Lightweight Materials Market Size, Share, Trends, Industry Analysis Report: By Product (Aluminum, High Strength Steel, Titanium, Magnesium, Polymers & Composites, and Others); Application; and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM1629

- Base Year: 2023

- Historical Data: 2019-2022

Lightweight Materials Market Overview

The lightweight materials market size was valued at USD 204.24 billion in 2023. The market is projected to grow from USD 221.32 billion in 2024 to USD 426.31 billion by 2032, exhibiting a CAGR of 8.5% during 2024–2032.

Lightweight materials are increasingly important in various industries, particularly in automotive and aerospace applications, where reducing weight leads to significant improvements in fuel efficiency, performance, and sustainability.

The rising adoption of electric vehicles (EVs) to curb hazardous air pollution is estimated to propel the global lightweight materials market. As per data published by the International Energy Agency, almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million. Lightweight materials are vital components of EVs as they enhance the energy efficiency of the vehicle, increasing the range between charges and making the vehicle more practical and attractive to consumers. Therefore, as the demand for EVs increases, the adoption of lightweight materials also spurs.

To Understand More About this Research: Request a Free Sample Report

The market for lightweight materials is driven by the growing advancement in technology. Technologies such as 3D printing (additive manufacturing), nanotechnology, and automated composite manufacturing have evolved, making it easier and more cost-effective to produce and utilize lightweight materials. Additionally, significant progress in material science is producing new and improved lightweight materials with enhanced properties, such as increased strength-to-weight ratios, thermal stability, corrosion resistance, and durability. This increases the demand for these advanced and effective lightweight materials.

Lightweight Materials Market Drivers Analysis

Rising Government Investment in Renewable Energy Projects

The rising government investment in renewable energy projects is expected to drive the global lightweight materials market. Government investment in wind energy projects is fueling demand for more efficient, durable, and high-performing wind turbines. Lightweight materials, particularly composites like carbon fiber and fiberglass, are used in turbine blades to reduce weight while allowing higher energy generation, helping meet ambitious renewable energy targets. For instance, the total investment in wind energy projects in India was expected to be around ₹74,000 crores in 2023.

Growing Demand for Aircraft

The growing demand for aircraft is estimated to expand the global lightweight materials market. Lightweight materials are widely used in aircraft manufacturing to improve fuel efficiency, as fuel accounts for a large portion of an airline's operating costs. Moreover, airlines and aircraft manufacturers are focusing on building planes that carry more passengers or cargo without significantly increasing fuel consumption. This increases the demand for lightweight materials as they increase the structural strength of aircraft while keeping the weight down, as well as optimizing load capacity, allowing for more passengers or cargo to be carried while minimizing energy use per trip.

Lightweight Materials Market Segment Insights

Lightweight Materials Market Breakdown – Product Insights

Based on products, the global lightweight materials market is segmented into aluminum, high-strength steel, titanium, magnesium, polymers & composites, and others. The aluminum segment dominated the market in 2023 due to its established use in the automotive and aerospace industries. Aluminum's lightweight properties, combined with its excellent corrosion resistance, make it an ideal choice for manufacturers seeking to enhance fuel efficiency and reduce emissions. The automotive sector increasingly adopted these materials to meet stringent regulations and consumer demand for greener or sustainable vehicles. At the same time, the aerospace industry benefited from the improved performance and weight savings that aluminum provides.

The polymers & composites segment is also expected to grow at a robust pace in the coming years owing to their versatility and advanced properties. Innovations in manufacturing processes, such as additive manufacturing and advanced molding techniques, have significantly enhanced the performance characteristics of these materials, making them suitable for a wider range of applications. The automotive industry is particularly interested in utilizing composites to achieve lighter vehicles without sacrificing safety or durability. Additionally, the growing emphasis on sustainable materials aligns with the development of bio-based and recycled polymers, further driving the adoption of these lightweight alternatives in various sectors.

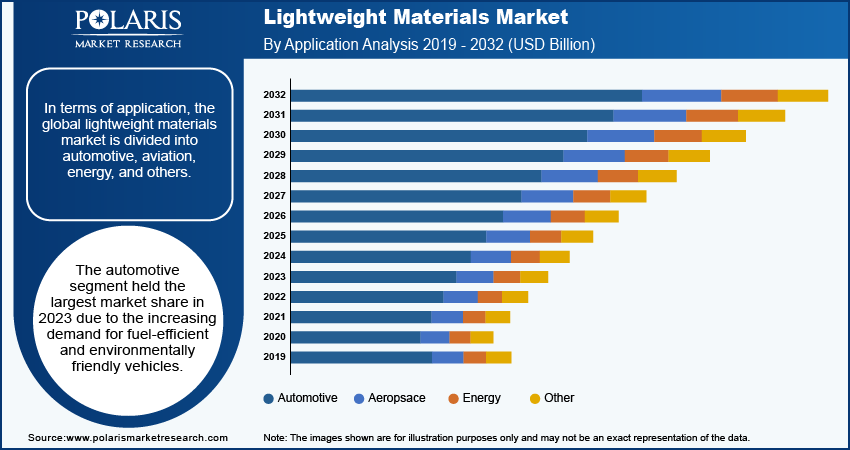

Lightweight Materials Market Breakdown – Application Insights

In terms of application, the global lightweight materials market is divided into automotive, aviation, energy, and others. The automotive segment held the largest market share in 2023 due to the increasing demand for fuel-efficient and environmentally friendly vehicles. Manufacturers focused on reducing vehicle weight to enhance fuel economy and meet stringent emissions regulations. Lightweight materials such as aluminum and high-strength steel played a pivotal role in achieving these goals, allowing automakers to design vehicles that not only meet performance standards but also comply with global sustainability initiatives. The integration of these materials into vehicle components, such as body panels and structural elements, has significantly improved performance while minimizing overall weight. The rise of electric vehicles further accelerated this trend as manufacturers sought to maximize battery efficiency and range through weight reduction.

The aviation segment is also projected to grow at a rapid pace during the forecast period owing to the advancements in aerospace technology and an increasing emphasis on fuel efficiency. Airlines and manufacturers are investing in lightweight materials to enhance aircraft performance and reduce operating costs. Composites, in particular, offer exceptional strength-to-weight ratios, which enable the design of lighter and more fuel-efficient aircraft. The growing trend towards sustainable aviation fuels and the need for reduced carbon footprints also drive demand for innovative lightweight materials that support these goals.

Lightweight Materials Market Regional Insights

By region, the study provides lightweight materials market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific lightweight materials dominated the market in 2023, with China as the major dominant country. The rapid industrialization and urbanization in China, coupled with a booming automotive and aerospace sector, drove the high demand for lightweight alternatives. According to a report published by the Ministry of Industry and Information Technology China, over 26 million vehicles were sold in 2021 in China, including 21.48 million passenger vehicles, an increase of 7.1% from 2020. Manufacturers in the region increasingly adopted aluminum, high-strength steel, and advanced composites to enhance fuel efficiency and meet rigorous environmental regulations. The significant investments in infrastructure and transportation also spurred growth as the demand for energy-efficient solutions became paramount. Additionally, local manufacturers benefitted from government initiatives promoting the use of sustainable technologies, further contributing to the region's position in the global landscape.

North America lightweight materials market is expected to grow at the highest CAGR from 2024 to 2032 owing to continuous innovations in manufacturing and stringent regulations aimed at reducing carbon emissions. The US stands out as the leading country in this region, where automotive manufacturers actively seek to incorporate lightweight alternatives to improve vehicle performance and fuel efficiency. The push for electric vehicles also fuels this growth, as manufacturers prioritize weight reduction to enhance battery life and range. Furthermore, the aerospace sector in North America is investing heavily in advanced materials to achieve higher performance standards and comply with environmental initiatives, supporting market growth.

Lightweight Materials Market – Key Players and Competitive Insights

New entrants have a promising opportunity to establish themselves and capture a significant market share in the coming years. Additionally, key lightweight materials market players are pursuing strategies to reinforce their market position and broaden their geographical presence. Market participants are also undertaking several strategic activities, including new product launches, agreements, mergers & acquisitions, and collaboration, to expand their footprint.

Henkel Corporation; SGL Group; Owens Corning Corp.; LyondellBasell Industries; Hexcel Corporation; Nippon Graphite Fiber Corp.; Mitsubishi Rayon; Zoltek Companies; UC Rusal; Aluminium Corporation of China; Rio Tinto Alcan; China Hongqiao Group; Kaiser Aluminium; and A&S Magnesium are among the major players in the lightweight materials market.

Owens Corning is a manufacturer of composite and building materials systems specializing in fiberglass composites. Its product range includes thermal and acoustical batts, foam sheathing, loose-fill insulation, and various accessories. The company also provides roofing components, such as laminate and strip asphalt shingles, oxidized asphalt, and synthetic packaging materials. Owens Corning markets its products under several brand names, including PINK, Next Gen, FIBERGLAS, FOAMGLAS, Paroc, and FOAMULAR. The company operates in North America, Europe, South & Central America, and Asia Pacific. It is headquartered in Toledo, Ohio, US.

Zoltek Corporation is a materials company specializing in the development, manufacturing, and sale of carbon fiber and related products across various industries. Their offerings are designed to enhance the performance of other materials, supported by stable pricing, reliable supply, and advanced technology. Zoltek primarily serves customers in the wind energy, alternative energy, lightweight automotive, construction and infrastructure, and oil exploration sectors. The company also produces filament winding and pultrusion equipment for creating large-volume composite parts. Zoltek operates manufacturing facilities in the US, Mexico, and Hungary and maintains a global sales and distribution network.

List of Key Companies in Lightweight Materials Market

- A&S Magnesium Inc.

- Aluminium Corporation of China

- China Hongqiao Group Ltd.

- Henkel Corporation

- Hexcel Corporation

- Kaiser Aluminium

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Group Corporation.

- Nippon Graphite Fiber Corporation

- Owens Corning Corporation

- Rio Tinto Alcan Inc.

- SGL Group

- ThyssenKrupp AG

- UC Rusal

- US Magnesium LLC

- Zoltek Companies Inc

Lightweight Materials Industry Developments

May 2023: Alcoa, the largest independent alumina supplier globally and a low-carbon emissions company, signed an agreement with Emirates Global Aluminium (EGA) to supply smelting-quality alumina to EGA.

June 2022: BMW announced that it is using sustainable carbon fiber-reinforced plastics (CFRP) in its EVs. The company has developed a new process for producing CFRP using renewable energy sources, aiming to reduce the environmental impact of its vehicles.

May 2022: Tesla unveiled a new structural battery pack design that integrates the battery cells directly into the vehicle's structure. This design is built using lightweight materials such as aluminum and steel and aims to enhance the efficiency and range of Tesla's vehicles.

February 2021: Boston Materials, a manufacturer of advanced lightweight materials, began distributing its Z-axis carbon fiber to customers in Europe and North America.

Lightweight Materials Market Segmentation

By Product Outlook (Volume, Kilotons; Revenue, USD billion, 2019 - 2032)

- Aluminum

- High Strength Steel

- Titanium

- Magnesium

- Polymers & Composites

- Others

By Application Outlook (Volume, Kilotons; Revenue, USD billion, 2019 - 2032)

- Automotive

- Aviation

- Energy

- Other

By Regional Outlook (Volume, Kilotons; Revenue, USD billion, 2019 - 2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lightweight Materials Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 204.24 billion |

|

Market Size Value in 2024 |

USD 221.32 billion |

|

Revenue Forecast in 2032 |

USD 426.31 billion |

|

CAGR |

8.5 % from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Volume, Kilotons; Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global lightweight materials market size was valued at USD 204.24 billion in 2023 and is projected to grow to USD 426.31 billion by 2032.

The global market is projected to grow at a CAGR of 8.5% during 2024–2032.

Asia Pacific accounted for the largest share of the global market in 2023.

Henkel Corporation; SGL Group; Owens Corning Corp.; LyondellBasell Industries; Hexcel Corporation; Nippon Graphite Fiber Corp.; Mitsubishi Rayon; Zoltek Companies; UC Rusal; Aluminium Corporation of China; Rio Tinto Alcan; China Hongqiao Group; Kaiser Aluminium; and A&S Magnesium are among the key players in the market.

The aluminum segment dominated the market in 2023.

The automotive segment accounted for the largest market share in 2023.