Liquid Dietary Supplements Market Size, Share, Trends, Industry Analysis Report: By Ingredient Type (Vitamins & Minerals, Proteins & Amino Acids, Omega Fatty Acids, Probiotics & Prebiotics, and Others); Type; Application; Distribution Channel; End User; and Region – Market Forecast, 2025-2034

- Published Date:Dec-2024

- Pages: 120

- Format: PDF

- Report ID: PM4982

- Base Year: 2024

- Historical Data: 2020-2023

Liquid Dietary Supplements Market Overview

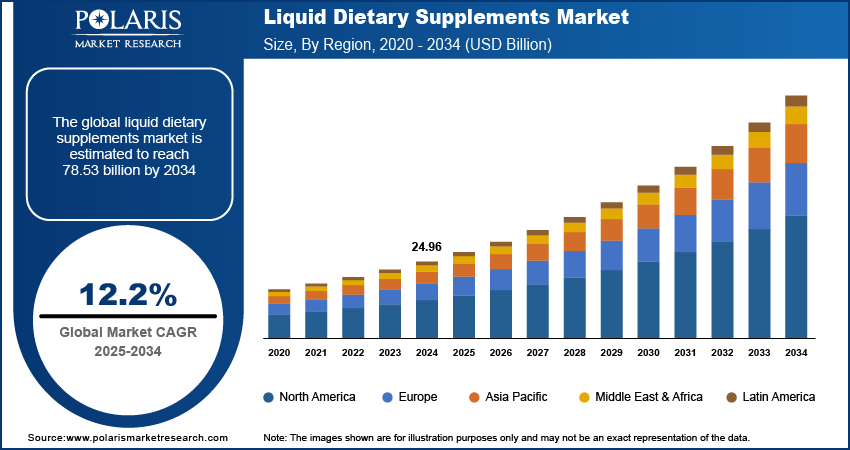

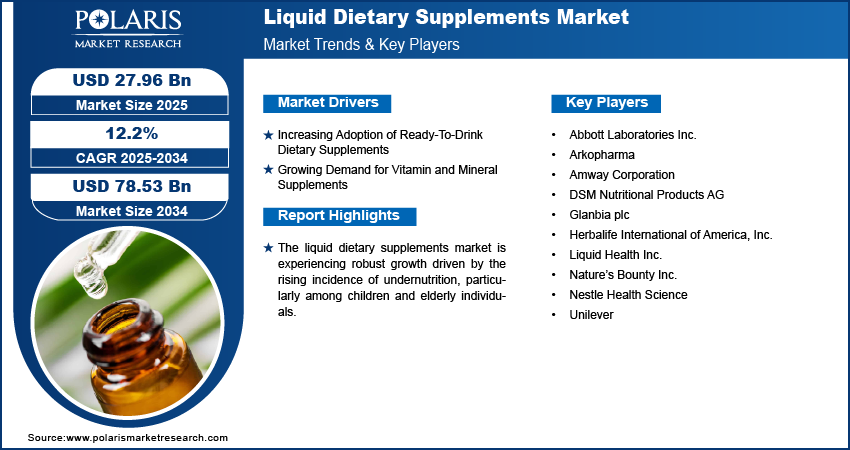

The global liquid dietary supplements market size was valued at USD 24.96 billion in 2024. The market is projected to grow from USD 27.96 billion in 2025 to USD 78.53 billion by 2034, exhibiting a CAGR of 12.2% during the forecast period.

The liquid dietary supplements market is experiencing robust growth driven by the rising incidence of undernutrition, particularly among children and elderly individuals. Specialized liquid dietary supplements enriched with extra calories or protein are readily accessible to meet the unique nutritional requirements of individuals. For instance, in August 2023, Abbott updated its popular Ensure product line, introducing options with higher calorie content and customized nutrient blends for older adults susceptible to undernutrition. This addressed the dietary needs of the expanding geriatric population.

The rising consumption of botanical supplements such as mangosteen, noni, and acai is likely to boost the popularity of liquid dietary supplements, shaping market trends positively. As botanical drinks become more popular, the demand for liquid dietary supplements rises, reflecting changing consumer preferences.

To Understand More About this Research: Request a Free Sample Report

People suffering from conditions such as cancer, unconsciousness, paralysis, and other illnesses may struggle with food intake. Liquid dietary supplements offer a simple way to provide essential nutrients, aiding in their recovery. This is one of the factors that drives the growth of the market. For instance, Danone launched an enteral formula enriched with immune-boosting micronutrients such as vitamin C and zinc, catering to patients with weakened immune systems, such as those recovering from surgery or chronic illness.

Liquid Dietary Supplements Market Drivers Analysis

Increasing Adoption of Ready-To-Drink Dietary Supplements

Market CAGR for liquid dietary supplements is being driven by the rise of ready-to-drink (RTD) dietary supplements. These drinks are gaining popularity globally, especially in developing countries such as China and India, where health consciousness is on the rise as they offer convenience, portability, and high nutritional value. This trend is set to make the liquid dietary supplements market highly profitable. For instance, in April 2023, Yakult, a leading probiotic manufacturer, broadened its product range to include ready-to-drink (RTD) options customized with flavors and ingredients for the Chinese market.

The rising health consciousness among consumers is fueling the demand for liquid dietary supplements. These products are perceived as a convenient way to achieve specific health goals such as weight management, enhanced energy levels, or improved immunity. The market is witnessing innovation in formulations, flavors, and packaging designs to attract a broader consumer base. As a result, the liquid dietary supplements market is poised for continued expansion as companies innovate to meet evolving consumer demands for health-focused, convenient nutritional solutions.

Growing Demand for Vitamin and Mineral Supplements

The liquid dietary supplements market is experiencing significant growth, driven by the increasing demand for vitamin and mineral-based supplements. This trend is fueled by various factors, including the growing vegan population’s need for vitamin B12 and athletes’ adoption of supplements like magnesium for enhanced performance. Additionally, heightened awareness of immune system health is boosting the liquid dietary supplements market. For instance, in November 2022, The Vegan Society, the UK’s top vegan charity, launched VEG 1 Baby and Toddler, a liquid multivitamin customized for vegan infants and young children.

The customization and formulation flexibility offered by liquid supplements allow manufacturers to cater to specific health concerns and preferences, further driving liquid dietary supplements market revenue.

Liquid Dietary Supplements Market Segment Analysis

Liquid Dietary Supplement Market Assessment by Ingredient

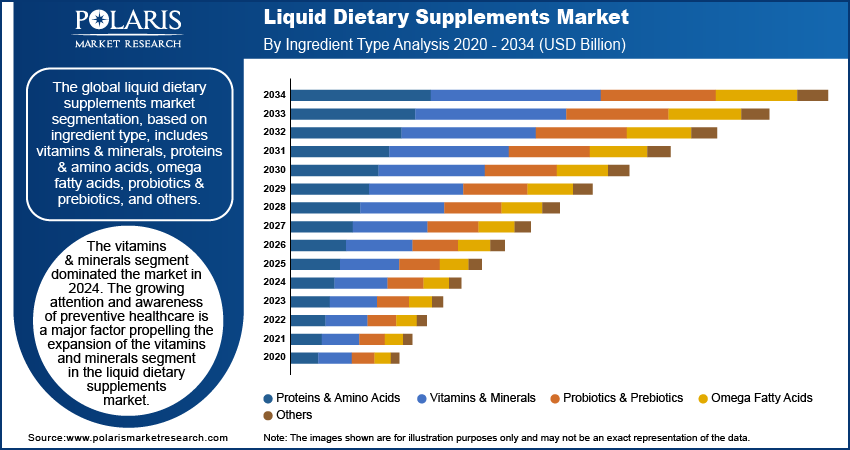

The global liquid dietary supplements market segmentation, based on ingredient type, includes vitamins & minerals, proteins & amino acids, omega fatty acids, probiotics & prebiotics, and others. The vitamins & minerals segment dominated the market. The growing attention and awareness of preventive healthcare is a major factor propelling the expansion of the vitamins and minerals segment in the liquid dietary supplements market. According to the US Department of Health & Human Services, the prevalence and impact of chronic diseases in the US underscore the significant economic burden and increasing healthcare challenges, affecting an estimated 129 million Americans with at least one major chronic condition, driving 90% of the $4.1 trillion annual healthcare expenditure.

There is an increasing need for supplements that can easily supply vital vitamins and minerals in liquid form as consumers become more proactive about preserving their health and avoiding nutritional deficits. For those seeking effective nutrient absorption, liquid supplements are preferred due to their quicker absorption rates as compared to traditional tablet forms.

Liquid Dietary Supplement Market Breakdown by Application Insights

The global liquid dietary supplements market segmentation, based on application, includes energy & weight management, sports nutrition, bone & joint health, cardiac health, and others. The energy & weight management segment accounted for the largest share, which is majorly driven by rising global obesity rates and increased consumer awareness of health issues. As obesity becomes a more pressing concern worldwide, there is a growing demand for effective weight management solutions.

According to the World Health Organization, in 2022, global statistics showed significant increases in obesity and overweight rates: 2.5 billion adults were overweight, including 890 million living with obesity, while 37 million children under 5 were overweight, and 390 million aged 5-19 were overweight, with 160 million living with obesity. These concerns in consumers are increasingly turning to liquid dietary supplements as convenient and effective options to support their weight control efforts.

Liquid Dietary Supplement Market Breakdown by Regional Insights

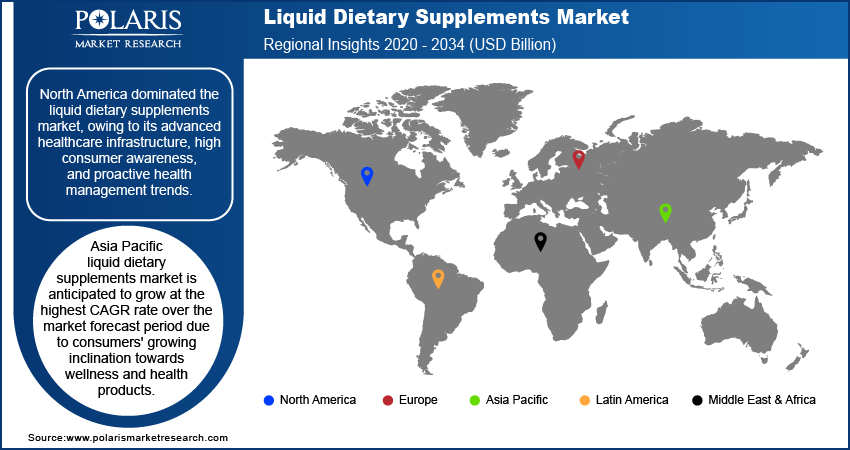

By region, the study provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the liquid dietary supplements market, owing to its advanced healthcare infrastructure, high consumer awareness, and proactive health management trends. The region's dominance is further fueled by the increasing incidence of chronic diseases such as diabetes and cancer, which are prevalent due to modern lifestyle factors such as sedentary living and dietary habits. According to the International Diabetes Federation, Diabetes affects 10.5% of adults globally, with projections indicating a 46% increase by 2045. Type 2 diabetes predominates due to urbanization, aging populations, sedentary lifestyles, and rising obesity rates, but preventive measures and early intervention can mitigate its impact and complications.

Consumers in North America increasingly turn to liquid dietary supplements for their convenience and perceived benefits in managing these health concerns, contributing to the market's robust growth.

Asia Pacific liquid dietary supplements market is anticipated to grow at the highest CAGR rate over the market forecast period due to consumers' growing inclination towards wellness and health products. Convenient health solutions are in greater demand due to growing middle-class awareness, increased disposable incomes, and urbanization. The hectic lifestyles that are common in cities are appealed to by liquid supplements, which are well-known for their simplicity of use and apparent effectiveness.

Liquid Dietary Supplements Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their product lines, which will help the liquid dietary supplements market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the liquid dietary supplements market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global liquid dietary supplements industry to benefit clients and increase the market sector. In recent years, the liquid dietary supplements market has offered some technological advancements. Major players in the market includes Abbott Laboratories Inc.; Amway Corporation; BASF SE; DSM Nutritional Products AG; Glanbia plc; Herbalife International of America, Inc.; Liquid Health Inc.; Nestle Health Science; and Unilever.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. In July 2022, BASF strengthened its Nutrition & Health division's role as a leading ingredients partner in the nutrition, flavor, and fragrance industries through strategic integration and expansions in vitamins, carotenoids, feed enzymes, and aroma ingredients.

Abbott develops, produces, and markets a wide and diverse range of medical products. It functions through the following divisions, including pharmaceutical, diagnostic, pharmaceutical, and medical device products. Pharmaceutical products include branded generic pharmaceutical medicines. The Nutritional Products section serves the global sales of adult and pediatric nutritional products. Additionally, Abbott's nutrition business develops specialized products for infants, children, and adults. In January 2024, Abbott launched the PROTALITY brand, offering high-protein nutrition shakes to support adults in their weight loss journey while preserving muscle mass and ensuring good nutrition.

Key Companies in Liquid Dietary Supplements Market

- Abbott Laboratories Inc.

- Arkopharma

- Amway Corporation

- DSM Nutritional Products AG

- Glanbia plc

- Herbalife International of America, Inc.

- Liquid Health Inc.

- Nature’s Bounty Inc.

- Nestle Health Science

- Unilever

Liquid Dietary Supplements Industry Developments

November 2023: Abbott launched the new PediaSure with the Nutri-Pull system, combining vitamin K2, vitamin D, vitamin C, and casein phosphopeptides to support children's growth and development through enhanced nutrient absorption.

May 2023: Childlife Essentials introduced an organic liquid elderberry supplement for kids’ immune health, designed to enhance overall wellness with its potent formula.

May 2022: Vantage Nutrition acquired AquaCap, a Philadelphia-based company specializing in liquid-filled dietary supplement capsules.

Liquid Dietary Supplements Market Segmentation

By Ingredient Type Outlook (Revenue - USD Billion, 2020-2034)

- Vitamins & Minerals

- Proteins & Amino Acids

- Omega Fatty Acids

- Probiotics & Prebiotics

- Others

By Type Outlook (Revenue - USD Billion, 2020-2034)

- OTC

- Prescribed

By Application Outlook (Revenue - USD Billion, 2020-2034)

- Energy & Weight Management

- Sports Nutrition

- Bone & Joint Health

- Cardiac Health

- Anti-aging

- Others

By Distribution Channel Outlook (Revenue - USD Billion, 2020-2034)

- Offline

- Online

By End User Outlook (Revenue - USD Billion, 2020-2034)

- Adults

- Geriatric

- Children

- Infants

By Regional Outlook (Revenue - USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Liquid Dietary Supplements Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 24.96 billion |

|

Market Size Value in 2025 |

USD 27.96 billion |

|

Revenue Forecast in 2034 |

USD 78.53 billion |

|

CAGR |

12.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global liquid dietary supplements market size was valued at USD 24.96 billion in 2024 and is projected to be valued at USD 78.53 billion in 2034

The global market exhibits a CAGR of 12.2% during the forecast period 2025-2034.

North America had the largest share of the global market

The key players in the market are Abbott Laboratories Inc.; Amway Corporation; BASF SE; DSM Nutritional Products AG; Glanbia plc; Herbalife International of America, Inc.; Liquid Health Inc.; Nestle Health Science; and Unilever.

The vitamins & minerals category dominated the market in 2024.

Energy & weight management had the largest share of the global market.