Location Analytics Market Size, Share, Trends, Industry Analysis Report: By Component, Location Type (Indoor and Outdoor), Application, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 125

- Format: PDF

- Report ID: PM1677

- Base Year: 2024

- Historical Data: 2020-2023

Location Analytics Market Overview

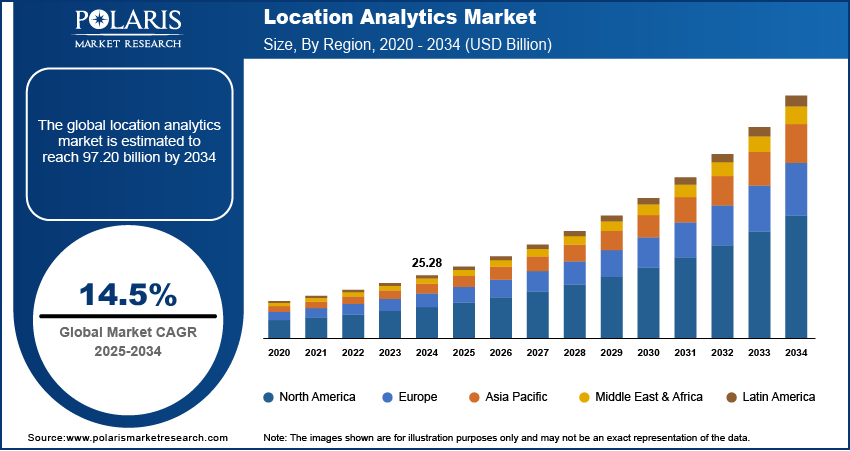

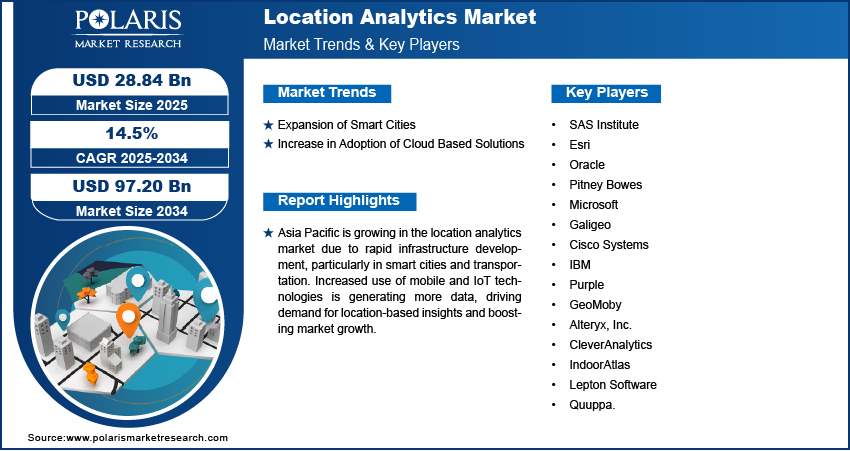

Location analytics market size was valued at USD 25.28 billion in 2024. The market is projected to grow from USD 28.84 billion in 2025 to USD 97.20 billion by 2034, exhibiting a compound annual growth rate of 14.5% during the forecast period.

Location analytics software helps businesses analyze geographic and movement data to make informed decisions about locations, customer behavior, and operational strategies. The software combines data from various sources to provide insights that support site selection, marketing, and overall business optimization.

Businesses today are focusing more on data to make important decisions, such as where to open new stores or how to improve customer service. Location analytics software provides valuable insights by analyzing geographic and movement data, which helps businesses optimize operations. This rise of data-driven strategies has enabled companies to make smarter decisions about targeting the right customers, selecting the best locations, and understanding market trends. This growing reliance on data is driving the location analytics market demand.

To Understand More About this Research: Request a Free Sample Report

The rising usage of mobile devices and IoT sensors worldwide is driving the location analytics market adoption. The widespread use of mobile devices and IoT sensors has created a vast amount of location-based data. For instance, according to IoT Analytics, the number of IoT-connected devices reached 16.6 billion in 2023, showcasing a large volume of IoT devices. People now carry smartphones that continuously track their movements, and IoT devices can monitor traffic flow, customer behavior, and product usage in real time. This data provides businesses with the ability to understand customer habits, improve operational efficiency, and optimize services. The explosion of mobile and IoT devices, along with the data they generate, is driving the adoption of location analytics solutions, thereby fueling the location analytics market value.

Location Analytics Market Dynamics

Expansion of Smart Cities

Smart cities are transforming how urban areas operate by integrating technology and data to improve the quality of life for residents. In these cities, location analytics is crucial for managing everything from traffic flow to public transportation and infrastructure planning. For instance, according to the Indian Government Press Information Bureau, India alone has an extensive network of 110 smart cities, showcasing an expansion of smart cities. By collecting and analyzing location-based data, city planners and government agencies can optimize services, reduce congestion, and improve resource allocation. The rapid expansion of smart cities and their reliance on data for decision-making is creating a significant demand for location analytics software to enhance urban development and daily operations.

Increase in Adoption of Cloud Based Solutions

Cloud computing has made location analytics more accessible for businesses of all sizes. Cloud-based location analytics platforms offer businesses the flexibility to analyze data in real time without needing extensive on-site IT infrastructure. These solutions are scalable, cost-effective, and easy to implement, making them attractive to small, medium, and large companies alike. Cloud technology enables businesses to access and analyze location data from anywhere, anytime, supporting faster decision-making and greater collaboration. The rise in cloud adoption is a major factor driving the location analytics market growth.

Location Analytics Market Segment Analysis

Location Analytics Market Assessment by Location Type Outlook

The location analytics market segmentation, based on location type, includes indoor and outdoor. The indoor segment is expected to experience a significant CAGR in the global market during the forecast period. This growth is driven by the increasing use of technology to track and analyze customer behavior inside stores, malls, and other indoor spaces. Businesses are adopting indoor location analytics to better understand customer movement, optimize store layouts, and improve the overall shopping experience, due to which the demand for indoor location analytics software is rising, leading to segmental growth.

Location Analytics Market Evaluation by Component Outlook

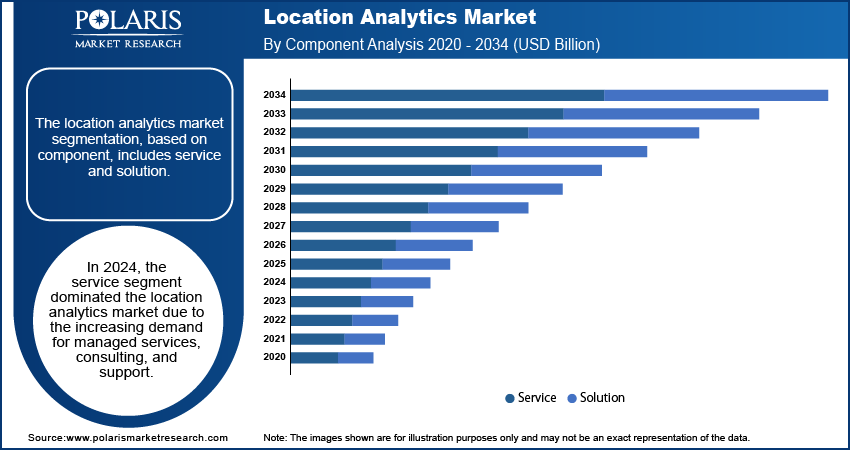

The location analytics market segmentation, based on component, includes services and solution. The service segment dominated the market in 2024. This growth is due to the increasing demand for managed services, consulting, and support to help businesses implement and optimize location analytics solutions. Many organizations prefer outsourcing the complexity of setting up and maintaining location analytics tools to experts, ensuring they get the most accurate insights. Service providers offer end-to-end solutions, from data integration to customized analytics and reporting, which makes it easier for businesses to use location data effectively, leading to segment growth in the global location analytics market.

Location Analytics Market Regional Insights

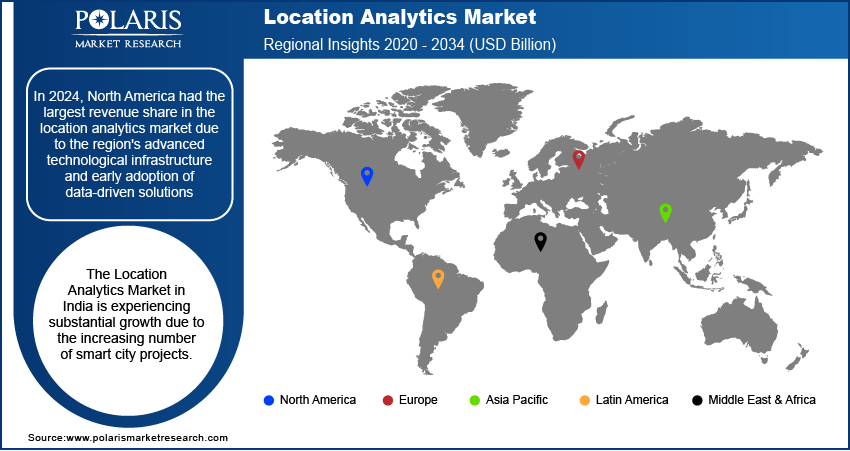

By region, the study provides location analytics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America had the largest location analytics market revenue share due to the region's advanced technological infrastructure and early adoption of data-driven solutions. The US, in particular, is a key driver, with businesses across industries such as retail and transportation utilizing location data for better decision-making. The growing use of mobile devices, IoT technology, and cloud-based solutions has further boosted the demand for location analytics in North America. Additionally, the region's focus on improving customer experiences, optimizing supply chains, and improving operational efficiency is fueling the market in North America.

Asia Pacific is experiencing significant growth in the global market, driven by rapid infrastructure development. Countries such as China, India, and Japan are investing heavily in transportation, urban planning, and smart city projects, which rely on accurate location data to optimize operations. Continuous infrastructure expansion has led businesses to use location analytics to improve logistics, manage traffic, and improve customer experiences. Additionally, the rise of mobile and IoT technologies in the region is generating vast amounts of data, further boosting demand for location-based insights and leading to market growth in Asia Pacific.

The location analytics market in India is experiencing substantial growth due to the increasing number of smart city projects. The government is focusing on developing smart cities across the country, which has created a growing need for advanced location data to optimize urban planning, improve public services, and enhance transportation systems. These developments have enabled businesses to adopt location analytics to make data-driven decisions in real time.

Location Analytics Market Key Players & Competitive Analysis Report

The location analytics market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. Continuous progress in product offerings amplifies this competitive environment. Major players in the location analytics industry include SAS Institute; Esri; Oracle; Pitney Bowes; Microsoft; Galigeo; Cisco Systems; IBM; Purple; GeoMoby; Alteryx, Inc.; CleverAnalytics; IndoorAtlas; Lepton Software; and Quuppa.

Oracle Corporation provides products and services that address enterprise information technology environments globally. Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain, as well as manufacturing management, enterprise resource planning (ERP), Oracle Advertising, NetSuite applications suite, Oracle Fusion cloud human capital management, and Oracle Fusion Sales, Service, and Marketing, are few of the cloud software programs included in the company's Oracle software as a service. It also provides licensed cloud-based business infrastructure solutions, middleware (which contains tools for development and other purposes), and enterprise databases such as Oracle and Java. Also, the company provides Generative AI powered by state-of-the-art LLMs from Cohere, ensuring unparalleled data security, trusted performance, and versatile deployment options for text generation. Oracle Corporation offers oracle spatial and graph, oracle analytics cloud, and oracle database with location intelligence, enabling geospatial data analysis, mapping, and real-time insights for businesses in retail, logistics, and smart city applications.

Microsoft is a multinational technology company headquartered in Redmond, Washington. Microsoft offers various products and services, including operating systems, productivity software, gaming consoles, and cloud-based solutions. Its flagship product, Microsoft Windows, is the world's most widely used operating system. Other popular products include Microsoft Office, Skype, and the Xbox gaming console. Microsoft has invested heavily in artificial intelligence (AI) and machine learning technologies in recent years. The company has been using AI to improve its products and services and developing new AI-based applications. For Instance, Microsoft's Cortana virtual assistant uses machine learning to provide personalized recommendations and insights to users. Microsoft offers Azure Maps, Power BI with geospatial analytics, and AI-driven location intelligence, enabling real-time mapping, spatial analysis, and data visualization for industries like retail, logistics, smart cities, and transportation.

Key Companies in Location Analytics Market

- SAS Institute

- Esri

- Oracle

- Pitney Bowes

- Microsoft

- Galigeo

- Cisco Systems

- IBM

- Purple

- GeoMoby

- Alteryx, Inc.

- CleverAnalytics

- IndoorAtlas

- Lepton Software

- Quuppa.

Location Analytics Market Developments

July 2021: INRIX IQ Location Analytics was launched as a cloud-based LBS application, providing businesses with powerful insights to select locations, increase revenue, and maximize ROI through easy-to-use, on-demand mobility analytics.

September 2020: Targomo's new location analytics platform, TargomoLOOP, was launched. It offers free access to location analysis tools, allowing users to easily analyze locations' potential, catchment areas, and demographics without needing downloads or setups.

Location Analytics Market Segmentation

By Component Outlook (Revenue USD Billion, 2020–2034)

- Services

- Solution

- Geocoding and Reverse Geocoding

- Data Integration and ETL

- Reporting and Visualization

- Thematic Mapping and Spatial Analysis

- Others

By Location Type Outlook (Revenue USD Billion, 2020–2034)

- Indoor

- Outdoor

By Application Outlook (Revenue USD Billion, 2020–2034)

- Risk Management

- Emergency Response Management

- Customer Experience Management

- Remote Monitoring

- Supply Chain Planning and Optimization

- Sales and Marketing Optimization

- Predictive Assets Management

- Inventory Management

- Other

By Verticals Outlook (Revenue USD Billion, 2020–2034)

- Retail

- Manufacturing

- Govt & Defense

- Media & Entertainment

- Transportation

- Energy & Utilities

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Location Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 25.28 billion |

|

Market Size Value in 2025 |

USD 28.84 billion |

|

Revenue Forecast in 2034 |

USD 97.20 billion |

|

CAGR |

14.5% from 2025–2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The location analytics market size was valued at USD 25.28 billion in 2024 and is projected to grow to USD 97.20 billion by 2034.

• The global market is projected to register a CAGR of 14.5% during the forecast period, 2025-2034.

• North America had the largest share of the global market in 2024.

• The key players in the market are SAS Institute; Esri; Oracle; Pitney Bowes; Microsoft; Galigeo; Cisco Systems; IBM; Purple; GeoMoby; Alteryx, Inc.; CleverAnalytics; IndoorAtlas; Lepton Software; and Quuppa.

• The indoor segment is expected to experience a significant CAGR in the global market during the forecast period due to the increasing use of technology to track and analyze customer behavior inside stores, malls, and other indoor spaces.

• The service segment dominated the location analytics market in 2024 due to the increasing demand for managed services, consulting, and support.