Lactation Support Supplements Market Size, Share, Trends, Industry Analysis Report: By Ingredient Type (Fenugreek, Moringa, Milk Thistle, Fennel, Oatmeal, and Others), Formulation, Sales Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 114

- Format: PDF

- Report ID: PM3546

- Base Year: 2024

- Historical Data: 2020-2023

Lactation Support Supplements Market Overview

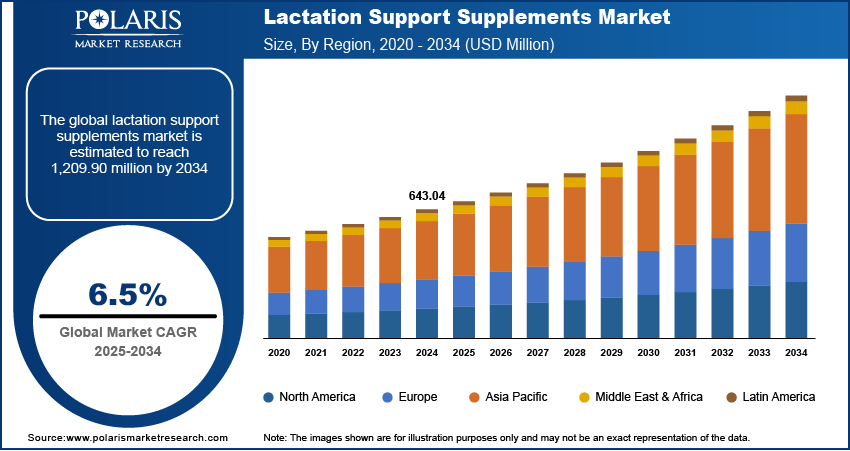

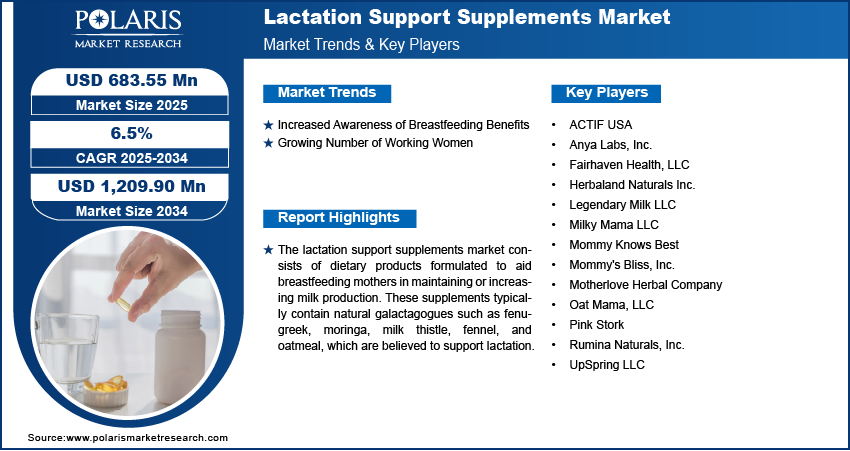

The lactation support supplements market size was valued at USD 643.04 million in 2024. The market is projected to grow from USD 683.55 million in 2025 to USD 1,209.90 million by 2034, exhibiting a CAGR of 6.5% during 2025–2034.

The lactation support supplements market encompasses dietary supplements formulated to enhance breast milk production in nursing mothers. These supplements typically contain natural ingredients such as fenugreek, fennel, blessed thistle, and moringa, which are traditionally known for their lactation-boosting properties. The lactation support supplements market expansion is driven by increasing awareness regarding maternal and infant health, a growing preference for natural and organic supplements, and the rising number of working mothers seeking convenient solutions to support breastfeeding. Additionally, the availability of lactation support supplements in various formats, including capsules, powders, teas, and chews, contributes to market expansion.

To Understand More About this Research: Request a Free Sample Report

Key drivers of the lactation support supplements market include increasing breastfeeding support initiatives from healthcare organizations, the expansion of e-commerce platforms facilitating easy access to these products, and rising disposable income, allowing consumers to invest in specialized nutrition. Furthermore, concerns over declining breastfeeding rates in certain regions have led to increased adoption of lactation supplements as a preventive measure. The market is expected to expand due to continuous product innovation and increasing consumer preference for plant-based and non-GMO formulations.

Lactation Support Supplements Market Dynamics

Increased Awareness of Breastfeeding Benefits

Growing awareness of the health benefits associated with breastfeeding has significantly influenced mothers' choices, leading to a higher demand for lactation support supplements. Breastfeeding is known to protect infants from infections and illnesses, including diarrhea, ear infections, and pneumonia. It also reduces the risk of asthma and sudden infant death syndrome (SIDS) in children, while mothers experience a decreased risk of breast and ovarian cancers. This heightened awareness encourages mothers to initiate and continue breastfeeding, often turning to lactation support supplements to address challenges such as low milk supply, thereby driving the growth of the lactation support supplements market.

Rising Number of Working Women

The increasing number of women returning to work after childbirth has led to a growing demand for lactation support supplements. Many working mothers struggle to maintain a consistent milk supply while balancing their professional and family responsibilities. Lactation supplements help ensure milk production continue, even when breastfeeding sessions are less frequent throughout the day. These supplements offer the convenience mothers need, enabling them to continue breastfeeding without interrupting their work life. The rising trend of working mothers is significantly contributing to the lactation support supplements market expansion.

Lactation Support Supplements Market Segment Insights

Lactation Support Supplements Market Assessment by Ingredient Type

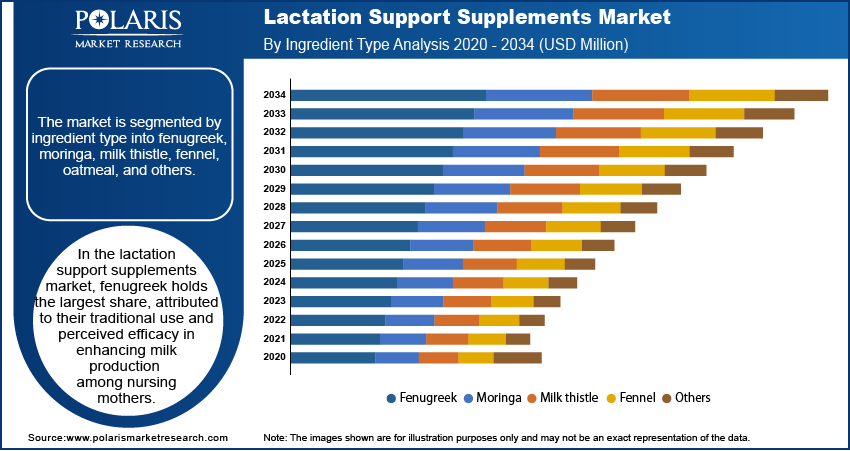

The lactation support supplements market segmentation, based on ingredient type, includes fenugreek, moringa, milk thistle, fennel, oatmeal, and others. The fenugreek segment holds the largest market share, attributed to their traditional use and perceived efficacy in enhancing milk production among nursing mothers. Fenugreek seeds are rich in phytoestrogens, which are believed to stimulate milk ducts and increase milk supply. Their widespread availability and incorporation into various supplement forms, such as capsules, teas, and powders, have solidified their prominence in the market. Additionally, fenugreek's minimal side effects and natural origin appeal to health-conscious consumers seeking herbal solutions for lactation support.

Lactation Support Supplements Market Evaluation by Formulation

The lactation support supplements market is segmented by formulation into capsules/tablets, powder, liquid, and others. The capsules/tablets represent the most significant formulation segment. Their dominance is attributed to the convenience and precise dosing they offer, which is essential for lactating mothers managing their nutritional intake. These formulations effectively mask the strong taste and odor of certain herbal ingredients, enhancing palatability and compliance among users. The structured dosage form ensures consistent consumption, thereby optimizing the efficacy of the supplements. Additionally, the extended shelf life of capsules/tablets contribute to their widespread acceptance and preference in the market.

Lactation Support Supplements Market Regional Insights

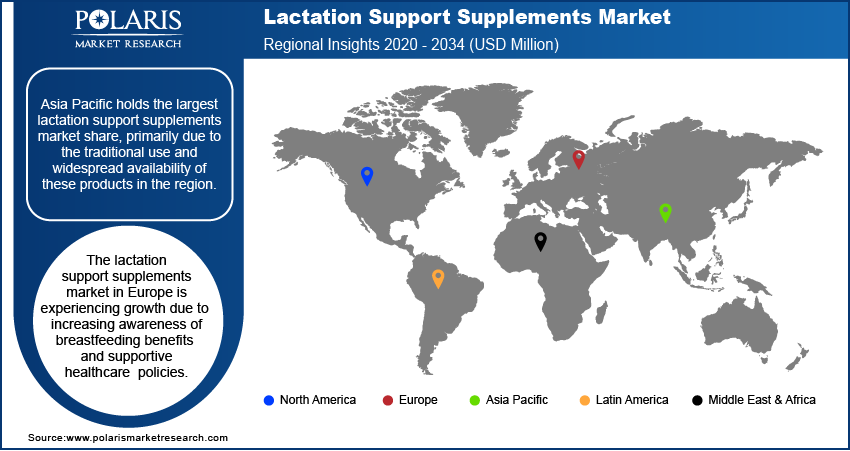

By region, the study provides lactation support supplements market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest market share, primarily due to the traditional use and widespread availability of these products in the region. Cultural practices in countries such as India and China have long incorporated natural galactagogues to support breastfeeding mothers. This cultural acceptance, combined with a large population base and increasing awareness of maternal health, has led to significant adoption of lactation support supplements. Additionally, the presence of key market players and the introduction of diverse product offerings tailored to regional preferences further boost the market's dominance in Asia Pacific.

The lactation support supplements market in Europe is experiencing growth due to increasing awareness of breastfeeding benefits and supportive healthcare policies. Countries such as Germany, France, and the UK are leading contributors, driven by robust healthcare systems and a high prevalence of working mothers seeking convenient solutions to support lactation. The rising trend of e-commerce has also facilitated easier access to these supplements, further propelling market expansion in the region.

Lactation Support Supplements Market – Key Players and Competitive Insights

The Lactation Support Supplements Market is highly competitive, driven by increasing awareness of breastfeeding benefits and the demand for natural, plant-based supplements. Key players include ACTIF USA; Anya Labs, Inc.; Fairhaven Health, LLC; Herbaland Naturals Inc.; Legendary Milk LLC;, competing through product innovation, organic certifications, and specialized formulations. Companies focus on herbal ingredients like fenugreek, fennel, and blessed thistle to enhance milk production.

Notable participants include ACTIF USA; Anya Labs, Inc.; Fairhaven Health, LLC; Herbaland Naturals Inc.; Legendary Milk LLC; Milky Mama LLC; Mommy Knows Best; Mommy's Bliss, Inc.; Motherlove Herbal Company; Oat Mama, LLC; Pink Stork; Rumina Naturals, Inc.; and UpSpring LLC.

Motherlove Herbal Company, founded over 30 years ago by an herbalist mother, specializes in organic herbal body care and supplements designed to support women through various stages of motherhood, including pregnancy, birth, postpartum, breastfeeding, and baby care. Their products are rooted in the wisdom of traditional herbal remedies, aiming to provide natural and effective solutions for maternal and infant health. As a Certified B Corporation, Motherlove emphasizes sustainability and social responsibility in its operations.

Pink Stork is a wellness brand dedicated to empowering women by offering scientifically backed products and solutions. The company also has a supportive community committed to guiding and uplifting women through all stages of life. Founded by Amy Suzanne, who experienced severe pregnancy complications herself, Pink Stork provides a range of products tailored for maternal health, including fertility, pregnancy, postpartum, and lactation support supplements. The company is a woman-owned and operated enterprise, with over 80% of its workforce comprised of women.

List of Key Companies in Lactation Support Supplements Market

- ACTIF USA

- Anya Labs, Inc.

- Fairhaven Health, LLC

- Herbaland Naturals Inc.

- Legendary Milk LLC

- Milky Mama LLC

- Mommy Knows Best

- Mommy's Bliss, Inc.

- Motherlove Herbal Company

- Oat Mama, LLC

- Pink Stork

- Rumina Naturals, Inc.

- UpSpring LLC

Lactation Support Supplements Market Developments

- March 2024: Emcure Pharmaceuticals launched its Galact lactation supplement for breastfeeding mothers in the over-the-counter market. The product, formulated with natural ingredients, has been prescribed by healthcare professionals for over two decades.

Lactation Support Supplements Market Segmentation

By Ingredient Type Outlook (Revenue-USD Million, 2020–2034)

- Fenugreek

- Moringa

- Milk Thistle

- Fennel

- Oatmeal

- Others

By Formulation Outlook (Revenue-USD Million, 2020–2034)

- Capsules/Tablets

- Powder

- Liquid

- Others

By Sales Channel Outlook (Revenue-USD Million, 2020–2034)

- Online Sales Channel

- Direct Sales Channel

- Pharmacies/Drug Stores

- Other Offline Channels

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Lactation Support Supplements Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 643.04 million |

|

Market Size Value in 2025 |

USD 683.55 million |

|

Revenue Forecast by 2034 |

USD 1,209.90 million |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The lactation support supplements market has been segmented into detailed segments of ingredient type, formulation, and sales channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: Companies in the lactation support supplements market focus on product diversification, digital marketing, and expanding distribution channels to enhance market presence. Brands leverage e-commerce platforms, social media engagement, and influencer collaborations to reach a broader audience, particularly targeting new mothers. The emphasis on organic and clean-label ingredients aligns with consumer preferences, driving brand differentiation. Partnerships with healthcare professionals and maternity centers help build trust and credibility. Additionally, companies invest in research and development to introduce scientifically-backed formulations, strengthening their market position and consumer confidence.

FAQ's

The lactation support supplements market size was valued at USD 643.04 million in 2024 and is projected to grow to USD 1,209.90 million by 2034.

The market is projected to register a CAGR of 6.5% during the forecast period, 2024-2034.

North America had the largest share of the market.

Notable participants include ACTIF USA; Anya Labs, Inc.; Fairhaven Health, LLC; Herbaland Naturals Inc.; Legendary Milk LLC; Milky Mama LLC; Mommy Knows Best; Mommy's Bliss, Inc.; Motherlove Herbal Company; Oat Mama, LLC; Pink Stork; Rumina Naturals, Inc.; and UpSpring LLC.

The fenugreek segment accounted for the larger share of the market in 2024.

The capsules/tablets segment accounted for the larger share of the market in 2024.