Machine Tools Market Size, Share, Trends, Industry Analysis Report: By Product (Milling Machines, Drilling Machines, Turning Machines, and Grinding Machines), Technology, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 129

- Format: PDF

- Report ID: PM2011

- Base Year: 2024

- Historical Data: 2019-2022

Machine Tools Market Overview

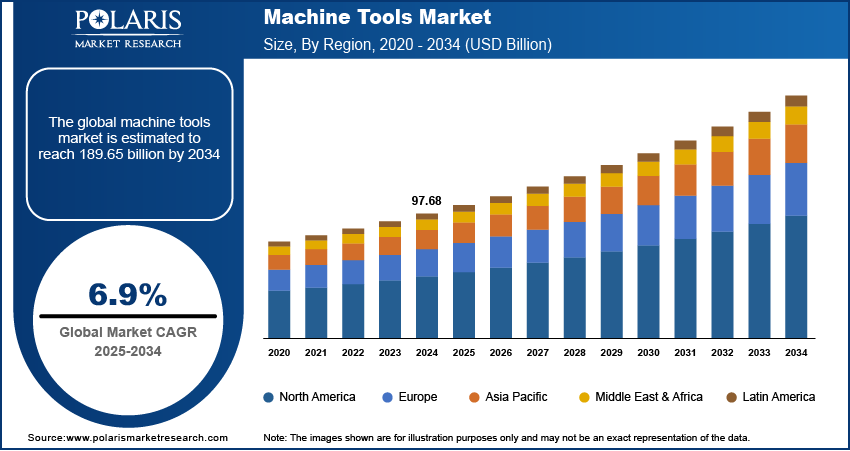

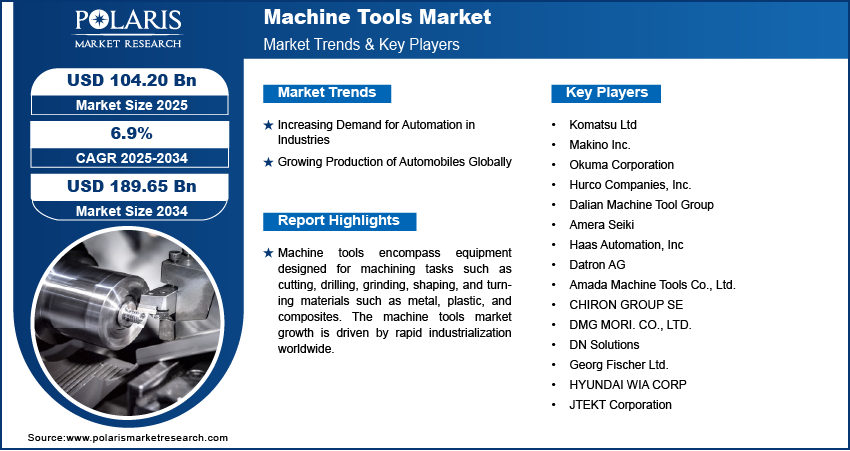

The global machine tools market size was valued at USD 97.68 billion in 2024. The market is projected to grow from USD 104.20 billion in 2025 to USD 189.65 billion by 2034, exhibiting a CAGR of 6.9% from 2025 to 2034.

Machine tools refer to equipment designed for machining tasks such as cutting, drilling, grinding, shaping, and turning materials such as metal, plastic, and composites. These tools are crucial in industries including automotive, aerospace, construction, and electronics, facilitating precision and efficiency in manufacturing. With advancements in automation and smart technologies, machine tools have evolved to integrate artificial intelligence, IoT, and robotics, further enhancing productivity and operational accuracy.

The machine tools market growth is driven by rapid industrialization worldwide, which boosts manufacturing activities and drives the demand for advanced machine tools to produce high-quality components. For instance, according to the Economic Survey 2023-24, presented by the Union Minister of Finance and Corporate Affairs of India, India witnessed robust industrial growth of 9.5% during the period.

To Understand More About this Research: Request a Free Sample Report

Machine Tools Market Dynamics

Increasing Demand for Automation in Industries

The growing demand for automation in industries, particularly manufacturing, is driving the machine tools market development. Automated systems require highly accurate components and consistent production, which machine tools enable through advanced cutting, shaping, and forming capabilities. Industries adopting automation, such as aerospace and electronics, invest heavily in machine tools such as computerized numerical control (CNC) machines and robotic-integrated tools to enhance productivity and reduce operational costs. In addition, the integration of smart technologies in machine tools also aligns with automation trends by offering real-time monitoring and enhanced performance. Therefore, as industries continue to shift toward automation, the demand for advanced machine tools is expected to grow.

Growing Production of Automobiles Globally

The growing production of automobiles globally is boosting the machine tools market revenue. According to European Automobile Manufacturers' Association, 85.4 million motor vehicles were produced globally in 2022. Automotive manufacturers need a wide range of machine tools to shape, cut, and form metal parts for vehicles, making machine tools essential for vehicle production. In addition, the automotive industry's focus on precision and quality drives demand for advanced machine tools, including CNC machines and automated systems, to meet strict tolerances and specifications.

Machine Tools Market Segment Insights

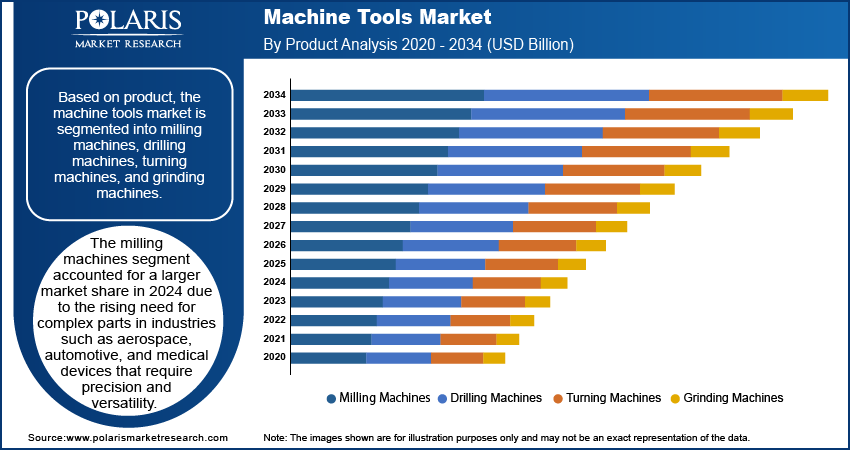

Machine Tools Market Evaluation Based on Product

The machine tools market, based on product, is segmented into milling machines, drilling machines, turning machines, and grinding machines. The milling machines segment accounted for a larger machine tools market share in 2024 due to increasing need for multi-functional equipment capable of performing complex machining tasks. Milling machine has evolved significantly, offering capabilities such as 5-axis machining, which enables the creation of complex parts with improved efficiency and accuracy. Industries focused on renewable energy, such as wind and solar, as well as medical device manufacturers, are adopting advanced milling systems to meet the rising demand for custom-designed components. The push for energy efficiency and sustainable manufacturing processes has also encouraged the adoption of these milling machines, which minimize material waste while maintaining high productivity.

Machine Tools Market Assessment Based on Industry Vertical

The machine tools market, based on industry vertical, is segmented into automotive, aerospace, electronics, construction, and others. The automotive segment accounted for the largest market share in 2024 due to its reliance on machine tools for manufacturing high-precision components such as engine parts and transmission systems. The rise in electric vehicle production further accelerates the segment’s growth as manufacturers invest heavily in machine tools to meet design specifications.

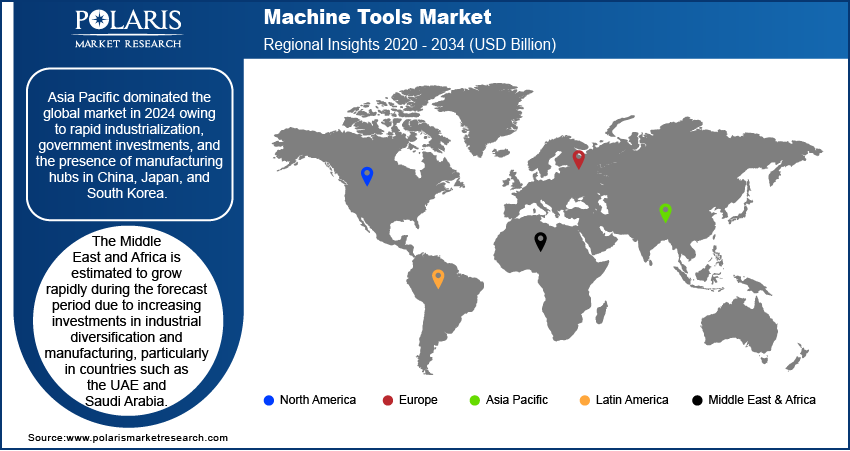

Machine Tools Market Regional Analysis

By region, the report provides the machine tools market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global machine tools market in 2024 owing to rapid industrialization, government investments, and the presence of manufacturing hubs in emerging countries such as China, Japan, and South Korea. China holds the largest market share within the region due to its extensive automobile production, technological advancements, and strategic focus on high-tech machinery. For instance, as per the report published by the CEIC, China's motor vehicle production was reported at 30,160,966.000 Units in Dec 2023, an increase from the previous number of 27,020,615.000 Units in Dec 2022.

The Middle East and Africa machine tools market is projected to witness rapid growth from 2025 to 2034 due to increasing investments in industrial diversification and manufacturing, particularly in countries like the UAE and Saudi Arabia, which are working to reduce their reliance on oil revenues. The region’s growing infrastructure development further fuels the market demand. Large-scale infrastructure projects such as bridges, railways, airports, and highways require extensive metal manufacturing and precision components, thereby driving the need for various machine tools such as lathes, boring machines, and milling equipment.

Machine Tools Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the machine tools market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

Komatsu Ltd., a Japan-based multinational corporation, has established itself as a significant player in the machine tools and heavy equipment industry since its founding in 1921. Headquartered in Minato, Tokyo, Komatsu specializes in manufacturing construction, mining, and forestry equipment, along with industrial machinery such as machine tools, diesel engines, and various types of press machines. The company began as a subsidiary of Takeuchi Mining Industry, focusing on producing industrial tools for its parent company. Over the years, Komatsu has expanded its product offerings and now ranks as one of the world's largest manufacturers of construction and mining equipment. Komatsu is well-positioned to meet the diverse needs of its customers with a global workforce of approximately 50,000 employees and manufacturing facilities across Japan, Asia, the Americas, and Europe.

Haas Automation, Inc., founded in 1983 by Gene Haas, has established itself as a major manufacturer of machine tools, particularly known for its cost-effective and reliable CNC (computer numerical control) equipment. Headquartered in Oxnard, California, Haas Automation stands as the largest machine tool builder in the Western world, producing a comprehensive line of products that includes vertical machining centers (VMCs), horizontal machining centers (HMCs), CNC lathes, and rotary tables. The company initially gained recognition with its innovative, fully automatic programmable collet indexer, which set the stage for its expansion into more complex machinery.

List of Key Players in Machine Tools Market

- Komatsu Ltd

- Makino Inc.

- Okuma Corporation

- Hurco Companies, Inc.

- Dalian Machine Tool Group

- Amera Seiki

- Haas Automation, Inc.

- Datron AG

- Amada Machine Tools Co., Ltd.

- CHIRON GROUP SE

- DMG MORI. CO., LTD.

- DN Solutions

- Georg Fischer Ltd.

- Mazak Corporation

- HYUNDAI WIA CORP

- JTEKT Corporation

Machine Tools Market Developments

June 2023: Nidec Machine Tool, a designer, manufacturer, seller, and provider of consulting services for machine tools and cutting tools announced the launch of a new cutting tool factory in India. The factory is inaugurated to enable to meet the growing demand for automotive and related components.

September 2022: Mitsubishi Electric, a global company in the manufacturing, marketing, and sales of electrical and electronic products and systems, announced the launch of the new M800V & M80V series CNCs with state-of-the-art solutions to revolutionize smart manufacturing in India.

July 2022: Nidec Machine Tool Corporation introduced MVR-Ax, the company’s series of new models of double-column machining centers. The company stated that the new models are developed as easy-to-use machines to meet the diverse needs of factories that machine large-size components.

Machine Tools Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Milling Machines

- Drilling Machines

- Turning Machines

- Grinding Machines

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- CNC (Computerized Numerical Control) Machines

- Conventional Machines

By Industry Vertical Outlook (Revenue – USD Billion, 2020–2034)

- Automotive

- Aerospace

- Electronics

- Construction

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Machine Tools Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 97.68 billion |

|

Market Forecast Value in 2025 |

USD 104.20 billion |

|

Revenue Forecast by 2034 |

USD 189.65 billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 97.68 billion in 2024 and is projected to grow to USD 189.65 billion by 2034.

The global market is projected to register a CAGR of 6.9% from 2025 to 2034.

Asia Pacific had the largest share of the global market in 2024.

\Some of the key players in the market are Komatsu Ltd; Makino Inc.; Okuma Corporation; Hurco Companies, Inc.; Dalian Machine Tool Group; Amera Seiki; Haas Automation, Inc; Datron AG; Amada Machine Tools Co., Ltd.; CHIRON GROUP SE; DMG MORI. CO., LTD.; DN Solutions; Georg Fischer Ltd.; HYUNDAI WIA CORP; and JTEKT Corporation.

The milling machines segment held a larger market share in 2024.