L-Citrulline Market Size, Share, Trends, Industry Analysis Report: By Form Type (Powder and Crystal), By Classification, By Distribution Channel, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Aug-2024

- Pages: 117

- Format: PDF

- Report ID: PM5025

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

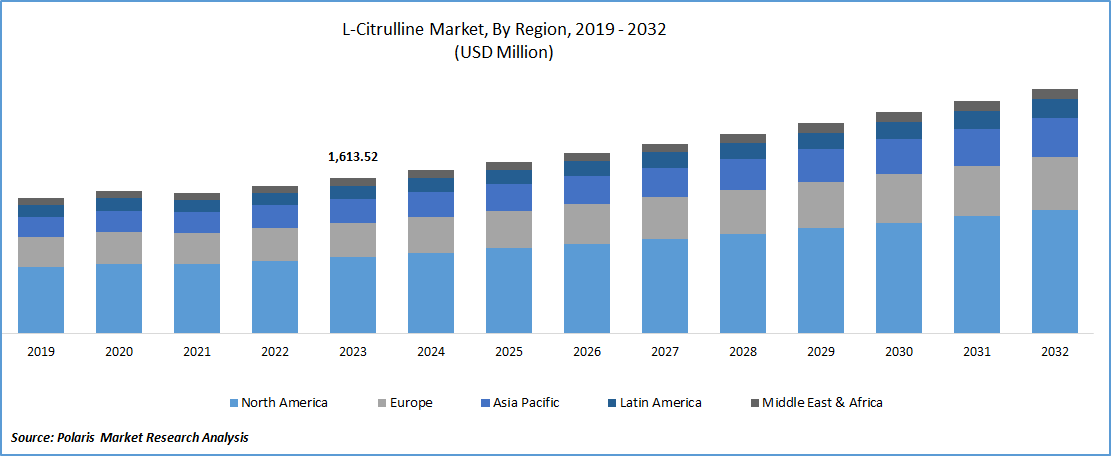

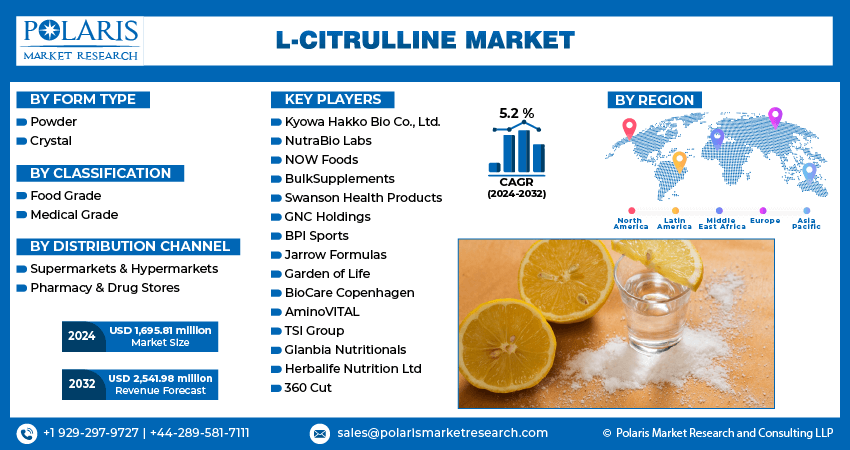

The global L-citrulline market size was valued at USD 1,613.52 million in 2023. The market is projected to grow from USD 1,695.81 million in 2024 to USD 2,541.98 million by 2032, exhibiting a CAGR of 5.2% during the forecast period.

The global L-citrulline market is experiencing notable growth due to its applications in the sports nutrition and dietary supplement sectors, driven by its benefits in improving exercise performance and reducing muscle fatigue. This amino acid is gaining popularity among athletes and fitness enthusiasts for its potential to enhance endurance and recovery. Key drivers of this market include the rising demand for natural and performance-enhancing supplements and increasing awareness of the health benefits associated with L-citrulline. Notable trends include the expansion of L-citrulline-based products in the functional foods & beverages sector and the growing incorporation of L-citrulline in personalized nutrition solutions to cater to individual health needs.

To Understand More About this Research:Request a Free Sample Report

L-Citrulline Market Outlook

Growing Demand for Sports Nutrition

The increasing focus on health and fitness is driving the demand for L-citrulline in sports nutrition. Athletes and fitness enthusiasts are increasingly turning to L-citrulline supplements to enhance performance, reduce muscle soreness, and improve recovery times. This trend is fueled by the rising popularity of fitness activities and a growing awareness of the benefits of dietary supplements in achieving athletic goals. As a result, manufacturers are expanding their product lines to include L-citrulline in various forms such as powders, capsules, and drinks to cater to diverse consumer preferences.

Expansion into Functional Foods and Beverages

L-citrulline is making its way into functional foods and beverages, reflecting a broader trend of integrating beneficial nutrients into everyday products. This expansion is driven by consumer interest in convenient ways to incorporate health-boosting ingredients into their diets. Companies are developing new products such as energy drinks, protein bars, and functional water that contain L-citrulline, capitalizing on the growing trend of combining health benefits with convenience. This shift is expected to increase market reach and create new revenue streams for L-citrulline producers.

Rise of Personalized Nutrition Solutions

Personalized nutrition is a significant trend in the L-citrulline market, with increasing emphasis on tailoring dietary supplements to individual health needs. Advances in nutrition science and technology are enabling companies to offer customized L-citrulline formulations based on genetic, metabolic, or lifestyle factors. This trend is driven by a growing consumer preference for personalized health solutions and a desire for more targeted dietary interventions. As the market evolves, personalized L-citrulline products are expected to become prevalent, reflecting a broader movement toward individualized wellness and nutrition strategies.

L-Citrulline Market Segment Insights

L-Citrulline Market – Form Type-Based Insights

In the global market, the segmental analysis based on form type reveals distinct trends and dynamics. The powder segment dominated the market in 2023 due to its versatility and ease of incorporation into various dietary supplements and functional foods. This form is favored for its flexibility in dosage and its suitability for blending into protein powders, energy drinks, and pre-workout formulations. On the other hand, the crystal form, while less prevalent, is gaining traction in niche applications where high purity and specific formulation requirements are crucial.

The powder segment is expected to witness highest growth rate during the forecast period, driven by its widespread use in the expanding sports nutrition and dietary supplement markets. As consumer demand for convenient and effective performance-enhancing products rises, the powder segment continues to experience robust growth. Meanwhile, the crystal segment, though growing at a slower pace, is witnessing increased interest in high-end, specialized applications. This growth reflects a broader trend of consumers seeking high-quality, targeted supplements to meet their specific health and performance needs.

L-Citrulline Market – Classification-Based Insights

In the global L-citrulline market, the segmental analysis based on classification highlights notable trends. In 2023, the food grade segment dominated the market, due to its extensive use in dietary supplements, functional foods, and beverages aimed at enhancing athletic performance and overall wellness. This segment benefits from the high demand for sports nutrition products and the growing consumer interest in health-oriented functional foods. However, the medical grade segment, which includes L-citrulline used in clinical settings or for specific therapeutic purposes, is a smaller but increasingly important segment.

The medical grade segment is witnessing a higher growth rate, driven by advancements in medical research and a rising focus on the potential therapeutic benefits of L-citrulline in managing conditions such as cardiovascular diseases and erectile dysfunction. As scientific evidence supporting these medical applications continues to grow, the medical grade segment is expected to expand rapidly in the coming years. This shift reflects a broader trend toward integrating amino acids into therapeutic regimens and highlights the evolving role of L-citrulline beyond its traditional dietary applications.

L-Citrulline Market – Distribution Channel-Based Insights

In the global L-citrulline market, the distribution channel segmental analysis reveals significant patterns. In 2023, the supermarkets & hypermarkets segment dominated the market due to their wide reach and the convenience offered by them in purchasing dietary supplements and health products. These retail channels are preferred for their extensive product selections and competitive pricing, which attract a broad consumer base seeking L-citrulline supplements in bulk or as part of a regular shopping routine.

The pharmacy & drug stores segment is experiencing a higher growth rate, driven by increasing consumer awareness of health and wellness products and a growing preference for purchasing supplements from specialized, trusted sources. Pharmacies and drug stores are becoming key players in the distribution of L-citrulline due to their role in providing personalized health advice and their ability to cater to specific medical and health needs. This trend highlights a shift toward more targeted and health-focused purchasing behaviors, reflecting the rising demand for reliable and accessible supplement options in specialized retail environments.

Global L-Citrulline Market, Segmental Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

L-Citrulline Market Regional Insights

By region, the study provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads the global L-citrulline market with strong demand driven by health-conscious consumers and a robust fitness industry, while Europe follows with significant interest in functional foods and dietary supplements. The Asia Pacific market is experiencing rapid growth due to increasing health awareness and rising disposable incomes, particularly in China, Japan, and India. Latin America shows steady growth with expanding fitness trends and a growing middle-class population, although it remains smaller compared to other regions. The Middle East & Africa are emerging markets, with growth driven by increasing health and wellness awareness and rising disposable incomes, though the market is still developing compared to other regions.

L-Citrulline Market Regional Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

The Europe L-citrulline market follows closely, with growth spurred by increasing awareness of functional foods and dietary supplements. The region’s demand is propelled by the rising interest in natural and performance-enhancing ingredients. Countries such as Germany, the UK, and France are key markets, with stringent regulations ensuring high-quality products and expanding research into L-citrulline’s benefits, particularly in sports nutrition and cardiovascular health.

The Asia Pacific L-citrulline market is experiencing rapid growth due to rising health awareness and increasing disposable incomes. Countries such as China, Japan, and India are significant contributors, with growing fitness trends and expanding dietary supplement sectors. The market is also driven by an increasing inclination toward preventive healthcare and a burgeoning sports nutrition industry in these rapidly developing economies.

L-Citrulline Market – Key Players and Competitive Insights:

Kyowa Hakko Bio Co., Ltd.; NutraBio Labs; NOW Foods; and BulkSupplements are among the prominent key players in the global L-citrulline market. Other significant players are Swanson Health Products, GNC Holdings, BPI Sports, Jarrow Formulas, and Garden of Life. Additionally, BioCare Copenhagen, AminoVITAL, TSI Group, Glanbia Nutritionals, Herbalife Nutrition Ltd., and 360 Cut contribute to the market’s competitive landscape. These companies are known for their extensive product offerings and established brands, providing L-citrulline in various forms such as powders, capsules, and tablets to cater to diverse consumer preferences.

The competitive analysis of the L-citrulline market reveals a highly competitive environment characterized by innovation and strategic positioning. Major players differentiate themselves through the introduction of new formulations and product lines that combine L-citrulline with other performance-enhancing ingredients. Strong distribution networks and effective marketing strategies are key factors in maintaining market dominance. Companies are also investing in research and development to improve product quality and meet evolving consumer demands.

Insights into the market indicate a trend toward increasing consumer awareness of the benefits of L-citrulline for sports performance and overall health. This has led to heightened competition among key players, who are focusing on expanding their reach in established and emerging markets. Strategic partnerships, acquisitions, and expansions into new geographic regions are common strategies adopted by these companies to enhance their market position and address the growing demand for effective dietary supplements.

Kyowa Hakko Bio used adopted Co., Ltd. is a major player known for its high-quality L-citrulline products, particularly under the brand name Kyowa Quality L-Citrulline. The company is renowned for its advanced fermentation technology and rigorous quality control processes, ensuring the purity and efficacy of its products. In recent news, In July 2023, Kyowa Hakko Bio announced the launch of a new L-citrulline formulation designed to enhance exercise performance and recovery, reflecting their commitment to innovation and meeting evolving consumer needs.

NutraBio Labs is another significant market player, offering a wide range of dietary supplements, including L-citrulline. Known for its transparency and high-quality standards, NutraBio Labs provides products that are tested for purity and potency. In March 2024, NutraBio Labs expanded its product line with a new L-citrulline blend that incorporates additional ingredients aimed at optimizing workout performance and muscle recovery, showcasing their focus on delivering effective and comprehensive supplement solutions.

Key Companies in L-Citrulline Market:

- Kyowa Hakko Bio Co., Ltd.

- NutraBio Labs

- NOW Foods

- BulkSupplements

- Swanson Health Products

- GNC Holdings

- BPI Sports

- Jarrow Formulas

- Garden of Life

- BioCare Copenhagen

- AminoVITAL

- TSI Group

- Glanbia Nutritionals

- Herbalife Nutrition Ltd

- 360 Cut

L-Citrulline Industry Developments

- In March 2024, NutraBio Labs expanded its product line with a new L-citrulline blend that incorporates additional ingredients.

- In July 2023, Kyowa Hakko Bio announced the launch of a new L-citrulline formulation designed to enhance exercise performance.

L-Citrulline Market Segmentation:

L-Citrulline– Form Type Outlook

- Powder

- Crystal

L-Citrulline– Classification Outlook

- Food Grade

- Medical Grade

L-Citrulline– Distribution Channel Outlook

- Supermarkets & Hypermarkets

- Pharmacy & Drug Stores

L-Citrulline– Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

L-Citrulline Market Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,613.52 million |

|

Market size value in 2024 |

USD 1,695.81 million |

|

Revenue forecast in 2032 |

USD 2,541.98 million |

|

CAGR |

5.2 % from 2024 to 2032 |

|

Base year |

2023 |

|

Historical data |

2019–2022 |

|

Forecast period |

2024–2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive landscape |

|

|

Report format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentations. |

How the report is valuable for an organization?

Workflow/Innovation Strategy: The L-citrulline market report provides detailed segmentation of form types, such as powder and crystal. In addition, the study provides the reader with a detailed understanding of the different distribution channels and classifications.

Growth/Marketing Strategy: The companies are increasingly investing in research and development to innovate new formulations and combinations that meet consumer needs, such as performance enhancement and overall wellness. Effective marketing strategies include leveraging digital platforms for targeted advertising, influencer partnerships, and educational content to raise awareness about the benefits of L-citrulline

FAQ's

The global L-citrulline market size was valued at USD 1,613.52 million in 2023 and is projected to grow to USD 2,541.98 million by 2032

The global market is projected to register a CAGR of 5.2% during 2023–2032

North America accounted for the largest global market share.

The powder segment dominated the market in 2023.

L-Citrulline, a nonessential amino acid, plays a crucial role in the urea cycle, which helps the body eliminate ammonia, a byproduct of protein metabolism. It is found in various foods, particularly in watermelon, and is commonly used as a dietary supplement. L-citrulline is known for its potential benefits in enhancing exercise performance, reducing muscle soreness, and improving cardiovascular health. It is often taken by athletes and fitness enthusiasts to boost endurance, increase nitric oxide levels, and improve overall exercise recovery. In addition to sports nutrition, L-citrulline is being studied for its possible therapeutic effects on conditions such as hypertension and erectile dysfunction

A few key trends observed in this market are described below: Rising Popularity in Sports Nutrition: Increasing demand for performance-enhancing supplements among athletes and fitness enthusiasts. Growth of Functional Foods and Beverages: Integration of L-citrulline into various food and beverage products to enhance health benefits and convenience. Expansion of Personalized Nutrition: Customization of L-citrulline products based on individual health needs and fitness goals. Advancements in Formulations: Development of new L-citrulline blends and combinations with other nutrients for improved efficacy. Increased Online and Direct-to-Consumer Sales: Growing emphasis on digital marketing and e-commerce platforms to reach health-conscious consumers.

For a new company entering the global L-citrulline market, focusing on innovation and differentiation is crucial. It should prioritize developing unique formulations that combine L-citrulline with other performance-enhancing or health-boosting ingredients to cater to consumer needs, such as endurance or recovery. Emphasizing high-quality production processes and transparent labeling will help build trust and credibility. Additionally, leveraging digital marketing strategies, including social media and influencer partnerships, can effectively reach and engage health-conscious consumers. Expanding into emerging markets with growing fitness and health trends, and offering personalized products tailored to individual health goals, can also provide a competitive edge.

Companies producing L-citrulline, health and nutritional manufacturer s, distributors, and consultants, and pharmaceutical and supplement manufacturers