Joint Replacement Devices Market Size, Share, Trends, Industry Analysis Report: By Product (Hip Replacement, Knee Replacement, Shoulder Replacement, Wrist Replacement, and Others), Surgery Type, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5471

- Base Year: 2024

- Historical Data: 2020-2023

Joint Replacement Devices Market Overview

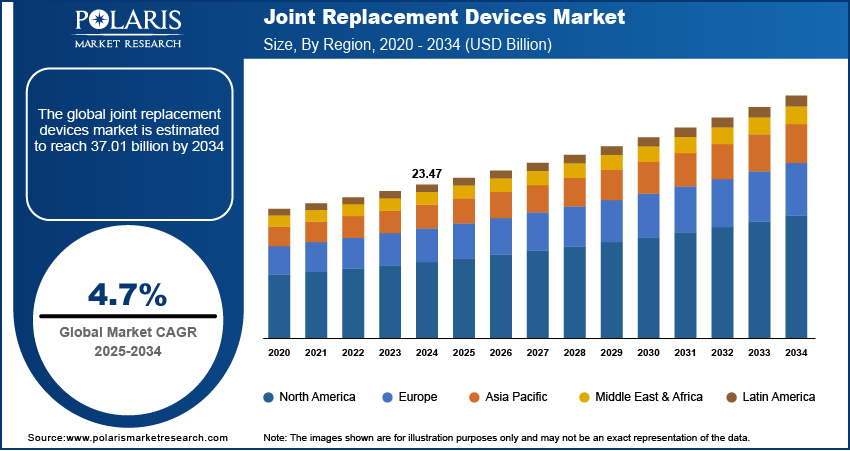

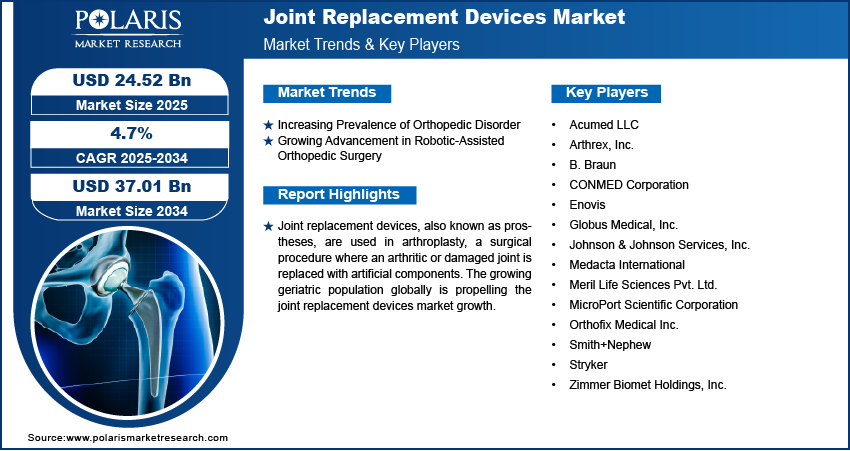

The global joint replacement devices market size was valued at USD 23.47 billion in 2024. The market is projected to grow from USD 24.52 billion in 2025 to USD 37.01 billion by 2034, exhibiting a CAGR of 4.7 % during 2025–2034.

Joint replacement devices, also known as prostheses, are used in arthroplasty, a surgical procedure where an arthritic or damaged joint is replaced with artificial components. These devices are made from materials such as metals, plastics, or ceramics, designed to mimic the natural movement of a healthy joint. The primary purpose of joint replacement devices is to alleviate severe pain and restore mobility in patients suffering from conditions such as osteoarthritis or rheumatoid arthritis. These devices are considered when less invasive treatments fail to provide relief. The most common types of joint replacement devices are hip and knee replacement devices.

The growing geriatric population globally is propelling the joint replacement devices market growth. United Nations published data stating that by the late 2070s, the global population aged 65 and above is projected to reach 2.2 billion, surpassing the number of children under age 18. Geriatric population usually suffers from bone wear and tear, leading to conditions such as osteoarthritis and rheumatoid arthritis. These conditions often necessitate joint replacement surgeries and devices to alleviate pain and restore mobility. Geriatric population has further greater access to healthcare services and insurance coverage, making joint replacement surgeries more accessible and affordable, thereby boosting the adoption of joint replacement devices as these devices are required in replacement surgeries. Additionally, healthcare providers and manufacturers are increasingly focusing on geriatric care, developing innovative and durable joint replacement devices that cater specifically to the needs of the elderly. This drives the geriatric population to invest in these innovative and durable joint replacement devices to improve mobility and quality of life.

To Understand More About this Research: Request a Free Sample Report

The joint replacement devices market demand is driven by the growing healthcare spending in emerging nations. Governments and private sectors in these nations are investing heavily in healthcare infrastructure, making joint replacement surgeries more available to a larger population, which propels demand for joint replacement devices. Higher healthcare budgets also lead to improved insurance coverage and reimbursement policies, reducing the financial burden of joint replacement surgeries. Many individuals in emerging nations previously avoided these replacement surgeries due to high costs. With increased government support and private health insurance plans, more patients are going through knee, hip, and shoulder replacement surgeries. This drives the need for joint replacement devices as these devices are required in knee, hip, and shoulder replacement surgeries.

The growing healthcare spending in emerging countries such as India and Brazil is fueling medical tourism. For instance, the share of Government Health Expenditure (GHE) in India’s GDP increased from 1.13% in 2014–15 to 1.84% in 2021–22. Rising healthcare spending is driving demand for joint replacement surgeries and, consequently, for joint replacement devices.

Joint Replacement Devices Market Dynamics

Increasing Prevalence of Orthopedic Disorders

Conditions such as osteoarthritis, osteoporosis, and other degenerative joint diseases and inflammatory joint diseases are becoming more common globally. These disorders often lead to chronic pain, reduced mobility, and a diminished quality of life, necessitating surgical interventions such as joint replacement surgeries, which propel the adoption of joint replacement devices. Osteoporosis further weakens bones, increasing the risk of fractures, particularly in the hips and knees. According to a report published by the Lancets, cases of osteoarthritis are projected to increase by 74.9% for the knee, 48.6% for the hand, and 78.6% for the hip by 2050 compared to 2020. This drives the need for joint replacement surgeries and joint replacement devices to enhance mobility.

Rheumatoid arthritis, a type of inflammatory joint disease, causes inflammation and joint deformity, making movement painful and difficult. This drives the need for joint replacement devices to improve restore function and prevent further complications, thereby contributing to joint replacement devices market expansion.

Growing Advancement in Robotic-Assisted Orthopedic Surgery

Advancements in robotic-assisted orthopedic surgery significantly boost the demand for joint replacement devices. Robotic technology enhances the precision and accuracy of joint replacement surgeries, enabling surgeons to perform operations with greater control and consistency. This precision leads to better alignment of implants, reduced tissue damage, and improved patient outcomes, which encourages orthopedic patients to adopt robotic-assisted orthopedic surgery. Moreover, the integration of robotic systems in orthopedic surgery has expanded the range of patients who benefit from joint replacement surgeries, including those with complex anatomical challenges. Thus, as advancement in robotic-assisted orthopedic surgery increases, the joint replacement devices market demand also spurs.

Joint Replacement Devices Market Segment Insights

Joint Replacement Devices Market Evaluation by Product

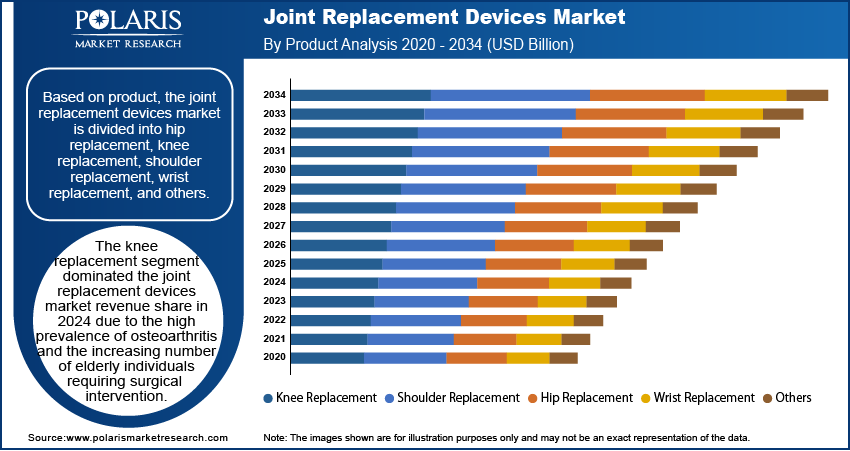

Based on product, the joint replacement devices market is divided into hip replacement, knee replacement, shoulder replacement, wrist replacement, and others. The knee replacement segment dominated the joint replacement devices market share in 2024 due to the high prevalence of osteoarthritis and the increasing number of elderly individuals requiring surgical intervention. Millions of people worldwide suffer from knee joint degeneration caused by aging, obesity, and repetitive stress injuries. The rising number of minimally invasive knee replacement procedures has further contributed to the segment’s growth. Surgeons now use advanced techniques, such as robotic-assisted surgery and customized implants, to improve precision and patient outcomes. Additionally, improved implant materials, including highly cross-linked polyethylene and ceramic components, have extended implant longevity, reducing the need for revision surgeries. These technological advancements, combined with increasing healthcare investments and favorable reimbursement policies, have strengthened the dominance of the knee replacement segment.

Joint Replacement Devices Market Outlook by End User

In terms of end user, the joint replacement devices market is segregated into hospitals & surgical centers, ambulatory care centers & trauma units, and others. The hospitals & surgical centers accounted for a major market share in 2024 due to the high volume of joint replacement procedures performed in these facilities. Many patients prefer hospitals for joint surgeries owing to the availability of advanced medical technology, highly skilled orthopedic surgeons, and comprehensive post-operative care. Hospitals offer advanced surgical suites equipped with robotic-assisted systems, 3D imaging, and specialized imaging technologies that improve joint replacement surgical precision. The presence of multidisciplinary teams, including anesthesiologists, physical therapists, and pain management specialists in hospitals, ensures better patient outcomes and faster recovery. Additionally, many hospitals have established dedicated orthopedic departments, allowing them to perform a higher number of knee, hip, and shoulder replacements each year. This encourages patients to opt for hospitals for joint replacement surgeries. Government and private healthcare investments have further strengthened hospital infrastructure, increasing accessibility for patients worldwide. These factors have contributed to the dominance of the hospitals and surgical centers segment.

Joint Replacement Devices Market Regional Analysis

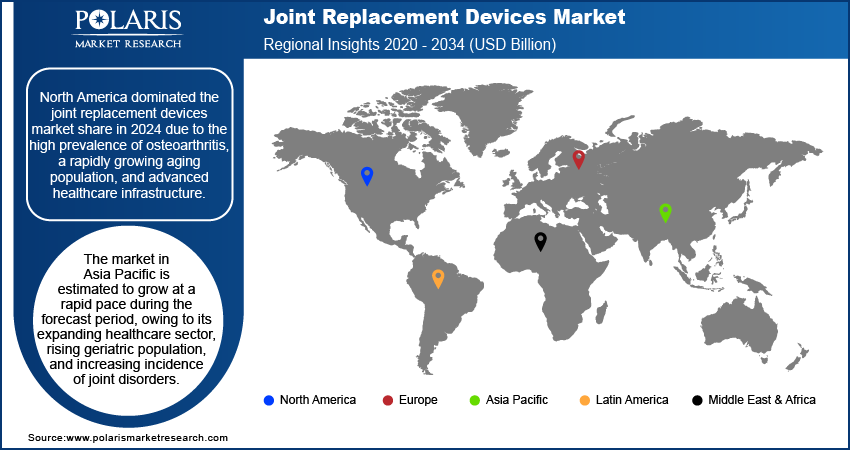

By region, the report provides joint replacement devices market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the joint replacement devices market share in 2024 due to the high prevalence of osteoarthritis, a rapidly growing aging population, and advanced healthcare infrastructure. The region has witnessed a steady increase in the number of knee and hip replacement devices, with more individuals seeking surgical solutions for joint-related disorders. The presence of well-established medical device manufacturers and research institutions has driven continuous advancements in implant materials, robotic-assisted surgeries, and minimally invasive techniques. Many hospitals and specialized orthopedic centers across North America offer advanced joint replacement treatment options, driving demand for joint replacement devices. Additionally, favorable reimbursement policies and comprehensive health insurance coverage have encouraged more patients to undergo joint surgeries without facing significant financial burdens, thereby boosting demand for joint replacement devices. Increased healthcare spending and government initiatives supporting orthopedic care have further strengthened the North America joint replacement devices market expansion.

The joint replacement devices market in Asia Pacific is estimated to grow at a rapid pace during the forecast period, owing to its expanding healthcare sector, rising geriatric population, and increasing incidence of joint disorders. Many countries in the region are investing heavily in modernizing their medical facilities, making joint replacement surgeries more accessible to a larger population. The growing middle-class population, coupled with improving health insurance coverage, is encouraging more individuals to seek surgical treatment for knee and hip degeneration. Countries such as China, India, and Japan are witnessing a surge in demand for orthopedic procedures due to lifestyle changes and urbanization, contributing to higher adoption of joint replacement devices. Additionally, international medical device manufacturers are expanding their presence in Asia Pacific, introducing innovative implants and robotic-assisted surgical systems to improve treatment outcomes, which is fueling joint replacement market growth in the region.

Joint Replacement Devices Market Players & Competitive Analysis Report

The competitive landscape of the joint replacement devices market is characterized by the presence of global medical device manufacturers, emerging orthopedic technology firms, and strategic collaborations focused on innovation and market expansion. Companies are investing in advanced biomaterials, 3D printing, and robotic-assisted surgery to enhance implant longevity and surgical precision. Regulatory approvals, reimbursement policies, and clinical trial data significantly impact market positioning. Strategic mergers and acquisitions, and partnerships with healthcare providers drive market penetration. The growing demand for personalized implants, minimally invasive procedures, and AI-driven surgical planning tools further intensifies competition, pushing companies to differentiate through technological advancements and patient outcomes.

The joint replacement devices market consists of numerous global and regional market players. A few major players in the market include Acumed LLC; Arthrex, Inc.; B. Braun; CONMED Corporation; Enovis; Globus Medical, Inc.; Johnson & Johnson Services, Inc.; Medacta International; Meril Life Sciences Pvt. Ltd.; MicroPort Scientific Corporation; Orthofix Medical Inc.; Smith+Nephew; Stryker; and Zimmer Biomet Holdings, Inc.

Arthrex, Inc. is a global company in the development and manufacturing of minimally invasive orthopedic surgical products and solutions. Founded in 1981 by Reinhold Schmieding, the company began its journey in Munich, Germany, with a focus on arthroscopic techniques in sports medicine and orthopedics. Arthrex is currently headquartered in Naples, Florida, and operates as a privately held company, which allows it to rapidly evaluate new technologies and develop innovative products that significantly impact patient care. Arthrex offers a wide range of surgical products for various orthopedic procedures, including shoulder, knee, elbow, hand and wrist, foot and ankle, and hip surgeries. The company also specializes in orthobiologics and imaging and resection systems, providing comprehensive solutions for surgeons worldwide.

Johnson & Johnson Services, Inc. is a global company in medical devices, including orthopedic solutions, which encompass a wide range of products and technologies designed to improve patient outcomes in joint replacement surgeries. Johnson & Johnson Services, Inc., through its DePuy Synthes division, offers a comprehensive portfolio of joint reconstruction solutions or replacement devices. One of the key innovations in this area is the VELYS Robotic-Assisted Solution, which is designed to enhance the precision and personalization of knee replacement surgeries. This technology allows surgeons to gather detailed data about the patient's knee anatomy, ensuring accurate implant placement and alignment. In addition to robotic-assisted solutions, Johnson & Johnson has introduced other innovative products aimed at improving joint replacement procedures. The WATSON EXTRACTION SYSTEM simplifies the removal of femoral implants during revision surgeries, reducing surgery time and improving predictability.

List of Key Companies in Joint Replacement Devices Market

- Acumed LLC

- Arthrex, Inc.

- B. Braun

- CONMED Corporation

- Enovis

- Globus Medical, Inc.

- Johnson & Johnson Services, Inc.

- Medacta International

- Meril Life Sciences Pvt. Ltd.

- MicroPort Scientific Corporation

- Orthofix Medical Inc.

- Smith+Nephew

- Stryker

- Zimmer Biomet Holdings, Inc.

Joint Replacement Devices Industry Developments

November 2024: Johnson & Johnson MedTech, a global company in orthopedic technologies and solutions, unveiled new joint reconstruction solutions at the American Association of Hip and Knee Surgeons (AAHKS) 2024 Annual Meeting in Dallas.

August 2024: Exactech, a global medical technology company, announced the launch of new balancing technology, ExactechGPS computer-assisted technology, for patients in need of total knee replacement surgery.

January 2023: Aster Medcity launched joint replacement devices, including robots for knee replacement surgeries

Joint Replacement Devices Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Hip Replacement

- Knee Replacement

- Shoulder Replacement

- Wrist Replacement

- Others

By Surgery Type Outlook (Revenue, USD Billion, 2020–2034)

- Total Replacement

- Partial Replacement

- Revision Replacement

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals & Surgical Centers

- Ambulatory Care Centers & Trauma Units

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Joint Replacement Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 23.47 Billion |

|

Market Forecast in 2025 |

USD 24.52 Billion |

|

Revenue Forecast by 2034 |

USD 37.01 Billion |

|

CAGR |

4.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global joint replacement devices market size was valued at USD 23.47 billion in 2024 and is projected to grow to USD 37.01 billion by 2034.

The global market is projected to register a CAGR of 4.7 % during the forecast period.

North America held the largest share of the global market in 2024.

A few of the key players in the market are Acumed LLC; Arthrex, Inc.; B. Braun; CONMED Corporation; Enovis; Globus Medical, Inc.; Johnson & Johnson Services, Inc.; Medacta International; Meril Life Sciences Pvt. Ltd.; MicroPort Scientific Corporation; Orthofix Medical Inc.; Smith+Nephew; Stryker; and Zimmer Biomet Holdings, Inc.

The knee replacement segment dominated the market share in 2024