Lithium Mining Market Share, Size, Trends, Industry Analysis Report, By Type (Chloride, Hydroxide, Carbonate, and Concentrate); By Source; By End-Use; By Region; Segment Forecast, 2023-2032

- Published Date:Jun-2023

- Pages: 117

- Format: PDF

- Report ID: PM3315

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

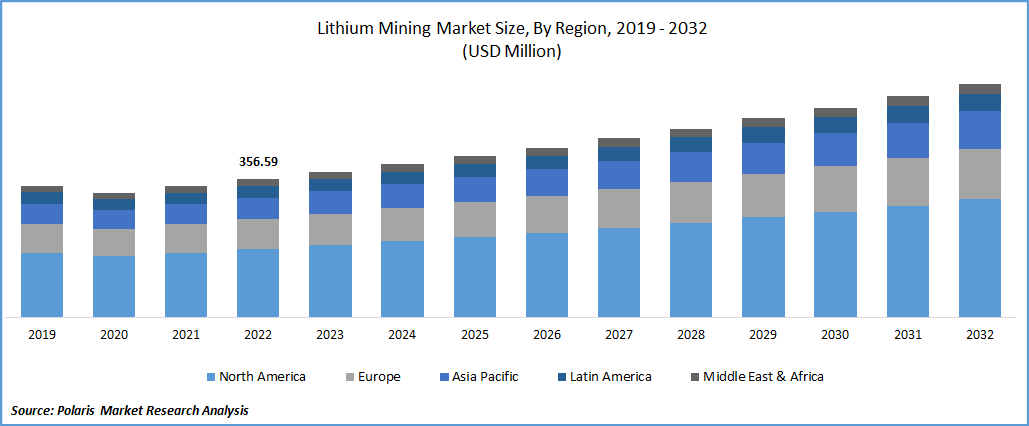

The global lithium mining market was valued at USD 356.59 million in 2022 and is expected to grow at a CAGR of 5.4% during the forecast period. Rocks and brines are mined for lithium throughout the mining process. The washing of the sodium carbonate in the shallow, PVC-lined ponds and the brine's condensation. In glass and ceramics, lithium compounds are widely employed. The prospective properties of ceramics, such as higher strength, better coating viscosity, enhanced glazing color, viscosity, power, and luster of the ceramic bodies, are thought to be the main drivers of ceramics, consequently boosting the overall expansion of the lithium mining sector. On the other hand, the mining industry's technology is also evolving, developing effective and productive mining techniques.

To Understand More About this Research: Request a Free Sample Report

The global energy demand has increased due to expanding industrialization and urbanization. Electricity consumption in the digital world is high due to its rising capabilities. Due to process automation dependency and 24-hour network usage, the demand for a dependable power supply has expanded significantly. This is a key market driver for energy storage. Non-renewable power sources are being replaced with renewable ones as they swiftly run out of resources. This shift to renewable energy has led to a rise in the need for energy storage.

Further, using Direct Lithium Extraction (DLE) for mining is a current market trend. It is substantially faster and has a much lower operational footprint. After lithium is extracted from subsurface brine, DLE uses ion exchange resins or nanofiltration technologies. The efficacy of this technology and others opens up a road to a lithium supply that is significantly more economical and sustainable for many nations. The lithium business is expanding quickly, necessitating the construction of a more sustainable future.

One major factor that is anticipated to slow the growth of market revenue is the environmental impact of mining. Some common environmental negative effects of lithium mining are water loss, ground instability, biodiversity loss, increasing river salinity, contaminated soil, and toxic waste. This will affect every component of the ecological system, from the wide variety of microorganisms found in brine to a few microbes that frequent salt flats.

Every sector of the economy has been negatively impacted by the worldwide health catastrophe brought on by the unexpected emergence of the new coronavirus. The outbreak has changed the product's demand. The market is heavily dependent on mining operations, and the worst collapse the mining industry has had in a long time has also influenced mining investment. Mining companies were compelled to halt production due to the limited availability of metals. This has had an immediate effect on the mining of lithium.

For Specific Research Requirements, Speak With a Research Analyst

Industry Dynamics

Growth Drivers

The rise in the usage of lithium in air treatment applications, the increasing popularity of electric vehicles (EVs), and the deployment of grid-scale lithium-ion batteries for energy storage are the main drivers of lithium mining market revenue growth. In September 2021, Lyten introduced the Li-S battery platform. This innovation is optimized specifically for electric vehicles and is designed to deliver three times the gravimetric energy density of Li-ion batteries. The Lyten 3D Graphene Li-S architecture has the high potential to reach the gravimetric energy density of around 900 Wh/kg, which will significantly outperform both conventional Li-ion and solid-state batteries.

In addition, technology is transforming the industrial sector, especially in the lithium mining industry. Mobile lithium extraction equipment is used in this cutting-edge way of mining lithium, which decreases the amount of time and upfront costs required to start extracting lithium. In October 2022, Imerys, a leader in mineral-based specialty solutions, revealed the beginning of a historic lithium mining operation at its Beauvoir location. The project will support the goals of the French and European Union for the energy transition once it is completed. Using amphibious vehicles to safely transport minerals over a variety of salt flat ground surfaces is another development in lithium mining technology that increases the value and lowers risk. As a result of necessity, a new technique has also been devised to safeguard water and land resources.

Report Segmentation

The market is primarily segmented based on type, end-use, source, and region.

| By Type |

By Source |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The Pharmaceuticals Segment is Expected to Witness the Fastest Growth During Forecast Period

Increased use of lithium for drug development is anticipated to result in rapid growth for the pharmaceutical industry throughout the forecast period. Lithium belongs to the class of drugs known as mood stabilizers. Therapy for mental disorders like mania, hypomania, and bipolar disease, when a patient's mood frequently shifts from feeling extremely high (during mania) to feeling extremely low (during the depression), and other medications have not been able to treat it. In addition, lithium, which is available in both regular and slow-release tablet formulations, can help to lessen aggressive or destructive behavior. Lithium citrate is also offered as a liquid that is consumed and is only available with a prescription. These are a few of the main variables influencing this segment's revenue growth.

Lithium Carbonate Segment Industry Accounted For the Largest Market Share in 2022

Lithium carbonate is a chemical used in various business, science, and health care applications. Lithium carbonate is frequently the first chemical in the manufacturing chain for lithium, with additional processes creating other chemicals as needed, such as various types of lithium hydroxide. The quantity of lithium produced is, therefore, commonly stated as lithium carbonate equivalent. In addition, lithium carbonate is used for purposes other than lithium-ion batteries. Moreover, both lithium hydroxide & lithium carbonate are required to meet the growing need for Li-ion batteries.

The Demand in Europe is Expected to Witness Significant Growth During Projected Periods

European nations are engaged in producing electric vehicles and advancing their medical and automotive sectors. As a result, the intense use of lithium in these industries is driving up market trends for lithium mining. Europe has made fuel efficiency a priority and has implemented rules requiring the use of fuel-efficient vehicles. Also, according to the International Energy Agency, the nation sold more than 7 million electric automobiles.

Moreover, Australia now holds most of the market due to the country's significant lithium reserves and extensive mining plans. In June 2022, to increase the amount of lithium that can be extracted from lithium mining waste for the Australian lithium sector, scientists at ANSTO and Lithium Australia Limited (LIT) created a technology that is the first in the world. The two companies developed LieNA, a method for processing waste and obtaining most lithium value from Australia's hard rock deposits without high-temperature processing. The Lithium Australia-owned LieNA method initially uses caustic treatment in an autoclave to turn waste spodumene into a readily recoverable synthetic lithium sodalite. The country's market expansion would also be fueled by the rising popularity of environmentally friendly electric vehicles.

Furthermore, due to the increase of brine mining operations in the region, Chile still holds the second-largest market share for lithium mining at this time. South American nations Brazil, Bolivia, and Argentina all have large deposits that might be completely utilized with increasing mining activity investments. In August 2022, A Government Decree released by the Ministry for Mines and Energy stated that the Brazilian government would legalize unrestricted international trade in lithium materials, ores, and related derivatives. Leading lithium prospecting company Oceana is participating. As a result of multiple upcoming mining projects, the nation's mining activity is predicted to increase.

Competitive Insight

Key players include Allkem, Albemarle Corporation, FMC Corporation, Galaxy Resources, Ganfeng Lithium, Jiangxi Ganfeng Lithium, Lithium Americas, Livent Corp., MGX Minerals, Nemaska Lithium, Orocobre Limited, Piedmont Lithium, Pilbara Minerals, SQM, Sociedad Quimica, Tianqi Lithium, & Wealth Minerals.

Recent Developments

- In February 2023, Century Lithium is thrilled to announce a partnership with Koch Technology to apply the Li-Pro method for direct lithium extraction at Century Lithium's mining facilities in the USA.

Lithium Mining Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 375.46 million |

|

Revenue forecast in 2032 |

USD 604.80 million |

|

CAGR |

5.4% from 2023- 2032 |

|

Base year |

2022 |

|

Historical data |

2019- 2021 |

|

Forecast period |

2023- 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Source, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Allkem Ltd., Albemarle Corporation, FMC Corporation, Galaxy Resources Limited, Ganfeng Lithium Group Co Ltd, Jiangxi Ganfeng Lithium, Lithium Americas Corporation, Livent Corp., MGX Minerals Inc., Nemaska Lithium Inc., Orocobre Limited Pty Ltd., Piedmont Lithium, Inc., Pilbara Minerals Limited, SQM SA, Sociedad Quimica y Minera de Chile SA, Tianqi Lithium Corporation, and Wealth Minerals Limited. |

FAQ's

The lithium mining market report covering key segments are type, end-use, source, and region.

Lithium Mining Market Size Worth $604.80 Million By 2032.

The global lithium mining market expected to grow at a CAGR of 5.4% during the forecast period.

Europe is leading the global market.

key driving factors in lithium mining market are rise in the usage of lithium in air treatment applications.