Laboratory Proficiency Testing Market Share, Size, Trends, Industry Analysis Report, By Industry (Clinical Diagnostics, Cannabis, Microbiology, Others), By Technology (Cell Culture, PCR, Others), By End-use (CROs, Hospitals, Others), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4388

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

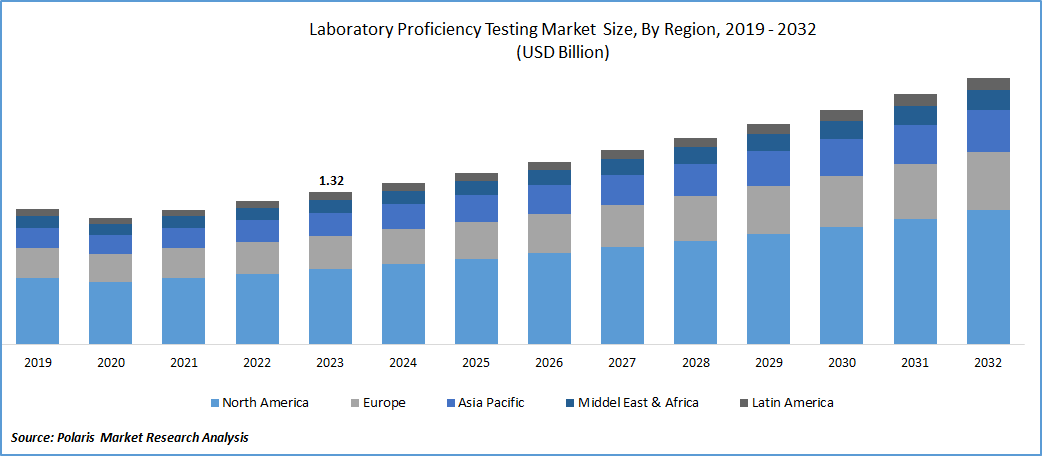

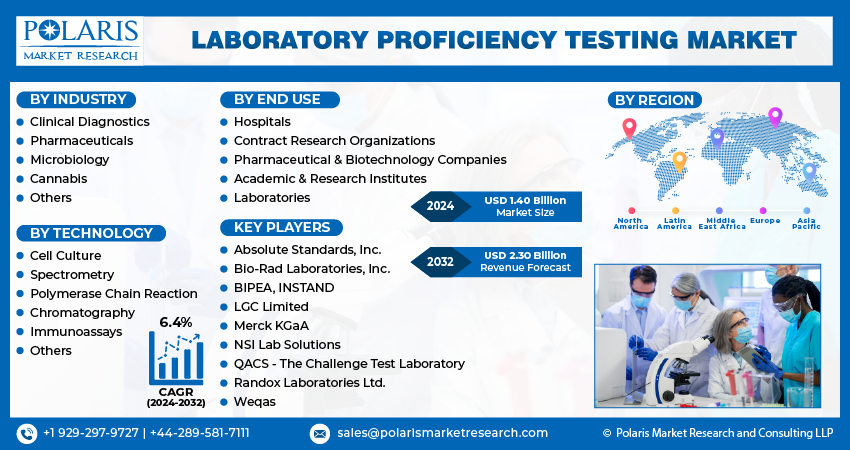

The global laboratory proficiency testing market was valued at USD 1.32 billion in 2023 and is expected to grow at a CAGR of 6.4% during the forecast period.

Factors driving this growth include a heightened emphasis on water testing, the legalization of medical cannabis, a surge in the number of cannabis testing laboratories, an increase in foodborne illnesses, a rise in cases of chemical contamination in foods, and the ongoing introduction of new products and services.

Proficiency testing (PT) is employed in diagnosing groundwater age using tritium to map aquifer reserves and assess their vulnerability to surface pollution. The International Atomic Energy Agency (IAEA) reports that only half of the 78 laboratories conducting this test meet the necessary analytical testing standards. Various organizations support laboratories in ensuring the calibration of instruments and verifying their performance. For example, in September 2020, the IAEA provided training to laboratories in tritium testing and the interpretation of data.

To Understand More About this Research:Request a Free Sample Report

Moreover, laboratory standards of practice, exemplified by programs like the Cannabis Laboratory Accreditation Program (CanNaLAP), emphasize the significance of proficiency testing. They offer guidance on the types of samples suitable for testing and the criteria for evaluating results. Additionally, many cannabis production facilities undergo regular inspections by state governments. Organizations like the American Council of Independent Laboratories (ACIL) collaborate with federal agencies to establish standards and protocols for the handling, sampling, testing, and inspection of cannabis products.

A significant technological trend in laboratory proficiency testing (PT) involves the incorporation of digital platforms and software solutions. These technologies streamline various aspects of the PT process, including the submission of test results, data analysis, and reporting. The integration of digital platforms offers a more efficient and standardized approach, enabling laboratories to participate remotely, receive real-time feedback, and compare their performance with peers. Moreover, these solutions support data management, quality control, and trend analysis, ultimately elevating the accuracy and effectiveness of PT programs.

A forthcoming trend in laboratory proficiency testing involves the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms. AI and ML have the capability to analyze extensive proficiency testing data, recognize patterns, and offer valuable insights to laboratories for enhancing their performance. These technologies play a crucial role in pinpointing areas for improvement, predicting potential errors, and providing personalized recommendations. The incorporation of AI and ML in proficiency testing holds promise for enhancing laboratory quality and efficiency soon.

Industry Dynamics

Growth Drivers

Increasing Awareness

Growing awareness among laboratories about the importance of proficiency testing in maintaining accuracy and credibility is driving participation. Educational initiatives and outreach programs contribute to increased awareness.

Proficiency testing (PT) for the detection of endotoxin and pyrogen levels plays a crucial role in water testing. Endotoxins are toxic components released from the outer membrane of specific bacteria, while pyrogens are substances capable of causing fever and other adverse effects. PT ensures that laboratories can accurately measure and assess the levels of endotoxins and pyrogens in water samples. It also verifies the laboratory's competence in employing appropriate testing methods, such as Limulus Amebocyte Lysate (LAL) assays, to detect and quantify these contaminants.

Accurate testing in this regard is vital for evaluating the safety and quality of water, particularly in industries like pharmaceutical production, medical device manufacturing, and dialysis. PT in endotoxin and pyrogen testing ensures reliable and consistent results, facilitating informed decisions to safeguard public health and ensure regulatory compliance in water-related sectors.

Report Segmentation

The market is primarily segmented based on industry, technology, end use, and region.

|

By Industry |

By Technology |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Industry Analysis

Clinical Diagnostic Segment Accounted for the Largest Market Share in 2023

Clinical diagnostics segment accounted for the largest share. These laboratories play a pivotal role in the healthcare ecosystem, conducting various diagnostic tests to support medical professionals in disease diagnosis and patient care. These laboratories have shown a lower likelihood of diagnostic errors compared to hospitals, as they specialize in diagnostic testing and are dedicated to maintaining high accuracy and precision in their results.

Cannabis testing segment will grow rapidly. With the expanding legalization of cannabis, there is a substantial rise in the demand for precise and dependable testing services. Laboratory proficiency testing (PT) plays a crucial role in validating the proficiency and precision of cannabis testing laboratories. This ensures that these laboratories adhere to regulatory standards and offer consumers the confidence that cannabis products meet specified quality and safety criteria.

By Technology Analysis

Cell Culture Segment Held the Significant Market Share in 2023

Cell culture segment held the significant market share. The escalating adoption of cell-culture-based products, such as monoclonal antibodies, has led to an increased need for cell culture tests to optimize the production of microbial strain cultures. Proficiency testing in this domain is centered on evaluating laboratory efficacy and detecting contaminants and impurities present in cell cultures. Minerva Biolabs stands out as a notable provider of proficiency tests designed to assess common contaminants and evaluate a laboratory's sensitivity to yeast/fungi, bacteria, and mycoplasmas.

Chromatography segment is expected to gain substantial growth rate. To ensure the effectiveness of chromatography devices and the dependability of test results, proficiency testing materials are accessible. For instance, Merck, provides a comprehensive selection of gas chromatography proficiency testing materials at cost-effective prices, with offerings starting as low as USD 257. These proficiency testing programs empower laboratories to validate their chromatography techniques, evaluate their performance, and improve the accuracy and consistency of their analytical results.

Regional Insights

North America Dominated the Global Market in 2023

North America dominated the global laboratory proficiency testing market. This can be ascribed to the advanced healthcare system and a high adoption rate of proficiency testing (PT). The well-established regulatory framework in this region places a strong emphasis on quality management, contributing positively to market growth. The extensive availability of PT programs further enhances the market potential. Additionally, the stringent environmental and water safety regulations are driving the demand for laboratory tests, thereby boosting the need for laboratory proficiency tests in the region.

The Asia Pacific will grow with substantial pace. This can be attributed to the increasing awareness of healthcare practices and a growing number of laboratories seeking international accreditations in the region. Furthermore, region is emerging as a hub for international biopharmaceutical and pharmaceutical companies, benefiting from the region's cost-effective labor and the production of high-quality products. In this context, the ongoing laboratory testing of raw materials, finished products, and microbial cultures for production and FDA approval becomes crucial for maintaining quality standards and meeting regulatory requirements.

Key Market Players & Competitive Insights

Major market players are implementing strategies such as launching new products, engaging in collaborations, and expanding into different geographical regions to enhance their presence on a global scale.

Some of the major players operating in the global market include:

- Absolute Standards, Inc.

- Bio-Rad Laboratories, Inc.

- BIPEA

- INSTAND

- LGC Limited

- Merck KGaA

- NSI Lab Solutions

- QACS - The Challenge Test Laboratory

- Randox Laboratories Ltd.

- Weqas

Recent Developments

- In April 2023, BIPEA has introduced the PTS 110A, a new Proficiency Testing Scheme designed to allow testing laboratories to evaluate their analytical capabilities through the analysis of a rice sample. This initiative aims to empower laboratories to assess and improve their performance in the analysis of rice samples, fostering excellence in the field.

- In April 2023, Trust in Testing has introduced national standards for cannabis testing, with the goal of improving the reliability and credibility of testing practices throughout the industry.

Laboratory Proficiency Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.40 billion |

|

Revenue forecast in 2032 |

USD 2.30 billion |

|

CAGR |

6.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Industry, By Technology, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in Laboratory Proficiency Testing Market include Absolute Standards, Bio-Rad Laboratories, BIPEA, INSTAND, LGC Limited.

The global laboratory proficiency testing market is expected to grow at a CAGR of 6.4% during the forecast period.

Laboratory Proficiency Testing Market report covering key segments are industry, technology, end use, and region

The key driving factors in Laboratory Proficiency Testing Market are Increasing Awareness

Laboratory Proficiency Testing Market Size Worth $ 2.30 Billion By 2032