Lentil Protein Market Share, Size, Trends, Industry Analysis Report, By Product Type (Protein Isolates, Protein Concentrates, Flour, and Other Product Types); By Nature; By End Use; By Region; Segment Forecast, 2023 – 2032

- Published Date:Oct-2023

- Pages: 115

- Format: PDF

- Report ID: PM3827

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

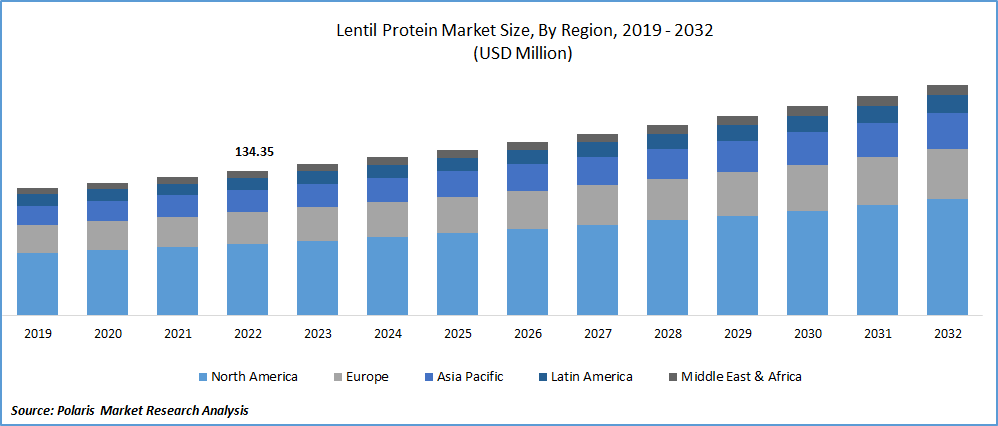

The global lentil protein market was valued at USD 134.35 million in 2022 and is expected to grow at a CAGR of 4.8% during the forecast period.

The growing proliferation of various protein-rich food products and inclining consumer behavior patterns towards plant-based and organic food products containing high amounts of lysine, arginine, aspartic acid, and glutamic acid, along with the surging adoption of lentils as an excellent source of essential amino acids, are among the primary factors driving the demand and growth of the market. Additionally, a growing number of consumers are increasingly concerned about the ingredients in their food products and prefer clean-label and natural alternatives, along with the ongoing R&D in the field of plant-based diets. Sustainable food products are likely to create huge growth potential in the market.

To Understand More About this Research: Request a Free Sample Report

For instance, in June 2023, Synthite introduced a new plant protein. The newly developed soluble plant protein combination is likely to offer all types of essential amino acids extracted from the lentils & yellow peas.

Moreover, researchers and food companies across the world have been exploring more efficient and environmentally friendly methods to extract and purify protein from lentils and implementing novel techniques, such as ultrasound-assisted extraction and enzyme-assisted extraction, to improve protein yields and reduce energy consumption during processing.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the lentil protein market. The emergence of the deadly virus across the world forced countries to take stringent and necessary actions like lockdowns and restrictions on movement that have disrupted the supply chains for lentils and other lentil-derived products. The transportation challenges and labor shortages in certain regions have also affected the availability of lentil protein and reduced its sales all over the world.

For Specific Research Requirements: Request for Customized Report

Industry Dynamics

Growth Drivers

Increasing Demand for Allergen-Free Ingredients

The rising applications of lentil protein across various end-use industries, including sports nutrition, nutraceutical, food, and infant formula products, and the increasing need and demand for allergen-free ingredients are among the major factors driving the global lentil protein market growth. Apart from this, lentils are now being considered environmentally friendly as they require less water and produce lower greenhouse gas emissions compared to livestock farming, thereby influencing the demand and growth of the lentil protein market at a rapid pace.

Furthermore, there has been a significant increase in the number of cases of obesity. Public awareness about the food products they are consuming, including additives and preservatives being used in the products, has led to higher consumption of plant-based and healthier food products, as they contain several essential amino acids and are high in protein, which in turn, has fueled the adoption and demand all over the world. For instance, according to the World Health Organization (WHO), around 1.9 billion adults aged 18 years or above are overweight globally, and 650 million people out of these are obese, which has tripled compared to 1975. Around 39 million children under the age of 5 years are estimated to be overweight or obese in 2020.

Report Segmentation

The market is primarily segmented based on product type, nature, end use, and region.

|

By Product Type |

By Nature |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

Protein Isolates Segment Accounted for the Largest Market Share in 2022

The protein isolates concentrate segment accounted for more than the global share. The growth of the segment market can be largely accelerated by increasing awareness of the health and environmental benefits of plant-based diets and significantly growing adoption of protein isolates across the world due to their ability to offer a nutritious and sustainable alternative to animal-based proteins while making them attractive to health-conscious consumers and vegan population globally.

The protein concentrates segment is projected to exhibit the fastest growth rate over the next coming years, mainly attributed to growing consumer inclination and shift towards healthier eating habits and the adoption of clean-label, natural, and minimally processed foods that have fueled the need and demand for lentil protein concentrates at a rapid pace. The protein concentrates are known to offer a balanced amino acid profile that contains essential amino acids required for human nutrition and is also rich in fiber, minerals, and vitamins, resulting in higher product popularity as an attractive nutritional option for health-conscious consumers.

By Nature Analysis

The Organic Segment Held a Significant Market Revenue Share in 2022

The organic segment held the maximum market share in terms of revenue in 2022 and is expected to have a noteworthy growth rate in the coming years, owing to a continuous increase in the demand for organic and natural food products and significantly rising adoption of plant-based diets, as a result of surging concerns about the environment sustainability, animal welfare, and health. In addition, the exponential rise in the number of vegans and vegetarians across the world has also been creating a huge demand for plant-based protein sources such as lentil protein.

For instance, the number of vegans across the globe stood at around 70 million as of September 2021, and almost 2 percent of US population are identified as vegan. The number of people eating meat products will be only forty percent of the world’s population by 2040, which is estimated to increase the number of vegans globally.

By End-Use Analysis

The Nutraceuticals Segment is Projected to Witness the Highest Growth During the Forecast Period

The nutraceuticals segment is projected to grow at a healthy growth rate during the anticipated period, which is mainly driven by the prevalence of product use as a key component in protein powders and dietary supplements that cater to individuals looking to boost their protein intake for various purposes such as muscle building, weight management, and overall nutrition.

The food processing segment led the industry market with a considerable share in 2022, which is highly attributable to the rapidly surging incorporation of lentil protein in various food products because of its rich essential nutrients, including protein, fiber, vitamins, and minerals, and also low fat and cholesterol-free. Besides this, major food product manufacturers and processors are continuously looking for innovative and sustainable ingredients to meet consumer demands and investing in the development of new products with these protein sources, thereby boosting the segment market.

Regional Insights

North America Region Dominated the Global Market in 2022

North America held the largest share, mainly due to a significant rise in health and environmental awareness and the popularity of lentil protein as a rich source of plant-based protein coupled with emerging health and wellness trends. Additionally, major companies in the region have been investing in research and development to create new and improved lentil protein products like protein powders, snacks, and meat alternatives. They are adopting effective marketing strategies, which have helped them to raise consumer awareness and drive demand for the product.

The Asia Pacific region is anticipated to emerge as fastest growing region with healthy CAGR during the forecast period, on account of continuous changes in consumer eating preferences and greater demand for healthier and meat-free plant-based products along with the rising number of favorable policies and initiatives towards promoting the sustainable and plant-based food system.

Market Key Players & Competitive Insight

Companies focus on product innovation and development to cater to the rising demand for allergen-free and plant-based protein solutions. Additionally, partnerships, acquisitions, and expansions into emerging markets are commonly employed strategies to expand their reach and customer base. With the growing awareness of the health and environmental benefits of lentil protein, competition is expected to intensify further, prompting players to invest in research and development and sustainable production practices to meet evolving consumer preferences and regulatory requirements.

Some of the major players operating in the global market include:

- AGT Food and Ingredients

- AMCO Proteins

- Archer Daniels Midland Company

- Biorefinery Solutions

- BI Nutraceuticals

- Cargill Inc.

- Distillery Winery of Thrace S.A.

- GEMEF Industries

- Glanbia Plc

- Henry Broch Foods

- Ingredion Inc.

- Iovate Health Sciences International Inc.

- Now Health Group Inc.

- Parabel USA Inc.

- Reliance Vitamin Company

- Vestkorn Milling AS

- Viglia Olives SA

Recent Developments

- In November 2022, Lentiful introduced new lentil meals. The newly developed range of meals will eliminate this time-consuming process of cooking lentils and will offer consumers a ready meal.

- In November 2022, the Broomfield family launched its new lentiful business, which aims to help people with busy lifestyles to eat healthy and plant-based meals. As consumers across the world are looking to eat healthier food products, the demand for lentil-based products has emerged drastically, and the company is looking to expand its business within the segment.

Lentil Protein Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 140.36 million |

|

Revenue forecast in 2032 |

USD 213.48 million |

|

CAGR |

4.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, Nature, End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global lentil protein market size is expected to reach USD 213.48 million by 2032.

Key players in the market are Lovate Health Sciences International, BI Nutraceuticals Biorefinery Solutions, Henry Broch Foods.

North America contribute notably towards the global lentil protein market.

The global lentil protein market is expected to grow at a CAGR of 4.8% during the forecast period.

The lentil protein market report covering key segments are product type, nature, end use, and region.