Loyalty Management Market Share, Size, Trends, Industry Analysis Report

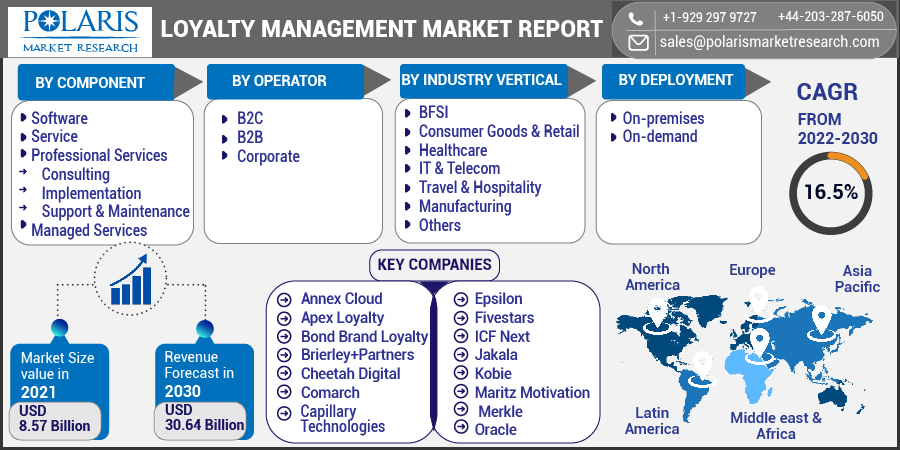

By Operator (B2C, B2B, Corporate); By Deployment (On-premises, On-demand); By Component; By Industry Vertical; By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 114

- Format: PDF

- Report ID: PM2399

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

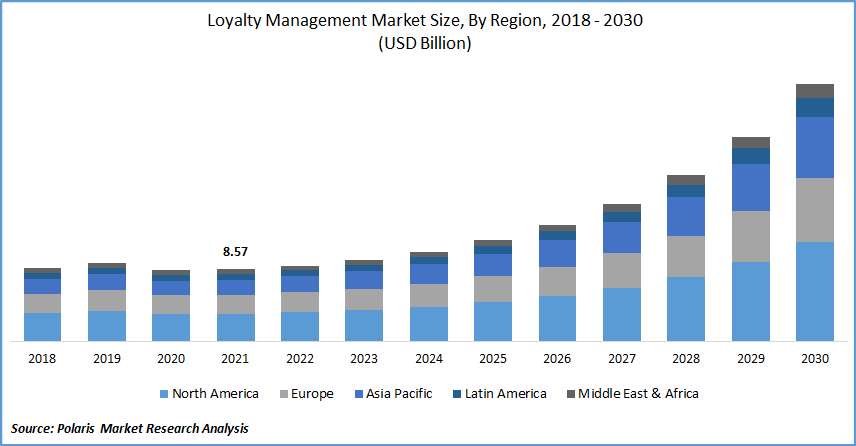

The global loyalty management market was valued at USD 8.57 billion in 2021 and is expected to grow at a CAGR of 16.5% during the forecast period. Increasing emphasis on a customer-centric approach leads to developing multiple loyalty programs for customer retention, cross-selling, and customer absorption. Reliability management is an important aspect of business that contributes to the company's success.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

It enables businesses to increase customer reliability, which leads to increased sales and revenue. Under fidelity management, businesses provide a variety of programs such as reward points, discounts, special product offers, and gift vouchers in areas such as banking, buying groceries, dining, and fuel purchasing.

Further, the adoption of reliability services is rapidly increasing by the B2C operator boosting the loyalty management market growth during the forecast period. These solutions are utilized by the business-to-consumer industry seeking to reap the benefits of the customer shopping experience data. Reliability management collects business-critical information to forecast and influence consumers' buying behavior, from consciously assembling customer information to internal procurement of customer experience (CX) data.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on component, industry vertical, operator, deployment, and region.

|

By Component |

By Operator |

By Industry Vertical |

By Deployment |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Vertical

Based on the vertical segment, the retail & consumer goods segment is expected to be the most significant revenue contributor. Retailers and consumer goods companies have launched programs to increase brand loyalty and encourage repeat purchases. Customers can be rewarded with gifts, discounts, certificates, and loyalty points, strengthening customer relationships and driving reliability management solutions.

Industry Dynamics

Growth Drivers

The rising application of big data and machine learning and advanced technology will likely accelerate loyalty management market growth. The introduction of big data concepts ushered in a new era of Customer Relationship Management (CRM) strategies. Big data analysis assists organizations in describing customer behavior, understanding their habits, developing appropriate marketing plans to identify sales transactions, and building long-term loyal relationships.

Customers were segmented as Time-Frequency Monetary (TFM): Time (T): the total duration of calls and concerned Internet sessions for a study period. Frequency (F): the frequency with which services are used in a given period. Monetary (M): Money spent in this specific period, loyal consideration, defined for each group.

Second, the reliability level descriptors were used as categories, with the best behavioral characteristics for customers, and demographic information such as age and gender were chosen. Third, several classification algorithms have been used to create multiple predictive models that were used to categorize new users based on reliability using the descriptive terms and features that were preferred.

Further, AI-powered programs can analyze huge amounts of data (big data) to self-learn and improve over time. These machine learning applications open up new opportunities to personalize customer knowledge from experience. Analytics is also advantageous to direct-to-customer brands.

Nespresso, for example, has incorporated IoT sensors into many of its coffee machines, which send information on each user's most frequently used capsules and drinking habits. The company then applies this knowledge to tailor its offerings to each individual's preferences. Nescafé Dolce Gusto, another Nestlé brand, utilizes the Oracle cloud-based email marketing implementation to reach, convert, and cross-sell consumers.

Eloqua employs AI for send-time optimization, fatigue analysis, subject line improvement, and other purposes. NDG has more than doubled its opt-in email customers to 6 million, increasing overall purchasing frequency and assisting in selling new varieties in countries where the company piloted an app. Thus, the advancement of the app's technology is offering benefits to the industry, driving the loyalty management market growth during the forecast period.

Geographic Overview

North America had the largest revenue share. The incorporation of innovative technologies such as machine learning and AI allows organizations in these economies to excel in the market space. North America is home to few loyalties management companies. The aerospace and BFSI industries are the two biggest industries contributing to the region's demand for fidelity management.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. The widely accepted mobile technologies and the strong focus on pursuing a customer-centric approach to value-added customer services are supposed to propel regional loyalty management market growth.

The rising internet penetration rate and the unchallenged growth of the e-commerce industry in countries like China and India portend well for the regional market's growth. Furthermore, businesses have implemented various loyalty management solutions and services to attract more customers in this region.

Competitive Insight

Some of the major players operating in the global market include Annex Cloud, Apex Loyalty, Bond Brand Loyalty, Brierley+Partners, Capillary Technologies, Cheetah Digital, Comarch, Epsilon, Fivestars, ICF Next, Jakala, Kobie, Maritz Motivation, Merkle, and Oracle.

Loyalty Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 8.57 Billion |

|

Revenue forecast in 2030 |

USD 30.64 Billion |

|

CAGR |

16.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Industry Vertical, By Operator, By Deployment, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Annex Cloud, Apex Loyalty, Bond Brand Loyalty, Brierley+Partners, Capillary Technologies, Cheetah Digital, Comarch, Epsilon, Fivestars, ICF Next, Jakala, Kobie, Maritz Motivation, Merkle, and Oracle |