Kitchen Appliances Market Size, Share, Trends, Industry Analysis Report: By Product (Cooking Appliances, Dishwasher, Refrigerator, Range Hood, and Others), Fuel Type, Technology, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Jan-2025

- Pages: 129

- Format: PDF

- Report ID: PM1033

- Base Year: 2024

- Historical Data: 2020-2023

Kitchen Appliances Market Overview

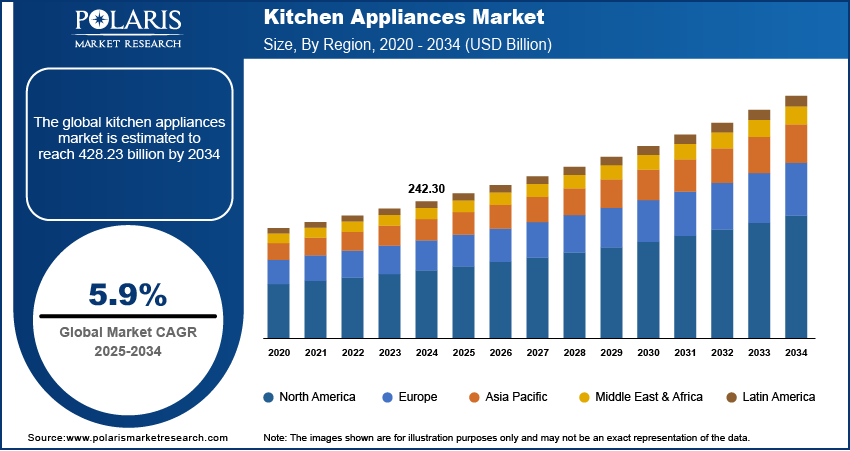

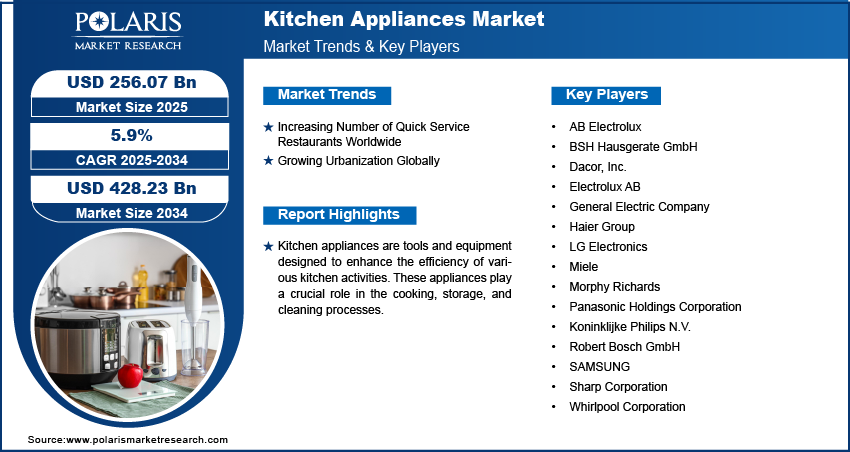

The global kitchen appliances market was valued at USD 242.30 billion in 2024. It is expected to grow from USD 256.07 billion in 2025 to USD 428.23 billion by 2034, at a CAGR of 5.9% during the forecast period.

Kitchen appliances are tools and equipment designed to enhance the efficiency of various kitchen activities. These appliances play a crucial role in the cooking, storage, and cleaning processes. Kitchen appliances are available in diverse colors, materials, styles, sizes, and mechanisms and encompass items such as ovens, refrigerators, stoves, blenders, and dishwashers.

The kitchen appliances market growth is driven by the increasing product development by key market players. Companies in the market are continuously launching appliances with advanced features, such as smart connectivity, energy efficiency, and multi-functionality, which appeal to modern lifestyles, thereby boosting demand for kitchen appliances. For instance, in March 2020, Samsung Electronics Co. Ltd. introduced advanced home and kitchen appliance products, including cube and bespoke refrigerators and induction cooktops, during the 2020 International CES Innovation Summit.

To Understand More About this Research: Request a Free Sample Report

Kitchen Appliances Market Driver Analysis

Increasing Number of Quick Service Restaurants Worldwide

The surging number of quick service restaurants (QSRs) worldwide is propelling the kitchen appliances market growth. QSRs rely on kitchen appliances such as high-capacity ovens, fryers, grills, and refrigeration units to ensure quick turnaround times and maintain food quality. Additionally, the adoption of automation and smart kitchen technologies and appliances by QSRs to streamline operations further drives the demand for innovative kitchen appliances.

Growing Urbanization Globally

Growing global urbanization is driving the kitchen appliances market revenue. According to data published by the United Nations, more than half of the global population lives in urban areas. Urban households, often characterized by busy schedules and smaller family units, seek innovative solutions such as smart appliances, microwaves, portable dishwashers, and induction cooktops that simplify meal preparation and household tasks. Furthermore, urbanization fosters higher disposable incomes and greater exposure to global trends, encouraging consumers to invest in premium and technologically advanced kitchen appliances.

Kitchen Appliances Market Segment Analysis

Kitchen Appliances Market Assessment by Product

Based on product, the kitchen appliances market is categorized into cooking appliances, dishwashers, refrigerators, range hoods, and others. The refrigerators segment accounted for a major kitchen appliances market share in 2024 due to their essential role in preserving food and reducing waste. The rising global population and growing urbanization have increased the need for efficient food storage solutions, thereby driving demand for refrigerators.

Kitchen Appliances Market Evaluation by End Use

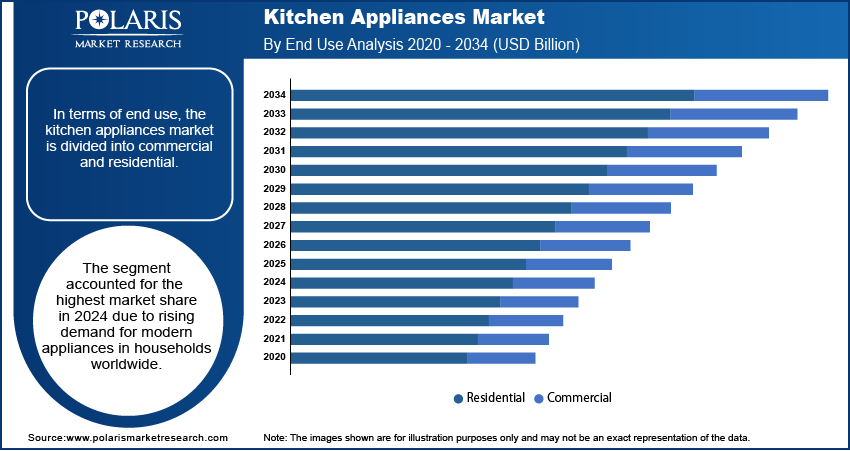

In terms of end use, the kitchen appliances market is divided into commercial and residential. The residential segment accounted for the highest market share in 2024 due to rising demand for modern appliances in households worldwide. Urbanization and the growing middle-class population have led to an increase in homeownership and apartment living, which has spurred the adoption of compact, energy-efficient, and multifunctional products. Households are increasingly investing in advanced technologies, such as smart appliances that integrate with smart home automation systems, offering convenience and control. Additionally, the influence of lifestyle changes, such as the preference for home-cooked meals and the emphasis on health and sustainability, has boosted the purchase of innovative cooking and food preservation products. Higher disposable incomes and the availability of financing options have further encouraged residential consumers to upgrade their kitchens, sustaining the dominance of the segment.

The commercial segment is also expected to grow at a robust pace in the coming years, owing to the rapid expansion of the food service industry. The rise of quick-service restaurants, cafés, and cloud kitchens has fueled demand for high-capacity, durable, and efficient cooking and refrigeration solutions. Businesses in the hospitality sector are increasingly adopting technologically advanced appliances that offer faster operation, reduce energy consumption, and improve workflow efficiency. The growing trend of dining out and the rising popularity of takeaway and delivery services have also necessitated investments in specialized equipment personalized to the needs of commercial kitchens.

Kitchen Appliances Market Outlook by Region

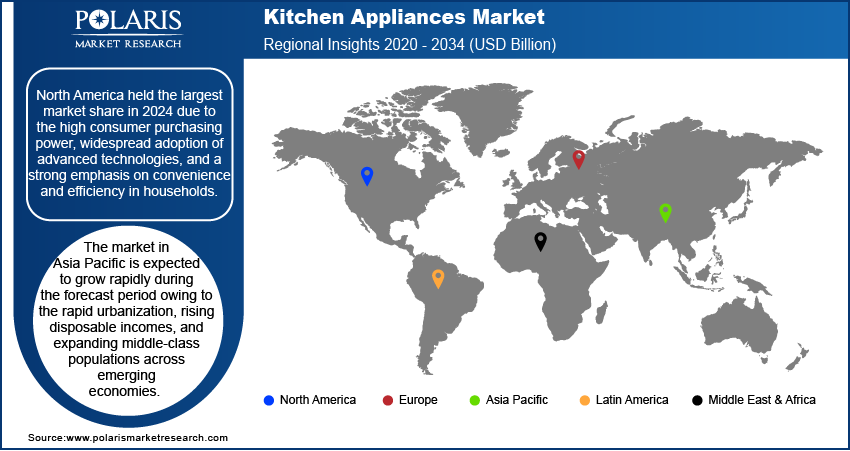

By region, the study provides the kitchen appliances market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to the high consumer purchasing power, widespread adoption of advanced technologies, and a strong emphasis on convenience and efficiency in households. The region's well-established retail and e-commerce networks have facilitated easy access to a wide range of appliances, further boosting sales. The growing trend of smart homes has fueled demand for connected products, allowing users to control and monitor their appliances through smartphones or voice-activated systems. The US dominated the North American market due to its large consumer base, preference for premium and energy-efficient products, and robust demand in both residential and commercial sectors. Additionally, initiatives promoting sustainable living and energy-saving solutions have encouraged consumers to upgrade to modern, environmentally friendly appliances, strengthening North America’s dominant position.

The kitchen appliances market in Asia Pacific is expected to grow at a rapid pace during the forecast period owing to the rapid urbanization, rising disposable incomes, and expanding middle-class populations across emerging economies. Countries such as China and India are experiencing a surge in kitchen appliance demand due to increasing homeownership rates, lifestyle shifts, and the growing influence of western cooking and dining practices. The region's booming food service industry, particularly in countries with large urban populations, has also driven the need for advanced commercial kitchen appliances. Additionally, government initiatives supporting local manufacturing and energy-efficient technologies have encouraged consumers to invest in modern appliances. China leads the Asia Pacific market, supported by its massive manufacturing base, technological advancements, and high domestic consumption.

Kitchen Appliances Market Key Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the kitchen appliances market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The kitchen appliances market is fragmented, with the presence of numerous global and regional market players. Major players in the market include AB Electrolux; BSH Hausgerate GmbH; Dacor, Inc.; Electrolux AB; General Electric Company; Haier Group; LG Electronics; Miele; Morphy Richards; Panasonic Holdings Corporation; Koninklijke Philips N.V.; Robert Bosch GmbH; SAMSUNG; Sharp Corporation; Whirlpool Corporation.

LG Electronics has established itself as a prominent player in the kitchen appliances sector, offering a diverse range of innovative products that combine advanced technology with sleek design. Founded in 1958 and headquartered in Seoul, South Korea, LG has continually evolved its product lineup to meet the changing needs of consumers. The company's kitchen appliances reflect a commitment to enhancing the culinary experience through smart features and user-friendly interfaces. LG's offerings include refrigerators, ovens, cooktops, microwaves, and dishwashers, each designed to optimize functionality while maintaining aesthetic appeal.

SAMSUNG has emerged as a major innovator in the kitchen appliances sector, offering a comprehensive range of products that blend advanced technology with stylish design. Established in 1938 and headquartered in Suwon, South Korea, SAMSUNG has continually expanded its portfolio to meet the diverse needs of modern consumers. The company’s kitchen appliance lineup includes refrigerators, ovens, cooktops, microwaves, dishwashers, and more, all designed to enhance culinary experiences while promoting convenience and efficiency in the kitchen.

Key Companies in Kitchen Appliances Market

- AB Electrolux

- BSH Hausgerate GmbH

- Dacor, Inc.

- Electrolux AB

- General Electric Company

- Haier Group

- LG Electronics

- Miele

- Morphy Richards

- Panasonic Holdings Corporation

- Koninklijke Philips N.V.

- Robert Bosch GmbH

- SAMSUNG

- Sharp Corporation

- Whirlpool Corporation

Kitchen Appliances Market Developments

February 2023: Electrolux expanded its appliance range in India to include built-in options such as microwaves, stoves, burners, cooker caps, dishwashers, and coffee machines. The appliances feature an Eco program for water and energy conservation, pre-programmed meal settings, a steamy mode for nutrient and moisture retention, and conventional and fan-assisted cooking options.

December 2022: V-Guard acquired Sunflame Enterprises Private Ltd (SEPL), which is known for its nationwide presence under the Sunflame brand. This strategic partnership aims to boost consumer engagement through innovation and experiences, propelling V-Guard toward leadership in the Indian kitchen appliances sector.

June 2022: TTK Prestige and Ultrafresh joined hands to bolster TTK's goal of becoming a leading kitchen solutions brand. Ultrafresh inaugurated its first experience center in Koramangala, Bengaluru, spanning 2,700 square feet featuring a diverse range of kitchen designs. With 120 operational studios and the production of over 5,000 steel and wooden kitchens nationwide, Ultrafresh is making substantial progress.

Kitchen Appliances Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020 - 2034)

- Cooking Appliances

- Cooktops & Cooking Range

- Ovens

- Others

- Dishwasher

- Refrigerator

- Range Hood

- Others

By Fuel Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Cooking Gas

- Electricity

By Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- Conventional

- Smart Appliances

By End Use Outlook (Revenue, USD Billion, 2020 - 2034)

- Commercial

- Residential

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Kitchen Appliances Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 242.30 billion |

|

Revenue Forecast in 2025 |

USD 256.07 billion |

|

Revenue Forecast in 2034 |

USD 428.23 billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2024 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global kitchen appliances market size was valued at USD 242.30 billion in 2024 and is projected to grow to USD 428.23 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are AB Electrolux; BSH Hausgerate GmbH, Dacor, Inc.; Electrolux AB; General Electric Company; Haier Group; LG Electronics; Miele; Morphy Richards; Panasonic Holdings Corporation; Koninklijke Philips N.V.; Robert Bosch GmbH; SAMSUNG; Sharp Corporation; and Whirlpool Corporation.

The commercial segment is projected for significant growth in the global market.

The refrigerator segment dominated the kitchen appliances market in 2024.