Loitering Munition Market Size, Share, Trends, Industry Analysis Report: By Type (Recoverable and Expendable), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM5387

- Base Year: 2024

- Historical Data: 2020-2023

Loitering Munition Market Overview

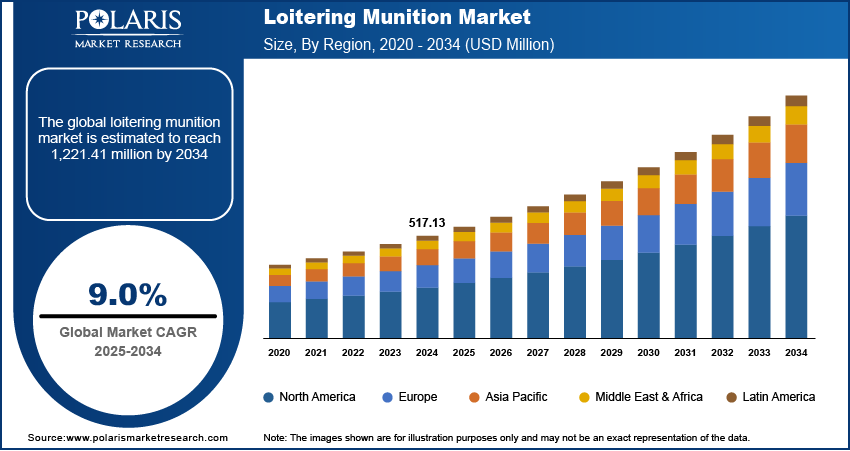

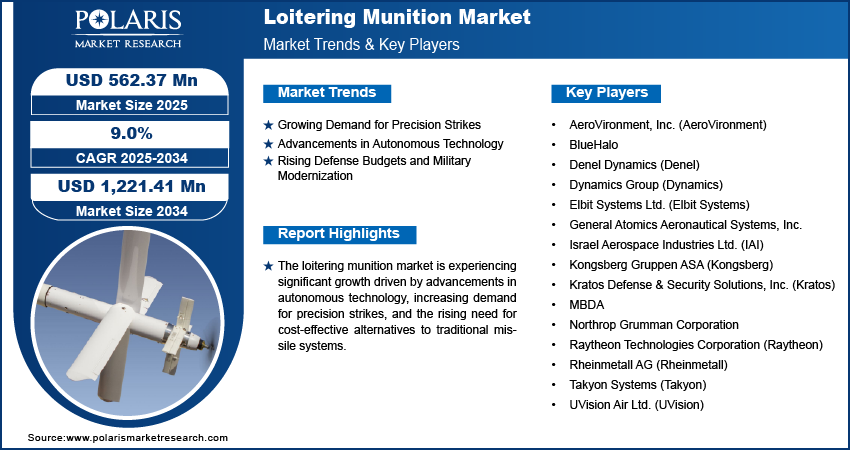

The loitering munition market size was valued at USD 517.13 million in 2024. The market is projected to grow from USD 562.37 million in 2025 to USD 1,221.41 million by 2034, exhibiting a CAGR of 9% during 2025–2034.

The loitering munition market refers to the segment of defense technology that involves weapons designed to loiter over a target area for an extended period before striking the target, often with the ability to be controlled remotely. These munitions are typically equipped with surveillance capabilities, allowing operators to choose the optimal moment for attack. The loitering munition market development is driven by the growing demand for precision strikes, advancements in autonomous technology, and the increasing need for low-cost, effective alternatives to traditional guided missiles. Key trends include the integration of artificial intelligence for target identification and autonomous decision-making, as well as an increased focus on miniaturized systems for tactical operations. Rising defense budgets, especially in countries focused on modernizing their military forces, also contribute to the expansion of this market.

To Understand More About this Research: Request a Free Sample Report

Loitering Munition Market Dynamics

Growing Demand for Precision Strikes

Military operations emphasize accuracy and minimized collateral damage. Loitering munitions, which can remain in the air for an extended period and strike only when the target is identified, offer a highly precise alternative to traditional artillery or missile systems. These munitions can engage targets with high accuracy, which is especially important in urban warfare and counterterrorism operations. According to a report by the International Institute for Strategic Studies (IISS), precision-guided munitions are becoming more prevalent in military arsenals, which increases the adoption of loitering munitions as a complementary weapon system. Hence, the increasing demand for precision strikes in modern warfare drives the loitering munition market growth.

Advancements in Autonomous Technology

Modern loitering munitions are increasingly equipped with autonomous capabilities, allowing them to identify and engage targets without human intervention. AI algorithms enhance their ability to differentiate between potential targets and reduce the risk of misidentification. As per a 2024 report from the Defense Innovation Unit, the integration of AI into defense technologies is expected to revolutionize precision strike capabilities, making autonomous loitering munitions a strategic asset for many armed forces. The continued development of machine learning, sensor fusion, and real-time data processing will further strengthen the capabilities of these systems. Therefore, technological advancements in autonomy and artificial intelligence (AI) are significantly contributing to the loitering munition market demand.

Rising Defense Budgets and Military Modernization

With defense budgets on the rise, particularly in emerging economies and countries seeking to upgrade their military capabilities, governments are investing in advanced weaponry systems. Loitering munitions offer a cost-effective solution compared to more expensive guided missile systems, making them an attractive option for military planners. In 2023, global defense spending reached approximately $2.1 trillion, a 3.7% increase from the previous year, with significant portions allocated to technological advancements and unmanned systems. This surge in defense spending is expected to fuel further demand for loitering munitions as part of modern military arsenals. Thus, the modernization of military forces worldwide is driving the loitering munition market development.

Loitering Munition Market Segment Insights

Loitering Munition Market Assessment – Type-Based Insights

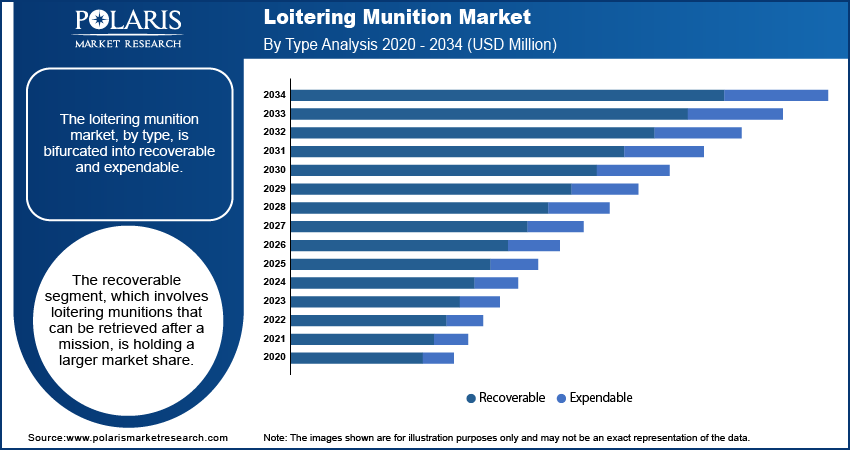

The loitering munition market, by type, can be bifurcated into recoverable and expendable. The recoverable segment, which involves loitering munitions that can be retrieved after a mission, is holding a larger market share. This is due to their capability to be reused in multiple operations, providing higher operational efficiency and cost-effectiveness for military forces. Recoverable munitions are particularly favored in extended surveillance and reconnaissance missions, where the ability to reuse the system contributes to lower overall costs. This segment is also supported by advancements in design, which focus on ensuring the durability and reusability of these systems.

The expendable segment, while holding a smaller loitering munition market share, is registering a higher growth rate. Expendable loitering munitions are designed for one-time use and offer the advantage of being simpler and less expensive to manufacture. The increasing demand for quick, tactical strike capabilities, especially in situations where precision and low-cost solutions are needed, is driving the growth of expendable loitering munitions. These systems are becoming more attractive due to their suitability for low-intensity conflicts, counterterrorism operations, and rapid-response scenarios. The trend toward more specialized and affordable munitions for a range of military applications is expected to sustain the growth of this segment in the coming years.

Loitering Munition Market Outlook – End User-Based Insights

The loitering munition market, by end user, is segmented into army, navy, and airforce. The army segment holds the largest share of the loitering munition market revenue, driven by the increasing demand for ground-based precision strike capabilities. Loitering munitions in the army are mainly used for close combat, counterinsurgency, and tactical support, where they can provide real-time surveillance and engage targets with high accuracy. The army's focus on modernizing its capabilities with autonomous systems that can operate in complex terrains has made loitering munitions an integral part of its arsenal. This segment continues to benefit from advancements in AI and automation, enhancing its operational effectiveness and cost-efficiency.

The airforce segment is registering the highest growth, as air forces are increasingly adopting loitering munitions for surveillance and strike missions. Air forces are leveraging loitering munitions for their extended range, precision targeting, and ability to strike high-value targets with minimal collateral damage. These systems are especially useful for intelligence, surveillance, and reconnaissance (ISR) operations, which are crucial in modern warfare. The rapid technological advancements in autonomous flight and miniaturization of loitering munition systems are expected to further drive the adoption in airforce operations, making it one of the fastest-growing segments in the market.

Loitering Munition Market Regional Insights

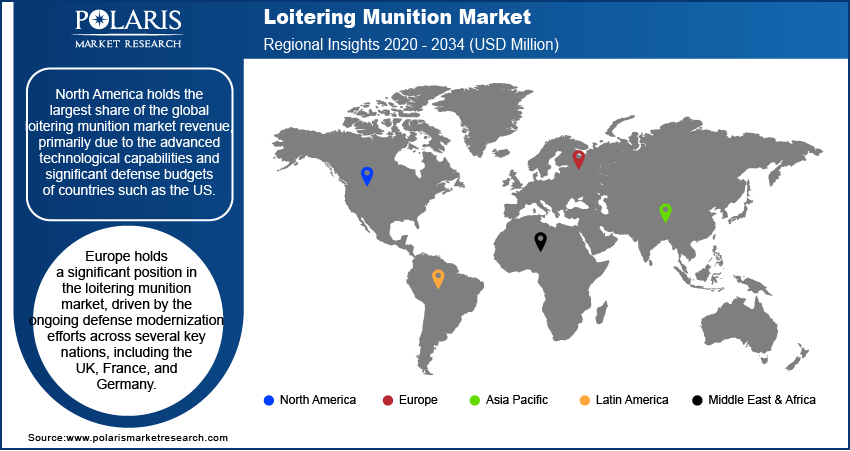

By region, the study provides loitering munition market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the loitering munition market, primarily due to the advanced technological capabilities and significant defense budgets of countries such as the US. The US military’s focus on modernization, particularly the adoption of autonomous systems and precision strike technologies, has led to a high demand for loitering munitions. Additionally, the region's robust defense infrastructure, ongoing investments in military research and development, and strategic defense initiatives contribute to North America's dominance in the market. While Europe and Asia Pacific also show growth potential, driven by military modernization and defense spending, North America's lead remains strong due to its continued emphasis on technological superiority and operational flexibility in defense systems.

Europe holds a significant position in the global loitering munition market, driven by the ongoing defense modernization efforts across several key nations, including the UK, France, and Germany. European countries are increasingly investing in advanced unmanned systems to enhance their military capabilities. The rising focus on precision strikes, counterterrorism, and border security has accelerated the adoption of loitering munitions, particularly by armed forces seeking cost-effective solutions to address complex security challenges. Additionally, collaborations between European defense contractors and technology developers are promoting the integration of innovative AI and autonomous capabilities into loitering munition systems, further supporting loitering munition market growth in the region.

The Asia Pacific loitering munition market is experiencing rapid growth, with countries such as China, India, and Japan leading the adoption. The increasing military expenditure in this region, particularly in China and India, is contributing to the demand for more advanced and precise weaponry, including loitering munitions. These countries are modernizing their armed forces to maintain strategic military advantage and address regional security threats. The rise of defense partnerships and joint military exercises in Asia Pacific is also promoting the development and deployment of loitering munitions. Furthermore, the region’s focus on enhancing technological capabilities in unmanned systems, coupled with the increasing need for low-cost, high-efficiency weaponry, is driving the growth of the regional market growth.

Loitering Munition Market – Key Players and Competitive Insights

Key players in the loitering munition market include companies such as AeroVironment, Inc.; Elbit Systems Ltd.; Israel Aerospace Industries Ltd. (IAI®); and Rheinmetall AG. AeroVironment is known for its Switchblade loitering munitions, which are used for tactical operations. Elbit Systems offers the Harop and the upcoming Hammer loitering munitions, both of which are designed for precision strikes. Israel Aerospace Industries Ltd. (IAI) provides the Roket loitering munition, which is used for both surveillance and attack missions. Rheinmetall produces the Riegel system, which is focused on tactical support. Other notable players include UVision Air Ltd. (UVision), providing the Hero series, and Northrop Grumman Corporation (Northrop Grumman), which has introduced its Bat loitering munition system.

Kratos Defense & Security Solutions, Inc. (Kratos) provides the Mako loitering munition, and Denel Dynamics (Denel), a South African defense contractor, has developed the ZT3 loitering munition. Other players are MBDA, with its FIREBEE system, and Dynamics Group (Dynamics), known for the Dynamit loitering munition system. Also, companies such as Kongsberg Gruppen ASA (Kongsberg), with its Joint Strike Missile systems, and Takyon Systems (Takyon) add to the variety of systems available in the market. Additionally, industries such as Raytheon Technologies Corporation (Raytheon) are working on advanced loitering munition solutions for various military applications.

The loitering munition market is competitive, with companies focusing on differentiating their products through technological advancements, such as autonomous flight capabilities, precision targeting systems, and AI integration. Players such as AeroVironment and Elbit Systems dominate with a variety of solutions catering to both tactical and strategic military needs. Newer entrants, including UVision and Kratos, are focusing on providing cost-effective and highly specialized loitering munition systems designed for rapid deployment and high precision. The ongoing development of AI, autonomy, and enhanced targeting systems is leading to product diversification, with companies aiming to integrate these capabilities to meet the evolving demands of modern warfare. As a result, the market is seeing an increasing focus on both performance efficiency and cost-effectiveness, with a growing number of defense contractors entering the market to cater to the rising demand for loitering munitions across different military branches.

AeroVironment is a company that designs and produces unmanned aircraft systems (UAS) and loitering munitions. They are known for their Switchblade series, which are small, portable systems used for surveillance and precision strikes.

Elbit Systems is a company that develops and supplies a range of defense electronics, including unmanned systems and loitering munitions. They offer products such as the Harop and the upcoming Hammer loitering munitions, designed for precision strikes.

List of Key Companies in Loitering Munition Market

- AeroVironment, Inc. (AeroVironment)

- BlueHalo (BlueHalo)

- Denel Dynamics (Denel)

- Dynamics Group (Dynamics)

- Elbit Systems Ltd. (Elbit Systems)

- General Atomics Aeronautical Systems, Inc. (GA-ASI)

- Israel Aerospace Industries Ltd. (IAI)

- Kongsberg Gruppen ASA (Kongsberg)

- Kratos Defense & Security Solutions, Inc. (Kratos)

- MBDA (MBDA)

- Northrop Grumman Corporation (Northrop Grumman)

- Raytheon Technologies Corporation (Raytheon)

- Rheinmetall AG (Rheinmetall)

- Takyon Systems (Takyon)

- UVision Air Ltd. (UVision)

Loitering Munition Industry Developments

- In December 2024, Elbit Systems announced that it was awarded two contracts with a total value of ∼$175 million to supply Electronic Warfare (EW) and Directed Infrared Countermeasure (DIRCM) Self-Protection Suites to a NATO European country. These contracts are set to be performed over a period of five years.

- In November 2024, AeroVironment announced plans to acquire BlueHalo, a company specializing in drone defense systems and laser communication technologies, in an all-stock deal valued at ∼$4.1 billion. This acquisition aims to expand AeroVironment's portfolio and enhance its capabilities in counter-UAS systems, cyber, and space technologies.

Loitering Munition Market Segmentation

By Type Outlook

- Recoverable

- Expendable

By End User Outlook

- Army

- Navy

- Airforce

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Loitering Munition Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 517.13 million |

|

Market Size Value in 2025 |

USD 562.37 million |

|

Revenue Forecast by 2034 |

USD 1,221.41 million |

|

CAGR |

9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The loitering munition market has been segmented into detailed segments of type and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The loitering munition market growth and marketing strategy is focused on technological advancements, cost efficiency, and meeting the evolving needs of modern warfare. Key players are investing heavily in research and development to enhance the capabilities of their systems, particularly in autonomous flight, precision targeting, and AI integration. Collaborations with military forces and defense contractors are also driving market expansion by ensuring that loitering munitions meet specific operational requirements. Companies are also expanding their product portfolios and offering tailored solutions to cater to the needs of different military branches, including the army, airforce, and navy. Additionally, market players are targeting emerging economies, where increased defense spending and modernization efforts present growth opportunities.

FAQ's

? The loitering munition market size was valued at USD 517.13 million in 2024 and is projected to grow to USD 1,221.41 million by 2034.

? The market is projected to register a CAGR of 9% during the forecast period.

? North America held the largest share of the market in 2024.

? A few key players in the loitering munition market include AeroVironment, Inc.; BlueHalo; Denel Dynamics; Dynamics Group; Elbit Systems Ltd.; General Atomics; Aeronautical Systems, Inc.; Israel Aerospace Industries Ltd.; Kongsberg Gruppen ASA; Kratos Defense & Security Solutions, Inc.; MBDA; Northrop Grumman Corporation; Raytheon Technologies Corporation; Rheinmetall AG; Takyon Systems; and UVision Air Ltd.

? The recoverable segment holds a larger market share in 2024.

? The army segment dominated the market in 2024.

? Loitering munition refers to a type of weapon system designed to remain in the air over a target area for an extended period, gathering intelligence or waiting for a target to appear before striking. These systems combine the features of a missile and a drone, allowing them to loiter in the air, making real-time targeting decisions, and delivering a precision strike when the target is identified. Unlike traditional missiles, loitering munitions can be either recoverable or expendable, depending on the design, and are primarily used for precision strikes in tactical or counterterrorism operations. They are often equipped with advanced sensors, including cameras and other targeting systems, to improve targeting accuracy.

? A few key trends in the market are described below: Advancements in AI and Autonomy: The integration of artificial intelligence and autonomous systems is enhancing the capabilities of loitering munitions, enabling autonomous target identification and strike decision-making. Miniaturization and Enhanced Mobility: Smaller, more portable systems are being developed to enable rapid deployment and use in diverse military operations. Integration with ISR Systems: Loitering munitions are increasingly being used for both surveillance and strike missions, contributing to their growing use in intelligence, surveillance, and reconnaissance (ISR) operations. Cost-effective Solutions: A growing demand for low-cost, expendable loitering munitions as an alternative to more expensive, traditional missile systems.

? A new company entering the loitering munition market must focus on developing advanced autonomous systems with AI-driven target identification and decision-making to enhance the precision and efficiency of operations. Focusing on cost-effective, expendable loitering munitions could also cater to the rising demand for affordable alternatives to traditional missile systems. Additionally, investing in miniaturization to create highly portable systems and improving range and endurance would make the products more versatile across different military operations. Building strong partnerships with defense contractors and offering tailored solutions to various military branches could further differentiate the company from competitors. Exploring opportunities in emerging economies with growing defense budgets would present a valuable market expansion opportunity.

? Companies manufacturing, distributing, or purchasing loitering munition and related products and other consulting firms must buy the report.