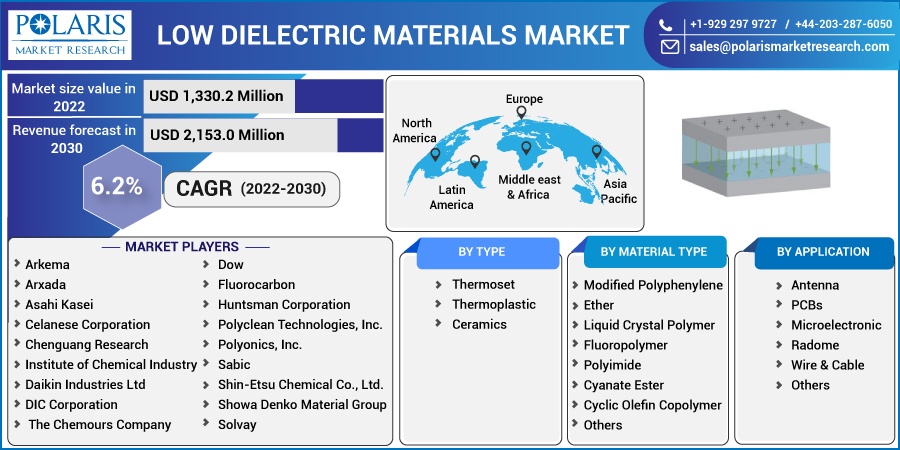

Low Dielectric Materials Market Share, Size, Trends, Industry Analysis Report, By Type (Thermoset, Thermoplastic, and Ceramics), By Material Type (Modified Polyphenylene Ether, Liquid Crystal Polymer, Fluoropolymer, Polyimide, Cyanate Ester, Cyclic Olefin Copolymer, and Others), By Application (Antenna, PCBs, Microelectronics, Radome, Wire & Cable, and Others), By Region; Segment others Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 118

- Format: PDF

- Report ID: PM2828

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

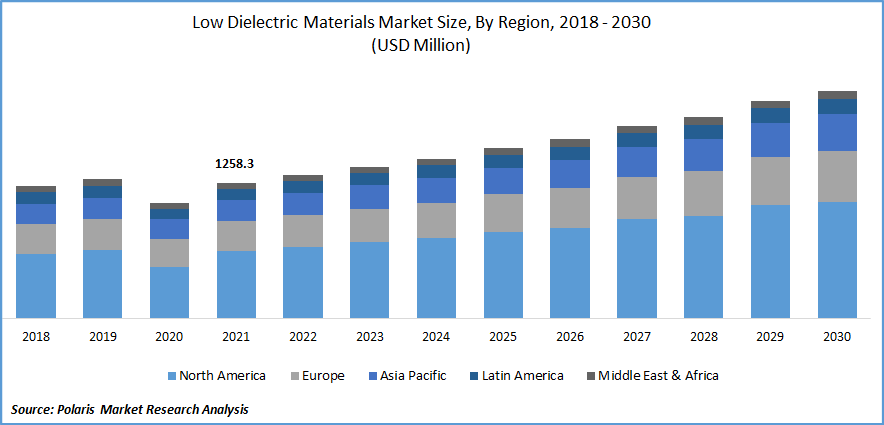

The global low-dielectric materials market was estimated at USD 1,258.3 million in 2021 and is projected to grow at a CAGR of 6.2% during the forecast period.

The market for display dielectric materials is increasing due to the demand for enhanced display in consumer electronics applications and the characteristics of the latest dielectric collections. The market is also expanding as significant trends have emerged in the display dielectric industry. These trends include the expanding use of electronic display devices, including televisions, cell phones, laptops, tablets, and other products.

Know more about this report: Request for sample pages

The widespread use of dielectric displays by end users for various applications as a tool for product promotion and advertising will also increase market growth in the ensuing years. However, the high cost compared to traditional materials is projected to be a significant barrier to market expansion in the foreseeable future.

Furthermore, the automobile industry's continued growth has enabled breakthroughs in in-car infotainment & autonomous vehicles. This has increased the need for higher levels of packaging dependability. Independent car makers use such packaging materials with a low dielectric constant demand for quick responses, high speeds, and little delay. On the other hand, there has been a growing trend of commercial aircraft electrification in recent years. This is accomplished by replacing hydraulic, mechanical, and pneumatic systems with electrical systems. In line with this, the aerospace and auto industries need more low-dielectric materials, contributing to the global market's growth.

The electric field can strongly polarize a dielectric substance which does not act as an electrical conductor. When an applied electric field is present, electricity cannot travel through dielectric materials, but the electric charge within the material can vary from its equilibrium position. The change is referred to as electrical polarization. Dielectric materials have a permanent electrical dipole moment, a unit that can split positive and negative electric charges.

Dielectrics are used in many display applications, including LCD, LED, OLED, and others. The dielectric constant of a low-dielectric material is lower than that of other materials and usually consists of a collection of conducting insulating materials that are electrically weak. These are mostly preferred for high-power or high-frequency applications for reducing electrical power loss.

The pandemic of COVID-19 has significantly impacted the low-dielectric materials market. COVID-19 has tremendously impacted almost every industry, including electronics, semiconductors, manufacturing, and vehicles. The market for low-dielectric materials has declined due to social distance laws and supply chain problems. Many regions saw the closure of low-dielectric material manufacturing operations in the second and third quarters of the fiscal year 2020.

The primary end-users were also temporarily shuttered, reducing demand for low-dielectric materials. Furthermore, the impact of the COVID-19 pandemic on the supply chain has resulted in a significant shortage of raw materials for the global semiconductor business. The COVID-19 epidemic has harmed PCB manufacturing in the global semiconductor sector. This has also resulted in high demand for and less availability of some raw resources, such as copper foil and aluminum. This had a further declining impact on worldwide market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Governments and business organizations are speeding up the construction of 5G networks worldwide. The demand for low-dielectric materials is projected to propel the market forward. Additionally, as the need for low dielectrics in antennas & micro-electronics grows, the market for low dielectrics is expected to rise.

Furthermore, high-speed communication devices are high-performance polymers with a high dielectric constant & low dielectric loss. Ether resins with low dielectric constants are more popular in these applications as the 5G network develops. Resins with low dielectric loss can be helpful in cables, communication equipment, and antenna interlayers. With such properties, the market for low-dielectric materials is projected to experience a growth in demand for several low-dielectric constant resins & ceramics.

Report Segmentation

The market is primarily segmented based on type, material type, application, and region.

|

By Type |

By Material Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The Thermoplastic type of segment is expected to witness the fastest growth.

In 2021, the thermoplastic segment was anticipated to expand rapidly throughout the projected period in the global market. When compared to thermosets, thermoplastics typically offer better dielectric properties, such as lower dissipation factors and dielectric constants. Furthermore, high-performance thermoplastics like polyaryletherketones & fluoropolymers are in high demand in aircraft applications due to their high purity, low outgassing, and extensive chemical resistance. In addition, polycarbonate (P.C.), acrylonitrile butadiene styrene (ABS), and polymethyl methacrylate (PMMA) are having increased demand from 5G communication systems. These factors account for most of the market's growth.

Fluoropolymers accounted for the second-largest market share in 2021

Due to their low cost and excellent moldability, polymers such as Polytetrafluoroethylene (PTFE), Ethylene tetrafluoroethylene (ETFE), and others hold the largest share of the market. PTFE is a thermoplastic having thermoset polymer characteristics. When heated, it changes shape, but at a relatively slow rate, considered suitable for producing the PCBs. ETFE & other fluoro-polymers are widely used in producing wires & cables, propelling the market to new heights. Whereas, liquid crystal polymers are in huge demand in the fabrication of microelectronics.

The PCBs segment is expected to witness the fastest growth

In 2021, the PCBs application held the highest market share. PCBs play an essential part in the operation of modern electronics and smart components, raising their demand in recent years. Furthermore, PCBs are essential for operating everyday devices such as televisions, refrigerators, and washing machines. They are also required to handle high-end devices such as missiles and satellites. As a result, the application segment accounts for most of the demand for low-dielectric materials.

The demand in Asia-Pacific is expected to witness significant growth

The global market is expected to dominate Asia-Pacific during the forecast period. APAC is the fastest-growing market for low-dielectric materials due to the increasing need to manufacture electronic components such as PCBs and microelectronics. Furthermore, increased air traffic has raised the demand for antennas in the region, which boosts demand for low-dielectric materials even further.

The region includes countries such as China, Taiwan, Japan, and South Korea, which are among the world's major electronics producers. These countries provide significant growth potential for enterprises that manufacture electronic solutions. Furthermore, the expansion of 5G and other telecommunication activities is predicted to drive demand for these materials in the region.

In North America is predicted to generate the highest revenue during the forecast period. Various factors, including increased demand for the miniaturization of electronic goods, radar and antenna demand with rising air traffic, and the emergence of autonomous vehicles & 5G communication, have all contributed to the growth of the market. This increase is due to the growing usage of dielectric displays in home appliances, mobile phones, and other consumer devices. Furthermore, rising consumer demand for dielectric displays for marketing, advertising, and other applications will propel the global market.

Competitive Insight

There are numerous significant players in the global market, such as Arxada, Circuit Components Supplies, Daikin Industries, Shin-Etsu Chemical, DIC Corporation, Dow, Fluorocarbon, Solvay, Huntsman Corporation, Olin Corporation, Nanjing Qingyan Polymer New Materials, Polyclean Technologies., Polyonics, Sabic, Showa Denko Material, Chemours Company, Topas Advanced Polymers, Victrex, Zeon Corp., and others.

Recent Developments

In November 2021, Arkema introduced three new low-loss materials for RF applications: PRO14729, PRO14730, & PRO14731. These unique substances were developed in response to the increasing need for materials with extremely low dielectric constants and dissipation factors for unique electronic applications.

In September 2021, TOPAS Advanced Polymers and Borealis cooperated to create a new class of engineered materials for capacitor film applications.

Low Dielectric Materials Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1,330.2 million |

|

Revenue forecast in 2030 |

USD 2,153.0 million |

|

CAGR |

6.2% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Material Type, By Application, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Arkema, Arxada, Asahi Kasei, Celanese Corporation, Chenguang Research Institute of Chemical Industry, Circuit Components Supplies Ltd, Daikin Industries Ltd, DIC Corporation, Dow, Fluorocarbon, Huntsman Corporation, Liyang Huajing Electronic Material Co., Ltd., Mitsubishi Chemical Corporation, Nanjing Qingyan Polymer New Materials Ltd., Olin Corporation, Polyclean Technologies, Inc., Polyonics, Inc., Sabic, Shin-Etsu Chemical Co., Ltd., Showa Denko Material Group, Solvay, The Chemours Company, Topas Advanced Polymers, Victrex, Yunda Electronic Materials Co., Ltd., Zeon Corp., and others. |