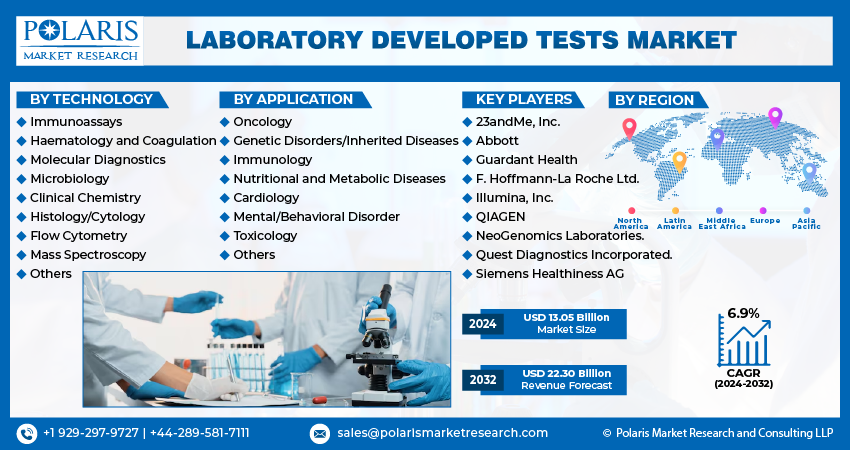

Laboratory Developed Tests Market Share, Size, Trends, Industry Analysis Report, By Technology (Immunoassays, Hematology and Coagulation, Molecular Diagnostics, Microbiology, Clinical Chemistry, Histology/Cytology, Flow Cytometry, Mass Spectroscopy, and Others); By Application; And By Region; Segment Forecast, 2024- 2032

- Published Date:May-2024

- Pages: 117

- Format: PDF

- Report ID: PM4910

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

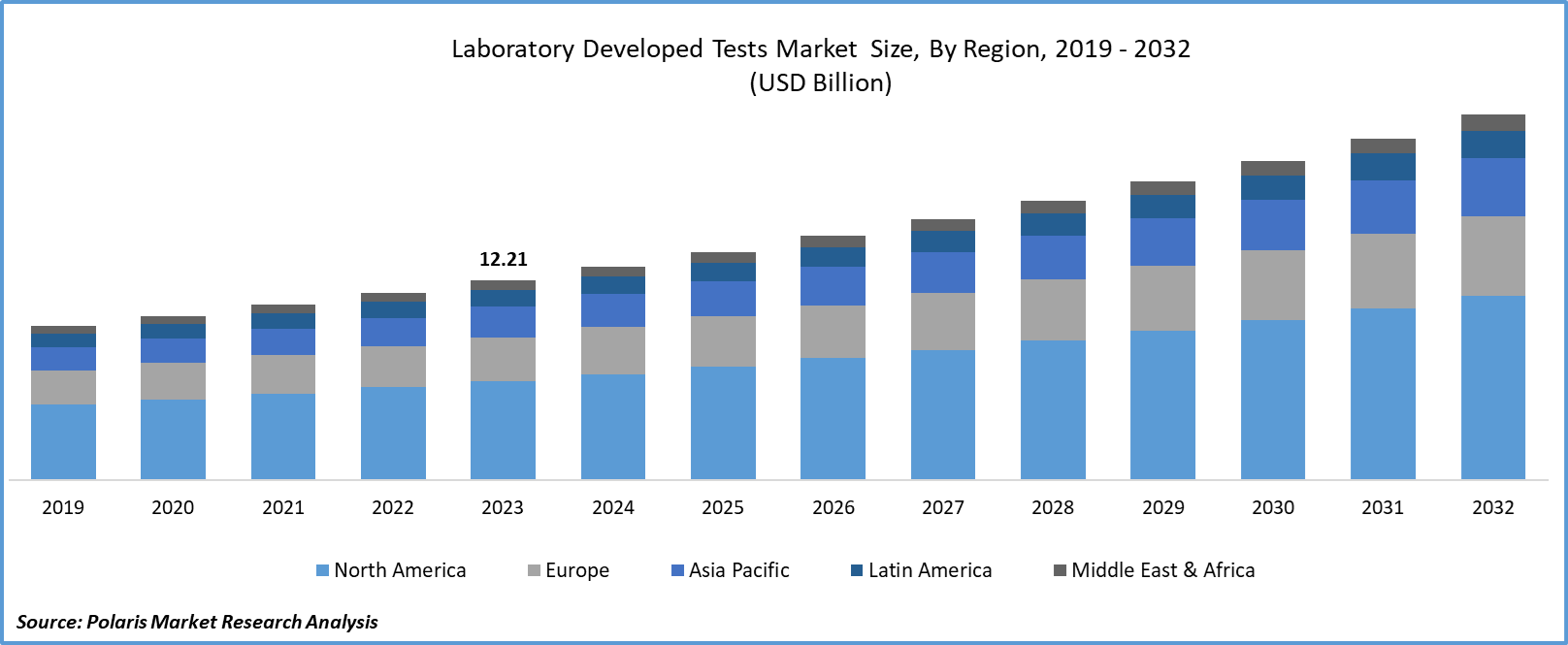

The laboratory developed tests market size was valued at USD 12.21 billion in 2023. The market is anticipated to grow from USD 13.05 billion in 2024 to USD 22.30 billion by 2032, exhibiting a CAGR of 6.9% during the forecast period.

Industry Trend

Laboratory developed tests (LDTs) and in vitro diagnostic products (IVDs) are vital tools used in clinical settings. These products are crafted, produced, and utilized within a single clinical laboratory certified under the Clinical Laboratory Improvement Amendments of 1988 (CLIA), ensuring adherence to high complexity testing standards.

Under the FD&C Act, IVDs encompass devices manufactured by laboratories. They are employed for gathering, preparing, and analyzing human body specimens like blood, saliva, or tissue. IVDs, which include LDTs, play a crucial role in detecting substances such as proteins, glucose, cholesterol, or DNA within the body. This information aids in diagnosing, monitoring, or determining treatment for various diseases and conditions, contributing to comprehensive patient care.

To Understand More About this Research: Request a Free Sample Report

LDTs are developed, validated, and performed within clinical laboratories, such as hospital laboratories, independent reference laboratories, academic research laboratories, and specialized diagnostic laboratories. These laboratories must comply with regulatory standards, such as the Clinical Laboratory Improvement Amendments (CLIA), to ensure the quality, accuracy, and reliability of test results. CLIA regulations encompass a set of quality standards that cover the entire testing process, from pre-analytical to analytical and post-analytical phases, and include requirements for personnel qualifications, quality control, proficiency testing, and laboratory inspection. Adherence to these standards is crucial to ensure that LDTs deliver accurate and reliable results that can inform clinical decision-making and improve patient outcomes.

Moreover, Diagnostic companies often collaborate with pharmaceutical firms, biotechnology companies, and academic institutions to develop and validate LDTs for specific diseases or therapeutic areas. These partnerships leverage expertise, resources, and technologies to accelerate the development and commercialization of innovative diagnostic tests.

For instance, in January 2023, QIAGEN revealed a strategic collaboration with Helix aimed at advancing companion diagnostics for hereditary diseases. The partnership will use the Helix Laboratory Platform, which got approval from the U.S. Food & Drug Administration to be the first-ever class II authorization for a whole exome sequencing platform. This provides a creative solution for biopharmaceutical customers who are working on therapies for hereditary diseases.

LDTs, or laboratory-developed tests, have a broad range of applications in healthcare, including oncology, infectious diseases, genetic disorders, cardiovascular diseases, autoimmune diseases, and neurological disorders. These tests play a crucial role in disease diagnosis, patient monitoring, treatment selection, and prognosis assessment.

Key Takeaway

- European dominated the largest market and contributed to more than 38% of the share in 2023.

- The North America market is expected to be the fastest-growing CAGR during the forecast period.

- By technology, the molecular diagnostics segment accounted for the largest market share in 2023.

- By application category, the oncology segment is projected to grow at a fastest CAGR during the projected period.

What are the Market Drivers Driving the Demand for the Laboratory Developed Tests Market?

Growing Prevalence of Chronic Diseases have Been Projected to Spur Market Demand

The growing incidence and prevalence of chronic diseases, encompassing conditions like cancer, cardiovascular diseases, diabetes, and infectious diseases, are significantly influencing the demand for diagnostic testing. As these diseases become more widespread, there is a pressing need for timely and accurate identification to initiate appropriate interventions and improve patient outcomes. Laboratory developed tests (LDTs) are instrumental in this regard, serving as essential tools for early disease detection, ongoing monitoring, and personalized treatment approaches.

LDTs offer a proactive means of identifying the presence of chronic conditions at their nascent stages, often before symptoms manifest. This early detection enables healthcare providers to intervene swiftly, implementing treatment strategies when they are most effective and potentially mitigating the progression of the disease. For example, LDTs can detect specific biomarkers or genetic mutations associated with certain cancers, allowing for targeted screening programs or surveillance of high-risk populations.

Moreover, LDTs play a pivotal role in monitoring the effectiveness of treatments and disease progression over time. For patients with chronic conditions, regular monitoring is crucial to assess response to therapy, adjust treatment regimens as necessary, and identify any adverse effects or complications that may arise. By providing clinicians with real-time data on disease status and treatment response, LDTs empower them to make informed decisions and tailor interventions to the individual needs of each patient.

Which Factor is Restraining the Demand for Laboratory Developed Tests?

Compliance Burden is Expected to Hinder the Growth of the Market

Ensuring compliance with regulatory standards, particularly the Clinical Laboratory Improvement Amendments (CLIA) in the U.S., demands substantial resources from laboratories involved in developing and providing Laboratory Developed Tests (LDTs). To maintain CLIA certification, laboratories must exhibit proficiency across test development, validation, quality assurance, and proficiency testing. The demanding nature of compliance, coupled with the prospect of regulatory scrutiny or enforcement measures, might dissuade laboratories from investing in LDT development or diversifying their test offerings. Consequently, this could restrict the availability and uptake of LDTs in the healthcare market, potentially limiting access to innovative diagnostic solutions and impeding advancements in patient care.

Report Segmentation

The market is primarily segmented based on technology, application, and region.

|

By Technology |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Technology Insights

Based on technology analysis, the market is segmented into immunoassays, hematology and coagulation, molecular diagnostics, microbiology, clinical chemistry, histology/cytology, flow cytometry, mass spectroscopy, and others. The molecular diagnostics segment held the largest market in 2023. Molecular diagnostics have witnessed significant technological advancements, enabling the development of highly sensitive and specific tests for various diseases and conditions. These tests utilize techniques such as polymerase chain reaction (PCR), next-generation sequencing (NGS), and nucleic acid amplification to detect genetic mutations, pathogens, and biomarkers associated with diseases. Molecular diagnostics offer a wide range of clinical applications across different disease areas, including oncology, infectious diseases, genetic disorders, and personalized medicine. These tests play a crucial role in disease diagnosis, prognosis, treatment selection, and monitoring, contributing to improved patient outcomes and precision healthcare delivery.

By Application Insights

Based on application analysis, the market has been segmented on the basis of oncology, genetic disorders/inherited diseases, immunology, nutritional and metabolic diseases, cardiology, mental/behavioral disorder, toxicology, others. The oncology segment is anticipated to experience the highest compound annual growth rate (CAGR) during the forecast period. Cancer prevalence continues to rise globally, driven by factors such as aging populations, lifestyle changes, and environmental factors. As cancer remains a leading cause of morbidity and mortality worldwide, there is a growing need for accurate and timely diagnostic tests to detect and manage various types of cancer. The field of oncology has witnessed rapid advancements in research, leading to the identification of novel biomarkers, genetic mutations, and therapeutic targets associated with different types of cancer. Laboratory developed tests (LDTs) play a crucial role in translating these discoveries into clinical practice by enabling the detection of specific molecular alterations or biomarkers indicative of cancer presence, prognosis, and treatment response.

Regional Insights

EuropeTop of Form

Europe region accounted for the largest market share in 2023. The dominance of laboratory-developed tests (LDTs) is further propelled by a notable surge in the occurrences of non-communicable diseases, intensifying the necessity for early disease detection tools and tests to effectively manage the escalating prevalence. This heightened demand stems from the imperative to swiftly identify and address health concerns, optimizing treatment outcomes and patient care. Additionally, the aging population in Europe contributes significantly to the escalating demand for advanced healthcare services, notably including LDTs. These tests serve as indispensable tools in diagnosing a spectrum of age-related disorders, catering to the unique healthcare needs of elderly individuals. As such, the convergence of these factors underscores the critical role of LDTs in meeting the burgeoning healthcare demands of an aging population and addressing the increasing prevalence of non-communicable diseases across Europe.

North America

North America is expected for the growth of fastest CAGR during the forecast period. The region has witnessed a growing demand for precision medicine approaches, which emphasize tailored treatment strategies based on individual patient characteristics. America faces significant healthcare challenges due to the increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, and diabetes. LDTs are essential tools for early disease detection, treatment monitoring, and personalized medicine, contributing to market growth as healthcare providers seek to address these challenges.

Competitive Landscape

The competitive landscape of the laboratory developed tests market, the market comprises a diverse array of players, including diagnostic companies, healthcare providers, academic institutions, and research organizations. These entities compete to develop, validate, and commercialize innovative LDTs across various disease areas and clinical applications. Competition in the LDTs market is driven by innovation, with companies continually striving to develop new and improved tests that offer enhanced performance, accuracy, and clinical utility. This includes advancements in molecular diagnostics, genomic testing, and other specialized testing modalities.

Some of the major players operating in the global market include:

- 23andMe, Inc.

- Abbott

- F. Hoffmann-La Roche Ltd.

- Guardant Health

- Illumina, Inc.

- NeoGenomics Laboratories.

- QIAGEN

- Quest Diagnostics Incorporated.

- Siemens Healthiness AG

Recent Developments

- In October 2023, PathAI Diagnostics introduced the world’s 1st AI-assisted laboratory-developed test, which was developed for histologic scoring and staging of metabolic dysfunction-associated liver disease. The newly developed tool uses an AI algorithm, which is proven to reduce the inter & intra-operator variability in the CRN scoring.

- In January 2023, QIAGEN, a leading provider of molecular diagnostics solutions, recently launched the EZ2 Connect MDx platform, aimed at revolutionizing automated sample processing within diagnostic laboratories. This innovative initiative is anticipated to empower clinical labs in achieving reliable and efficient nucleic acid purification.

- In January 2023, Quanterix broadened its range of laboratory-developed tests by introducing neurofilament light chain tests. This innovative blood test amplifies essential brain health biomarkers, facilitating optimal clinical care and driving forward research efforts.

Report Coverage

The laboratory developed tests market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, technology, application and their futuristic growth opportunities.

Laboratory Developed Tests Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 13.05 billion |

|

Revenue forecast in 2032 |

USD 22.30 billion |

|

CAGR |

6.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Technology, By Application, And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global laboratory developed tests market size is expected to reach USD 22.30 billion by 2032

Key players in the market are 23andMe, Inc., Abbott, F. Hoffmann-La Roche Ltd., Guardant Health, Illumina, Inc

Europe contribute notably towards the global Laboratory Developed Tests Market

The laboratory developed tests market exhibiting a CAGR of 6.9% during the forecast period.

The Laboratory Developed Tests Market report covering key segments are technology, application and region.