Jewelry Market Size, Share, Trend, Industry Analysis Report

By Product (Necklace, Ring, Earrings, Bracelet, Others), By Type, By Category, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM2284

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The global jewelry market size was valued at USD 269.80 billion in 2024, growing at a CAGR of 8.7% from 2025 to 2034. A few key factors, such as the strategic collaborations and acquisitions among major players, a growing trend for cross-cultural ornaments, and the adoption of e-commerce for jewelry purchasing, are driving the industry growth.

Key Insights

- The ring segment accounted for approximately 31% of the revenue share in 2024 due to strong demand for engagement and wedding rings.

- The gold segment accounted for ~60% of the revenue share in 2024 due to strong cultural value, and high investment appeal.

- The offline segment accounted for ~63% of the revenue share in 2024 due to the consumer preference for physical inspection.

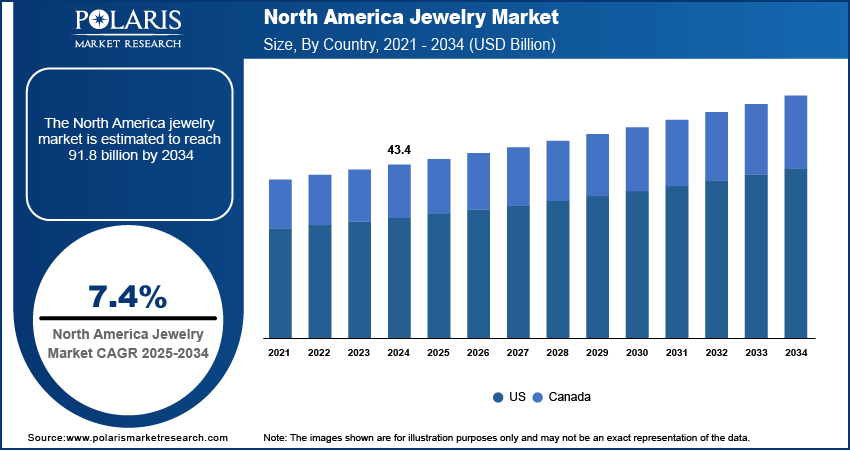

- North America jewelry market is expected to grow significantly with a CAGR of 8.4% due to increasing consumer interest in luxury goods and accessories and personalized adornments.

- In 2024, the U.S. accounted for ~94% of the revenue share in North America due to robust consumer spending, strong bridal and fashion jewelry demand.

- In 2024, Asia Pacific accounted for the largest revenue share of ~58% due to strong cultural affinity toward precious metals and growing middle-class spending.

- China accounted for ~24% of the revenue share in 2024 due to high demand for gold and diamond ornaments during cultural festivals and personal milestones.

- The Europe is expected to grow at a CAGR of 7.3% from 2025-2034 due to increased interest in luxury fashion accessories and sustainable fine jewelry.

To Understand More About this Research:Request a Free Sample Report

The jewelry market encompasses the design, production, and sale of ornaments made from precious metals, gemstones, and other materials. It includes categories such as fine jewelry, costume jewelry, and custom pieces, serving personal, cultural, and investment purposes. The growing trend of cross-cultural ornaments is driving market expansion to a greater level. Increased advertising budgets and new international campaigns will enable a diverse range of these products to be distributed globally in the coming years.

Cultural significance and tradition drive strong sales of jewelry in wedding ceremonies. Consumers are willing to invest in premium items for engagement rings, bridal sets, and heirloom-quality pieces. Moreover, digital platforms are expanding access to global brands and personalized jewelry. High-impact campaigns by influencers and celebrities are shaping consumer choices. Instagram, Pinterest, and TikTok are particularly effective in promoting new collections and seasonal trends.

Industry Dynamics

- Higher disposable income across emerging and developed economies is driving strong growth in jewelry purchases.

- Rapid digitalization in retail is transforming how jewelry is discovered, evaluated, and purchased.

- Consumers are increasingly seeking ethically sourced, eco-friendly jewelry options, creating opportunities for brands to expand offerings in lab-grown diamonds, recycled metals, and transparent supply chains, especially in North America and Europe.

- Fluctuating gold and silver prices, along with geopolitical tensions affecting raw material sourcing and logistics, pose cost and availability challenges.

Rising Disposable Income: Higher disposable income across emerging and developed economies is driving strong growth in jewelry purchases. Consumers are showing greater preference for luxury and lifestyle products, and jewelry remains a key category that reflects personal success and status. An expanding middle class, especially among urban populations, is shifting focus from traditional jewelry purchases to more branded, design-forward, and customized pieces. This shift is elevating overall spending and also increasing demand for quality assurance, brand reputation, and post-sale services. Aspirational buyers are now treating jewelry as an occasional purchase and as a regular fashion accessory that complements their lifestyle and identity, leading to overall growth.

Growing E-commerce Sector: Rapid digitalization in retail is transforming how jewelry is discovered, evaluated, and purchased. E-commerce platforms have become important sales channels, especially among millennials and Gen Z consumers who value convenience and personalization. According to the U.S. Census Bureau, in Q1 2025, e-commerce sales in the U.S. reached USD 300.2 billion, reflecting a 6.1% increase from Q1 2024. Secure payment options, virtual try-on features, and detailed product descriptions are building trust and enhancing the online buying experience. Direct-to-consumer brands are also disrupting traditional distribution by offering competitive pricing and customization tools. The online retail industry is helping smaller designers reach global audiences, while data analytics enables targeted marketing and tailored promotions. The shift toward Omni-channel strategies, combining online and offline experiences, is further fueling growth in digital jewelry sales.

Segmental Insights

Product Analysis

Based on product, the segmentation includes necklace, ring, earrings, bracelet, and other products. The ring segment accounted for ~31% of the revenue share in 2024, due to strong demand for engagement and wedding rings. Customization options, growing interest in minimalistic designs, and cultural significance of rings in celebratory events have further fueled sales. Jewelry retailers are expanding collections to include vintage-inspired, gemstone-embedded, and stackable rings, appealing to a wide range of consumers. Consumer inclination toward rings as both sentimental and fashionable pieces keeps this segment ahead in value and volume.

The necklace segment is projected to witness the highest CAGR of 8.1% from 2025 to 2034 due to rising popularity of statement jewelry and layered styling trends. Increasing demand for necklaces as everyday wear and gifting items is expanding their customer base. The rise of influencers and social media-driven fashion has also played a key role in boosting the appeal of necklaces among younger consumers. Frequent product innovations in pendant designs and the use of mixed materials have made necklaces more versatile and accessible across price points.

Type Analysis

In terms of type, the segmentation includes silver, gold, platinum, diamond, and others. The gold segment accounted for ~60% of the revenue share in 2024, due to strong cultural value, high investment appeal, and enduring demand for gold during weddings and festivals. Consumers view gold as both an adornment and a financial asset, contributing to steady sales of gold jewelry. The World Gold Council reported that total gold demand for Q1 2025 increased by 1% year-on-year, reaching 1,206 tonnes, including investment activity. Retailers offering hallmark-certified and lightweight gold jewelry have attracted a broader consumer base. Promotional campaigns and seasonal discounts have further supported gold jewelry’s consistent demand across income groups.

The silver segment is projected to register a CAGR of 8.0% during 2025–2034, due to its rising popularity among cost-conscious and fashion-forward consumers. Its affordability and adaptability across traditional and modern designs make it a go-to option for daily and occasion-based wear. Urban youth prefer silver for its lightweight nature and contemporary appeal. Growth in artisanal jewelry, oxidized finishes, and personalization options has given silver jewelry a fresh identity. Increasing use of silver in men’s jewelry also adds to the segment’s growth momentum.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes offline and online. The offline segment accounted for ~63% of the revenue share in 2024, due to the consumer preference for physical inspection, especially for high-value purchases such as gold and diamond jewelry. Trust in legacy jewelers, personalized services, and immediate product availability encourage in-store purchases. Many consumers also seek certification and secure billing. Therefore, they associate with established offline retailers. Flagship stores and showroom expansions in urban and semi-urban areas have further supported this channel’s performance.

The online segment is projected to witness a significant CAGR of 8.9% over the forecast period. Rising digital retail platform adoption, secure payment systems, and access to wider product ranges have made online platforms more attractive. Virtual try-on tools and detailed product videos have improved the customer experience. E-commerce players are also offering exchange and return policies, building consumer confidence. Exclusive online collections, seasonal discounts, and influencer-driven marketing are helping online channels gain strong traction, especially among urban millennials.

Category Analysis

In terms of category, the segmentation includes branded and unbranded. The unbranded segment accounted for ~61% of the revenue share in 2024, due to competitive pricing, design flexibility, and availability across local markets. Consumers in semi-urban and rural areas often prefer unbranded jewelry for traditional events and daily wear. Customization options, often lacking in branded products, add to its appeal. The ability of local artisans and retailers to offer personalized designs at lower price points has kept this segment resilient despite growing branded competition.

The branded segment is projected to witness a higher CAGR of 8.0% over the forecast period due to rising consumer preference for quality assurance, modern designs, and transparent pricing. Trust in hallmark certifications, consistent craftsmanship, and post-sale services drive the shift toward branded products. Organized players are expanding their retail presence, offering loyalty programs, and integrating omnichannel strategies to boost customer engagement. Changing lifestyles and higher disposable income are encouraging customers, especially in urban areas, to invest in branded jewelry as both fashion and identity statements.

Regional Analysis

The North America jewelry market is expected to register a significant CAGR of 8.4% during the forecast period due to increasing consumer interest in luxury goods and accessories and personalized adornments. Higher disposable income, strong gifting culture, and rising influence of celebrity and fashion trends are boosting demand. In 2024, the U.S. Census Bureau reported a steady rise in consumer spending on luxury goods, including a 9.2% year-over-year increase in jewelry retail sales. The industry is witnessing growing adoption of lab-grown diamonds and sustainable materials, aligning with changing consumer values. Major brands are leveraging digital platforms and omnichannel strategies to attract a tech-savvy population. Customization services, smart jewelry features, and augmented reality (AR) try-on tools are also helping accelerate market penetration across younger age groups.

U.S. Jewelry Market Insight

In 2024, the U.S. accounted for ~94% of the revenue share in North America due to robust consumer spending, strong bridal and fashion jewelry demand, and widespread availability of both premium and affordable product ranges. Department stores, luxury boutiques, and online platforms offer a broad selection, catering to diverse preferences. Aggressive marketing by global brands and the rising popularity of customized and ethically sourced pieces have also played a key role in maintaining the U.S. leadership.

Asia Pacific Jewelry Market Trends

In 2024, Asia Pacific accounted for the largest revenue share of ~58% due to strong cultural affinity toward precious metals and growing middle-class spending. Festivals, weddings, and heritage traditions sustain demand for gold, silver, and diamond jewelry across major economies. Rapid urbanization, digital commerce growth, and expansion of branded retail outlets are reshaping consumer buying behavior. For instance, according to the India Brand Equity Foundation, in Q2 2024, India’s gem and jewelry exports reached USD 7.1 billion, reflecting a 12% increase compared to the same period in 2023. Younger consumers are increasingly opting for lightweight, fashion-forward pieces while still valuing traditional craftsmanship, creating opportunities for both legacy jewelers and new-age brands to flourish.

China Jewelry Market Overview

China accounted for ~24% of the revenue share in 2024 due to high demand for gold and diamond ornaments during cultural festivals and personal milestones. Urbanization and a rising female workforce have led to greater self-purchase trends. Premiumization is gaining traction, with consumers seeking brand identity and certified products. Jewelry retailers are focusing on smart stores and digital innovation to attract young buyers, while heritage brands continue to benefit from long-standing consumer trust in product purity and design heritage.

India Jewelry Market Overview

India held the largest share of ~28% in Asia Pacific in 2024 due to deep-rooted cultural significance of jewelry and expanding consumer base. Weddings, festivals, and religious ceremonies drive consistent demand across urban and rural regions. The shift toward branded and hallmarked gold jewelry is gaining momentum, backed by government regulations and awareness campaigns. Millennial preferences are also influencing trends, with demand rising for lightweight designs, gemstone fusion pieces, and artisanal craftsmanship across both offline and online platforms.

Europe Jewelry Market Analysis

The industry in Europe is expected to register a CAGR of 7.3% from 2025 to 2034 due to increased interest in luxury fashion accessories and sustainable fine jewelry. Consumers are prioritizing high-quality craftsmanship, traceable sourcing, and limited-edition collections. Demand for high-end watches, vintage styles, and heritage-inspired pieces continues to rise. E-commerce growth, influencer marketing, and collaborations between fashion houses and jewelry designers are also enhancing visibility. Greater male participation in jewelry consumption and the resurgence of interest in art-deco and antique designs further add to the region’s evolving market dynamics.

Germany Jewelry Market Insights

Germany accounted for ~21% of the revenue share in 2024 due to strong demand for gold and silver items that blend timeless elegance with functionality. Consumers value certified, durable products and show interest in artisanal craftsmanship. Independent jewelers and family-owned brands remain popular, offering unique designs that reflect regional heritage. E-commerce expansion and preference for ethical sourcing have influenced consumer decisions. A growing trend toward minimalistic and stackable pieces is also shaping new product launches and marketing campaigns in the country.

Italy Jewelry Market Overview

The industry in Italy is projected to witness fastest growth from 2025 to 2034, due to its global reputation for superior design, intricate craftsmanship, and luxurious aesthetic is driving demand both domestically and internationally. Younger consumers are embracing contemporary styles that maintain a touch of Italian elegance. Local brands are innovating with materials such as enamel, ceramic, and eco-friendly metals to align with sustainable fashion trends. Export strength, tourism-related purchases, and fashion week collaborations further amplify Italy’s growth potential in the premium jewelry segment.

Key Players and Competitive Analysis

The competitive landscape of the jewelry market is shaped by dynamic industry analysis and evolving expansion strategies. Leading players are pursuing joint ventures and strategic alliances to strengthen global distribution networks and enter emerging markets. Mergers and acquisitions are being used to consolidate design expertise and diversify product portfolios, followed by efficient post-merger integration to enhance operational synergy. Technology advancements such as artificial intelligence (AI)-driven customization and augmented reality are redefining the consumer experience. Companies are investing in sustainable sourcing and digital transformation to meet evolving consumer expectations. Innovation in branding and personalized offerings continues to be central to competitive differentiation.

Key Players

- Buccellati

- Cartier

- Chow Tai Fook Jewellery Group Limited

- LVMH Group

- Malabar Gold & Diamonds

- PANDORA JEWELRY LLC

- SHR Jewelry Group LLC

- Swarovski

- Swatch Group AG

- Titan Company Limited

Jewelry Industry Developments

In June 2025, De Beers introduced Ombré Desert Diamonds, its first major jewelry collection in over a decade, featuring multi-stone pieces inspired by desert colors. The company also launched Origin, a program offering polished diamonds with blockchain-backed traceability, emphasizing each diamond’s origin, rarity, and social impact.

In May 2025, Dialog Solutions Inc. partnered with Kunming Diamonds to feature Kunming's collection of natural yellow diamonds on the Dialog platform, enhancing accessibility for gem enthusiasts and industry professionals.

In August 2023, Malabar Gold & Diamonds launched its first jewelry manufacturing facility in West Bengal.

In August 2023, Buccellati launched a special edition of its famous bangles that are inspired by the abundance of colors, scents, and flavors the Italian island of Capri has to offer.

In August 2023, Chow Tai Fook introduced a series of new creations to its HUÁ Collection through collaborating with Shaanxi History Museum and Northwestern Polytechnical University.

Jewelry Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Necklace

- Ring

- Earrings

- Bracelet

- Other Products

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Silver

- Gold

- Platinum

- Diamond

- Others

By Category Outlook (Revenue, USD Billion, 2020–2034)

- Branded

- Unbranded

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline

- Online

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Jewelry Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 269.80 billion |

|

Market Size in 2025 |

USD 286.15 billion |

|

Revenue Forecast by 2034 |

USD 608.65 billion |

|

CAGR |

8.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 269.80 billion in 2024 and is projected to grow to USD 608.65 billion by 2034.

The global market is projected to register a CAGR of 8.7% during the forecast period.

In 2024, Asia Pacific accounted for the largest revenue share of ~58% due to strong cultural affinity toward precious metals and growing middle-class spending.

A few of the key players in the market are Buccellati, Cartier, Chow Tai Fook Jewellery Group Limited, LVMH Group, Malabar Gold & Diamonds, PANDORA JEWELRY LLC, SHR Jewelry Group LLC, Swarovski, Swatch Group AG, and Titan Company Limited.

The ring segment accounted for ~31% of the revenue share in 2024, due to strong demand for engagement and wedding rings.

The gold segment accounted for ~60% of the revenue share in 2024 due to strong cultural value, high investment appeal, and enduring demand for gold during weddings and festivals.