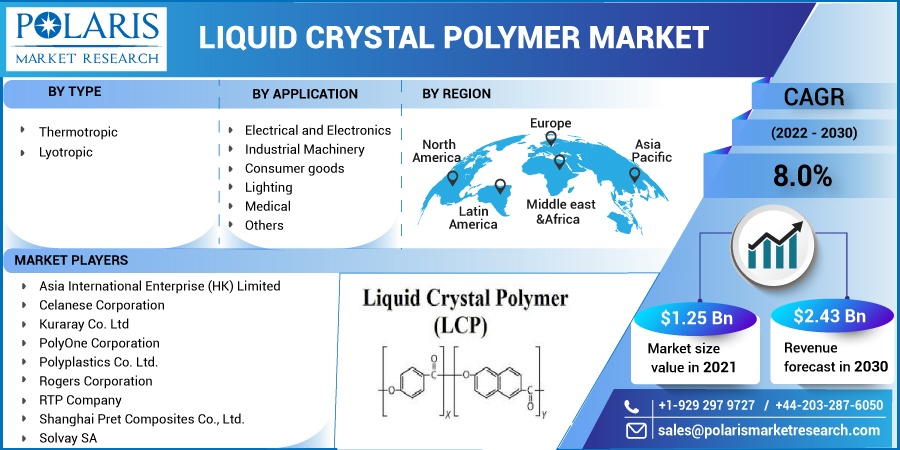

Liquid Crystal Polymer Market Share, Size, Trends, Industry Analysis Report, By Type (Thermotropic, Lyotropic), By Application (Electrical and Electronics, Industrial Machinery, Consumer goods, Lighting, Medical, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 115

- Format: PDF

- Report ID: PM2267

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

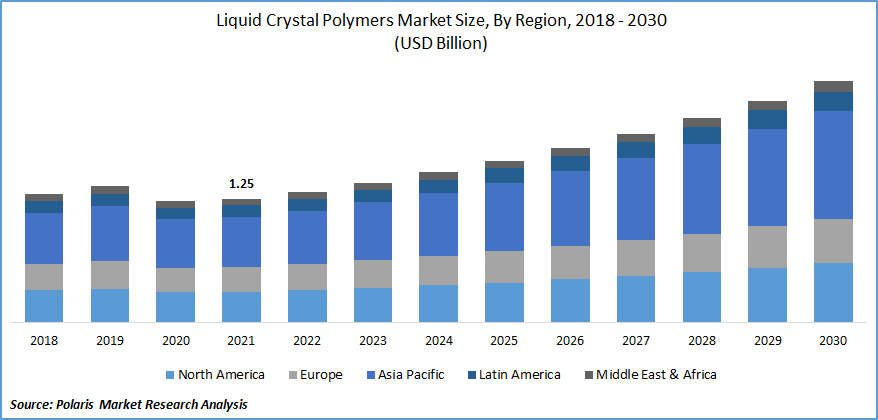

The global liquid crystal polymer market was valued at USD 1.25 billion in 2021 and is expected to grow at a CAGR of 8.0% during the forecast period. The rising demand for LPC (Liquid Crystal Polymer) from various end-user industries such as electronics & electrical, automotive, medical, and others are anticipated to drive the liquid crystal polymer market's growth globally. This growing demand can be attributed to the benefits offered by the material.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Furthermore, the emerging industry for thermoplastic polymers is anticipated to offer substantial growth opportunities to the industry globally. LCP's are the key thermoplastics used for high-temperature applications across various end-user industries. On account of their properties, such as high-temperature resistance, excellent chemical resistance, and higher weight to strength ratio, among others, these are gaining prominence as a substitute to traditional materials. Thus, the emerging applications of LCP's are further anticipated to enhance industry growth prospects. Moreover, the rising number of developments by key market players is projected to drive the liquid crystal polymer market globally.

The COVID-19 pandemic has had a negative impact on the liquid crystal polymer market. The pandemic spread has led the manufacturing & industrial segments into an unknown operating situation globally. Further, the imposition of lockdowns across nations has severely impacted the liquid crystal polymer industry. For instance, the production across various end-user industries of liquid crystal such as automotive, electrical & electronics, and others have almost come to a halt.

Further, the supply chain disruptions globally are having a significant impact on the production output. This additionally led to the increase in prices of LCP globally. For instance, in August 2021, Sumitomo Chemical increased the price of its LCP due to the rising logistics and raw material costs. Accordingly, this scenario causes slow economic recovery that may result in the slow recovery of aftermarket demand, and it may take years to get to 2019 levels. However, liquid crystal polymer industry players are taking several steps to boost their business strategy and come out stronger from the crisis. Hence, these tactical movements by the liquid crystal polymer industry vendors may augment the liquid crystal polymer industry growth over the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The increasing demand for miniaturization of electronic & electrical components globally is anticipated to drive the liquid crystal polymer demand. With the miniaturization trend, manufacturers are producing devices packed with more features in a smaller package. The benefits offered by LCP, such as excellent stiffness, flow, mechanical strength, chemical resistance, dimensional stability, and temperature resistance, make them a suitable material for the rising trend of miniaturization across the electronics & electrical industry.

For the same benefits, LCP's are injection molded into IC sockets, HF network switches, power modules for solar &wind converters & inverters, and custom electrical connectors, among other precision devices. Thus, the increasing acceptance of microinjection molding is anticipated to drive the liquid crystal polymer industry growth. The growing demand for connectors with high pin density is anticipated to drive the demand for LCP. Further, the increasing demand for lightweight and high-performance materials from the automotive industry to produce fuel-efficient vehicles is projected to present huge market growth opportunities.

Report Segmentation

The market is primarily segmented on the basis of type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Application

The electrical and electronics segment garnered the largest revenue share in the global liquid crystal polymer industry in 2021 due to the rising demand for LCP from the growing electrical & electronics industry globally. The increasing demand for miniaturization across the electronics industry is further anticipated to drive the segment growth. The benefits offered by LCP include thin-wall flowability, unique processability, and excellent dimensional stability, among others, making them suitable for the ongoing miniaturization trend. Further, the overall growth of the electrical & electronics industry globally is anticipated to offer substantial growth opportunities to the segment.

However, the medical segment of the market is anticipated to witness a progressive CAGR in the overall liquid crystal polymer industry. This growth of the segment can be attributed to the expanding applications of LCP’s across the medical sector. With manufacturers trying out new materials for better medical devices and equipment, LCP is a suitable substitute for traditional plastics and metals. Generally, in medical applications, LCP replaces stainless steel. Their use in medical equipment & devices is supported by their resistance to gamma radiation, chemical sterilization methods, and steam autoclaving.

Geographic Overview

Geographically, Asia Pacific accounted for the highest shares in the global liquid crystal polymer industry in 2021 and is expected to dominate the liquid crystal polymer industry over the projected period. The considerable share of the market in the region can be attributed to the rising demand from end-user industries across the developing nations, including India, China, and Japan, among others. China is one of the largest electronics producers globally and offers tough competition to the existing giants in the industry.

On account of the rising disposable incomes, the demand for electronic products is increasing, further estimated to boost the demand for the market. Thus, the increasing domestic demand and affordable manufacturing facilities are anticipated to drive the market. Moreover, the huge growth of the automotive industry and the 3D printing sector in these countries is projected to provide huge growth opportunities to the market. The LCP can be used as a substitute for the feedstocks in the 3D printing sector.

Moreover, North America is expected to witness progressive growth over the forecast years. The rising initiatives for new products and technologies are anticipated to drive the development of the market. The region is an early adopter of innovative technologies such as 5G and 3D printing. The adoption of these next-generation innovative technologies is estimated to provide tremendous market growth opportunities. Further, the growth of the automobile industry along with the rising demand for high-performance, lightweight materials in the automobile industry of the region is anticipated to drive the demand for LCP in the region.

Competitive Insight

Some of the major players operating in the global liquid crystal polymer market include Asia International Enterprise (HK) Limited, Celanese Corporation, Kuraray Co. Ltd, PolyOne Corporation, Polyplastics Co. Ltd., Rogers Corporation, RTP Company, Shanghai Pret Composites Co., Ltd., Solvay SA, Sumitomo Chemicals Co. Ltd., Toray Industries, Inc., and Ueno Fine Chemicals Industry Limited.

Liquid Crystal Polymer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.25 billion |

|

Revenue forecast in 2030 |

USD 2.43 billion |

|

CAGR |

8.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical datas |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Asia International Enterprise (HK) Limited, Celanese Corporation, Kuraray Co. Ltd, PolyOne Corporation, Polyplastics Co. Ltd., Rogers Corporation, RTP Company, Shanghai Pret Composites Co., Ltd., Solvay SA, Sumitomo Chemicals Co. Ltd., Toray Industries, Inc., and Ueno Fine Chemicals Industry Limited. |