Kuwait Crowdfunding Platform Market Size, Share, Trends, Industry Analysis Report: By Platform Type (Private and Public), Type, Application, End User – Market Forecast, 2025 - 2034

- Published Date:Mar-2025

- Pages: 73

- Format: PDF

- Report ID: PM5390

- Base Year: 2024

- Historical Data: 2020-2023

Kuwait Crowdfunding Platform Market Overview

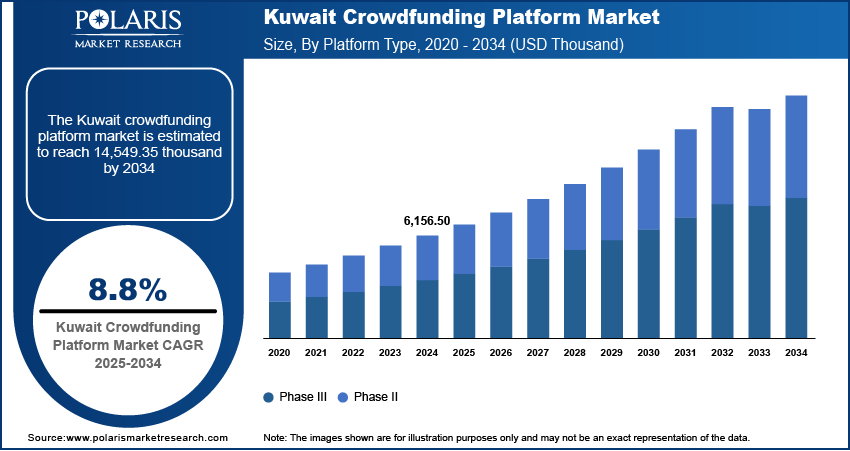

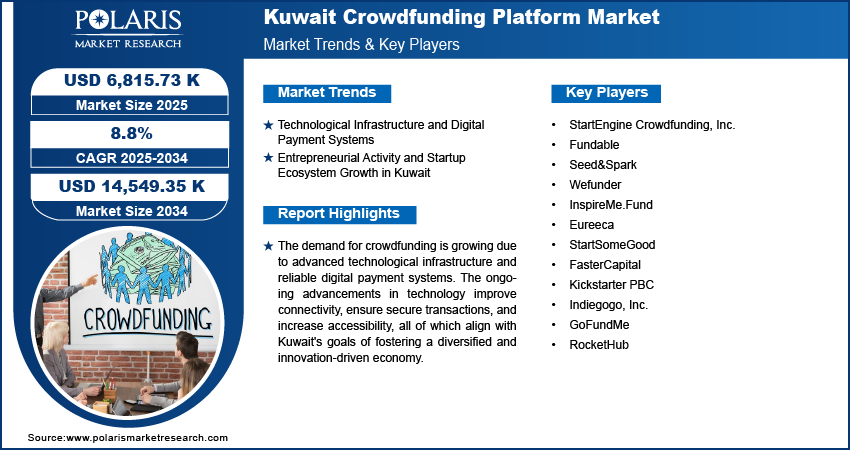

Kuwait crowdfunding platform market size was valued at USD 6,156.50 thousand in 2024. The market is projected to grow from USD 6,815.73 thousand in 2025 to USD 14,549.35 thousand by 2034, exhibiting a CAGR of 8.8% during the forecast period.

A crowdfunding platform is a digital marketplace where individuals or organizations raise funds for various projects, ideas, or causes by pooling small contributions from a large number of individuals. These platforms are often used to fund business startups, creative ventures, social causes, or personal needs. Crowdfunding provides an accessible alternative to traditional financing methods, enabling project creators to connect directly with potential backers and investors. The popularity of crowdfunding lies in its ability to democratize funding, allowing even small contributors to make a meaningful impact on innovative and worthwhile initiatives.

The Kuwait crowdfunding platform market demand is steadily growing as more entrepreneurs, innovators, and individuals recognize its potential. Kuwait's economic environment, increasingly focused on diversification and innovation, has created a solid foundation for the widespread adoption of crowdfunding platforms. Entrepreneurs view these platforms as a way to secure both financial support and public validation for their ideas. Furthermore, the rise of digital technology and the expansion of online communities have made it easier for individuals in Kuwait to participate in funding campaigns and share them within their networks, fostering increased engagement. This ongoing shift underscores the growing Kuwait crowdfunding platform market growth, positioning crowdfunding as an integral tool for entrepreneurship and innovation in the country. The Kuwait crowdfunding platform market size is poised for significant expansion as more people embrace these platforms as a viable alternative to traditional funding methods.

To Understand More About this Research: Request a Free Sample Report

Awareness and education about crowdfunding platforms are pivotal factors in the Kuwait crowdfunding platform market growth. Educational initiatives by governments, private entities, and the platforms themselves are empowering individuals with the knowledge needed to participate confidently in crowdfunding. Success stories and testimonials from previous campaigns also play a crucial role in demonstrating the value and reliability of crowdfunding, thereby encouraging more individuals and businesses to use these platforms.

Kuwait Crowdfunding Platform Market Driver Analysis

Technological Infrastructure and Digital Payment Systems

Kuwait's robust technological infrastructure and advanced digital payment systems are driving the Kuwait crowdfunding platform market demand. The country's Vision 2035, which emphasizes economic diversification and digital transformation, has established a solid foundation for fostering innovation and entrepreneurship. Investments in digital infrastructure, including 5G and 6G networks, fiber optic cabling, and nationwide internet accessibility, have created a seamless digital ecosystem that supports online platforms, such as crowdfunding. This enhanced connectivity ensures that users across the country can effortlessly access and engage with crowdfunding platforms, significantly boosting their adoption and usage, and contributing to the growing Kuwait crowdfunding platform market share.

The integration of advanced digital payment systems further elevates the appeal and functionality of crowdfunding platforms in Kuwait. Secure and efficient payment gateways simplify the process for contributors to support projects, overcoming traditional barriers like geographic and financial constraints. These systems, regulated by Kuwait's Communication and Information Technology Regulatory Authority (CITRA), instill confidence in users by ensuring compliance with data privacy regulations and safeguarding sensitive financial information. This secure and efficient environment fosters increased participation from individuals and businesses, thereby driving Kuwait crowdfunding platform market growth.

Entrepreneurial Activity and Startup Ecosystem Growth in Kuwait

The rise of entrepreneurial activity and the growth of the startup ecosystem in Kuwait have fueled a growing demand for innovative financing solutions such as crowdfunding platforms. Entrepreneurs and small businesses are increasingly seeking alternative funding sources beyond traditional bank loans and venture capital, as these often come with stringent requirements or limited availability. Crowdfunding offers an inclusive and accessible means for startups to raise capital while engaging directly with potential customers and investors, making it a key driver in the Kuwait crowdfunding platform market. As this demand grows, Kuwait crowdfunding market size is expected to expand, reflecting the increasing reliance on crowdfunding as a viable financial solution in Kuwait.

The focus on supporting entrepreneurship has greatly increased the demand for crowdfunding platforms in Kuwait. Government and private sector efforts to help small businesses, along with a rising culture of innovation, have created a strong startup environment. This ecosystem needs financial tools intended for early-stage companies. For example, in August 2024, Kuwait introduced securities-based crowdfunding platforms to provide alternative financing solutions for small projects, support entrepreneurs, enhance digital infrastructure, and boost financial market competitiveness, while ensuring fairness and transparency. This initiative plays a pivotal role in the expansion of overall Kuwait crowdfunding platform market value, further solidifying crowdfunding as a vital tool for entrepreneurial growth in Kuwait.

Securities-based crowdfunding platforms also align with the broader goals of enhancing Kuwait’s financial market transparency and competitiveness. By leveraging digital infrastructure, crowdfunding reduces barriers to entry for entrepreneurs and increases visibility for investors seeking high-growth opportunities. Such tools empower entrepreneurs to showcase their ideas to a wider audience, fostering trust and collaboration within the ecosystem. As a result, these factors are expected to drive the Kuwait crowdfunding platform market growth.

Additionally, the Kuwait crowdfunding platform market trends highlight the significant influence of the startup and charity sectors on the participation of investors and fundraisers. The growing interest in supporting entrepreneurship, particularly among younger demographics, has contributed to the rise of startups, which in turn drives demand for crowdfunding platforms. Furthermore, strong government support for Islamic charitable giving, including initiatives like Waqf and Zakat, has played a key role in shaping the market. These factors have fostered a unique environment that supports the continued growth of the Kuwait crowdfunding platform market demand, positioning crowdfunding platforms as a prominent funding solution for both businesses and charitable causes.

Kuwait Crowdfunding Platform Market Segment Insights

Kuwait Crowdfunding Platform Market Assessment by Platform Type Insights

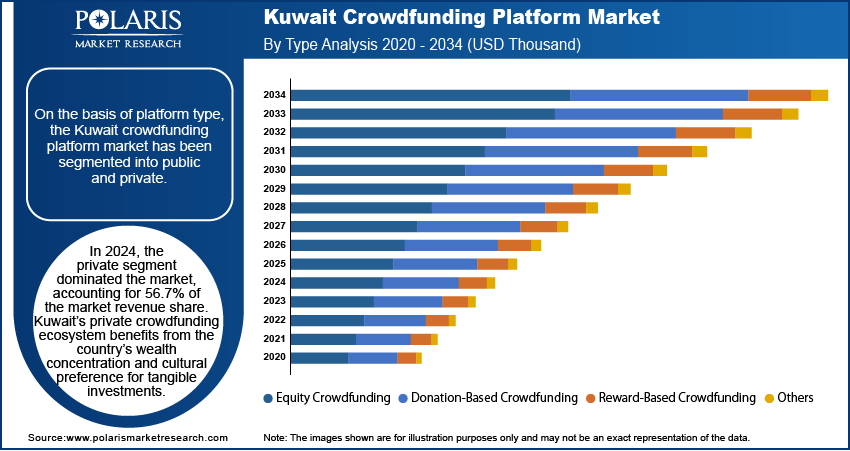

On the basis of platform type, the Kuwait crowdfunding platform market has been segmented into public and private. In 2024, the private segment dominated the market, accounting for 56.7% of the market revenue share. Kuwait’s private crowdfunding ecosystem benefits from the country’s wealth concentration and cultural preference for tangible investments. High-net-worth individuals and corporate entities favor equity-based platforms that promise returns and ownership stakes. Shariah-compliant investment options further enhance the appeal, aligning with the religious and ethical principles of Kuwaiti investors. As regulatory frameworks in Kuwait evolve to become more supportive of private equity participation, crowdfunding platforms are gaining increased attention. This interest is particularly notable among sophisticated investors who are drawn to the potential for high returns in emerging industries.

The Kuwait crowdfunding platform market for the private segment is presenting lucrative opportunities. However, in the near future, the growing demand for stringent regulatory compliance may restrict access for smaller investors. To capitalize on this demand, private crowdfunding platforms will need to prioritize transparency, implement robust investor protections, and develop tailored marketing strategies.

Kuwait Crowdfunding Platform Market Assessment by Application Insights

On the basis of application, the Kuwait crowdfunding platform market has been segmented into entrepreneurship, medical, social causes, and others. The entrepreneurship segment accounted for the largest share in 2024 and is expected to register at an 9.1% CAGR over the forecast period. In Kuwait crowdfunding platform market, entrepreneurship segment is witnessing significant growth in recent years, driven by both government initiatives and a vibrant, youthful population eager to innovate. The Kuwaiti government has supported entrepreneurship through various policies, such as the National Fund for small and medium enterprises development, which provides financial support and advisory services to new businesses. Additionally, the rise of tech hubs, such as the Kuwait National Fund for SMEs, has enabled entrepreneurs to access resources and mentorship, further fueling the startup culture.

Moreover, the rise of digital payment solutions and blockchain technology has enhanced the efficiency and transparency of crowdfunding campaigns, making them an increasingly attractive option for Kuwaiti entrepreneurs, propelling the Kuwait crowdfunding platform market demand.

Kuwait Crowdfunding Platform Market Key Market Players & Competitive Insights

Kuwait crowdfunding platform market key players are involved in continuous innovation, with companies focusing on improving platform accessibility, user experience, and integration with emerging technologies. Significant investment in research and development helps maintain a competitive edge, fostering advancements in platform efficiency, security, and compliance with evolving regulatory standards. Additionally, strategic partnerships, mergers, and acquisitions play a crucial role in expanding market presence and meeting diverse funding needs across sectors such as technology, real estate, healthcare, and small business ventures.

The Kuwait crowdfunding platform market report is characterized by key players such as StartEngine Crowdfunding, Inc.; Fundable; Seed&Spark; Wefunder; InspireMe.Fund; Eureeca; StartSomeGood; FasterCapital; Kickstarter PBC; Indiegogo, Inc.; GoFundMe; and RocketHub. These companies benefit from broad customer bases and well-established distribution networks, enhancing their market reach and penetration both locally and globally.

StartEngine Crowdfunding, Inc., established in 2014 and headquartered in Burbank, California, is an online investment platform that facilitates equity crowdfunding. StartEngine operates under several regulatory frameworks set by the US Securities and Exchange Commission (SEC), including Regulation A+, Regulation D, and Regulation Crowdfunding. Regulation A+ permits companies to raise up to USD 75 thousand from both accredited and non-accredited investors, while Regulation D is limited to accredited investors, allowing for unlimited capital raises with fewer disclosure requirements. Regulation Crowdfunding allows companies to raise up to USD 5 thousand within 12 months from both types of investors, with specific investment limits based on the investor's income and net worth. The platform primarily serves the US market and has facilitated over 1.3 billion in investments across various sectors such as technology, consumer products, and healthcare. The company implements online technology to connect entrepreneurs seeking funding with potential investors.

Fundable is a Software-as-a-Service (SaaS) funding platform that enables startups and small businesses to raise capital through rewards-based or equity-based crowdfunding. The company operates as a platform provider and does not offer investment advice or guidance on securities offerings. Fundable allows companies to create a detailed profile, select their preferred fundraising model, and collect commitments from investors. The company works through rewards-based funding and equity-based funding. In rewards-based crowdfunding, businesses offer tangible incentives such as product pre-orders or exclusive perks in exchange for funding, typically raising to USD 50 thousand. Fundable has facilitated over USD 700 thousand in committed funding through its network of more than 20,000 accredited investors. A range of companies use Fundable for capital raising across industries such as technology, healthcare, sustainable housing, and manufacturing. Examples include SmartAir, which focuses on smart home WiFi solutions; TibaRay, developing ultra-fast cancer radiation treatment; and NEIGHBR, which creates sustainable eco-villages.

List of Key Companies in Kuwait Crowdfunding Platform Market

- StartEngine Crowdfunding, Inc.

- Fundable

- Seed&Spark

- Wefunder

- InspireMe.Fund

- Eureeca

- StartSomeGood

- FasterCapital

- Kickstarter PBC

- Indiegogo, Inc.

- GoFundMe

- RocketHub

Kuwait Crowdfunding Platform Market Developments

November 2024: The Raise Capital program by FasterCapital is a new initiative designed to support electric vehicle (EV) startups worldwide, addressing the growing demand for sustainable transportation. This initiative aims to empower EV innovators by providing financial support, strategic mentorship, and access to a wide network of investors, thereby enhancing the scalability and viability of emerging technologies in the EV sector.

November 2024: Indiegogo and GoFundMe have launched the Trust Alliance to improve crowdfunding trust and safety, focusing on fraud prevention, policy, and sharing best practices to eliminate bad actors and promote community safety.

May 2023: StartEngine acquired the assets of SeedInvest for USD 24 thousand in common stock. This strategic acquisition includes SeedInvest's user email lists and intellectual property.

Kuwait Crowdfunding Platform Market Segmentation

By Platform Type Outlook (Revenue, USD Thousand, 2020- 2034)

- Private

- Public

By Type Outlook (Revenue, USD Thousand, 2020- 2034)

- Equity Crowdfunding

- Donation-Based Crowdfunding

- Reward-Based Crowdfunding

- Others

By Application Outlook (Revenue, USD Thousand, 2020- 2034)

- Entrepreneurship

- Medical

- Social Causes

- Others

By End User Outlook (Revenue, USD Thousand, 2020- 2034)

- Businesses

- Individuals

- Nonprofit Organizations

Kuwait Crowdfunding Platform Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6,156.50 Thousand |

|

Market Size Value in 2025 |

USD 6,815.73 Thousand |

|

Revenue Forecast in 2034 |

USD 14,549.35 Thousand |

|

CAGR |

8.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021 – 2023 |

|

Forecast Period |

2024 – 2034 |

|

Quantitative Units |

Revenue in USD Thousand and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The Kuwait crowdfunding platform market size was valued at USD 6,156.50 thousand in 2024 and is projected to grow to USD 14,549.35 thousand by 2034.

• The market registers a CAGR of 8.8% during the forecast period 2025-2034.

• The key players in the market are StartEngine Crowdfunding, Inc.; Fundable; Seed&Spark; Wefunder; InspireMe.Fund; Eureeca; StartSomeGood; FasterCapital; Kickstarter PBC; Indiegogo, Inc.; GoFundMe; and RocketHub.

• The equity crowdfunding segment dominated the market in 2024.

• The entrepreneurship segment had the largest share in the market.