishing electronics industry are two major factors driving the market for magnet wire in the area.

Competitive Insight

Large companies like Furukawa Electric Co., Ltd., Irce S.P.A., LS Group, REA Magnet Wire, Tongling Jingda Special Magnet Wire Co., Ltd., Sumitomo Electric Industries, Ltd., LWW Group, and Samdong Co., Ltd. are among the major players in the global industry. The players are fiercely competing and primarily distinguish their goods based on both price and quality.

Recent Developments

- Essex Furukawa unveiled Sight Machine Inc. as the platform for manufacturing efficiency for its facilities in China, the United States, and Germany on February 10, 2021. The manufacturing productivity platform from Sight Machine produces tangible improvements in output, sustainability, and quality. The latter produces the majority of the magnet wire and winding wire used to power motors, including those found in electric cars.

- The parent business of Essex Magnet Wire, Superior Essex Inc., and Furukawa Electric Co., Ltd. ("Furukawa"), both leaders in the creation of magnet wire products and specialised solutions, announced their intention to complete a global joint venture on October 1, 2020. The combined business will operate under the "Essex Furukawa" name and be known as Essex Furukawa Magnet Wire LLC.

Magnet Wire Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 33.52 billion |

|

Revenue forecast in 2032 |

USD 52.80 billion |

|

CAGR |

5.2% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Material, By Product Type, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Furukawa Electric Co., Ltd., Irce S.P.A., LS Group, REA Magnet Wire, Tongling Jingda Special Magnet Wire Co., Ltd., Sumitomo Electric Industries, Ltd., LWW Group, and Samdong Co., Ltd |

FAQ's

The magnet wire market report covering key segments are material, product, end-use, and region.

Magnet Wire Market Size Worth $52.80 Billion By 2032.

The magnet wire market anticipated to grow at a revenue based CAGR of 5.2%.

North America is leading the global market.

key driving factors in magnet wire market are growth and expansion of electric vehicles.