Lithium-Sulfur Battery Market Share, Size, Trends, Industry Analysis Report: By Component (Anode, Cathode, Electrolyte, Separator, and Others), By Battery Capacity, By End-User Industry, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Sep-2024

- Pages: 117

- Format: PDF

- Report ID: PM5043

- Base Year: 2023

- Historical Data: 2019-2022

Lithium-Sulfur Battery Market Overview

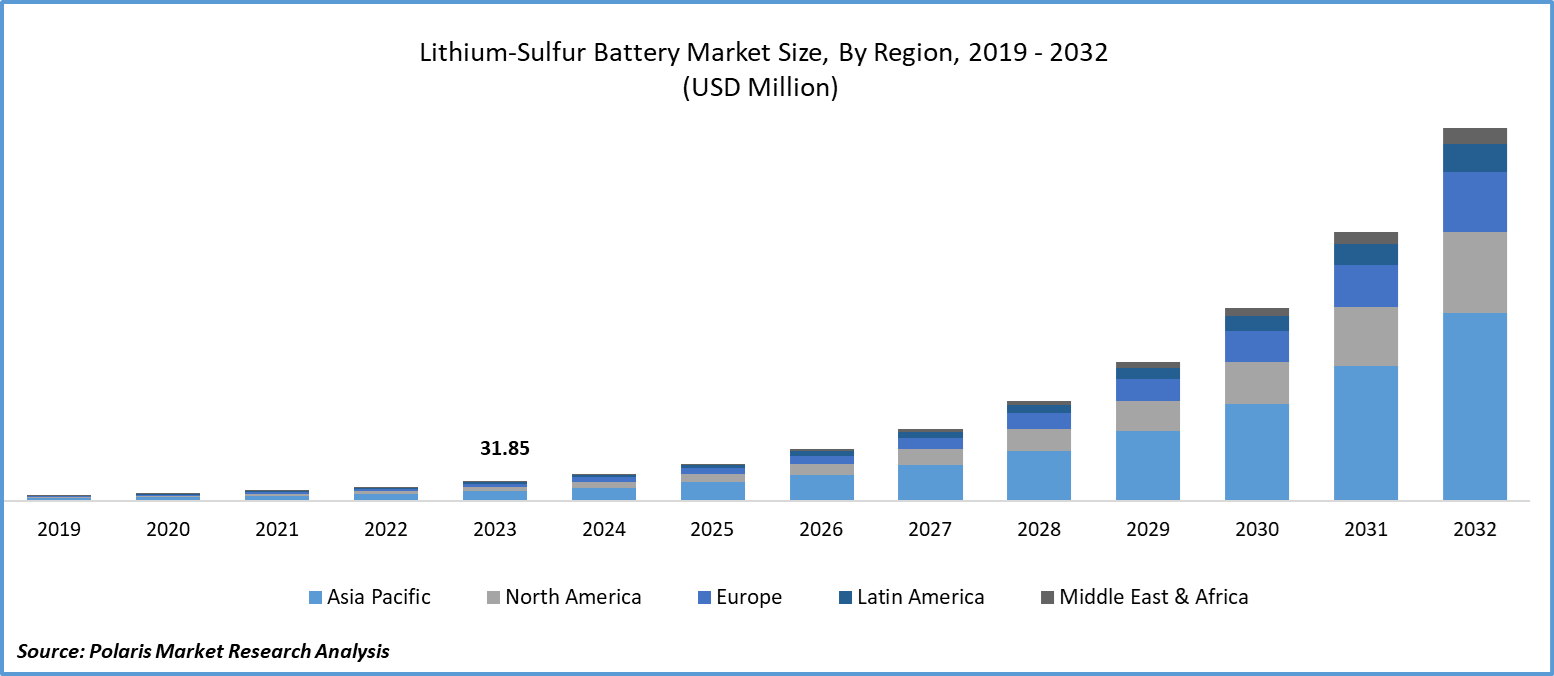

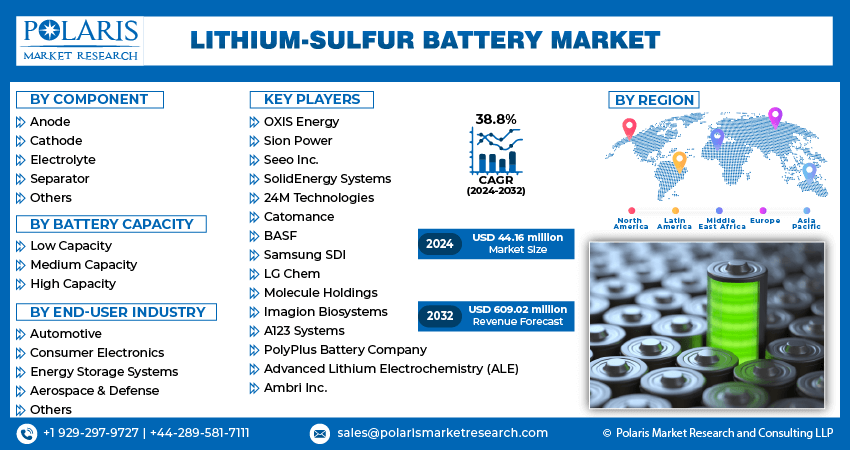

Global Lithium Sulfur Battery Market Size was valued at USD 31.85 million in 2023. The market is projected to grow from USD 44.16 million in 2024 to USD 609.02 million by 2032, exhibiting a CAGR of 38.8% during forecast period.

The global lithium-sulfur battery market focuses on the development and deployment of batteries that use lithium and sulfur as key components. Li-S batteries are gaining traction in electric vehicles and portable electronics, driving global market expansion known for their high energy density, lightweight nature, and potential for cost efficiency. The market is experiencing significant growth driven by the rising demand for advanced energy storage solutions with higher energy densities and lower costs. Key drivers include the increasing need for lightweight, high-capacity batteries in electric vehicles (EVs) and portable electronics, as well as advancements in battery technology that enhance performance and longevity. Trends shaping the market are ongoing research on improving the cycling stability and conductivity of lithium-sulfur batteries, government incentives for sustainable energy solutions, and rising investments in clean energy technologies. Additionally, the quest for more environmentally friendly alternatives to conventional lithium-ion batteries is propelling growth of lithium-sulfur technology.

To Understand More About this Research: Request a Free Sample Report

Lithium-Sulfur Battery Market Trends

Technological Advancements in Battery Performance

The global lithium-sulfur battery market is witnessing the rapid advancements in battery technology aimed at enhancing performance and longevity. Researchers and companies are focusing on overcoming the limitations of traditional lithium-sulfur batteries, such as poor cycling stability and low conductivity. Innovations such as improved sulfur cathode materials, advanced electrolytes, and new binder systems are being developed to increase the energy density, lifespan, and efficiency of these batteries. This trend is crucial for making lithium-sulfur batteries more viable for commercial applications, particularly in electric vehicles (EVs) and large-scale energy storage systems.

Growing Demand for Sustainable Energy Solutions

There is a rising shift toward sustainable energy solutions. As the world increasingly prioritizes environmental sustainability, there is a push for energy storage technologies that offer lower environmental impact compared to traditional lithium-ion batteries. Lithium-sulfur batteries are seen as a promising alternative due to their potential for higher energy density and lower costs. This trend is supported by government incentives and policies aimed at reducing carbon footprints and promoting clean energy technologies, which are accelerating the adoption of lithium-sulfur batteries in various sectors, including transportation and renewable energy storage.

Rising Investments and Research Funding

Increased investments and research funding are accelerating the development and commercialization of lithium-sulfur batteries. Private investors and public institutions are recognizing the potential of lithium-sulfur technology and are providing substantial financial support to advance research and development. This influx of capital is enabling innovation in battery design, materials, and manufacturing processes. Companies are also forming strategic partnerships and collaborations to leverage expertise and resources, further driving progress in the market. This trend is crucial for overcoming existing technological challenges and bringing lithium-sulfur batteries closer to widespread adoption.

Lithium-Sulfur Battery Market Segment Insights

Lithium-Sulfur Battery Market – Component Insights

In the global lithium sulfur battery market, the segmental analysis by component reveals that the cathode segment dominates the market due to its critical role in the overall performance and efficiency of the battery. Sulfur-based cathodes are central to lithium-sulfur technology, offering higher energy density than conventional materials. However, the electrolyte segment is experiencing the highest growth, driven by ongoing advancements in electrolyte formulations that improve battery stability and performance. Enhanced electrolytes are crucial for addressing issues related to conductivity and longevity, thus supporting the increasing demand for efficient and durable lithium-sulfur batteries.

While anode, separator, and other components contribute to the market, their roles are comparatively less influential in terms of growth and market share. The anode segment, typically composed of lithium or lithium alloys, is essential but does not see the same level of innovation and investment like the cathode and electrolyte segments. Similarly, separators and other components are important for battery assembly but are less prominent in driving market dynamics. Overall, the electrolyte segment's rapid growth reflects the industry's focus on overcoming technical challenges and enhancing the performance of lithium-sulfur batteries.

Lithium-Sulfur Battery Market – Battery Capacity Insights

The medium capacity segment dominates the global lithium-sulfur battery market, primarily due to its balanced performance and suitability for a wide range of applications, including consumer electronics and small-scale energy storage systems. Medium capacity batteries offer a practical compromise between energy density and cost, making them popular for various consumer and industrial uses. However, the high-capacity segment is experiencing the highest growth rate, driven by increasing demand for batteries that can support large-scale applications such as electric vehicles (EVs) and grid energy storage. High-capacity batteries are essential for meeting the growing energy requirements of these sectors, which require batteries with higher energy densities and longer lifespans.

The low-capacity segment, while important for specific applications such as small electronic devices, does not see the same level of growth or investment like the medium and high-capacity segments. This is due to the limited energy needs of such applications and the increasing focus on developing batteries with higher capacities to meet the demands of emerging technologies. The surge in high-capacity battery development is fueled by advancements in battery technology and increasing consumer and industrial interest in sustainable and efficient energy solutions. Overall, the shift toward high-capacity batteries reflects broader trends in the market that would lead to improved performance and greater energy storage capabilities.

Lithium-Sulfur Battery Market – End-User Industry Insights

The automotive segment dominates the global lithium-sulfur battery market, based on end-user industry, due to its substantial demand for advanced energy storage solutions to power electric vehicles (EVs). The high energy density and potential cost benefits of lithium-sulfur batteries make them appealing for automotive applications, where long-range and efficiency are critical. As the automotive industry increasingly shifts toward electrification and sustainable transport solutions, the adoption of lithium-sulfur batteries is expected to expand significantly in the coming years.

The energy storage systems (ESS) segment is showing highest growth, driven by the rising need for efficient and scalable energy storage solutions for renewable energy integration and grid stability. As more regions invest in renewable energy sources such as solar and wind, the demand for high-capacity, long-life batteries to store and manage this energy is surging. While consumer electronics and aerospace & defense are among the important sectors for lithium-sulfur batteries, their growth rates are slower than automotive and ESS. The overall trend shows a strong focus on sectors that require high-performance, large-scale energy storage solutions, aligning with broader advancements in battery technologies and sustainability goals.

Lithium-Sulfur Battery Market, Segmental Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Lithium-Sulfur Battery Market – Regional Insights

By region, the study provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In the global lithium-sulfur battery market, Asia Pacific stands out as the dominating region, driven by its significant advancements in battery technologies and its robust manufacturing capabilities. This dominance is primarily due to the presence of major battery manufacturers and technology developers in countries such as China, Japan, and South Korea, which are at the forefront of innovation and production in the battery sector. Additionally, the rapid growth of electric vehicle adoption and energy storage solutions in Asia Pacific further fuels the region's leading position. North America and Europe also show strong market potential, with increasing investments in sustainable technologies and growing adoption of lithium-sulfur batteries, but they are currently outpaced by the scale and pace of developments in Asia Pacific.

Lithium-Sulfur Battery Market, Regional Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

In Europe, the lithium-sulfur battery market is driven by the region's strong focus on sustainability and clean energy. European countries are investing heavily in the development of advanced battery technologies to support the growing electric vehicle (EV) market and renewable energy integration. The European Union's stringent environmental regulations and ambitious targets for reducing carbon emissions are fueling demand for high-performance, eco-friendly batteries. Countries such as Germany, France, and the UK are leading the charge with significant research and development efforts, as well as collaborative projects between industry and academia. Despite these advancements, Europe's market share is smaller than Asia Pacific, due to a higher costs and slower adoption rates of new technologies.

Lithium-Sulfur Battery Market – Key Market Players and Competitive Insights

OXIS Energy, Sion Power, and Seeo Inc. are a few of the key players in the global lithium sulfur battery industry. These players are recognized for their advancements in lithium-sulfur battery technology. Other notable companies include SolidEnergy Systems, 24M Technologies, and Catomance, all of which are involved in developing innovative solutions to enhance battery performance. Additionally, companies such as BASF, Samsung SDI, and LG Chem are making significant investments in lithium-sulfur technology as part of their broader battery development portfolios. The market also features emerging players such as Molecule Holdings, Imagion Biosystems, and A123 Systems, which contributes to the competitive landscape with their novel approaches to battery technology.

In terms of competitive analysis, the lithium-sulfur battery market is characterized by a high level of innovation and rapid technological advancements. Established players such as OXIS Energy and Sion Power are focusing on improving battery energy density and cycling stability, positioning themselves as leaders in the development of next-generation batteries. Meanwhile, companies such as BASF and Samsung SDI leverage their extensive R&D resources and manufacturing capabilities to drive progress in the field. This intense focus on technological innovation is a key factor in maintaining a competitive edge in the market.

Insights into the competitive dynamics reveal that companies are increasingly forming strategic partnerships and collaborations to accelerate the development and commercialization of lithium-sulfur batteries. Joint ventures between battery manufacturers and automotive companies aim to integrate advanced battery technologies into EVs, enhancing their performance and market appeal. Additionally, investments in research and development are crucial for staying ahead in the market, as players work to overcome existing technical challenges and meet the growing demand for high-performance, cost-effective energy storage solutions. The competitive landscape is therefore shaped by continuous innovation, strategic alliances, and significant investments in technology development.

OXIS Energy is a prominent player in the lithium-sulfur battery market, known for its focus on developing high-energy-density batteries with longer lifespans. The company has made significant strides in enhancing the performance of lithium-sulfur technology, targeting applications in EVs and portable electronics. OXIS Energy’s innovative approach includes advancements in sulfur cathode materials and electrolytes to improve battery efficiency and reduce costs.

Sion Power is another key player in the global lithium-sulfur battery market, specializing in high-performance energy storage solutions. The company focuses on commercializing advanced lithium-sulfur battery technologies with a strong emphasis on increasing energy density and reducing overall costs. Sion Power’s batteries are particularly geared toward applications in EVs and aerospace.

Key Companies in Lithium-Sulfur Battery Market

- OXIS Energy

- Sion Power

- Seeo Inc.

- SolidEnergy Systems

- 24M Technologies

- Catomance

- BASF

- Samsung SDI

- LG Chem

- Molecule Holdings

- Imagion Biosystems

- A123 Systems

- PolyPlus Battery Company

- Advanced Lithium Electrochemistry (ALE)

- Ambri Inc.

Lithium-Sulfur Battery Industry Developments

- In August 2024, Sion Power announced a significant breakthrough in their battery development, revealing a new lithium-sulfur battery prototype that achieved record energy density levels, underscoring their role as a major innovator in the field and enhancing their competitive position in the market.

- In June 2024, OXIS Energy announced a new partnership with a major automotive manufacturer to develop and test lithium-sulfur batteries for next-generation EVs, showcasing their commitment to expanding their market presence and advancing technology.

Lithium-Sulfur Battery Market Segmentation

Lithium-Sulfur Battery – Component Outlook

- Anode

- Cathode

- Electrolyte

- Separator

- Others

Lithium-Sulfur Battery – Battery Capacity Outlook

- Low Capacity

- Medium Capacity

- High Capacity

Lithium-Sulfur Battery – End-User Industry Outlook

- Automotive

- Consumer Electronics

- Energy Storage Systems

- Aerospace & Defense

- Others

Lithium-Sulfur Battery – Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lithium-Sulfur Battery Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 31.85 million |

|

Market size value in 2024 |

USD 44.16 million |

|

Revenue forecast in 2032 |

USD 609.02 million |

|

CAGR |

38.8% from 2024 to 2032 |

|

Base year |

2023 |

|

Historical data |

2019–2022 |

|

Forecast period |

2024–2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive landscape |

|

|

Report format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global lithium sulfur battery market size was valued at USD 31.85 million in 2023 and is projected to grow to USD 609.02 million by 2032.

The global market is projected to register a CAGR of 38.8% during 2023–2032.

Asia Pacific held the largest share of the global market in 2023.

OXIS Energy, Sion Power, and Seeo Inc. are among the key players in the global lithium-sulfur battery market.

The cathode segment dominated the market in 2023.

The medium capacity segment accounted for the largest share of the global market in 2023.

A lithium-sulfur (Li-S) battery is a type of rechargeable battery that uses lithium as the anode and sulfur as the cathode. Unlike traditional lithium-ion batteries that typically use materials such as cobalt or nickel in the cathode, lithium-sulfur batteries leverage sulfur’s high theoretical capacity to achieve higher energy densities.

A few key trends in the lithium-sulfur battery market are described below: Technological Advancements: Innovations in cathode materials, electrolytes, and manufacturing processes to improve energy density, cycling stability, and overall performance. Sustainability Focus: Increasing emphasis on environmentally friendly and cost-effective battery solutions to support the transition to cleaner energy and reduce reliance on traditional lithium-ion batteries. Rising Investment: Growing financial support and research funding from private and public sectors to accelerate the development and commercialization of lithium-sulfur batteries.

A new company entering the lithium-sulfur battery market must focus on several key areas to stay ahead of the competition. Prioritizing advancements in battery technology, such as improving energy density and extending cycle life, will be crucial for offering superior performance. Additionally, investing in sustainable and cost-effective production methods can help differentiate the company from competitors. Forming strategic partnerships with automotive and energy firms will facilitate market entry and integration into high-growth applications. Moreover, targeting emerging markets and sectors with high demand for energy storage solutions, such as EVs and renewable energy, can provide significant growth opportunities.

Companies producing and distributing lithium-sulfur batteries and consulting firms must buy the report.