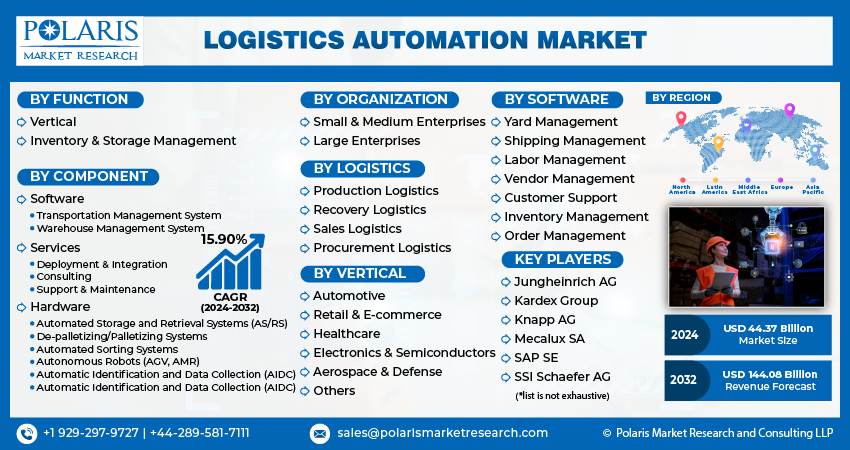

Logistics Automation Market Share, Size, Trends, Industry Analysis Report, By Function (Vertical, Inventory & Storage Management); By Component; By Organization; By Logistics; By Vertical; By Software; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM3955

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

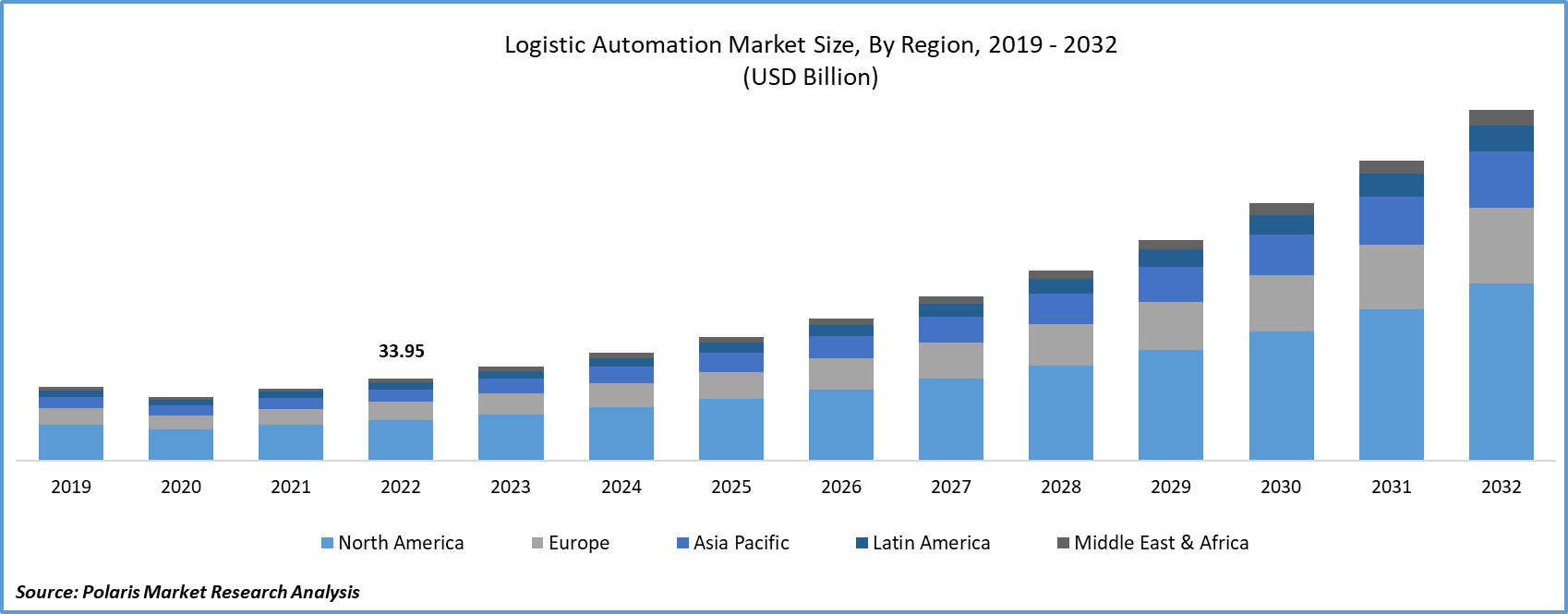

The global logistics automation market size and share was valued at USD 38.76 billion in 2023 and is expected to grow at a CAGR of 15.90% during the forecast period.

Logistics automation encompasses both hardware and software solutions designed to streamline logistics procedures, including transportation, storage, retrieval, and data management. The automation of these operations enhances efficiency, minimizes errors, and shortens turnaround times. Automation solutions play a pivotal role in facilitating business expansion, as they enable the efficient handling of larger volumes through the utilization of autonomous robots, conveyor systems, and automated storage systems.

Logistic automation refers to the usage of technology such as machinery and logistic software to enhance the efficacy of logistical procedures from acquisition to production, inventory handling, dispensation, customer service, and healing. Logistic automation is excessively vital these days as e-commerce sales nowadays are higher than ever, and this swing shows no full stops. This ever-escalating glide of goods globally is stressful for both producers and distributors. To remain aggressive, firms are required to decipher their procedures as much as feasible.

Logistics automation can assist the company scale while saving money. The manual processes costs are saved as it puts aside businesses a vast amount of uninteresting tasks such as manual picking and data entry. The logistics automation market demand is on the rise as by mechanizing time-consuming low-grade processes, the teams can concentrate on escalated value chores and perform duties for customers in less time. Another advantage is that errors with their high costs are decreased. Presuming that one invests in accurate solutions, one can exceedingly lessen human inaccuracy and, therefore, prohibit the several expenses that arrive with it.

To Understand More About this Research: Request a Free Sample Report

The market is experiencing significant growth due to increasing consumer preferences for online shopping and the rising demand for swift delivery. The heightened consumer expectations have prompted the expansion of fulfillment centers focused on last-mile and rapid deliveries. These fulfillment centers are progressively integrating automation, transitioning from mechanized support to operator-free equipment. As automated vehicle and robotics technologies mature over time, they are expected to broaden their applications in logistics and warehousing, thereby creating substantial growth prospects for the market during the forecast period.

Warehouse automation provides substantial cost-cutting advantages and contributes to error reduction in product deliveries. Even though the benefits of automation are apparent, as per Dalsey, Hillblom, and Lynn, a prominent 3PL company heavily reliant on warehouse automation solutions, approximately 80% of warehouses still operate without significant automation support. Warehouses utilizing sorters, conveyors, and pick-and-place systems, while not necessarily fully automated, make up 15% of the total. In contrast, only 5% of existing warehouses have implemented full automation.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the logistics automation market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

The logistics automation industry encounters various challenges, including a competitive market environment, a need for more standardization within the logistics sector, and a shortage of skilled and expert labor capable of operating advanced systems. Given the intricacy of automation devices and software, they demand a specific skill set and expertise for efficient operation and management. The deficit of skilled and trained labor, particularly in emerging economies like India and China, has the potential to impede the expansion of the market. Additionally, the absence of standardization complicates the development of uniform solutions for supply chain processes, resulting in elevated costs associated with crafting specialized solutions.

Industry Dynamics

Growth Drivers

- The growing embrace of eCommerce platforms across the Globe will Facilitate Market Growth

There has been a surging demand for logistics automation, elevating the efficiency of logistics and supply chain operations. The widespread adoption of automation has led to enhanced service quality. The sales of various products through online platforms have experienced significant growth. Substantial investments have been made in warehouse development, with a noticeable increase in the deployment of robotics within these facilities. The availability of diverse warehouse management software solutions has further fueled market growth. Collaborative robots are extensively used for automating various tasks by companies, contributing to increased productivity.

However, there needs to be more growth in the adoption of warehouse automation using automated storage and conveyor systems, hindering further productivity enhancement. The increased utilization of artificial intelligence, data analytics, and machine learning has significantly improved the logistics automation market in recent years, and this trend is anticipated to continue during the forecast period. These services and solutions are widely embraced for their role in ensuring workforce safety.

Report Segmentation

The market is primarily segmented based on component, function, logistics, organization, software, vertical and region.

|

By Function |

By Component |

By Organization |

By Logistics |

By Vertical |

By Software |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

- The Hardware segment held the largest revenue share in 2022

In 2022, the hardware segment is expected to show a CAGR throughout the forecast period. Within the hardware category, the market is divided into several subsegments, including autonomous robots, conveyor systems, automated sorting systems, automated storage and retrieval systems, de-palletizing/palletizing systems, and automatic identification and data collection. Among these, the autonomous robots segment holds the largest market share, driven primarily by the increasing demand for automated transportation. Autonomous guided vehicles, a subset of the autonomous robot’s category, are projected to attract a significant portion of investments.

The software segment can be divided into two key categories: warehouse management systems and transportation management systems. Warehouse management software streamlines and enhances various warehouse operations, encompassing inventory tracking, storage management, receipt processing, and workload planning, among others. Among these, it is expected that warehouse management software will exhibit the most rapid growth as a software solution during the forecast period. Simultaneously, the service segment is projected to achieve the highest CAGR throughout the entire forecast period. This sustained market expansion is primarily attributed to the escalating need for logistics automation deployment and integration.

By Logistics Analysis

- The Sales Logistics segment accounted for the highest market share during the forecast period

The market is expected to achieve a CAGR throughout the forecast period. Sales logistics plays a pivotal role in the supply chain, encompassing the movement and delivery of goods to the end consumer. It involves crucial elements like order management, inventory management, shipping management, and vendor management. To enhance the efficiency and expedite delivery times in sales logistics operations, automation solutions like autonomous robots and automated storage and retrieval systems are witnessing increased adoption.

The production logistics segment is poised for substantial growth, with a notable CAGR projected throughout the forecast period. Businesses place a strong emphasis on streamlining production processes to enhance profitability, which involves optimizing both time and cost factors. Logistics represents a significant portion of a business's expenses, and automation plays a pivotal role in reducing these costs or, at the very least, optimizing them to a significant degree. Production logistics encompasses the management of raw material inventory, internal transportation within the manufacturing unit, and distribution processes.

Regional Insights

- North America dominated the largest market in 2022

The growth of the region can be ascribed to the presence of numerous logistics automation solution providers and key players in the logistics industry, including UPS, DHL, and FedEx Corporation, among others, in North America. Additionally, the rapid adoption of cutting-edge technologies and the presence of modern infrastructure in the region provide favorable conditions for the growth of the target market. The United States is anticipated to maintain its leadership in the market throughout the forecast period, primarily due to the explosive growth of the e-commerce sector within the country.

The Asia-Pacific region is projected to achieve the highest CAGR during the forecast period. This growth is driven by the rapid economic expansion in the Asia-Pacific region, particularly in the e-commerce sector. Additionally, Asia-Pacific encompasses several countries that serve as logistical hubs, including Singapore, Indonesia, China, and India. Furthermore, the increasing technological advancements and the adoption of Industry 4.0 in countries like China, India, Japan, and Southeast Asian nations are expected to fuel substantial demand for logistics automation throughout the forecast period.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Beumer Group GmbH & Co. KG

- Daifuku Co. Limited

- Dematic Corp. (Kion Group AG)

- Honeywell International Inc.

- Jungheinrich AG

- Kardex Group

- Knapp AG

- Mecalux SA

- Murata Machinery Ltd

- One Network Enterprises Inc.

- Oracle Corporation

- SAP SE

- SSI Schaefer AG

- Swisslog Holding AG (KUKA AG)

- TGW Logistics Group GmbH

- Vanderlande Industries BV

- WITRON Logistik

Recent Developments

- In April 2023, TGW Logistics Group has introduced innovative visualization dashboards for both new and existing customers to enhance the performance of their intralogistics systems. These dashboards enable the consolidation, analysis, and graphical representation of data from various software sources, covering aspects ranging from goods-in monitoring to warehouse operations and sorting systems.

- In March 2023, KNAPP AG unveiled cutting-edge robotic solutions for automation and digitalization during the LogiMAT 2023 trade show. These robot solutions are anticipated to reduce expenses in logistics operations while enhancing shipping capacity. KNAPP AG has coined this forward-looking approach as "zero-touch fulfillment."

Logistics Automation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 44.37 billion |

|

Revenue forecast in 2032 |

USD 144.08 billion |

|

CAGR |

15.90% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component, By Function, By Logistics, By Organization, By Software, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Delve into the intricacies of the logistics automation market in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.