Lactic Acid Market Size, Share, Trends, Industry Analysis Report

: By Source (Natural and Synthetic), Form, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 119

- Format: PDF

- Report ID: PM1630

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

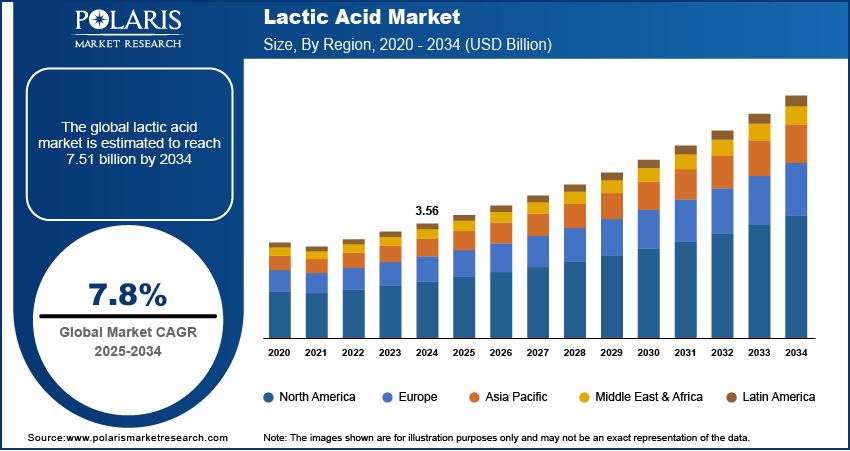

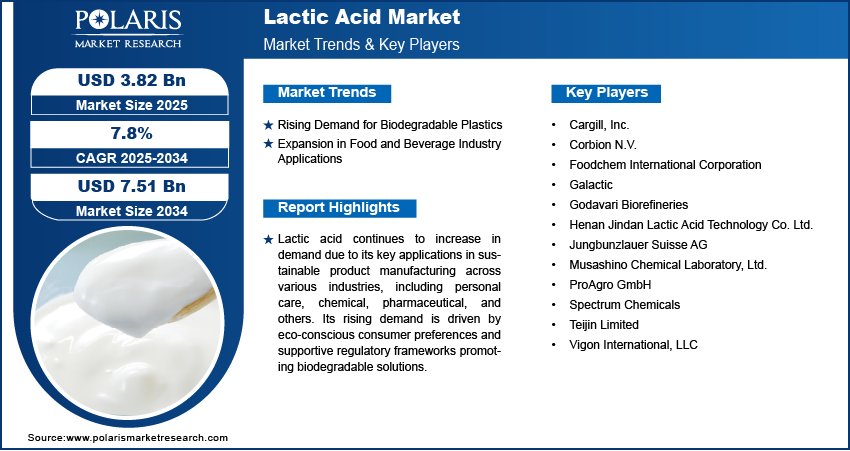

The global lactic acid market size was valued at USD 3.56 billion in 2024, exhibiting a CAGR of 7.8% during 2025–2034. The market growth is driven by growing awareness about environmental sustainability, rising adoption of biodegradable plastics, and increased regulatory support for bio-based materials.

Key Insights

- The natural segment led the market in 2024. The segment’s dominance is driven by growing demand for sustainable products across industries such as food and packaging.

- The dry segment accounted for the largest market share in 2024, owing to its functional benefits and extensive industrial applications.

- North America dominated the market in 2024. The presence of advanced pharmaceutical and personal care industries drives high demand for lactic acid in the region.

- Asia Pacific is witnessing the fastest growth, driven by the region’s sustainable value chain factors and proactive market expansion strategies.

Industry Dynamics

- The rising environmental concerns globally have led to increased demand for biodegradable plastics. Lactic acid plays a key role in these plastics, driving market expansion.

- The widespread adoption of lactic acid in the food and beverage industry due to its multifunctional properties contributes to market development.

- The shift towards circular economies is expected to drive the adoption of lactic acid in the coming years.

- High production costs of lactic acid and raw material price volatility may present challenges to market growth.

Market Statistics

2024 Market Size: USD 3.56 billion

2034 Projected Market Size: USD 7.51 billion

CAGR (2025-2034): 7.8%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Lactic acid is a naturally occurring organic acid that is colorless and has a mild sour taste. The organic characteristics of lactic acid make it suitable for the manufacturing of eco-friendly and sustainable products. The rising consumer awareness about environmental sustainability and regulatory support for biodegradable and bio-based materials are a few of the key factors driving market growth. The lactic acid market revenue is projected to rise steadily, with notable contributions from key regions such as North America, Europe, and the Asia Pacific, where industrial applications are rapidly evolving.

The increasing demand for natural and organic ingredients in food products and the growing adoption of biodegradable plastics in response to environmental concerns are other factors fueling the lactic acid market expansion. Additionally, the use of lactic acid in pharmaceutical applications, particularly in skin-enhancing formulations for cosmetics, is another significant driver of market growth.

Key lactic acid market trends include the shift toward circular economies and sustainable production practices aimed at minimizing environmental impact. In addition, market participants are contributing to advanced fermentation technologies such as cell immobilization, solid-state fermentation, and others to enhance efficiency and reduce carbon footprints. Companies like NatureWorks LLC, a joint venture between Cargill, Inc. and PTT Global Chemical, are also contributing to market growth through the production of polylactic acid (PLA) products like Ingeo.

Market Dynamics

Rising Demand for Biodegradable Plastics

Environmental concerns worldwide have significantly increased the demand for biodegradable plastics as part of sustainability efforts, with lactic acid playing a key role. Biodegradable plastics manufactured from polylactic acid (PLA) serve as a key alternative to conventional plastics, helping reduce carbon footprint issues. PLA, derived from renewable resources such as corn starch and sugarcane, is compostable and reduces reliance on fossil fuels, which in turn drives the demand for lactic acid. Additionally, these rising concerns have compelled the packaging industry to adopt PLA-based materials to align with consumer preferences for eco-friendly products. For instance, TotalEnergies Corbion, a manufacturer of PLA and lactide monomers, offers Luminy, a polymer used in industries such as food, automotive, and packaging for sustainable practices. This shift towards sustainable materials in packaging and manufacturing has increased the need for precision-engineered lactic acid. Therefore, the move towards sustainable materials in these sectors acts as a key lactic acid market growth driver, enhancing the adoption of natural lactic acid.

Expansion in Food and Beverage Industry Applications

The multifunctional properties of lactic acid have led to its widespread adoption in the food and beverage industry. It serves as a preservative, pH regulator, and flavoring agent, enhancing product safety and taste profiles. The growing consumer inclination towards minimally processed and natural foods has increased the use of lactic acid in products such as dairy items, baked goods, and beverages. At the same time, the rising demand for convenience foods such as ready-to-eat and long-shelf-life products have also contributed to the expanded utilization of lactic acid in food processing industry. Additionally, the clean-label movement, where consumers seek transparency in ingredient lists, has prompted manufacturers to replace synthetic additives with natural alternatives such as lactic acid, thereby expanding its application scope and presenting growth opportunities in the market.

Segment Insights

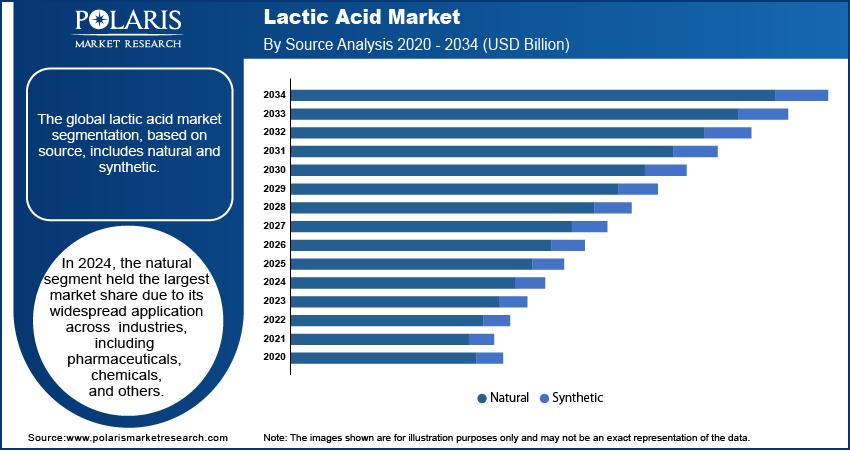

Lactic Acid Market Assessment by Source Insights

The global lactic acid market segmentation, based on source, includes natural and synthetic. In 2024, the natural segment dominated the market, primarily due to the increasing demand for eco-friendly and sustainable products across industries such as packaging and food. Natural lactic acid is primarily produced through the fermentation of renewable resources such as sugarcane, corn, and cassava. Moreover, increasing consumer shift towards non-GMO and plant-based products has further fueled the demand for naturally sourced lactic acid. Also, owing to the biodegradable and compostable nature of lactic acid, goods primarily manufactured from polylactic acid (PLA) bioplastics are further helping to maintain circular economy practices, contributing to the segment growth.

Lactic Acid Market Evaluation by Form Insights

The global lactic acid market segmentation, based on form, includes dry and liquid. In 2024, the dry segment dominated the market, driven by its extensive industrial applications and functional advantages. The dry form of lactic acid, typically available as powder or granules, offers superior stability and ease of handling, making it a preferred choice in various industries. In the food and beverage sector, it serves as a preservative and flavoring agent, enhancing product shelf life and taste profiles. The pharmaceutical industry utilizes dry lactic acid in formulations due to its controlled release properties and compatibility with active ingredients. Additionally, in the personal care industry, it is incorporated into products such as creams and lotions for its exfoliating and pH-regulating properties. The versatility and functional benefits of dry lactic acid contributes significantly to its market dominance.

Lactic Acid Market Outlook by Application Insights

The global lactic acid market segmentation, based on application, includes personal care, food & beverages, chemical, pharmaceutical, industrial, biodegradable plastics & polymers, and others. The biodegradable plastics & polymers segment is expected to witness significant growth during the forecast period. The surge is primarily driven by increasing environmental concerns and a global shift towards sustainable materials, leading to increased demand for biodegradable polymers like PLA. Industries such as packaging, agriculture, and textiles are increasingly adopting PLA due to its compostable nature and reduced carbon footprint. Additionally, industry trends indicate significant expansion opportunities in untapped markets, particularly in regions with emerging economies, where industrial applications of biodegradable plastics are gaining traction.

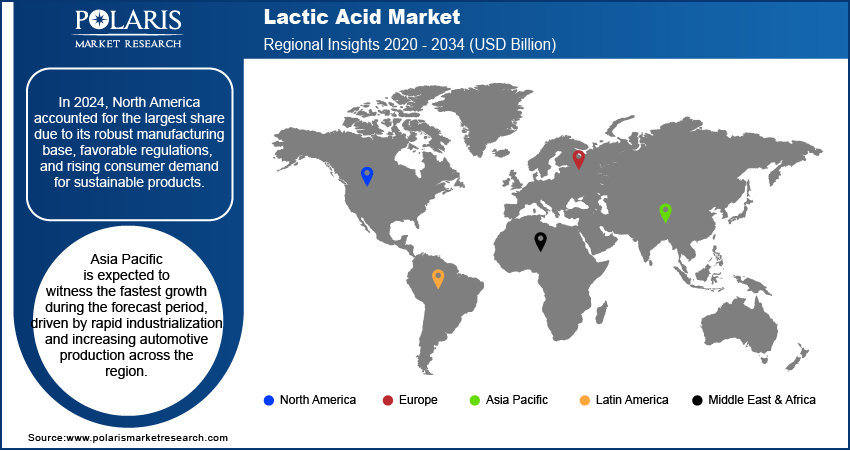

Regional Analysis

By region, the study provides the lactic acid market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to its advanced pharmaceutical and personal care industries, which extensively utilize lactic acid in various applications. Additionally, the presence of major market players, ongoing technological advancements, and a strong regulatory framework to support bio-based products have contributed to the region’s dominance. Key strategic developments, such as significant investments in research and development, have also strengthened North America's leading position in the global market.

Europe is the second-largest market for lactic acid, driven by favorable market dynamics and macroeconomic trends supporting sustainable development. The region's stringent environmental regulations and strong consumer preference for biodegradable products have spurred demand for lactic acid, particularly in the packaging and automotive sectors. Additionally, balanced supply and demand, coupled with a well-established infrastructure for production and distribution, are contributing to market growth. Other factors fueling regional market demand include continuous advancements in production technologies and strategic collaborations among key players.

Asia Pacific is experiencing the fastest growth in the lactic acid market, propelled by sustainable value chain factors and proactive market expansion strategies. Rapid industrialization, coupled with increasing environmental awareness, has led to an increased demand for biodegradable plastics and green chemicals. Companies are exploring new opportunities in the market by investing in local production facilities and forming joint ventures to enhance their presence. Moreover, regulatory frameworks promoting the use of bio-based and biodegradable materials are encouraging manufacturers to adopt innovative production processes, further accelerating market growth in the region.

Key Players and Competitive Insights

The competitive landscape of the lactic acid market is characterized by the presence of established global players and a growing number of regional manufacturers, all striving to gain lactic acid market share through innovation, product differentiation, and strategic expansions. Leading companies such as Cargill, Inc. and Corbion N.V. dominate the market, leveraging advanced technologies, extensive R&D investments, and robust global distribution networks to maintain their competitive edge. These key players are focused on lactic acid market development by introducing efficient products, particularly for applications such as chemicals, drugs, cosmetics, packaging, and others. Additionally, mergers, acquisitions, and collaborations are key strategies employed to expand lactic acid market reach and strengthen portfolios. Regional manufacturers are also gaining traction by catering to cost-sensitive markets with competitively priced products.

Cargill, Inc. is a global provider of food, ingredients, agricultural solutions, and industrial products, serving multiple sectors with a focus on safety, responsibility, and sustainability. The company's diverse product and service offerings span agriculture, animal nutrition, beauty, bio-industrial solutions, data asset solutions, food and beverage, food service, industrial applications, meat and poultry, pharmaceuticals, risk management, supplements, and transportation. The bio industrial business segment of the company is into the production of lactic acid, which is also supplied to its subsidiary unit for the manufacturing of polylactic acid used in industrial applications.

Corbion is a global manufacturing company engaged in the production of sustainable ingredients, particularly biochemicals. The company’s key business segments include biobased chemicals, food & beverages, and pharmaceuticals, with a focus on providing eco-friendly solutions across these industries. Additionally, Corbion's biobased chemicals business segment includes products such as lactic acids, lactates, and derivatives, which play a vital role in food preservation, safety, and functional ingredients.

List of Key Companies

- Cargill, Inc.

- Corbion N.V.

- Foodchem International Corporation

- Galactic

- Godavari Biorefineries

- Henan Jindan Lactic Acid Technology Co. Ltd.

- Jungbunzlauer Suisse AG

- Musashino Chemical Laboratory, Ltd.

- ProAgro GmbH

- Spectrum Chemicals

- Teijin Limited

- Vigon International, LLC

Lactic Acid Industry Developments

In June 2021, International Flavors and Fragrances (IFF) introduced YO-MIX ViV, a line of products made with lactic acid bacteria culture, including ambient yogurt and other fermented drinks. The product range is primarily aimed at the Asia Pacific market, with a strong emphasis on China.

Lactic Acid Market Segmentation

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Natural

- Synthetic

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Dry

- Liquid

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Personal Care

- Food & Beverages

- Chemical

- Pharmaceutical

- Industrial

- Biodegradable Plastics & Polymers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lactic Acid Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.56 billion |

|

Market Size Value in 2025 |

USD 3.82 billion |

|

Revenue Forecast by 2034 |

USD 7.51 billion |

|

CAGR |

7.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global lactic acid market size was valued at USD 3.56 billion in 2024 and is estimated to grow to USD 7.51 billion by 2034.

• The global market is projected to register a CAGR of 7.8% during 2025–2034.

• North America accounted for the largest share of the market in 2024 due to strong demand for biodegradable products and significant investments in research and development.

• Some of the key players in the market are Cargill, Inc.; Corbion N.V.; Galactic; Godavari Biorefineries; Henan Jindan Lactic Acid Technology Co. Ltd.; Jungbunzlauer Suisse AG; Musashino Chemical Laboratory, Ltd.; Spectrum Chemicals; Vigon International, LLC; Teijin Limited; ProAgro GmbH; and Foodchem International Corporation.

• In 2024, the natural source segment held the largest market share due to its widespread applications across the automotive and packaging industry for the manufacturing of sustainable products.

• In 2024, the dry segment accounted for the largest market share in the lactic acid market in 2024.