Lobster Market Share, Size, Trends, & Industry Analysis Report

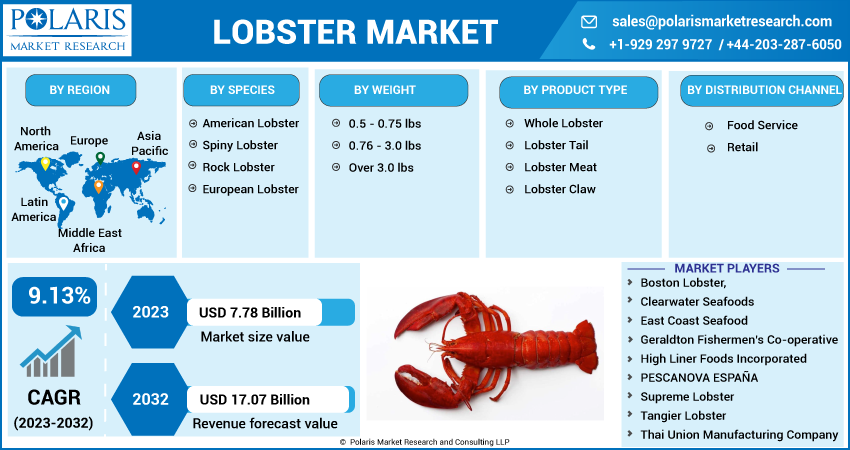

By Species (American, Spiny, Rock, European); By Weight; By Product Type; By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM3479

- Base Year: 2024

- Historical Data: 2020-2023

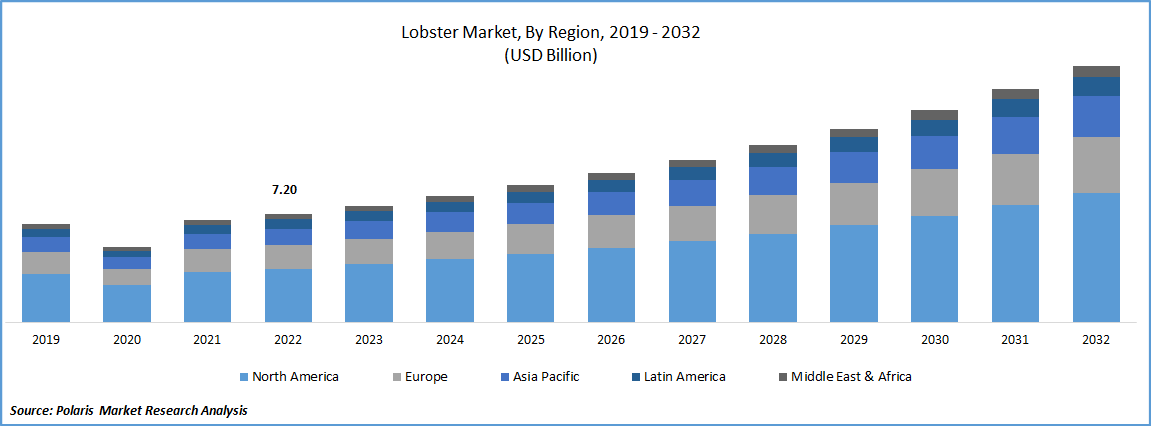

The global lobster market size was valued at USD 8.8 billion in 2024, exhibiting a CAGR of 8.50% during 2025–2034. The market is driven by rising global seafood consumption, increasing demand from premium hospitality sectors, and expanding international trade routes. The growing production of fish meal and fish oil is one of the key factors fuelling the market growth. Fish meal and fish oil are important ingredients in the production of lobster feed, which is used to feed farmed lobsters.

Key Insights

- The American lobster segment is projected to grow rapidly due to its high demand in global seafood markets and strong supply from North America.

- The 0.5-0.75 lb size segment holds a larger market share, favored by consumers and restaurants for its portion control and affordability.

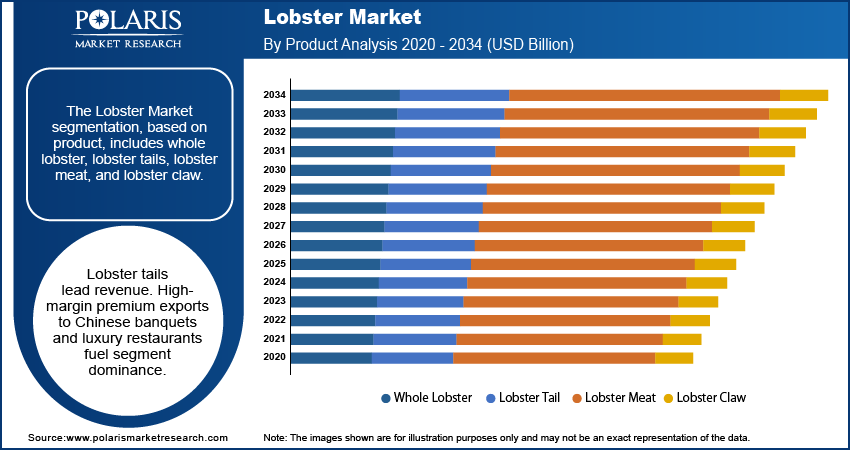

- The whole lobster segment dominates revenue, driven by its appeal in fine dining and premium seafood offerings.

- The food service segment is expected to experience significant growth, driven by increasing demand for lobster in restaurants, hotels, and catering services.

- The North American lobster market, particularly in Canada, leads the global market due to its well-established fisheries and robust export infrastructure.

- Southeast Asia is the fastest-growing region, with Thailand and Vietnam experiencing annual growth of 15–20% in imports and domestic aquaculture to meet the rising demand for seafood.

Industry Dynamics

- Rising consumer demand for premium seafood, combined with the increasing popularity of lobster in fine dining, is fueling market growth.

- The expansion of international trade and improved cold chain logistics are driving the global distribution of lobster.

- Overfishing and strict regulatory controls limit supply, posing sustainability challenges.

- Aquaculture advancements offer potential to meet the rising demand for lobster through sustainable farming practices.

Market Statistics

- 2024 Market Size: USD 8.80 billion

- 2034 Projected Market Size: USD 20.18 billion

- CAGR (2025-2034): 8.50%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

As the global production of fish meal and fish oil increases, the availability of high-quality lobster feed has also increased, which has helped to boost the growth of the lobster farming industry. According to the Organization for Economic Cooperation and Development Agriculture Outlook, in terms of product weight, it is anticipated that production of fishmeal and fish oil from whole fish will rise in 2029 by 5.6% and 9.2%, respectively, over the baseline period. The price of fishmeal and fish oil, along with the predicted growth in catch fisheries production, are the main factors driving this increase.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The growing consumption of fish in Asia is fueling the growth of the lobster market by driving up demand for high-end seafood products, particularly among consumers with high levels of disposable income. By 2029, Asia will consume 75% more fish than it does now, despite not having the fastest growth rate because it is by far the biggest consumer of the fish. As a result, market is likely to continue to expand in the coming years, as the Asian market continues to grow and evolve. Lobster is a high-value seafood product that has traditionally been harvested from the wild.

However, with the increasing demand for lobster, many producers have turned to aquaculture to meet this demand. Aquaculture is expected to produce 58% of the fish used for human consumption by 2029, up from 53% in 2017–19. Aquaculture allows for the controlled cultivation of lobsters, which can be raised in large quantities and harvested at specific times to meet market demand. This has led to a more consistent supply of lobster throughout the year, rather than just during the traditional lobster season.

Report Segmentation

The market is primarily segmented based on species, weight, product type, distribution channel and region.

|

By Species |

By Weight |

By Product Type |

By Distribution Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

American Lobster is expected to witness fastest growth during forecast period

American Lobster segment is projected to experience a faster growth rate for the growth in the study period. These species are highly prized for their succulent meat, and there is a high demand for them in the US, Canada, and other markets. This demand is driven by consumers' preference for the taste, texture, and quality of American lobsters. The American lobster industry has adopted sustainable fishing practices, including size limits, trap limits, and escape vents, to ensure the long-term health and viability of lobster populations. This has helped to maintain a steady supply of lobsters, which has further fueled demand.

0.5 - 0.75 lbs projected to witness for the largest market share in 2024

The 0.5 - 0.75 lbs segment is expected to witness a larger market share for the lobster market. These lobsters are smaller in size and therefore more affordable compared to larger lobsters. This makes them more accessible to a wider range of consumers who may not be able to afford larger lobsters. Smaller lobsters are versatile and can be used in a variety of dishes, such as lobster rolls, pasta dishes, and salads. This versatility makes them a popular choice for restaurants and home cooks alike. Smaller lobsters are generally considered to be healthier as they have a lower fat content compared to larger lobsters. This makes them a preferred choice for health-conscious consumers who want to enjoy lobster without consuming too many calories. The 0.5 - 0.75 lbs lobsters are more abundant in the market, and their availability is more consistent compared to larger lobsters. This makes them a more stable and reliable option for consumers and businesses.

Whole Lobster is expected to hold the significant revenue share in 2024

Whole lobster segment is expected to have a larger revenue share for the lobster market. These lobsters are typically sold at a higher price point compared to lobster meat or other lobster products. This is because consumers are willing to pay a premium for the experience of eating a whole lobster, which is seen as a luxury and indulgent item. Whole lobsters are considered a premium product and are often associated with luxury dining experiences, such as fine dining restaurants and special occasions. This premium status further adds to the demand and price of whole lobsters.

Food Service segment is projected to witness higher growth rate in the study period

Food service segment is expected to have a higher growth rate during the forecast period. Restaurants and food service providers are the primary buyers of lobster products, and the demand for lobster in the food service industry is increasing. This is driven by consumer demand for high-quality seafood products, including lobster, in restaurants and other food service outlets. With the increasing popularity of seafood and the growing demand for unique and high-quality ingredients, many restaurants are adding lobster dishes to their menus. This diversification of menus is driving the demand for lobster in the food service industry.

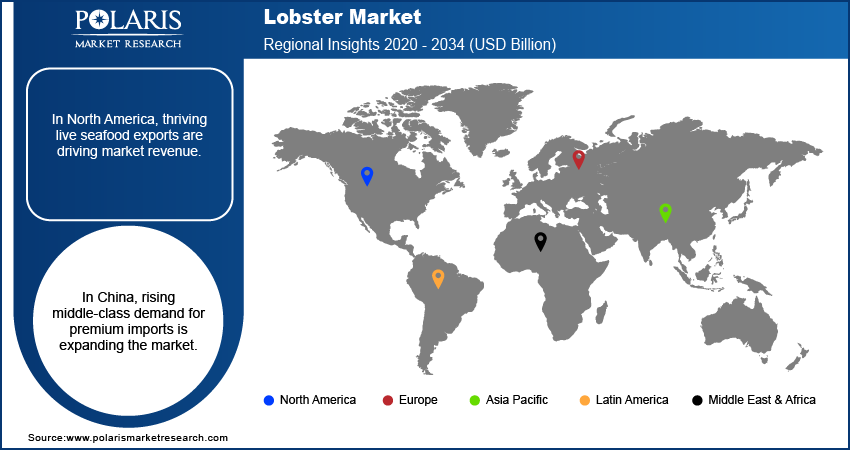

Regional Analysis

The North America lobster market holds a dominant position, with the United States and Canada being the leading producers and exporters. The coastal regions of Maine in the U.S. and the Atlantic provinces of Canada are well-known for their high-quality lobster harvests. The region benefits from established fishing infrastructure, sustainable harvesting practices, and strong demand from both domestic and international markets, especially in Asia and Europe.

The Europe lobster market shows consistent demand, primarily driven by high consumption in countries such as France, Spain, and the United Kingdom. European consumers appreciate lobster for its culinary appeal and nutritional value. Additionally, Europe's robust hospitality and tourism sectors drive demand for lobster in fine dining and luxury food services. Import dependence remains high, with a significant portion of the supply sourced from North America and Africa.

The Asia Pacific lobster market is emerging as a major growth region, with China leading the surge in demand due to rising middle-class incomes, growing interest in gourmet cuisine, and increased seafood imports. Live lobster imports have grown rapidly, particularly from Canada and Australia. Other countries, such as Japan and South Korea, also contribute significantly to regional consumption, making the Asia Pacific a key driver in the global market.

Competitive Insight

Some of the major players operating in the global market include Boston Lobster, Clearwater Sea-foods, East Coast Sea-food, Geraldton Fishermen’s, High Liner Foods, PESCANOVA ESPANA, Supreme Lobster, Tangier Lobster & Thai Union Manufacturing.

Recent Developments

- In January 2025, India’s leading shrimp supplier (often referred to as an “Indian shrimp giant”) acquired a North American lobster distributor and exporter based in Massachusetts, aiming to surpass USD 100 million in revenue this year—signaling strong industry consolidation and global expansion

- In November 2022, A West Australian company and an Indian distribution company have successfully concluded talks, and live western coast rock lobster will shortly be sent to India. After the deal is implemented, other products, including as mandarins and lamb, might be shipped to new Indian markets.

- In June 2022, High Liner Foods, a major North American value-added frozen seafood manufacturer, announced that it will continue to invest in updating its Newport News facility with new machinery and product lines.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 9.55 billion |

|

Revenue forecast in 2034 |

USD 20.18 billion |

|

CAGR |

8.50% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Species, By Weight, By Product Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Boston Lobster, Clearwater Seafoods, East Coast Seafood, Geraldton Fishermen’s Co-operative, High Liner Foods Incorporated, PESCANOVA ESPAÑA, Supreme Lobster, Tangier Lobster & Thai Union Manufacturing Company. |

FAQ's

key companies in lobster market are Boston Lobster, Clearwater Sea-foods, East Coast Sea-food, Geraldton Fishermen’s, High Liner Foods, PESCANOVA ESPANA.

The global lobster market is expected to grow at a CAGR of 8.50% during the forecast period.

The lobster market report covering key segments are species, weight, product type, distribution channel and region.

key driving factors in lobster market are growing consumption of fish in Asia.

The global lobster market size is expected to reach USD 20.18 billion by 2034.