Lithium-Ion Battery Cathode Market Size, Share, Trends, Industry Analysis Report: By Chemical Composition, Cell Type, End Use (Automotive, Consumer Electronics, Medical Devices, and Industrial and Energy Storage), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM1756

- Base Year: 2024

- Historical Data: 2020-2023

Lithium-Ion Battery Cathode Market Overview

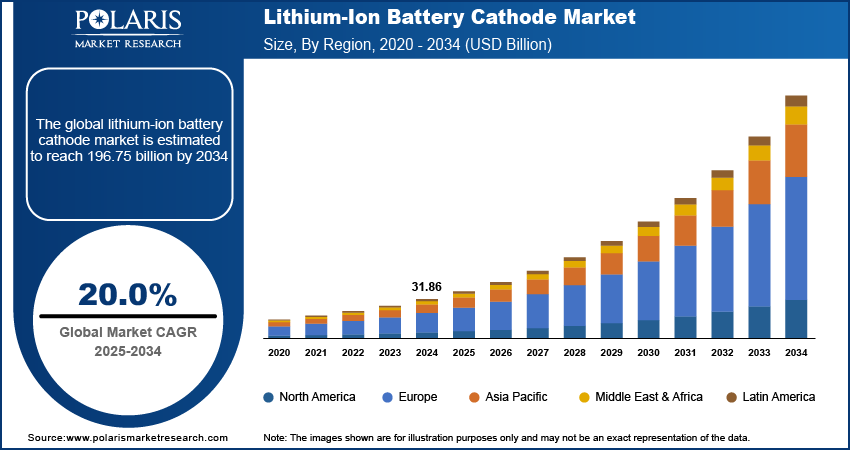

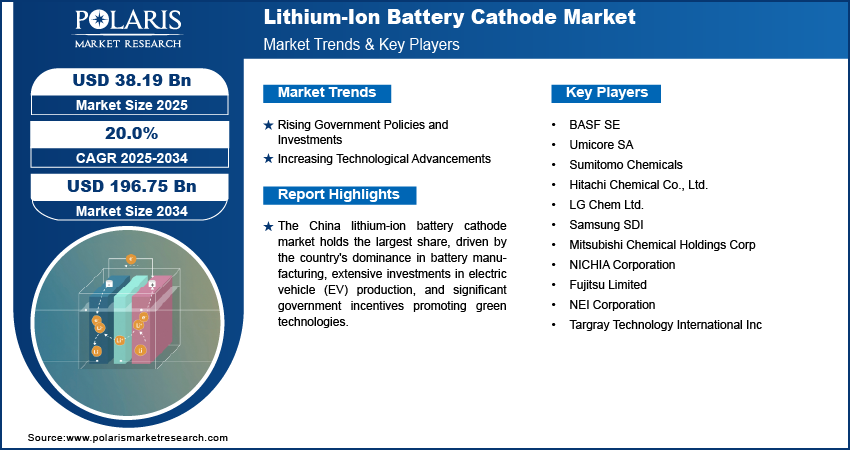

The lithium-ion battery cathode market size was valued at USD 31.86 billion in 2024. The market is projected to grow from USD 38.19 billion in 2025 to USD 196.75 billion by 2034, exhibiting a CAGR of 20.0% during the forecast period.

The lithium-ion battery cathode market is focused on the production and distribution of cathode materials, which are essential components in lithium-ion batteries. These batteries are key to many technologies, from portable devices to electric vehicles (EVs). The role of the cathode in a battery is crucial for its performance, energy density, and cost.

One major factor driving growth in this market is the increasing demand for renewable energy storage solutions. Lithium-ion batteries are vital for storing energy from renewable sources like solar and wind. The need for efficient energy storage is growing as the world shifts towards more sustainable energy, which in turn boosts the demand for these batteries.

Technological advancements have also played a big role in the market’s expansion. Improvements in battery efficiency and lower production costs have made lithium-ion batteries more accessible and affordable for a variety of industries. The rise in the use of portable electronic devices like smartphones, laptops, and tablets is another key factor fueling market growth. These devices require high-performance batteries, further driving the demand for lithium-ion batteries.

To Understand More About this Research: Request a Free Sample Report

Additionally, the growing popularity of electric vehicles (EVs) is a significant market driver. In 2023, global EV sales reached around 14 million units, and the share of electric cars in total vehicle sales rose from 4% in 2020 to 18% in 2023, according to the International Energy Agency (IEA). This shift towards EVs is creating even more demand for lithium-ion batteries and, by extension, cathode materials driving the market demand.

Lithium-Ion Battery Cathode Market Dynamics

Rising Government Policies and Investments

Rising government initiatives are significantly contributing to the lithium-ion battery cathode market growth. Strategic investments in large-scale battery manufacturing infrastructure, such as gigafactories by government is driving the market revenue. For instance, according to the U.S. Department of Energy, in September 2024, the Biden-Harris Administration declared over USD 3 billion to increase the local production of innovative batteries and battery materials globally. The establishment of resilient cathode material supply chains is enhancing production capacity and supporting market, thereby contributing to market expansion. Furthermore, targeted subsidies and grants for electric vehicles (EVs) and renewable energy projects are intensifying demand for lithium-ion batteries and their cathode materials, further driving market growth.

Increasing Technological Advancements

Advancements in technology are playing a pivotal role in the lithium-ion battery cathode market expansion. The development of high-performance cathode materials such as NMC, NCA, and LFP is enhancing energy density, reducing costs, and improving safety, which is directly contributing to market growth. Additionally, ongoing research into recyclable and eco-friendly materials is fostering sustainability and reducing the environmental footprint of battery production, further accelerating the market's growth trajectory.

For instance, in September 2024, according to Nature Communications, Columbia Engineering revealed advancements in battery technology aimed at improving renewable energy storage. The team has developed K-Na/S batteries, utilizing the abundant elements sodium and potassium alongside sulfur (S) to create an economical and high-energy solution for long-duration energy storage.

Lithium-Ion Battery Cathode Market Segment Insights

Lithium-Ion Battery Cathode Market Assessment by End Use Outlook

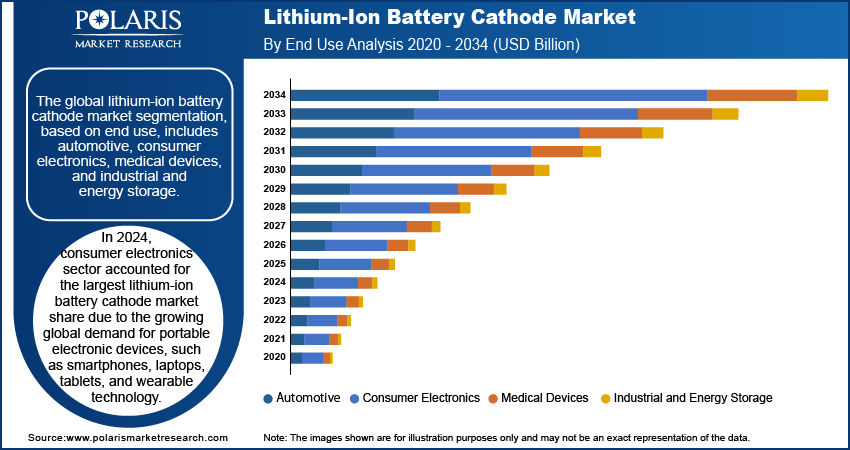

The global lithium-ion battery cathode market segmentation, based on end use, includes automotive, consumer electronics, medical devices, and industrial and energy storage. In 2024, the consumer electronics sector accounted for the largest market share due to the growing global demand for portable electronic devices, such as smartphones, laptops, tablets, and wearable technology. These devices require lightweight, high-energy-density batteries that offer long battery life and fast charging capabilities, making lithium-ion batteries with advanced cathode materials the preferred choice.

Technological advancements and the integration of features such as AI, IoT, and 5G in consumer electronics further increased the demand for efficient energy storage solutions, thereby driving the dominance of the consumer electronics segment and contributing to the market's growth.

Lithium-Ion Battery Cathode Market Evaluation by Chemical Composition Outlook

The global lithium-ion battery cathode market segmentation, based on chemical composition, includes lithium cobalt oxide, lithium manganese oxide, lithium nickel manganese cobalt oxide, lithium iron phosphate, and lithium nickel cobalt aluminum oxide. The lithium manganese oxide segment is projected to experience significant growth during the forecast period due to its widespread use in power tools, medical devices, and hybrid electric vehicles (HEVs). Lithium manganese oxide cathodes are valued for their high thermal stability, safety, and cost-effectiveness, making them suitable for applications requiring moderate energy density. Additionally, the increasing adoption of lithium-ion batteries in industrial and energy storage solutions is further driving demand for LMO materials, contributing to its robust market expansion.

Lithium-Ion Battery Cathode Market Regional Insights

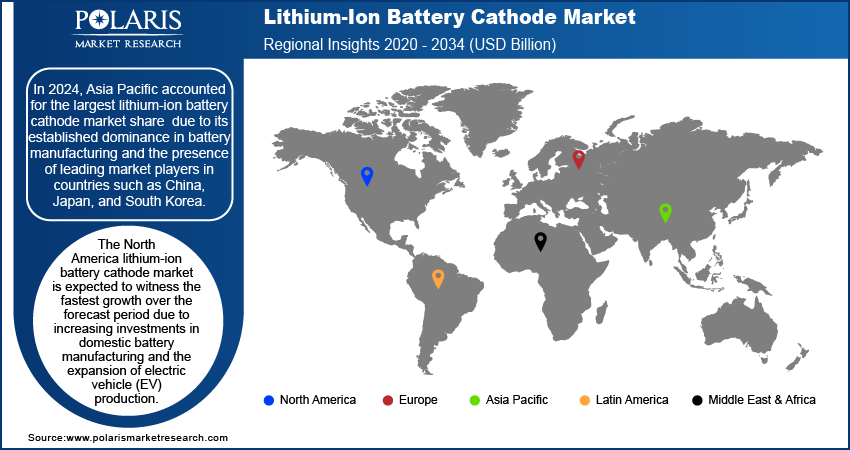

By region, the study provides lithium-ion battery cathode market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest share due to its established dominance in battery manufacturing and the presence of leading market players in countries such as China, Japan, and South Korea. For instance, in September 22, the Ministry of Industry and Information Technology reported that China leads the global consumer electronics market in production and sales, driven by enhanced innovation and brand development. Official Xu Wenli emphasized China's role as a key manufacturing hub, drawing major international electronics companies to set up production and R&D facilities in the country. The region benefits from a robust supply chain for raw materials, significant investments in gigafactories, and strong government support for electric vehicle (EV) adoption. Additionally, the high demand for consumer electronics and rapid industrialization further contributed to the region's leading position, driving market growth.

The market in China holds the largest share, driven by the country's dominance in battery manufacturing, extensive investments in electric vehicle (EV) production, and significant government incentives promoting green technologies. China is the world's largest producer of lithium-ion batteries, with a well-established supply chain for raw materials and a strong focus on expanding EV infrastructure.

The lithium-ion battery cathode market in North America is expected to witness the fastest growth over the forecast period due to increasing investments in domestic battery manufacturing and the expansion of electric vehicle (EV) production. For instance, Panasonic is poised to enhance its electric vehicle battery manufacturing capabilities with the establishment of a battery plant in De Soto, Kansas. Construction commenced in November 2022, with production slated to begin in 2025. This facility will primarily focus on the high-capacity 2170 cylindrical lithium-ion cells, which are increasingly sought after by automotive manufacturers due to the growing demand for electric vehicles (EVs). Strong government support, including incentives for EV adoption and renewable energy projects, is driving demand for advanced battery technologies. Additionally, the region's efforts to reduce dependency on foreign battery supply chains, coupled with growing demand from consumer electronics and energy storage sectors, are fueling rapid market expansion in North America.

The US is expected to witness the fastest growth in the market over the forecast period due to the country’s efforts to reduce dependency on foreign battery supply chain. Further, the growing demand from consumer electronics and energy storage sectors, which is also fueling rapid market expansion in the US.

Lithium-Ion Battery Cathode Market – Key Players and Competitive Analysis Report

The competitive landscape of the lithium-ion battery cathode market is marked by a blend of established industry leaders, emerging players, and continuous technological advancements. Key players, including LG Chem, CATL, Samsung SDI, Panasonic, and SK Innovation, dominate the market with their strong presence in the electric vehicle (EV) and consumer electronics sectors. Material suppliers such as Umicore, BASF, Johnson Matthey, and Sumitomo Metal Mining are crucial for providing essential cathode materials, such as NCM (Nickel Cobalt Manganese), NCA (Nickel Cobalt Aluminum), and LFP (Lithium Iron Phosphate). Competition is driven by factors including technological innovation, with companies focusing on improving the energy density, safety, and cost-effectiveness of cathode materials. Vertical integration is becoming a key strategy as players aim to secure their supply chains for critical raw materials. Sustainability is also a growing competitive factor, with an emphasis on eco-friendly practices and recycling initiatives. A few key major players are BASF SE; Umicore SA; Sumitomo Chemicals; Hitachi Chemical Co., Ltd.; LG Chem Ltd.; Samsung SDI; Mitsubishi Chemical Holdings Corp; NICHIA Corporation; Fujitsu Limited; NEI Corporation; Targray Technology International Inc.

BASF SE is a chemical corporation that operates all over the world. The company operates through seven segments, including chemicals, industrial solutions, materials, surface technologies, nutrition & care, and agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. In November 2023, BASF and SK On partnered in the lithium-ion battery market, focusing on North America and Asia Pacific. This alliance aims to combine its strengths in business and product development to innovate advanced battery materials for lithium-ion technologies.

Hitachi Ltd is an electric power transmission, control, and distribution company that specializes in energy, technology, utilities, transportation, renewable energy, infrastructure, semiconductors, e-mobility, transformers, industries, smart cities, and power. The company’s product portfolio is categorized into products and systems, software, and solutions. The product and systems category is further segmented into capacitors and filters, cable accessories, communication networks, disconnectors, energy storage, cooling systems, flexible AC transmission systems, high-voltage switchgear, generator circuit-breakers, and breakers, instrument transformers, high-voltage direct current, semiconductors, substation automation control and protection, surge arresters, transformers, substations and electrification, and transformer components and insulation.

Key Companies in Lithium-Ion Battery Cathode Market Outlook

- BASF SE

- Umicore SA

- Sumitomo Chemicals

- Hitachi Chemical Co., Ltd.

- LG Chem Ltd.

- Samsung SDI

- Mitsubishi Chemical Holdings Corp

- NICHIA Corporation

- Fujitsu Limited

- NEI Corporation

- Targray Technology International Inc.

Lithium-Ion Battery Cathode Market Developments

October 2024: Air Liquide invested around USD 150 million to expand its production capacity and pipeline network in Tennessee, in line with a long-term contract with LG Chem. This investment will facilitate oxygen supply to LG Chem’s new cathode active material plant, enhancing the U.S. battery supply chain.

July 2022: Hitachi High-Tech Corporation launched a service for the remote diagnosis of degradation in automotive lithium-ion batteries. This development is crucial for enhancing the stability and efficiency of electric vehicle (EV) battery systems.

August 2024: SAMSUNG SDI completed an agreement with General Motors to supply electric vehicle (EV) batteries in the United States, aiming to enhance production capabilities to meet increasing market demand.

Lithium-Ion Battery Cathode Market Segmentation

By Chemical Composition Outlook (Revenue, USD Billion; 2020–2034)

- Lithium Cobalt Oxide

- Lithium Manganese Oxide

- Lithium Nickel Manganese Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Cobalt Aluminum Oxide

By Cell Type Outlook (Revenue, USD Billion; 2020–2034)

- Cylindrical

- Prismatic

- Polymer

By End Use Outlook (Revenue, USD Billion; 2020–2034)

- Automotive

- Consumer Electronics

- Medical Devices

- Industrial and Energy Storage

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lithium-Ion Battery Cathode Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 31.86 billion |

|

Market Size Value in 2025 |

USD 38.19 billion |

|

Revenue Forecast by 2034 |

USD 196.75 billion |

|

CAGR |

20.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global lithium-ion battery cathode market size was valued at USD 31.86 billion in 2024 and is projected to grow to USD 196.75 billion by 2034.

The global market is projected to register a CAGR of 20.0% during the forecast period.

In 2024, Asia Pacific accounted for the largest share in the due to its established dominance in battery manufacturing and the presence of leading market players in countries including China, Japan, and South Korea.

A few key players in the market are BASF SE; Umicore SA; Sumitomo Chemicals; Hitachi Chemical Co., Ltd.; LG Chem Ltd.; Samsung SDI; Mitsubishi Chemical Holdings Corp; NICHIA Corporation; Fujitsu Limited; NEI Corporation; Targray Technology International Inc

In 2024, consumer electronics accounted for the largest market share in the lithium-ion battery cathode market due to the growing global demand for portable electronic devices, such as smartphones, laptops, tablets, and wearable technology.

The lithium manganese oxide segment is projected to experience significant growth during the forecast period due to its widespread use in power tools, medical devices, and hybrid electric vehicles (HEVs).