Liquid Waste Management Market Share, Size, Trends, Industry Analysis Report, By Source (Residential, Commercial), By Industry (Textile, Paper), By Service (Transportation, Collection), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3705

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

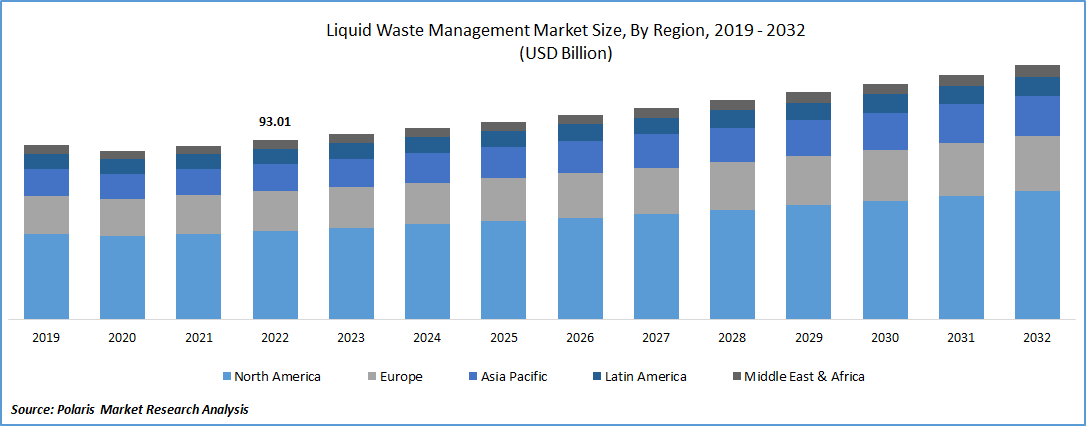

The global liquid waste management market was valued at USD 96.01 billion in 2023 and is expected to grow at a CAGR of 3.60%during the forecast period.

The need for managing liquid waste is increasing due to the demand for wastewater treatment plants and concerns about safety and toxicity. Sales Lead report that is currently 32 units under construction, and eight units are being expanded for wastewater treatment in the United States. This expansion is expected to lead to a surge in demand for liquid waste management. Companies across various industries generate significant amounts of non-recyclable and non-consumable liquid waste, which makes effective waste management crucial to prevent environmental degradation and protect the planet.

To Understand More About this Research: Request a Free Sample Report

Large corporations, in particular, are responsible for safeguarding their workers from exposure to hazardous substances by adopting suitable methods for the safe and proper disposal of industrial liquid waste in their waste management processes. Wastewater treatment plays a vital role in preserving public health and improving water quality by reducing toxins in wastewater and mitigating harmful effects on the environment and human well-being. The Clean Water State Revolving Fund (CWSRF) program offers funding to communities for water-related infrastructure projects, including wastewater treatment. Governments worldwide have also implemented strict regulations to prevent water pollution, which is expected to drive market growth for secondary wastewater treatment equipment.

Industry Dynamics

Growth Drivers

Rising number of users connecting to centralized treatment systems

Due to multiple factors, the liquid waste management market is predicted to experience significant growth in the forest period. The American Society of Civil Engineers (ASCE) 2017 Infrastructure Report estimates that around 56 million people will be connected to centralized treatment plants by 2032, increasing the population served by these plants. This growth will drive the expansion of the market. Additionally, the U.S. Environmental Protection Agency (EPA) reports that a substantial number of sanitary sewers, ranging from 23,000 to 75,000, experience overflow annually across the country. Therefore, there's an urgent need to upgrade existing treatment facilities or construct new ones to accommodate the rising number of users connecting to centralized treatment systems. It is estimated that approximately 532 new treatment facilities will need to be built to meet the growing demand for wastewater treatment. These developments highlight the importance of liquid waste management and the market's potential for growth.

The increasing population, growing number of new housing projects, and expanding centralized wastewater treatment systems are expected to drive the demand for secondary wastewater treatment equipment in the coming years. These factors, combined with a favorable government stance towards funding wastewater treatment plants, are anticipated to impact the market for secondary wastewater treatment equipment positively. The Clean Water State Revolving Fund (CWSRF) program exemplifies such government support. Established in 1987 as a partnership between the U.S. Environmental Protection Agency (EPA) and the states, it provides funding for wastewater infrastructure projects.

Report Segmentation

The market is primarily segmented based on source, industry, service, and region.

|

By Source |

By Industry |

By Service |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source

Residential segment held the significant market share in 2022

The residential segment held a significant market share. The residential sector utilizes water for various applications, and with the rapid growth of the population, the demand for water in these applications is increasing. As a result, there is a substantial rise in the amount of wastewater generated per capita, driving the demand for liquid waste management services in this sector. In the United States, there is a growing awareness regarding the proper disposal of waste to safeguard animal and human health. This has led to the development of various disposal methods and techniques. Significant quantities of hazardous compounds, including salts and metals, in the waste necessitate timely disposal or recycling by waste management companies to mitigate environmental risks.

The commercial segment is expected to witness a steady growth rate. The commercial sector is experiencing notable growth due to advancements in medical facilities and the high demand within the hospitality industry. This growth contributes to increased emissions of liquid waste, primarily wastewater, which is expected to drive liquid waste generation in the coming years. Moreover, the rising water demand for various activities in commercial establishments like hotels and hospitals is anticipated to increase wastewater production further, consequently boosting the demand for liquid waste management services.

By Industry

Oil & Gas segment held the significant market share in 2022

The oil & gas segment is expected to register a significant growth rate. Effective liquid waste management is important in this industry due to the high levels of immiscible hydrocarbons in the liquid waste and water discharged from oil and gas operations. Various sources contribute to releasing pollutants into the environment, including pump leakage, corrosion, equipment failures, and industrial accidents. Additionally, regular operational activities can result in the unintentional release of liquid waste into the atmosphere.

By Service

Transportation segment accounted for the largest market share in 2022

The transportation segment accounted for the largest market share. It contains hazardous materials, requiring specific precautions during handling and collection. Disposal of hazardous waste in landfills is not permissible. Liquid waste collection services involve waste segregation, loading and unloading of waste, identifying suitable storage areas at a safe distance from the waste source, and ensuring the proper maintenance of the waste.

To ensure the safe transportation of liquid waste, it is necessary to cover the waste materials adequately and ensure they are leak-proof during transit. The transportation of certain types of liquid waste carries a high environmental risk. Industrial and commercial sites transport hazardous liquid waste using specialized vehicles, while non-hazardous liquid waste is typically transported to recycling facilities or permitted sewage system inlets.

Regional Analysis

North America region dominated the global market in 2022

The North America region dominated the global market with a substantial share. This significant market share is attributed to the strong presence and penetration of liquid waste management services in commercial, residential, and industrial sectors. It is driven by stringent environmental regulations and disposal requirements imposed by regulatory bodies. In the United States, for example, the Environmental Protection Agency (EPA) reports that wastewater treatment plants process approximately 34 billion gallons of wastewater each day.

Asia Pacific region is likely to emerge as the fastest-growing region with a healthy CAGR during the projected period. This growth is driven by the increased emphasis of governments on addressing environmental pollution issues caused by rapid economic growth, extensive industrialization, and a large population. The rising awareness of environmental concerns and the need for sustainable waste management practices in the region will contribute to the region's expansion.

Competitive Insight

The Liquid Waste Management market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- Veolia

- Waste Management Solutions

- Clean Harbors

- Clean Water Environmental

- Liquid Environmental Solutions

- DC Water

- Covanta Holding

- Stericycle

- U.S. Ecology

- Republic Services

- Hazardous Waste Experts.

Recent Developments

- In March 2023, Veolia made a significant commitment of USD 1.5 billion in annual investments in technology, infrastructure, innovation, and research for water and sanitation initiatives. This commitment aims to support and advance 13 United Nations Sustainable Development Goals (UNSDGs) related to water and sanitation across 52 countries worldwide.

Liquid Waste Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 99.16 billion |

|

Revenue forecast in 2032 |

USD 131.64 billion |

|

CAGR |

3.60% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Source, By Industry, By Service, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global liquid waste management market size is expected to reach USD 131.64 billion by 2032.

Key players in the liquid waste management market are Veolia, Waste Management Solutions, Clean Harbors, Clean Water Environmental, Liquid Environmental Solutions.

North America contribute notably towards the global liquid waste management market.

The global liquid waste management market is expected to grow at a CAGR of 3.6%during the forecast period.

The liquid waste management market report covering key segments are source, industry, service, and region.