Last Mile Delivery Market Size, Share, Trends, Industry Analysis Report: By Service Type (B2C, B2B, and C2C), Technology, Application, Delivery Time, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 120

- Format: PDF

- Report ID: PM3938

- Base Year: 2024

- Historical Data: 2020-2023

Last Mile Delivery Market Overview

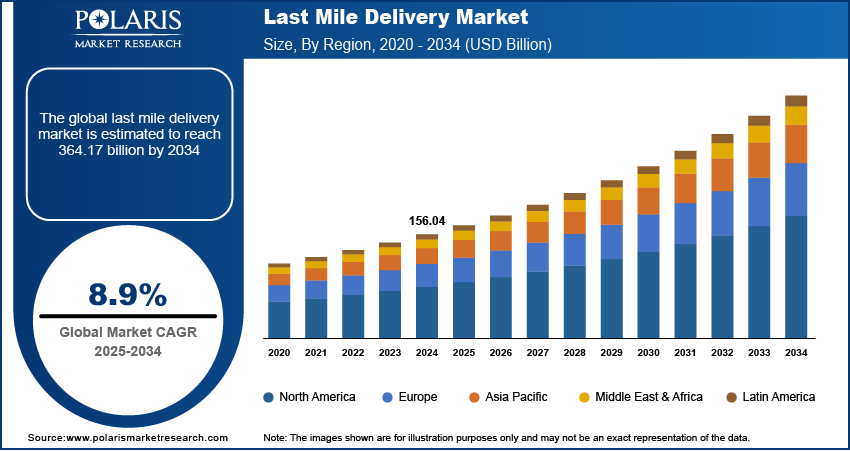

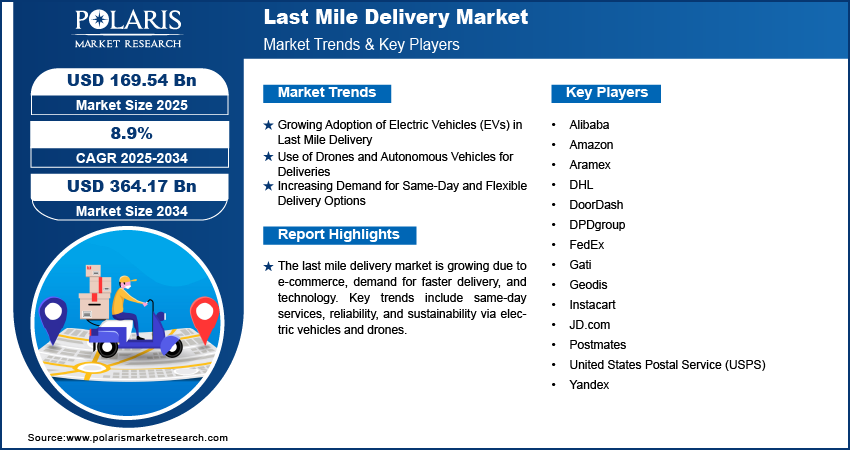

The last mile delivery market size was valued at USD 156.04 billion in 2024. The market is projected to grow from USD 169.54 billion in 2025 to USD 364.17 billion by 2034, exhibiting a CAGR of 8.9% during 2025–2034.

The last mile delivery market refers to the final leg of the supply chain process, where goods are transported from a distribution center to the end consumer's location. This segment plays a critical role in ensuring the timely and efficient delivery of products, particularly in the e-commerce and retail sectors. The growing demand for faster delivery of products, increasing adoption of e-commerce, and consumer preference for convenient, flexible delivery options boost the last mile delivery market growth. Trends shaping the market include the use of technologies such as route optimization software, autonomous delivery vehicles, and drones. Additionally, sustainable delivery solutions and the rise of localized fulfillment centers are positively influencing the market growth. These factors are expected to drive continued innovation and competition within the last mile delivery industry.

To Understand More About this Research: Request a Free Sample Report

Last Mile Delivery Market Dynamics

Growing Adoption of Electric Vehicles (EVs) in Last Mile Delivery

One of the major trends in the last mile delivery market is the increasing adoption of electric vehicles (EVs) for last mile deliveries. As companies strive to reduce their carbon footprints and comply with environmental regulations, the shift toward EVs has gained significant momentum. EVs, including electric vans and bikes, provide a more sustainable and cost-effective alternative to traditional gas-powered vehicles. This trend is being further accelerated by government incentives and subsidies for the adoption of electric mobility solutions. A report from the International Transport Forum suggests that electric vehicles could reduce transportation emissions by up to 70% by 2050. Additionally, a few companies, such as UPS and Amazon, have already committed to deploying electric delivery fleets to meet sustainability goals. The integration of EVs reduces greenhouse gas emissions and helps companies cut down on fuel costs and operational expenses.

Use of Drones and Autonomous Vehicles for Deliveries

Companies are increasingly experimenting with and implementing unmanned aerial vehicles (UAVs) and self-driving vehicles to enhance delivery efficiency, speed, and cost-effectiveness. Drones, particularly, offer an advantage in densely populated urban areas where traffic congestion can cause delays. In 2023, Wing, a subsidiary of Alphabet, completed over 200,000 commercial deliveries using drones in countries such as Australia and the US. Similarly, autonomous delivery vans are being tested by companies such as Nuro and Starship Technologies. These technologies aim to improve delivery times and reduce human labor costs, while also offering potential safety benefits by minimizing driver error. The growth in demand for faster deliveries and the expansion of autonomous vehicle technologies are driving this trend forward, with governments and regulatory bodies working to establish guidelines for their integration into public infrastructure. Therefore, the deployment of drones and autonomous vehicles in last mile delivery is becoming another transformative market trend.

Increasing Demand for Same-Day and Flexible Delivery Options

The demand for same-day and flexible delivery options continues to rise as consumers increasingly expect quicker and more convenient delivery services. E-commerce giants such as Amazon have set high expectations for faster delivery. To meet the consumer demands for rapid deliveries, companies are investing heavily in improving their logistics networks, including the establishment of hyper-localized fulfillment centers and advanced sorting facilities. This trend has led to innovations such as predictive delivery systems and the ability to track parcels in real-time, which enhance the overall customer experience. As the desire for faster, more flexible delivery continues to grow, logistics providers are increasingly focusing on optimizing their last mile delivery strategies to offer shorter lead times and greater consumer convenience, which drives the last mile delivery market demand.

Last Mile Delivery Market Segment Insights

Last Mile Delivery Market Outlook – Service Type-Based Insights

By service type, the last mile delivery market is primarily segmented into B2C, B2B, and C2C, each catering to different customer needs and business models. The B2C (Business-to-Consumer) segment holds the largest market share, driven by the rapid growth of e-commerce and the increasing demand for fast, reliable delivery services. Consumer expectations for same-day or next-day deliveries, especially for goods such as clothing, electronics, and groceries, have significantly contributed to the dominance of this segment. The surge in online shopping, especially post-pandemic, has further accelerated this trend, prompting companies to enhance their last-mile delivery capabilities to meet customer expectations. Additionally, the B2C segment benefits from the widespread use of mobile apps and digital platforms, allowing consumers to track deliveries in real time and choose convenient delivery windows, which enhances the overall customer experience.

The C2C (Consumer-to-Consumer) segment is registering the highest growth rate. The rise of peer-to-peer delivery services, facilitated by mobile technology, has led to an increase in this segment’s adoption. Platforms such as Postmates and DoorDash, which connect individuals for local deliveries, are gaining traction, particularly in urban areas. This growth is driven by various advantages such as convenience, flexibility, and cost-effectiveness, as consumers increasingly turn to platforms that allow them to send goods quickly to other consumers, often without the need for traditional logistics companies. The B2B (Business-to-Business) segment, while crucial, experiences moderate growth, as businesses continue to rely on established logistics providers for larger, bulk shipments. However, it remains an important aspect of the market due to the increasing need for efficient and reliable delivery services for industrial and commercial goods.

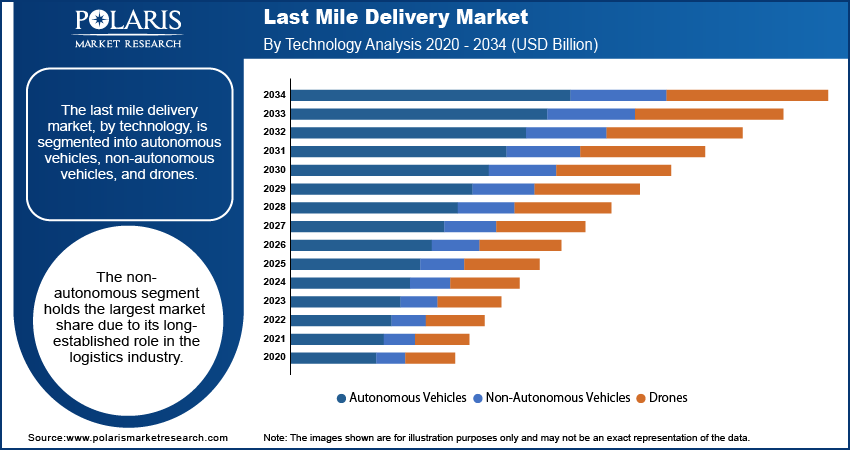

Last Mile Delivery Market Outlook – Technology-Based Insights

By technology, the last mile delivery market is segmented into autonomous vehicles, non-autonomous vehicles, and drones. The non-autonomous vehicles segment holds the largest market share due to its long-established role in the logistics industry. Traditional vehicles, including vans, trucks, and motorcycles, remain the backbone of last-mile delivery services, as they offer reliability and scalability for transporting goods over longer distances. This segment's widespread adoption and the infrastructure already in place for non-autonomous vehicles ensure its dominance in the market. The demand for non-autonomous vehicles remains strong, especially for businesses that require high-volume deliveries or operate in regions where newer technologies are not yet feasible due to regulatory, infrastructure, or technical limitations.

The autonomous vehicles segment is experiencing the highest growth rate, driven by technological advancements and increasing investments in automation. Companies are increasingly adopting self-driving delivery vehicles to optimize efficiency, reduce costs, and address labor shortages in the logistics sector. Autonomous vehicles, including delivery vans and small robots, offer the potential for faster and more efficient deliveries, particularly in urban environments where traffic congestion and delivery speed are major challenges. This segment is still in the early stages of adoption but is poised for significant growth as regulatory hurdles are cleared and technology becomes more reliable. Drones, while growing, face more regulatory challenges than autonomous vehicles. They are mainly being tested for specific applications such as small package deliveries in rural or hard-to-reach areas.

Last Mile Delivery Market Assessment – Application-Based Insights

The last mile delivery market, by application, is segmented into e-commerce, FMCG, and others, with the e-commerce segment holding the largest market share. This is driven by the exponential growth of online shopping and consumers’ increasing expectations for faster deliveries. The rise in demand for quick deliveries of products such as electronics, fashion, and household goods has made e-commerce the dominant force in the last mile delivery market landscape. E-commerce companies are investing heavily in refining their last-mile logistics to meet customer expectations for speed and reliability, which further supports the growth of this segment. The FMCG segment, while essential, has a more moderate share in comparison, focusing primarily on the timely delivery of goods such as groceries and personal care products. The others segment includes industries such as healthcare and pharmaceuticals, which also rely on specialized delivery systems, but these applications represent a smaller portion of the overall market.

Last Mile Delivery Market Evaluation – Delivery Time-Based Insights

In terms of delivery time, the last mile delivery market is bifurcated into regular and same day. The same day segment is registering the highest growth, driven by the increasing consumer demand for faster and more flexible delivery options. As e-commerce platforms, particularly large players such as Amazon, continue to push the boundaries of what is possible in terms of speed, customers now expect the ability to receive their orders on the same day they place them. Companies are adapting their logistics networks to offer same-day delivery by utilizing local fulfillment centers and advanced route optimization technologies. This shift is particularly prevalent in urban areas where high population density and infrastructure support rapid delivery capabilities. Regular delivery times, while still significant in volume, are growing at a slower pace as customers increasingly prioritize speed and convenience.

Last Mile Delivery Market Regional Analysis

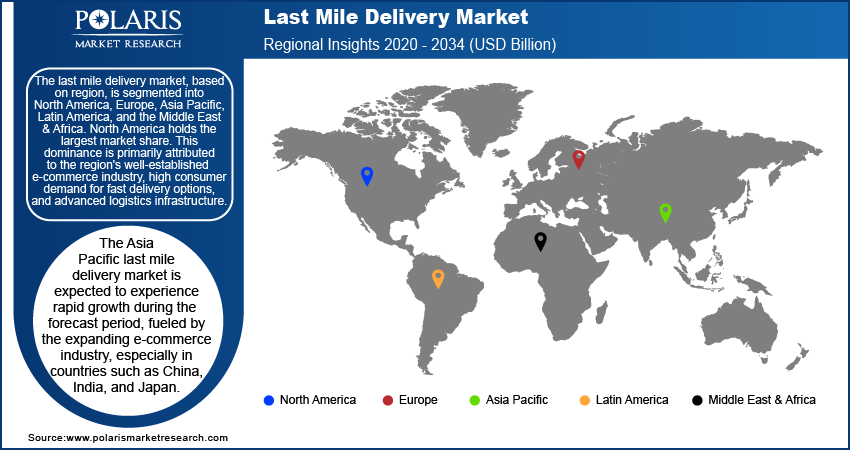

The last mile delivery market is widely distributed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share due to the region's well-established e-commerce industry, high consumer demand for fast delivery options, and advanced logistics infrastructure. The presence of major e-commerce players such as Amazon and Walmart, along with strong technological adoption, particularly in autonomous vehicles and drones, further strengthens North America's position. Additionally, the region benefits from a high level of investments in innovative delivery solutions and a favorable regulatory environment that supports the growth of last-mile delivery technologies. The combination of these factors has led North America to maintain its lead in the global market.

Europe holds a significant share of the last mile delivery market revenue, driven by the growing e-commerce sector and the region's focus on sustainability and innovation. Major countries such as the UK, Germany, and France are witnessing high demand for fast delivery services, particularly with increasing consumer expectations for quick shipping in urban areas. The adoption of electric vehicles and green delivery initiatives is also prevalent in Europe, supported by stringent environmental regulations and incentives for sustainable logistics. In addition, the region is actively testing and implementing autonomous vehicles and drones for last-mile deliveries, particularly in tech-forward cities such as Amsterdam and Berlin. As a result, Europe is poised for steady growth, supported by technological advancements and the ongoing push toward eco-friendly solutions.

The Asia Pacific last mile delivery market is expected to experience rapid growth during the forecast period, fueled by the expanding e-commerce industry, especially in countries such as China, India, and Japan. The growing urban population, increasing internet penetration, and rising disposable incomes are driving demand for efficient and fast delivery services. China, in particular, has become a hub for last-mile delivery innovations, with companies such as Alibaba and JD.com leading the way in integrating autonomous vehicles and drone technologies for faster deliveries. India, with its large and diverse consumer base, presents a significant opportunity, though challenges such as infrastructure and logistical complexity need to be addressed. The region's large-scale adoption of mobile technology and the rise of on-demand delivery services further contribute to the regional market growth, making Asia Pacific a key player in shaping the future of last-mile delivery market.

Last Mile Delivery Market – Key Market Players and Competitive Insights

Key players in the last mile delivery market include companies such as Amazon, UPS, FedEx, DHL, United States Postal Service (USPS), Postmates, DoorDash, Instacart, Aramex, Alibaba, JD.com, Yandex, Geodis, DPDgroup, and Gati. Amazon is a significant player with its advanced logistics network, enabling fast and efficient last-mile delivery services. UPS and FedEx remain major logistics providers with extensive delivery networks across the globe. Postmates and DoorDash are key players in the on-demand delivery segment, offering quick delivery services primarily in urban areas. Companies such as Alibaba and JD.com are leading innovators in China and Asia, utilizing advanced technology such as drones and automated delivery systems to improve delivery times. Aramex and Geodis focus on the Middle East & Europe, offering reliable services, while DPDgroup is well-established in Europe for efficient last-mile solutions.

The last mile delivery market competitive dynamics are heavily influenced by factors such as delivery speed, customer experience, and cost efficiency. Companies are investing in technology, such as route optimization software, autonomous vehicles, and electric delivery fleets, to reduce operational costs and increase delivery speed. The growth of on-demand delivery platforms such as Postmates, DoorDash, and Instacart reflects the increasing consumer preference for faster and more flexible delivery services. Companies with established global networks, including UPS, FedEx, and DHL, focus on integrating advanced technologies to maintain competitive advantages, whereas newer entrants such as Amazon and JD.com are disrupting the market with innovative approaches, including drone deliveries and localized fulfillment centers.

The last mile delivery market is witnessing continuous innovation, especially as companies focus on sustainability and reducing carbon footprints. Players in Europe, such as Geodis and DPDgroup, have introduced electric vehicles and eco-friendly delivery options as part of their sustainability efforts. Meanwhile, autonomous vehicles and drones are being tested and implemented by companies such as Amazon, JD.com, and Yandex, offering the potential for faster, more efficient deliveries. This technological advancement, combined with a strong focus on customer satisfaction and reduced delivery times, is shaping the competitive landscape, with companies vying to offer the most efficient and cost-effective last-mile delivery solutions. Companies are also increasingly adopting hyper-localization strategies to shorten delivery times and improve overall service quality.

Amazon is a key player in the last mile delivery market, primarily known for its vast logistics network that supports the delivery of products to consumers quickly and efficiently. Amazon's focus on improving delivery times is driven by its large-scale fulfillment centers and advanced technologies, including automated sorting and route optimization tools. The company has made significant investments in electric vehicles, aiming to reduce carbon emissions and meet its environmental targets. Amazon’s commitment to faster, more reliable deliveries continues to shape its strategies, including the exploration of drone delivery systems in certain regions.

UPS is another significant player in the last mile delivery market, providing services globally through its extensive network of ground, air, and freight operations. The company focuses on efficient delivery processes and continues to invest in technology to streamline its operations. The company’s efforts to embrace automation and green technology align with its ongoing commitment to improve service reliability and reduce environmental impact. UPS is also investing in smart logistics systems to handle increasing delivery demands while maintaining cost-effectiveness.

List of Key Companies in Last Mile Delivery Market

- Alibaba

- Amazon

- Aramex

- DHL

- DoorDash

- DPDgroup

- FedEx

- Gati

- Geodis

- Instacart

- JD.com

- Postmates

- United States Postal Service (USPS)

- Yandex

Last Mile Delivery Industry Developments

- In November 2024, UPS unveiled plans to expand its fleet of autonomous delivery vehicles, aimed at improving delivery efficiency, particularly in urban areas.

- In October 2024, Amazon announced the expansion of its electric delivery fleet as part of its broader sustainability efforts.

Last Mile Delivery Market Segmentation

By Service Type Outlook

- B2C

- B2B

- C2C

By Technology Outlook

- Autonomous Vehicles

- Non-Autonomous Vehicles

- Drones

By Application Outlook

- E-commerce

- FMCG

- Others

By Delivery Time Outlook

- Regular

- Same Day

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Last Mile Delivery Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 156.04 billion |

|

Market Size Value in 2025 |

USD 169.54 billion |

|

Revenue Forecast by 2034 |

USD 364.17 billion |

|

CAGR |

8.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The last mile delivery market has been broadly segmented on the basis of service type, technology, application, and delivery time. Moreover, the study provides the reader with a detailed understanding of the different segments at both global and regional levels.

Growth/Marketing Strategy

The last mile delivery market growth and marketing strategy focuses on enhancing delivery speed, customer satisfaction, and cost efficiency. Companies are investing in advanced technologies such as route optimization software, autonomous vehicles, and drones to reduce operational costs and improve delivery times. Additionally, players are expanding their logistics networks with localized fulfillment centers to support faster deliveries in urban areas. Sustainability is also a key focus, with companies adopting electric vehicles and eco-friendly solutions to meet consumer demand for greener delivery options. Strategic partnerships and collaborations are being formed to improve service offerings and extend market reach.

FAQ's

? The market size was valued at USD 156.04 billion in 2024 and is projected to grow to USD 364.17 billion by 2034.

? The market is projected to register a CAGR of 8.9% during the forecast period.

? North America accounted for the largest share of the market in 2024.

? A few key players in the last mile delivery market include Amazon, UPS, FedEx, DHL, United States Postal Service (USPS), Postmates, DoorDash, Instacart, Aramex, Alibaba, JD.com, Yandex, Geodis, DPDgroup, and Gati.

? The B2C segment accounted for the largest share of the market in 2024.

? The non-autonomous vehicles segment accounted for the largest share of the market in 2024.

? Last mile delivery refers to the final step in the supply chain process, where goods are transported from a distribution center or warehouse to the end consumer's location. This stage is crucial for ensuring that products arrive at the customer's doorstep in a timely and efficient manner. It involves various modes of transportation, including vans, trucks, motorcycles, drones, and even autonomous vehicles, depending on the size and type of parcel. The goal of last mile delivery is to optimize speed, reduce costs, and enhance customer satisfaction by offering flexible delivery options such as same-day or next-day deliveries.

A few key last mile delivery market trends are described below: Adoption of Electric Vehicles (EVs): Companies are integrating electric vehicles to reduce carbon emissions and operational costs while meeting sustainability goals. Use of Autonomous Vehicles: Self-driving delivery vans and robots are being tested and deployed to optimize efficiency and reduce labor costs. Drone Deliveries: Drones are being used for small package deliveries, particularly in urban areas, to bypass traffic and increase delivery speed. Same-Day and On-Demand Deliveries: Growing consumer demand for faster delivery options is driving the requirement for same-day and time-slot specific deliveries.

? A new company entering the last mile delivery market could focus on leveraging technology to differentiate itself, particularly by investing in route optimization software, real-time tracking, and data analytics to improve delivery efficiency. Additionally, adopting sustainable practices, such as electric vehicles or green delivery solutions, could help meet growing consumer demand for eco-friendly services. Focusing on the fast-growing on-demand delivery segment, offering flexible, same-day, and time-specific delivery options would appeal to customers seeking convenience. Building localized fulfillment centers in urban areas could further reduce delivery times and operational costs, giving the company a competitive edge.

? Companies related to last mile delivery and related solutions and other consulting firms must buy the report.