Linseed Oil Market Size, Share, Trends, Industry Analysis Report: By Application Type (Pharmaceuticals, Flooring, Cosmetics, Coating & Paints, Processed Food, and Others), Production Process Type, Form Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 118

- Format: PDF

- Report ID: PM1491

- Base Year: 2024

- Historical Data: 2020-2023

Linseed Oil Market Overview

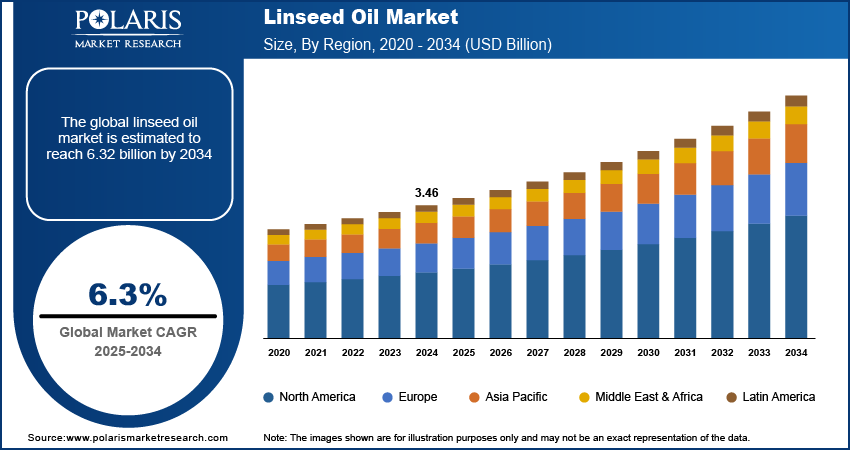

The global linseed oil market size was valued at USD 3.46 billion in 2024. The market is projected to grow from USD 3.65 billion in 2025 to USD 6.32 billion by 2034, at a CAGR of 6.3 % from 2025 to 2034.

Linseed oil, or flaxseed oil, is a versatile oil derived from flax plant seeds. Linseed oil is extracted from flax seeds via a hot, high-pressure steam method. The oil has been used for a long time, initially to treat digestive and skin issues. Paints, coatings, wood preservatives, linoleum, putty, and cosmetics are among the many applications of linseed oil. It is also used as a dietary supplement and in traditional European recipes. Linseed oil is rich in omega-3 fatty acids, including α-linolenic and oleic acid. It is also high in phenolic compounds. Linseed oil is slightly hazardous if it comes into direct contact with skin as it can irritate the respiratory tract and mucous membranes.

To Understand More About this Research: Request a Free Sample Report

Major factors such as an increase in the popularity of natural and organic products, a rise in health concerns, and an upsurge in awareness of the benefits of linseed oil for skin and hair drive the linseed oil market growth. Market growth opportunities arise as the nutraceutical and cosmetic markets expand, as does the growing demand for linseed oil as a green alternative to industrial oils.

Recent linseed oil market opportunities in the linseed oil industry include the development of functional foods and beverages fortified with linseed oil, the implementation of innovative techniques, and the growing acceptance of cold-opened linseed oil due to its health benefits. As people's desire for health and wellness grows, there is a surge in demand for organic and non-genetically modified linseed oil. Furthermore, the prevalence of chronic illnesses is increasing, and there is a greater emphasis on disease prevention through health promotion, both of which would help the market grow.

Linseed Oil Market Dynamics

Rising Demand for Paints & Coatings

Global demand for paints and coatings is expected to rise as the demand for automobiles and consumer goods increases. Urbanization has expanded the construction industry worldwide, increasing demand for oil paints. As linseed oil has a high film-forming capacity, durability, and resistance to moisture and UV radiation, the rising demand for oil paints propels the requirement for linseed oil. The growing demand for sustainable and environmentally friendly products in the construction and automotive industries is driving the demand for linseed-oil-based paints and coatings over traditional synthetic and petroleum-based substitutes. Thus, increasing demand for paints and coatings boosts the linseed oil market development.

Increasing Applications in Pharmaceuticals and Food Products

Linseed oil and its components have a variety of health benefits. The oil is used in medication used for heart health management, constipation and diarrhea relief, weight management, inflammation reduction, rheumatoid arthritis treatment, and cancer treatment. The oil contains high levels of omega-3 fatty acids, which are essential for human health. It contains ALA, which is good for improving fat metabolism and endurance, particularly for athletes and runners. Additionally, the oil is used in traditional medicine and skincare products due to its anti-inflammatory and antioxidant properties. Therefore, the rising applications of linseed oil in pharmaceuticals and food products boost the linseed oil market expansion.

Linseed Oil Market Segment Insights

Linseed Oil Market Outlook by Application Type Insights

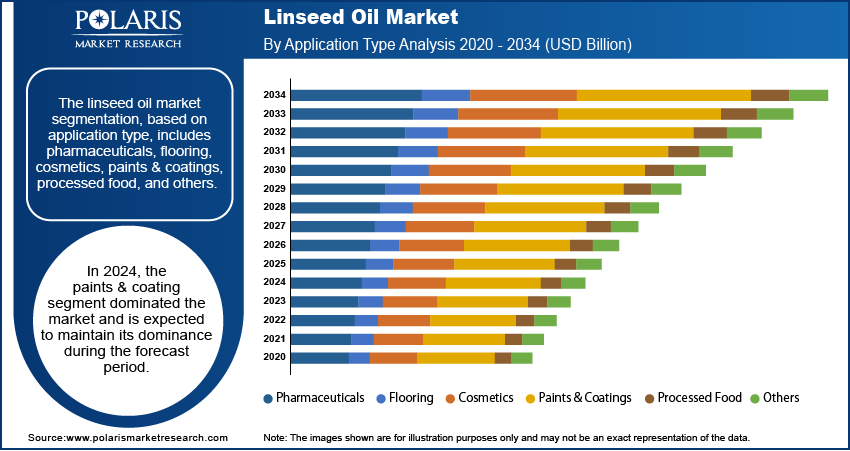

The linseed oil market segmentation, based on application type, includes pharmaceuticals, flooring, cosmetics, paints & coatings, processed food, and others. In 2024, the paints & coatings segment held the largest share of the linseed oil market revenue, and the segment is expected to continue its dominance during the forecast period. The market is expanding due to the rising demand for sustainable and environmentally friendly paints and coatings, as well as increasing construction activities worldwide. Traditional floor coverings made from linseed oil, such as linoleum and oilcloth, are becoming popular due to their strength and visual appeal.

Linseed Oil Market Assessment by Production Process Type Insights

The linseed oil market, based on production process type, is segmented into enzyme extraction, cold-pressing, and solvent extraction. The solvent extraction segment dominates the market. The solvent extraction process extracts oil from linseed using hexane or other solvents. Cold-pressing, a mechanical process that does not use solvents, preserves more nutrients and flavor in the oil while producing a lower yield. Enzyme extraction is a relatively new method that employs enzymes to degrade oil-bearing cells, resulting in higher oil yield and quality. However, it is more expensive than its counterparts.

Linseed Oil Market Regional Analysis

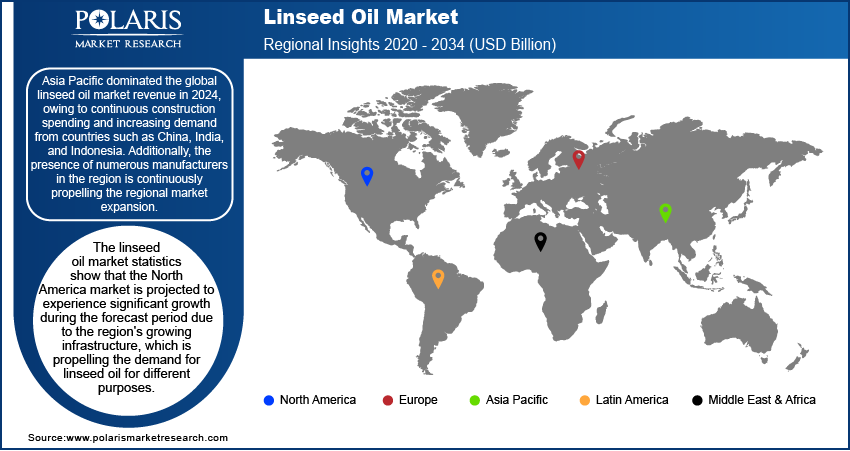

The research report offers linseed oil market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the linseed oil market share in 2024, owing to the continuous construction spending and increasing demand from countries such as China, India, and Indonesia and the presence of numerous manufacturers in the region. Investments in linseed oil production in China are expected to grow rapidly due to rising demand for the product from other countries through imports and exports. China, Russia, Argentina, and Kazakhstan are among the largest producers of linseed or flaxseed.

The linseed oil market statistics show that the market in North America is projected to experience steady and significant growth during the forecast period. The region's growing infrastructure has resulted in a significant increase in demand for wooden products in residential and commercial construction, driving the demand for linseed oil. The diets of most Americans lack adequate amounts of omega-3 fatty acids, which can be obtained by consuming linseed oil as a salad dressing or in a smoothie. Linseed oil contains a high concentration of ALA (alpha-linolenic acid), a precursor to the essential omega-3 fatty acid EPA (eicosapentaenoic acid). These benefits fuel the regional market growth.

Linseed Oil Market – Key Players and Competitive Insights

The companies conduct extensive research and development to create innovative products that improve the quality and quantity of linseed oil. Furthermore, businesses are increasingly pursuing mergers and acquisitions and joint venture strategies to increase their market share, broaden their global reach, and improve their product offerings. A lot of businesses use investment and expansion plans to boost their output and break into emerging markets.

There is fierce competition and a fair amount of market concentration. Natural Factors, Inc.; Cargill, Inc.; Archer Daniels Midland (ADM) Company; Gustav Heess GmbH; Granovita; Natrol LLC; Krishi Oils Limited (KOL); and Henry Lamotte Oils GmbH are among the key market players.

List of Key Companies in Linseed Oil Market

- Natural Factors, Inc.

- Archer Daniels Midland (ADM) Company

- Cargill, Inc.

- Gustav Heess GmbH

- Henry Lamotte Oils GmbH

- Krishi Oils Limited (KOL)

- Barkeans Bioriginal Food and Science Corp.

- Natrol LLC

- Granovita

Linseed Oil Industry Developments

In December 2021, Cargill Inc. and Croda signed a contract. Cargill Inc. contracted to pay USD 1.03 billion for most of its industrial chemicals and performance technology. Giving manufacturers more environmentally friendly ingredient options will benefit Cargill Inc.'s bio-industrial division.

In September 2021, Croda International Plc. reinforced its position in the agrochemical market by opening its Crop Care Product Certification Center in Brazil to aid in product development. This strategic move will contribute to an increase in linseed oil production.

Linseed Oil Market Segmentation

By Application Type Outlook

- Pharmaceuticals

- Flooring

- Cosmetics

- Paints & Coatings

- Processed Food

- Others

By Production Process Type Outlook

- Enzyme Extraction

- Cold-Pressing

- Solvent Extraction

By Form Type Outlook

- Organic

- Refined

- Raw

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Linseed Oil Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.46 billion |

|

Market Size Value in 2025 |

USD 3.65 billion |

|

Revenue Forecast by 2034 |

USD 6.32 billion |

|

CAGR |

6.3 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The linseed oil market is valued at USD 3.46 billion in 2024 and is projected to grow to USD 6.32 billion by 2034.

The linseed oil market is expected to record a CAGR of 6.3% during 2025–2034.

Asia Pacific accounted for the largest market share in 2024.

Natural Factors, Inc.; Cargill, Inc.; Archer Daniels Midland (ADM) Company; Gustav Heess GmbH; Granovita; Natrol LLC; Henry Lamotte Oils GmbH; and Krishi Oils Limited (KOL) are among the key market players.

The solvent extraction segment dominated the linseed oil market revenue in 2024.

The paints and coating segment held the largest share of the market in 2024.