LNG Storage Tank Market Share, Size, Trends & Industry Analysis Report

By Product Type (Self-Supporting Tanks, Non-Self-Supporting Tanks); By Material Type; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 140

- Format: PDF

- Report ID: PM3072

- Base Year: 2024

- Historical Data: 2020-2023

The global LNG Storage Tanks Market was valued at USD 5.7 billion in 2024 and is expected to grow at a CAGR of 8.50% from 2025 to 2034. Expansion in natural gas infrastructure and clean fuel adoption are driving market demand.

Industry Trends

Liquefied natural gas (LNG) is widely recognized as a clean, secure, and efficient energy source, surpassing other fossil fuels in environmental sustainability. Its diverse applications include milk product processing, ovens, fluid bed dryers, food service, production, logging, electricity generation, and rotational stoves. Recent developments in liquefaction methods, along with enhanced storage capabilities and easier transportation, have diversified liquefaction trains, with a focus on smaller and floating designs.

To Understand More About this Research:Request a Free Sample Report

The global LNG storage tank market is influenced by factors such as increased exploration and production from oil & liquids-rich basins, including coalbed methane and shale. The establishment of on-shore liquefaction and re-gasification terminals also contributes to market expansion. Notably, the China National Offshore Oil Corporation has raised the domes of the three largest LNG storage tanks simultaneously as part of the Yancheng Green Energy Port project, which includes a total of 10 gigantic LNG storage tanks.

Governments worldwide are actively promoting cleaner energy sources like LNG to curb carbon emissions. Japan aims to raise the natural gas share in its energy mix to 27% by 2030, while South Korea plans to phase out coal-fired power plants in favor of cleaner alternatives. These initiatives create a conducive environment for the growth of LNG infrastructure, particularly storage tanks, to support the increasing adoption of LNG.

Key Takeaways

- Asia Pacific dominated the market and contributed over 45% market share of the LNG storage tank market size in 2023

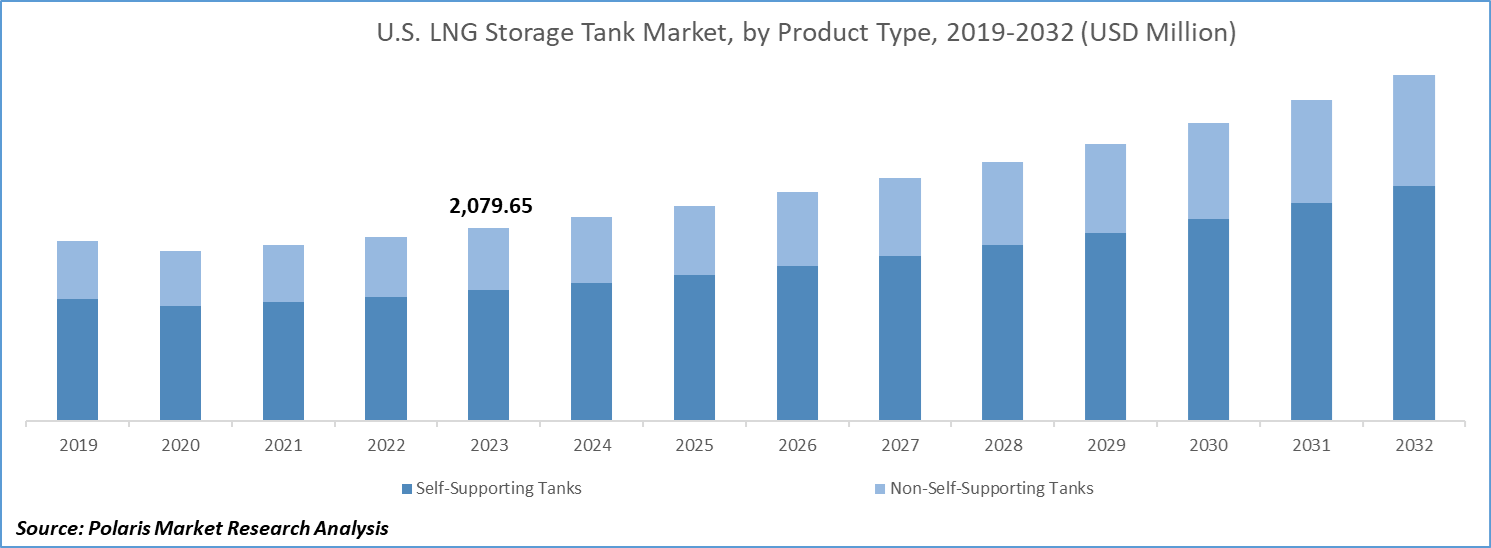

- By product type category, the self-supporting tanks segment dominated the global LNG storage tank market size in 2024

- By material type category, the steel segment is projected to grow with a significant CAGR over the LNG storage tank market forecast period

What are the market drivers driving the demand for market?

Advances in LNG storage tank technologies

Significant trends in liquefied natural gas (LNG) storage tank technologies, including materials, design, and safety features, are fueling efficiency enhancements and cost reductions. Innovations in the construction and insulation of these tanks contribute to making LNG storage more economically viable.

LNG storage tanks, whether situated in-ground, above ground, or within LNG carriers and vehicles, exhibit diverse configurations such as double-walled, horizontal, vertical, and insulated structures. Thermal insulation is a fundamental aspect of their construction, serving to mitigate evaporation, prevent heat transfer, and shield structures from the extreme cryogenic temperatures associated with LNG storage.

China Petroleum & Chemical Corporation (Sinopec) has recently unveiled the largest LNG storage tank in the world, situated at Sinopec's Qingdao LNG Receiving Terminal in Shandong. This impressive tank has a capacity of 270,000 cubic meters and is designed to cater to the winter gas demand of 2.15 Billion households for five months. It incorporates 17 patented technologies with intellectual property, showcasing Sinopec's dedication to technological innovation and advancement.

In a parallel development, in September 2019, technology group Wartsila engineered an innovative LNG storage and supply system for ships. This system, equipped with an In-Line Tank Connection Space (ILTCS), incorporates two 640 m3 single polyurethane insulated storage tanks. The ILTCS enhances fuel storage volume efficiency and simplifies the installation of LNG systems in ships, positioning Wartsila to expand its global presence and tap into untapped markets.

Which factor is restraining the demand for the market?

The construction of LNG storage tanks involves significant capital expenditure

The expansion of liquefied natural gas (LNG) infrastructure meets complex challenges in the land of infrastructure development. The complexity of this expansion extends beyond the simple construction of LNG storage facilities. It includes the imperative need for associated facilities like regasification terminals and comprehensive transportation infrastructure, such as pipelines and LNG carriers. Preparing a cohesive LNG supply chain demands extensive planning, regulatory approvals, and seamless coordination among diverse stakeholders.

LNG projects are considered by their long-term investment, rendering them liable to market uncertainties that can present difficult challenges. Variables such as fluctuations in natural gas prices, geopolitical factors, and regulatory changes have the potential to impact the economic viability of LNG projects. Uncertainties in demand forecasts or alterations in energy policies can have a significant influence on investment decisions and project timelines.

While LNG is often heralded as a cleaner alternative to certain fossil fuels, environmental concerns linger in its production and transportation. Issues pertaining to methane emissions during the LNG production and supply chain processes can emerge as contentious points, subjecting the industry to regulatory scrutiny and potentially impeding market growth.

Report Segmentation

The market is primarily segmented based on product type, material type, and region.

|

By Product Type |

By Material Type |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Product Type Insights

Based on product type category analysis, the market has been segmented on the basis of self-supporting tanks and non-self-supporting tanks. In 2023, the self-supporting tanks has emerged as the dominant segment in the global market. Self-supporting tanks, commonly used for various industrial applications, offer a versatile and efficient solution for storing liquids, with a particular focus on Liquified Natural Gas (LNG). These tanks are designed to stand independently without external support structures, showcasing robust engineering that ensures stability and reliability. The self-supporting design simplifies installation and maintenance processes, making these tanks a preferred choice for industries requiring flexible and cost-effective storage solutions.

Furthermore, the inherent safety features of self-supporting tanks, including advanced insulation and containment systems, contribute to the secure handling of LNG. As the energy industry continues to prioritize sustainability and environmental responsibility, the demand for LNG storage solutions, particularly self-supporting tanks, is anticipated to grow. These tanks represent a crucial link in the LNG supply chain, ensuring the reliability and accessibility of natural gas resources for a world increasingly focused on cleaner energy alternatives.

By Material Type Insights

Based on material type category analysis, the market has been segmented on the basis of steel, 9% nickel steel, aluminum alloys, and other. The steel segment is projected to witness a progressive growth rate in the forecasting years. The demand for steel liquefied natural gas (LNG) storage tanks has experienced a significant surge in recent years, driven by several key factors. Firstly, the global shift towards cleaner energy sources has propelled the demand for LNG as a viable alternative to traditional fossil fuels. As a result, the need for reliable and secure storage solutions has become paramount, and steel has emerged as a preferred material for constructing LNG storage tanks due to its durability and strength.

Additionally, the growing LNG trade and transportation industry have further boosted the demand for steel storage tanks. The inherent properties of steel, such as its ability to withstand extreme temperatures and pressures, make it an ideal choice for ensuring the integrity and safety of LNG storage. Furthermore, the versatility of steel allows for the construction of tanks in various sizes, catering to the diverse needs of different industries. The expansion of LNG infrastructure, driven by the increasing adoption of natural gas in power generation, industrial processes, and transportation, has fuelled the demand for steel storage tanks on a global scale. In conclusion, the rise in demand for LNG as a cleaner energy source, coupled with the unique characteristics of steel, positions steel LNG storage tanks as a crucial component of the evolving energy landscape.

Regional Insights

Asia Pacific

Asia Pacific accounted for the largest revenue share in the global market due to a considerable rise in energy demands. Governments in this region are actively seeking to diversify their energy mix and reduce reliance on traditional fossil fuels. Furthermore, governments across the Asia-Pacific are making substantial investments in infrastructure development, particularly in the construction of LNG terminals and storage facilities. Moreover, the application of heightened manganese steel for LNG tanks represents a milestone achieved through joint efforts by South Korean steel major POSCO and DSME (Daewoo Shipbuilding and Marine Engineering). This innovative material offers advantages such as a lower cost, high strength and wear resistance, and superior performance at cryogenic temperatures, making it a next-generation material for LNG fuel tanks.

Several companies in the Asia-Pacific region have successfully secured contracts for the construction and manufacturing of LNG storage tanks, signaling a notable demand in the market. The heightened demand for LNG, fueled by factors such as industrial development, energy diversification, and environmental considerations, has driven increased investments in LNG infrastructure, including storage facilities.

Competitive Landscape

The competitive landscape of the LNG storage tank market is characterized by a mix of established industry players and emerging contenders, each vying for market share in a dynamic and rapidly evolving industry. Leading companies dominate the market with their extensive product portfolios, global presence, and strong technological capabilities. These established players leverage their experience, brand reputation, and diversified offerings to maintain their competitive edge. However, the market also witnesses the emergence of niche players and regional manufacturers, capitalizing on technological advancements and innovative solutions to carve out their niche. Additionally, collaborations, partnerships, and strategic alliances among key players further intensify competition, fostering innovation and driving market growth.

Some of the major players operating in the global market include:

- Chart Industries, Inc.

- Corban Energy Group

- CRYOCAN

- Cryolor

- IHI Corporation

- INOX India Limited

- ISISAN A.S.

- Linde plc

- Luxi Group

- McDermott International Ltd

- Shijiazhuang Enric Gas Equipment Co., Ltd.

- TransTech Energy, LLC

Recent Developments

- In April 2024, CNOOC completed main construction of six 270,000-cbm LNG tanks at Binhai terminal, using 5,200 tons of perlite for insulation.

- In April 2022, McDermott secured multiple storage tank contracts in Saudi Arabia, including a large contract and two sizeable contracts for the engineering, procurement, fabrication, and construction (EPFC) of 38 tanks and 13 spheres across various locations in the Saudi Arabia.

- In January 2022, McDermott's CB&I, contracted by We Energies, will construct two LNG storage tanks in southeastern Wisconsin to address fluctuating natural gas demand during winter, ensuring a stable supply for homes and businesses.

- In October 2023, Isısan, responding to the surge in import-export demands, has expanded its factory area to 52,000 m² within a year, ensuring swift solutions, efficient planning, and product quality for its business partners.

- In May 2022, Chart Industries acquired Cryogenic Service Center AB (CSC), expanding its geographical footprint and extending service capabilities for transportable tanks and LNG fuelling stations. Such corporate developments, coupled with government initiatives promoting storage tank infrastructure, collectively contribute to driving the market in the region.

Report Coverage

The LNG storage tank market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, material type, and their futuristic growth opportunities.

LNG Storage Tank Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 6.2 Billion |

|

Revenue forecast in 2034 |

USD 12.9 Billion |

|

CAGR |

8.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product Type, By Material Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The LNG storage tank market report covering key segments are product type, material type, and region.

LNG Storage Tank Market Size Worth USD 12.9 Billion by 2034.

LNG storage tank market exhibiting the CAGR of 8.50% during the forecast period.

Asia Pacific is leading the global market.

The key driving factors in LNG storage tank market are Increasing demand for LNG and expansion of LNG infrastructure drives the LNG storage tank market