Lower Extremity Implants Market Size, Share, Trends, Industry Analysis Report: By Type, Biomaterial (Metallic Biomaterials, Ceramic Biomaterials, Natural Biomaterials, and Polymeric Biomaterials), End Use and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 119

- Format: PDF

- Report ID: PM5303

- Base Year: 2024

- Historical Data: 2020-2023

Lower Extremity Implants Market Overview

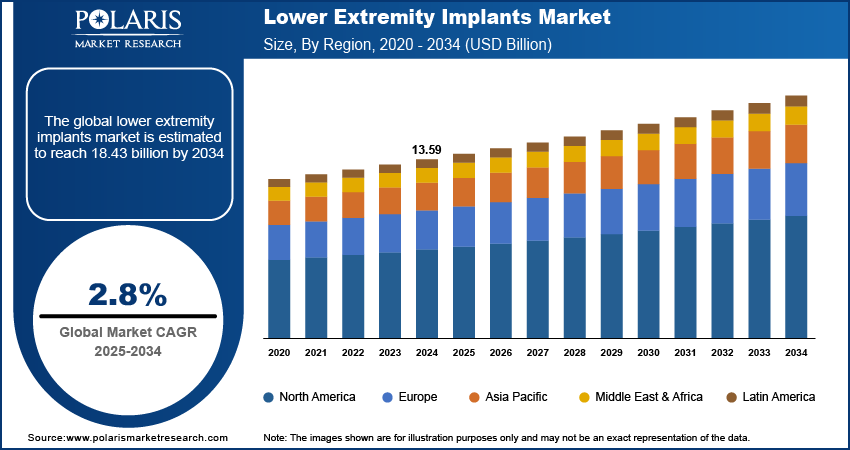

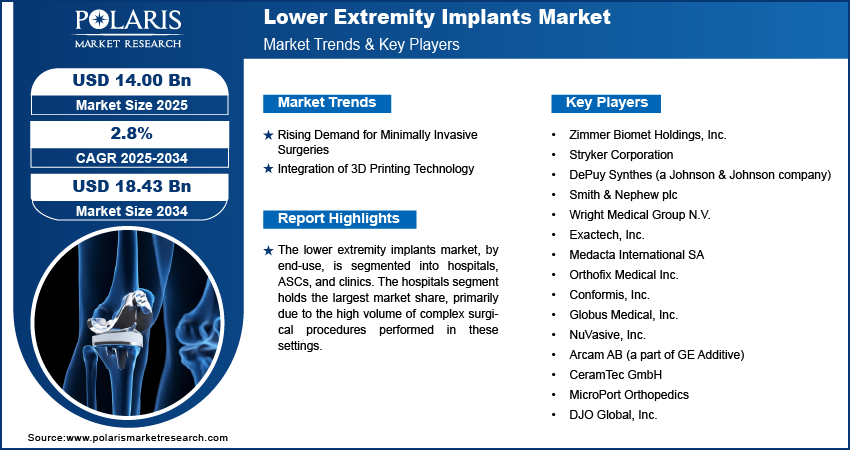

The lower extremity implants market size was valued at USD 13.59 billion in 2024. The market is projected to grow from USD 14.00 billion in 2025 to USD 18.43 billion by 2034, exhibiting a CAGR of 2.8% during 2025–2034.

The global lower extremity implants market focuses on the development, production, and application of implants used in the surgical treatment of lower extremity conditions, including fractures, deformities, and joint replacements. The increasing prevalence of osteoporosis and osteoarthritis, rising geriatric population, and the surging advancements in implant technology drive the market growth. Growing demand for minimally invasive surgical procedures, the rising use of 3D printing in implant design, and the development of durable and biocompatible materials are expected to emerge as key future trends in the market. The market is expected to continue growing as healthcare systems across the world invest in improving surgical outcomes and patient quality of life.

To Understand More About this Research: Request a Free Sample Report

Lower Extremity Implants Market Trends

Rising Demand for Minimally Invasive Surgeries

Patients and healthcare providers are increasingly opting for minimally invasive surgeries due to their benefits, including shorter recovery times, reduced pain, and lower complication risks. Innovations in surgical techniques and implant design, such as smaller incisions and more precise implant placement, are driving this trend. According to a 2022 study published in the Journal of Orthopedic Surgery and Research, minimally invasive procedures for lower extremity conditions have shown a 20% increase in adoption rates over the past five years, particularly in knee and ankle surgeries. Therefore, the emerging trend toward minimally invasive surgical procedures is expected to significantly shape the lower extremity implants market during the forecast period.

Integration of 3D Printing Technology

The 3D printing technology allows for the production of custom implants tailored to a patient’s specific anatomy, improving surgical outcomes and patient satisfaction. The technology also enables faster prototyping and produces complex designs that were previously impossible with traditional manufacturing methods. A report from The Lancet Digital Health in 2023 highlighted that 3D-printed implants had become a key innovation in orthopedic surgery, with a 15% annual increase in the adoption of 3D printing for lower extremity implants. Thus, the integration of 3D printing technology into the development of lower extremity implants is expected to transform the lower extremity implants market in the coming years.

Shift Toward Biocompatible and Durable Materials

The lower extremity implants market is witnessing a shift toward the use of biocompatible and durable materials in implant manufacturing. Traditional materials such as stainless steel and titanium are increasingly being replaced or supplemented by advanced biomaterials, such as polyetheretherketone (PEEK) and bioresorbable polymers. These materials offer better integration with the body’s tissues, reduce the risk of implant rejection, and enhance the longevity of the implants. According to a study published in Advanced Healthcare Materials in 2022, the adoption of biocompatible materials in lower extremity implants has grown by 25% over the past decade, reflecting the industry's commitment to improving patient outcomes and reducing the need for revision surgeries.

Lower Extremity Implants Market Segment Insights

Lower Extremity Implants Market Assessment by Type Outlook

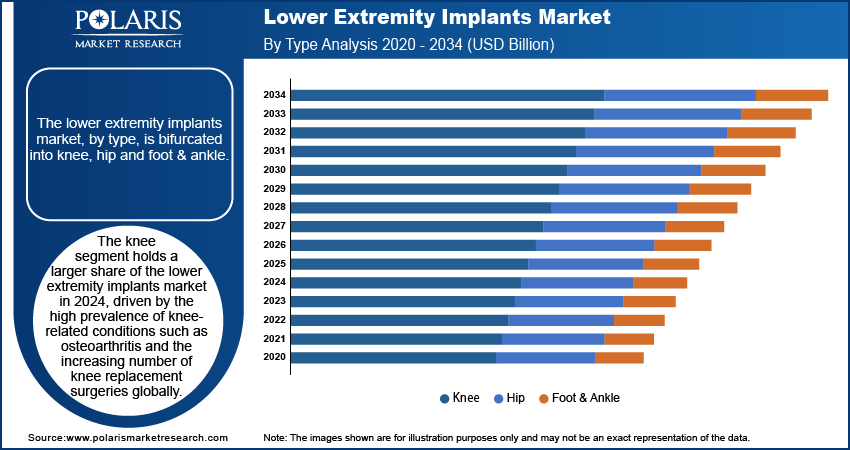

The lower extremity implants market, by type, is bifurcated into knee, hip and foot & ankle. The knee segment holds a larger share of the lower extremity implants market in 2024, driven by the high prevalence of knee-related conditions such as osteoarthritis and the increasing number of knee replacement surgeries globally. The growing geriatric population, coupled with advancements in knee implant technology, has propelled this segment's dominance. Innovations such as robot-assisted surgeries and the development of durable and biocompatible materials are enhancing surgical outcomes, leading to a higher adoption rate of knee implants.

The hip implants segment is registering a higher growth rate, attributed to the rising incidence of hip fractures and the expanding elderly population. The segment is benefiting from technological advancements such as minimally invasive hip replacement techniques and the growing preference for cement less hip implants, which offer better long-term outcomes. Additionally, increasing awareness about the benefits of early surgical intervention in hip disorders and the availability of advanced healthcare facilities drive the rapid growth of the hip implants segment.

Lower Extremity Implants Market Evaluation by End Use Outlook

The lower extremity implants market, by end-use, is segmented into hospitals, ASCs, and clinics. The hospitals segment holds the largest market share, primarily due to the high volume of complex surgical procedures performed in these settings. Hospitals are equipped with advanced surgical tools, highly trained medical professionals, and comprehensive postoperative care facilities, making them the preferred choice for lower extremity implant surgeries. The segment’s dominance is also supported by the growing number of multispecialty hospitals offering specialized orthopedic care, which drives the demand for high-quality implants and associated services.

The ambulatory surgery centers (ASCs) segment is registering the highest growth rate in the market owing to the increasing preference for outpatient procedures due to their cost-effectiveness and convenience. ASCs offer a streamlined environment for less complex lower extremity implant surgeries, enabling patient faster recovery. The segment’s rapid growth is further propelled by advancements in minimally invasive techniques, which are well-suited for the outpatient setting. Thus, the ambulatory surgery centers is expected to witness highest growth in the coming years.

Lower Extremity Implants Market Share, by Regional

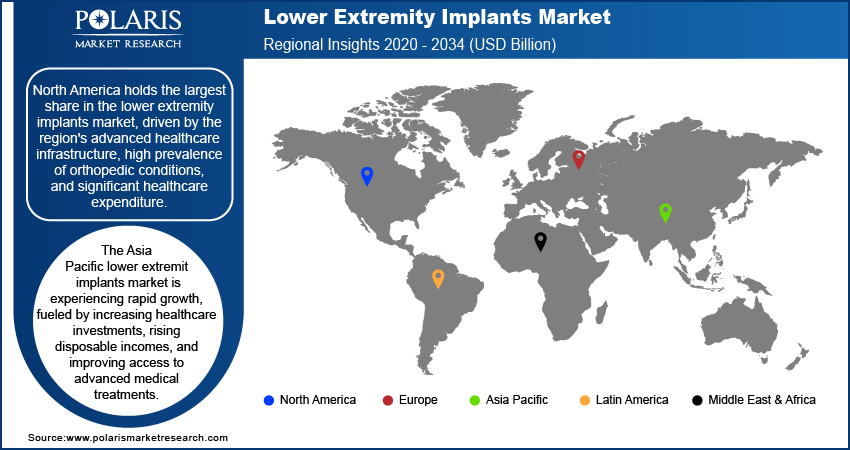

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share in the lower extremity implants market, driven by the region's advanced healthcare infrastructure, high prevalence of orthopedic conditions, and significant healthcare expenditure.

The US leads the regional market due to the growing aging population, increasing awareness about the benefits of early surgical intervention, and a strong presence of key market players. Additionally, the widespread adoption of advanced technologies, such as robotic-assisted surgeries and 3D printing for custom implants, further contribute to North America's dominance.

Europe lower extremity implants market is expected to witness significant growth over the forecast period due the increasing aging population. Countries such as Germany, the UK, and France are at the forefront, with high adoption rates of innovative implant technologies and a strong focus on minimally invasive procedures. The European market also benefits from substantial government support for healthcare infrastructure and research, which fosters continuous advancements in orthopedic treatments. Additionally, the presence of prominent medical device manufacturers in the region contributes to the development and availability of innovative lower extremity implants, further driving market growth.

The Asia Pacific lower extremity implants market is experiencing rapid growth, fueled by increasing healthcare investments, rising disposable incomes, and improving access to advanced medical treatments. Countries such as China, India, and Japan are key contributors to this growth, with a growing prevalence of orthopedic conditions and a large aging population driving demand for lower extremity implants. The region is also seeing a surge in medical tourism, particularly for orthopedic surgeries, due to the availability of high-quality healthcare services at competitive prices. Furthermore, the adoption of advanced surgical techniques and implants is expanding, supported by ongoing government initiatives to modernize healthcare infrastructure across the region.

Lower Extremity Implants Market – Key Players and Competitive Insights

Key players in the lower extremity implants market include companies such as Zimmer Biomet Holdings, Inc.; Stryker Corporation; DePuy Synthes (a Johnson & Johnson company); Smith & Nephew plc; and Wright Medical Group N.V. Other notable players are Exactech, Inc.; Medacta International SA; Orthofix Medical Inc.; Conformis, Inc.; and Globus Medical, Inc. Additionally, companies such as NuVasive, Inc.; Arcam AB (a part of GE Additive); and CeramTec GmbH are active in the market. Each of these companies is engaged in the development, manufacturing, and distribution of innovative lower extremity implants.

In terms of competitive analysis, the market is highly dynamic, with several key players focusing on advancing technology and enhancing product offerings. Companies such as Zimmer Biomet and Stryker are investing in research and development to introduce new products and improve existing ones, which helps them maintain a strong market presence. Stryker, for example, is known for its innovative minimally invasive surgical solutions and robotic-assisted technologies, which are becoming increasingly popular among healthcare providers.

The competition is influenced by regional factors and varying healthcare standards. In North America and Europe, companies such as DePuy Synthes and Smith & Nephew leverage their established market presence and comprehensive product portfolios to cater to a diverse customer base. Meanwhile, players in Asia Pacific such as Medacta International are experiencing rapid growth due to increasing demand for affordable and advanced medical solutions. This regional disparity creates opportunities and challenges for global players as they adapt to different market needs and regulatory environments.

Zimmer Biomet Holdings, Inc. is a significant player in the lower extremity implants market. The company is known for its broad range of orthopedic products, including implants for knee and hip surgeries. Zimmer Biomet focuses on innovating and improving surgical outcomes.

Stryker Corporation is another participant in the market, offering a wide array of implants and surgical tools. The company's products are used in various lower extremity surgeries, including hip and knee replacements.

Key Companies in Lower Extremity Implants Market

- Zimmer Biomet Holdings, Inc.

- Stryker Corporation

- DePuy Synthes (a Johnson & Johnson company)

- Smith & Nephew plc

- Wright Medical Group N.V.

- Exactech, Inc.

- Medacta International SA

- Orthofix Medical Inc.

- Conformis, Inc.

- Globus Medical, Inc.

- NuVasive, Inc.

- Arcam AB (a part of GE Additive)

- CeramTec GmbH

- MicroPort Orthopedics

- DJO Global, Inc.

Lower Extremity Implants Industry Developments

- In July 2024, Stryker revealed a new robotic-assisted surgery system aimed at improving the accuracy of joint replacement procedures, reflecting its commitment to integrating advanced technologies into surgical practices.

- In August 2023, Zimmer Biomet announced the launch of its new knee implant system designed to enhance the precision and efficiency of knee replacement surgeries.

Lower Extremity Implants Market Segmentation

By Type Outlook (Revenue, USD Million; 2020–2034)

- Knee

- Hip

- Foot & Ankle

By Biomaterial Outlook (Revenue, USD Million; 2020–2034)

- Metallic Biomaterials

- Ceramic Biomaterials

- Natural Biomaterials

- Polymeric Biomaterials

By End Use Outlook (Revenue, USD Million; 2020–2034)

- Hospitals

- Ambulatory Surgery Centers

- Clinics

By Regional Outlook (Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lower Extremity Implants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 13.59 billion |

|

Market Size Value in 2025 |

USD 14.00 billion |

|

Revenue Forecast by 2034 |

USD 18.43 billion |

|

CAGR |

2.8% from 2024 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global lower extremity implants market size was valued at USD 13.59 billion in 2024 and is projected to grow to USD 18.43 billion by 2034.

The global market is projected to register a CAGR of 2.8% during the forecast period.

In 2024, North America accounted for the largest share of the global market.

A few key players in the lower extremity implants market include companies such as Zimmer Biomet Holdings, Inc.; Stryker Corporation; DePuy Synthes (a Johnson & Johnson company); Smith & Nephew plc; and Wright Medical Group N.V. Other notable players are Exactech, Inc.; Medacta International SA; Orthofix Medical Inc.; Conformis, Inc.; and Globus Medical, Inc.

In 2024, The knee implant segment accounted for a larger share of the global market.

The metallic biomaterial segment accounted for the largest share of the global market.

Lower extremity implants are medical devices used in surgeries to replace or support damaged bones and joints in the leg parts, including the hip, knee, and ankle. These implants are designed to restore function, alleviate pain, and improve mobility for patients suffering from conditions such as fractures, arthritis, or other musculoskeletal disorders.

A few key trends in the lower extremity implants market are described below: Preference for Minimally Invasive Surgery: Increased adoption of minimally invasive techniques to reduce recovery times and improve surgical outcomes. Adoption of Advanced Materials: Growing use of innovative materials such as bioresorbable polymers and high-strength ceramics for better performance and biocompatibility. Emergence of Robotic-Assisted Surgery: Expansion of robotic-assisted surgical systems to enhance precision and efficiency in implant placement. Use of 3D Printing Technology: Rising application of 3D printing for custom implants and patient-specific solutions, allowing for more personalized treatments. Surging Geriatric Population: Increased demand driven by a growing elderly population requiring joint replacement and repair surgeries

A new company entering the lower extremity implants market must focus on leveraging advanced technologies such as 3D printing and robotic-assisted surgeries to offer advanced, customizable implant solutions. Prioritizing research and development to innovate biocompatible materials and minimally invasive techniques set it apart. Building strategic partnerships with healthcare providers and investing in digital tools for enhanced surgical planning will also be beneficial.

Companies manufacturing or distributing lower extremity implants and related products, healthcare providers, and other consulting firms must buy the report.