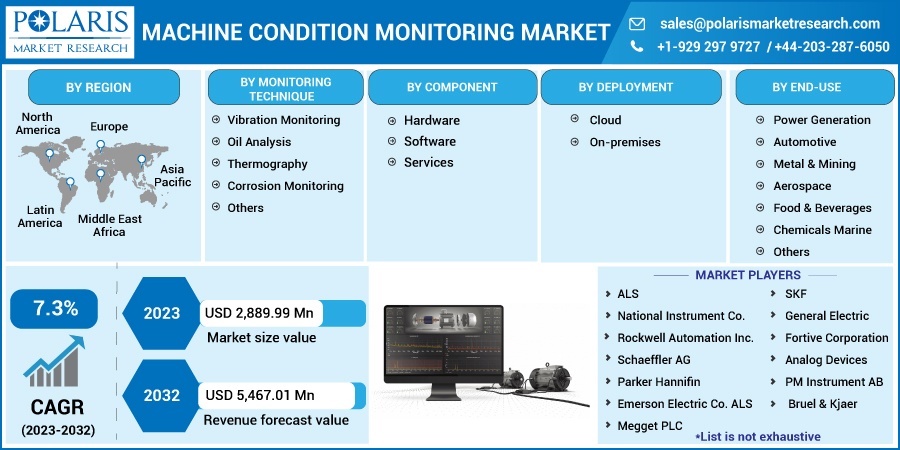

Machine Condition Monitoring Market Share, Size, Trends, Industry Analysis Report, By Monitoring Technique (Vibration Monitoring, Oil Analysis, Thermography, Corrosion Monitoring, Others); By Component; By Deployment; By Monitoring Process; By End-Use; By Region; Segment Forecast, 2023-2032

- Published Date:Jan-2023

- Pages: 116

- Format: PDF

- Report ID: PM2706

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

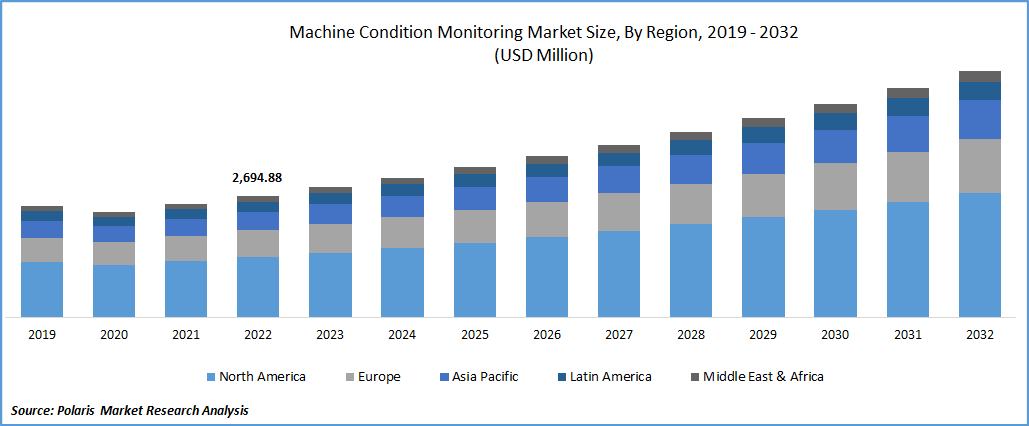

The global machine condition monitoring market was valued at USD 2,694.88 million in 2022 and is expected to grow at a CAGR of 7.3% during the forecast period.

The rapid expansion of digitalization worldwide and extensive growth in the development of several industries, including oil & gas, automotive, aerospace, defense, and medical industry, are key factors influencing the growth of the global market. Moreover, the goring prevalence of IoT, which has brought a significant shift to foster communication between many devices coupled with the adoption and integration of smart machines by key market stakeholders to boost efficiency and informed decisions, is augmenting the market growth at a rapid pace.

Know more about this report: Request for sample pages

Moreover, various types of operational equipment are responsive to many types of errors and technical faults; hence it is very crucial to monitor both minor and major changes in the equipment by measuring several different parameters, including vibration, voltage, temperature, pressure, flow, current, and many others. Thus, the need and demand for machine condition monitoring devices across the globe is gaining high traction, and many market players are focusing on the development and introduction to advanced and innovative devices to cater to the growing consumer requirements.

For instance, in April 2022, SKF entered a collaboration with Amazon Web Services to reinvent machine reliability and predictive maintenance. With this agreement, it will deliver an easy-to-use condition monitoring & analysis solution, which enables them to collect & analyze data with the help of machine learning technologies.

The outbreak of the COVID-19 pandemic has significantly impacted the market's growth. The rapid surge in deadly coronavirus resulted in imposed lockdowns, trade barriers, temporary shutdowns, and high disturbances in the global supply chain, which resulted in a slight decline in the adoption of machine condition monitoring devices all over the world. However, the increasing crisis led to rising demand for various machine monitoring in the healthcare sector to get accurate results and contributed positively to the market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The large presence of established players operating in the market and their continuously growing focus and implementation of several business developing strategies, including collaborations, mergers, partnerships, and acquisitions among independent software vendors, data analytics providers, and system integrators for the development and enhancement of world-class machine condition monitoring devices, is major factors driving the growth of the global market.

For instance, in September 2022, ABB announced its new strategic partnership with Samotics, a provider of electrical signature analysis technology, to expand and enhance condition monitoring services. Through this agreement, both will deploy each other’s capabilities to deliver better insight into machine health and energy efficiency.

Furthermore, a rapid surge in penetration of IIoT across the globe has leveraged manufacturers to connect their assets to smart sensors and actuators for the enhancement of manufacturing and industrial processes and real-time data collected from these types of technologies that catalyzes better control of plant operations, and seamless supervision is providing high market growth opportunities.

Report Segmentation

The market is primarily segmented based on monitoring technique, component, deployment, monitoring process, end-use, and region.

|

By Monitoring Technique |

By Component |

By Deployment |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Vibration Monitoring Segment Accounted for the Largest Market Share

The vibration monitoring segment accounted for the largest market share in 2022 due to the continuously growing demand to detect wear, misalignments, and imbalances coupled with the high penetration of monitoring devices to detect early-stage faults. The vibration monitoring gas gained an upsurge in minimizing maintenance, operational complexities, and integrations.

Moreover, the corrosion monitoring segment is expected to register significant market growth during the anticipated period. The growth of the segment market is mainly driven by the wide utilization of this monitoring technique to monitor and assess various equipment components, facilities, structures, and process units. In addition, growing anxiety and prevalence of knowing the life and serviceability of assets among industry players have also encouraged them to invest in corrosion monitoring devices.

Hardware Segment Held the Significant Market Revenue Share

The hardware segment held the highest market revenue share in 2022 and is likely to retain its position over the anticipated period on account of the growing use of ultrasonic detectors, vibration analyzers, accelerometers, and infrared sensors coupled with its ability to minimize machine downtime and successful implement of predictive maintenance.

High advancements and extensively growing investment in research & development activities to develop more advanced and innovative software to monitor vibration train, rotational speed, temperature, and types of machines are key factors driving the segment market growth.

The On-Premises Segment Held the Largest Market Share in 2022

The on-premises segment led the industry in 2022. The growth of this segment is accelerated by the growing adoption of on-premises among various industry verticals to ensure that the machines are working efficiently, monitor the status, and help teams to know about long-running or inefficient machines easily.

The cloud segment is projected to grow fastest at a CAGR during the anticipated period owing to its wide range of beneficial features and factors such as flexibility, scalability, collaboration, efficiency, high security, and privacy, along with the growing demand for Software as a Service model across the globe. A cloud-based solution enables their users to efficiently monitor their machines with the help of a web-based dashboard and provide a rapid overview and in-depth analysis.

Portable Monitoring Process Dominated the Market in 2022

The portable monitoring process dominated the global market in 2022 and is likely to grow significantly over the anticipated period as it allows users to gather and collect data about various critical machinery. This process is easy to operate, quick, light, and incredibly capable. Moreover, increasing penetration between industry players to use portable wireless sensors to troubleshoot complex machine failures and condition monitoring efficiently is driving the segment growth.

Furthermore, the online segment is emerging fastest and is expected to contribute significantly to the market growth over the coming years because of the rapidly growing need and demand for data monitoring and efficient management to minimize downtime and foster machinery life. In addition, several large manufacturers across the globe are influenced to integrate advanced condition monitoring systems to expand their reach into untapped regions.

Power Generation Segment Accounted for the Maximum Market Revenue Share

The power generation segment accounted for a desirable market revenue share in 2022. The growth of the segment market can be attributed to the increasing prevalence of machine condition monitoring devices in the industry owing to the high failure rate of a few components, system overhauls, unsafe work environments, and high repair costs. As the power generation sector is mainly product intensive, thus it requires continuous machine maintenance and monitoring, which is propelling the growth of the segment market.

In addition, the oil & gas segment will likely hold a significant market share during the forecast period, mainly driven by rapid demand for oil analysis, vibration monitoring, and thermography. The growing need to monitor and protect assets and detect leaks in pipelines, pressure vessels, and piping has paved the way for the higher adoption of machine condition monitoring products in the industry.

North America Dominated the Machine Condition Monitoring Market in 2022

The North America region dominated the global market in 2022 and is projected to maintain its dominance throughout the anticipated period. The rapid expansion of the aerospace sector and power generation, which includes large number of machinery components and requires continuous monitoring and maintenance especially in developed countries like United States and Canada is key factor driving the growth of the market in the region.

For instance, according to Federal Aviation Administration, FAA’s Air Traffic Organization provide its services to over 2.9 million airline passengers across 29 million square miles of airspace and more than 45,000 flights every day.

Furthermore, Europe is projected to emerge as fastest growing region over the anticipated period due to extensively growing prominence of the automotive industry across various countries including U.K., France, Germany, Spain, and Italy coupled with the presence of well-established players and their high investment into condition monitoring systems to tap into global industry.

Competitive Insight

Key players include ALS, National Instrument, Rockwell Automation, Schaeffler AG, Parker Hannifin, Honeywell International, Emerson Electric, ALS, Megget PLC, SKF, General Electric, Fortive Corporation, Analog Devices, PM Instrument, Bruel & Kjaer, Fluke Corporation, Flir Systems, and Pruftechnik Dieter Busch.

Recent Developments

- In May 2022, SKF announced the launch of the “Axios”, which helps to re-invent the field of industrial machine reliability based on a collaboration among Amazon Web Services, & SKF. It consists sensors, machine learning service, and gateways which is easy to install and scale without any necessary experience, and enable sensors and app to be operational quickly within minutes.

- In April 2022, OMRON Corporation, launched its new and advanced Condition Monitoring Device named K7TM, which can visualize the deterioration tendencies of heater equipment mainly used in the manufacturing process of Semiconductors and Automobiles. With this new launch, customers will be able to minimize their losses occur in the production process and reduce the energy loss of heaters as well.

Machine Condition Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2,889.99 million |

|

Revenue forecast in 2032 |

USD 5,467.01 million |

|

CAGR |

7.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Monitoring Technique, By Component, By Deployment, By Monitoring Process, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

ALS, National Instrument Co., Rockwell Automation Inc., Schaeffler AG, Parker Hannifin, Honeywell International Corporation, Emerson Electric Co., ALS, Megget PLC, SKF, General Electric, Fortive Corporation, Analog Devices, PM Instrument AB, Bruel & Kjaer, Fluke Corporation, Flir Systems, and Pruftechnik Dieter Busch. |