Liposomal Doxorubicin Market Size, Share, Trends, Industry Analysis Report: By Drug Formulation (Lyophilized Powder and Doxorubicin Injection), Product (Doxil, Lipodox, Myocet, and Others), Type (Anthracycline Antibiotic and Others), Route of Administration (Parenteral and Others), Application (Bladder Cancer, Kaposi Sarcoma, Leukemia, Lymphoma, Breast Cancer, and Others), End User (Hospitals, Homecare, Specialty Centers, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 118

- Format: PDF

- Report ID: PM5275

- Base Year: 2024

- Historical Data: 2020-2023

Liposomal Doxorubicin Market Overview

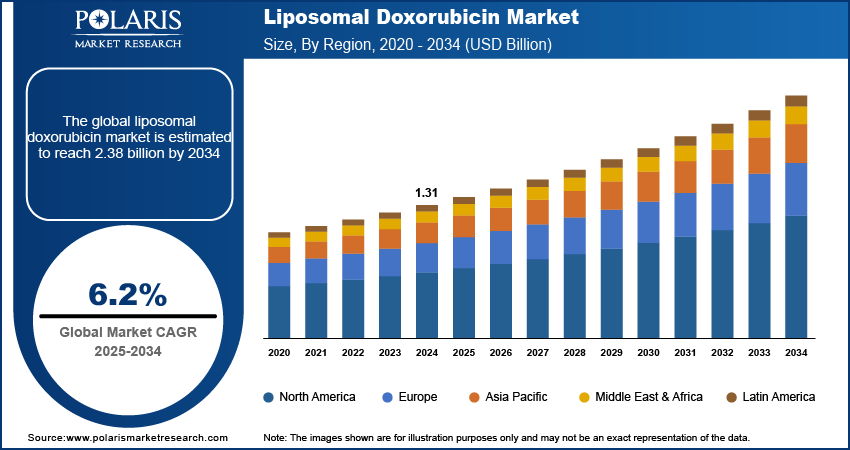

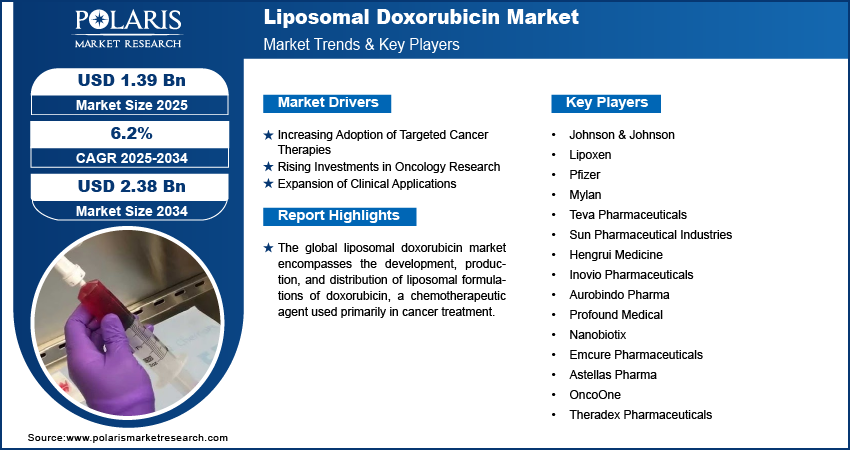

The global liposomal doxorubicin market size was valued at USD 1.31 billion in 2024. The market is projected to grow from USD 1.39 billion in 2025 to USD 2.38 billion by 2034, exhibiting a CAGR of 6.2 % during 2025–2034.

The global liposomal doxorubicin market encompasses the development, production, and distribution of liposomal formulations of doxorubicin, a chemotherapeutic agent used primarily in cancer treatment. Liposomal doxorubicin is designed to enhance the drug's efficacy and reduce its side effects by encapsulating the drug in lipid-based vesicles.

The increasing prevalence of cancer worldwide, ongoing advancements in drug delivery systems, and the growing adoption of targeted therapies drive the market growth. Additionally, trends such as rising investments in oncology research and development and the introduction of new liposomal formulations are expected to propel the market growth during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Liposomal Doxorubicin Market Drivers and Trends Analysis

Increasing Adoption of Targeted Cancer Therapies

Targeted cancer therapies aim to specifically target cancer cells while sparing healthy cells, which aligns with the benefits of liposomal doxorubicin in reducing systemic toxicity. According to a study published in Cancer Research, liposomal formulations improve the drug's concentration in tumor tissues by up to 3.5 times compared to conventional doxorubicin, enhancing therapeutic efficacy. As more healthcare providers shift toward personalized medicine, the demand for liposomal doxorubicin is expected to rise, reflecting the broader trend of customized cancer treatment strategies. Therefore, the adoption of targeted cancer therapies is significantly driving the growth of the liposomal doxorubicin market.

Rising Investments in Oncology Research

Governments, private companies, and research institutions are investing heavily in developing advanced drug delivery systems to improve cancer treatments. The National Cancer Institute reported a 12% increase in funding for cancer research in 2024, focusing on innovative drug delivery methods such as liposomal formulations. This growing financial commitment supports the development of new liposomal doxorubicin products and enhances ongoing research efforts to optimize its use in clinical settings. Hence, the increased investment in oncology research is expected to become another major future trend propelling the liposomal doxorubicin market.

Expansion of Clinical Applications

Originally approved for treating breast cancer, liposomal doxorubicin is now being explored for a variety of cancers, including ovarian, Kaposi's sarcoma, and multiple myeloma. Clinical trials have demonstrated its effectiveness in treating these cancers with reduced side effects compared to traditional doxorubicin. A clinical trial published in the Journal of Clinical Oncology in 2023 highlighted that liposomal doxorubicin showed a 20% increase in response rates for ovarian cancer patients compared to standard treatment regimens/ This broadening application base is contributing to the growing demand for liposomal doxorubicin in oncology. Thus, the expansion of clinical applications of liposomal doxorubicin is a significant future trend driving market growth.

Liposomal Doxorubicin Market Segment Analysis

Liposomal Doxorubicin Market Breakdown by Drug Formulation

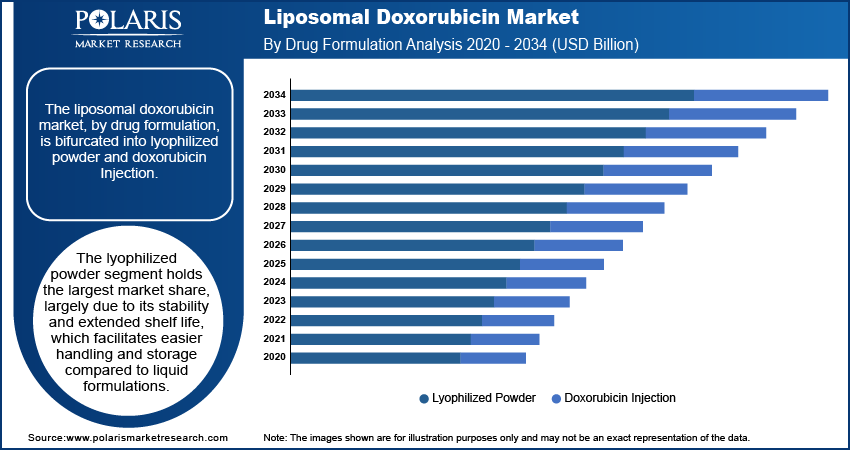

The liposomal doxorubicin market, by drug formulation, is bifurcated into lyophilized powder and doxorubicin Injection. The lyophilized powder segment holds the largest market share, largely due to its stability and extended shelf life, which facilitates easier handling and storage compared to liquid formulations. This form is particularly advantageous in clinical settings where stability and long-term storage are critical. Additionally, the lyophilized powder segment is experiencing significant growth driven by advancements in freeze-drying technologies and increased demand for durable drug formulations that reduce the need for refrigeration.

The doxorubicin injection segment is registering the highest growth rate, attributed to its ready-to-use nature and ease of administration. This formulation allows for immediate preparation and administration, which is crucial for patients requiring rapid treatment. The growth in this segment is also supported by the rising preference for intravenous therapies in oncology due to their effectiveness in delivering medication directly into the bloodstream. As the focus on enhancing patient convenience and reducing preparation time intensifies, the doxorubicin injection segment is expected to continue its robust growth trajectory in the coming years.

Liposomal Doxorubicin Market Breakdown Assessment by Product

The liposomal doxorubicin market, by product, is segmented into doxil, lipodox, myocet, and others. The Doxil segment leads the market by holding the largest market share due to its established reputation and extensive clinical use since its introduction. This product's prominence is reinforced by its approval for treating various cancers, including breast cancer and Kaposi's sarcoma, which has solidified its position as a preferred option in oncology treatments. The extensive clinical history and broad acceptance of Doxil contribute to its dominant market presence.

The Myocet segment is registering the highest growth rate in the market. Myocet, marketed as a non-pegylated liposomal formulation, is gaining traction due to its comparative advantages in certain clinical settings. Its effectiveness in treating breast cancer with potentially fewer side effects than Doxil is driving its adoption. The ongoing research and emerging clinical data supporting Myocet’s efficacy contribute to its rapid growth, reflecting the market's shifting preferences toward newer formulations with distinct therapeutic benefits.

Liposomal Doxorubicin Market Breakdown Evaluation by Type

The global liposomal doxorubicin market, based on product, is bifurcated into anthracycline antibiotic and others. The anthracycline antibiotic segment dominates the market, holding a larger share due to the established clinical efficacy of doxorubicin as an anthracycline in treating various cancers. Its long-standing use and robust therapeutic profile have made it a cornerstone in oncology, reinforcing its substantial market presence. The high demand for anthracycline antibiotics is driven by their proven effectiveness and the extensive clinical experience supporting their use in cancer treatments.

The others segment is registering a higher growth rate, largely due to the increasing exploration of alternative and novel therapeutic agents beyond traditional anthracyclines. This segment includes various new formulations and drug classes that are being developed to address limitations associated with conventional therapies. As research advances and new treatments are introduced, the growth of the others segment reflects the dynamic nature of cancer therapy development, with ongoing innovations seeking to offer improved efficacy and reduced side effects.

Liposomal Doxorubicin Market Breakdown by Route of Administration Insights

The global liposomal doxorubicin market, by the route of administration, is bifurcated into parenteral and others. The parenteral segment, which includes intravenous injections, holds a larger market share as it directly delivers into the bloodstream, ensuring immediate therapeutic effects. This method is widely preferred in oncology for its efficacy in managing cancer patients, where precise and controlled drug delivery is crucial. The dominance of the parenteral route is attributed to its established use in clinical practices and the preference for intravenous administration in cancer treatments.

The others segment is experiencing a higher growth rate, driven by ongoing research on alternative delivery methods. This includes innovations aimed at improving patient convenience and expanding the potential applications of liposomal doxorubicin. Developments in alternative administration routes, such as oral or local delivery systems, are gaining traction as they offer potential advantages in terms of ease of use and patient adherence. As new delivery technologies emerge and receive clinical validation, the others segment is anticipated to grow rapidly, reflecting the evolving landscape of drug administration strategies.

Liposomal Doxorubicin Market Breakdown by Application Insights

The global liposomal doxorubicin market, based on application, is segmented into bladder cancer, Kaposi sarcoma, leukemia, lymphoma, breast cancer, and others. The breast cancer segment holds the largest market share, driven by the widespread use of liposomal doxorubicin in treating this cancer. The effectiveness of liposomal doxorubicin in targeting tumor cells while minimizing systemic side effects has made it a preferred choice in breast cancer therapies. The extensive clinical evidence supporting its use and the high prevalence of breast cancer contribute to its dominant market position.

The lymphoma segment is experiencing the highest growth rate, fueled by increasing clinical trials and research demonstrating the efficacy of liposomal doxorubicin in treating various types of lymphoma. Recent advancements and positive trial outcomes have expanded its use in lymphoma therapies, leading to a rapid rise in demand. As new treatment protocols and combination therapies are developed, the growth in the lymphoma segment reflects the dynamic advancements in oncology and the increasing focus on optimizing treatment options for different cancer types.

Liposomal Doxorubicin Market Breakdown by End User Insights

The global liposomal doxorubicin market, based on end user, is segmented into hospitals, homecare, specialty centers, and others. The hospitals segment holds the largest market share, primarily due to their central role in administering complex cancer treatments. Hospitals are equipped with the necessary infrastructure and medical expertise to handle intravenous administrations of liposomal doxorubicin, making them the primary setting for its use. The extensive use of liposomal doxorubicin in hospital settings, supported by its established protocols and comprehensive patient care services, contributes to the dominant market position of the segment.

The homecare segment is registering the highest growth rate, driven by the increasing demand for at-home cancer care solutions and advancements in drug administration technologies. Patients and healthcare providers are seeking alternatives to hospital-based treatments for greater convenience and reduced exposure to healthcare settings. Innovations that allow for safe and effective at-home administration of liposomal doxorubicin are supporting this segment growth. The rise in homecare services reflects broader trends toward personalized and flexible treatment options, with ongoing developments enhancing the feasibility and safety of administering complex therapies outside traditional clinical environments.

Liposomal Doxorubicin Market Breakdown by Regional Insights

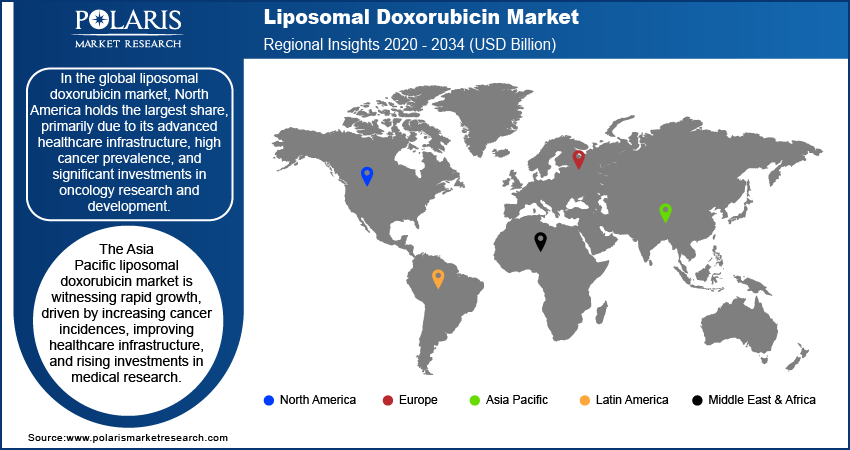

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In the global liposomal doxorubicin market, North America holds the largest share, primarily due to its advanced healthcare infrastructure, high cancer prevalence, and significant investments in oncology research and development. The region benefits from a well-established network of hospitals and specialty centers equipped to administer complex therapies such as liposomal doxorubicin. Additionally, North America's strong regulatory framework and high adoption of innovative cancer treatments contribute to its dominant market position. The presence of major pharmaceutical companies and ongoing clinical trials further boost North America's leading role in the market.

In Europe, the liposomal doxorubicin market is driven by robust healthcare systems, significant investments in cancer research, and a high prevalence of cancer cases. The region benefits from advanced medical facilities and a strong regulatory environment that supports the adoption of innovative treatments. Key markets include Western European countries such as Germany, France, and the UK, which have well-established oncology departments and extensive use of liposomal formulations in cancer care. Additionally, Europe’s collaborative research efforts and clinical trials contribute to the market growth by facilitating the development and approval of new liposomal doxorubicin products.

The Asia Pacific liposomal doxorubicin market is witnessing rapid growth, driven by increasing cancer incidences, improving healthcare infrastructure, and rising investments in medical research. Countries such as China and India are experiencing significant market expansion due to their large patient populations and growing focus on enhancing cancer treatment accessibility. The rising number of specialty cancer centers and advancements in drug delivery technologies in these countries are contributing to the increased adoption of liposomal doxorubicin. Moreover, the expansion of healthcare coverage and government initiatives to improve cancer care support the market growth in Asia Pacific.

Liposomal Doxorubicin Market – Key Players and Competitive Analysis Report

Johnson & Johnson is one of the key players in the liposomal doxorubicin market. It markets Doxil, a well-known formulation of liposomal doxorubicin. Another significant player is Lipoxen, which develops and manufactures liposomal products, including its proprietary formulations. Pfizer, through its acquisition of Mylan, offers a range of oncology products, including liposomal doxorubicin. Additionally, Teva Pharmaceuticals, known for its generic drug portfolio, contributes to the market with liposomal formulations. Sun Pharmaceutical Industries has its liposomal doxorubicin product, and Hengrui Medicine is engaged in developing advanced cancer therapies. Inovio Pharmaceuticals and Aurobindo Pharma are also notable players. Moreover, Profound Medical and Nanobiotix are working on innovative drug delivery systems. Emcure Pharmaceuticals and Astellas Pharma are other key contributors, alongside smaller but active firms such as OncoOne and Theradex Pharmaceuticals.

The competitive landscape of the liposomal doxorubicin market is shaped by several factors. Companies compete on the basis of product efficacy, safety profiles, and advancements in drug delivery technologies. Innovation in formulation and the ability to meet regulatory requirements are crucial for maintaining market presence. Additionally, the market dynamics are influenced by strategic partnerships, research and development activities, and the ability to bring new formulations to market effectively. Companies also focus on differentiating their products through enhanced patient convenience and reduced side effects, which are significant considerations in the oncology sector.

Insights into the market reveal that while established players such as Johnson & Johnson and Pfizer hold substantial market shares due to their established products and extensive distribution networks, emerging companies are gaining traction through innovations and new formulations. The presence of diverse players indicates a competitive market environment where ongoing research and development are key to maintaining and expanding market positions. As the market evolves, companies that can adapt to changing treatment paradigms and leverage technological advancements will likely see continued success.

Johnson & Johnson is a significant player in the liposomal doxorubicin market, primarily known for its product Doxil. Doxil is used to treat various types of cancer, including breast cancer and Kaposi's sarcoma. The company has a strong presence in the market due to its extensive experience and established product portfolio.

Pfizer is another global player in the liposomal doxorubicin market, particularly following its acquisition of Mylan, which included liposomal doxorubicin in its product range. Pfizer's involvement in the market is supported by its wide network and resources, allowing it to distribute and advance its oncology treatments effectively.

Key Companies in the Liposomal Doxorubicin Market

- Johnson & Johnson

- Lipoxen

- Pfizer

- Mylan

- Teva Pharmaceuticals

- Sun Pharmaceutical Industries

- Hengrui Medicine

- Inovio Pharmaceuticals

- Aurobindo Pharma

- Profound Medical

- Nanobiotix

- Emcure Pharmaceuticals

- Astellas Pharma

- OncoOne

- Theradex Pharmaceuticals

Liposomal Doxorubicin Market Developments

- In August 2024, Pfizer reported the initiation of a new clinical study to explore the potential benefits of its liposomal doxorubicin formulations in combination with other cancer therapies, reflecting its commitment to advancing treatment options.

- In July 2024, Johnson & Johnson announced an expansion of its oncology research program, aiming to enhance the effectiveness of its existing cancer treatments, including Doxil, through new clinical trials.

Liposomal Doxorubicin Market Segmentation

By Drug Formulation Outlook (Revenue – USD Billion, 2020–2034)

- Lyophilized Powder

- Doxorubicin Injection

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Doxil

- Lipodox

- Myocet

- Others

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Anthracycline Antibiotic

- Others

By Route of Administration Outlook (Revenue – USD Billion, 2020–2034)

- Parenteral

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Bladder Cancer

- Kaposi Sarcoma

- Leukemia

- Lymphoma

- Breast Cancer

- Others

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Homecare

- Specialty Centers

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Liposomal Doxorubicin Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.31 billion |

|

Market Size Value in 2025 |

USD 1.39 billion |

|

Revenue Forecast in 2034 |

USD 2.38 billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global liposomal doxorubicin market size was valued at USD 1.31 billion in 2024 and is projected to grow to USD 2.38 billion by 2034.

The global market is projected to register a CAGR of 6.2% during 2025–2034

North America accounted for the largest share of the global market.

One of the key players in the liposomal doxorubicin market is Johnson & Johnson, which markets Doxil, a well-known formulation of liposomal doxorubicin. Another significant player is Lipoxen, which develops and manufactures liposomal products, including its proprietary formulations.

The hospitals segment accounted for the largest share of the global market.

The breast cancer segment accounted for the largest share of the global market.