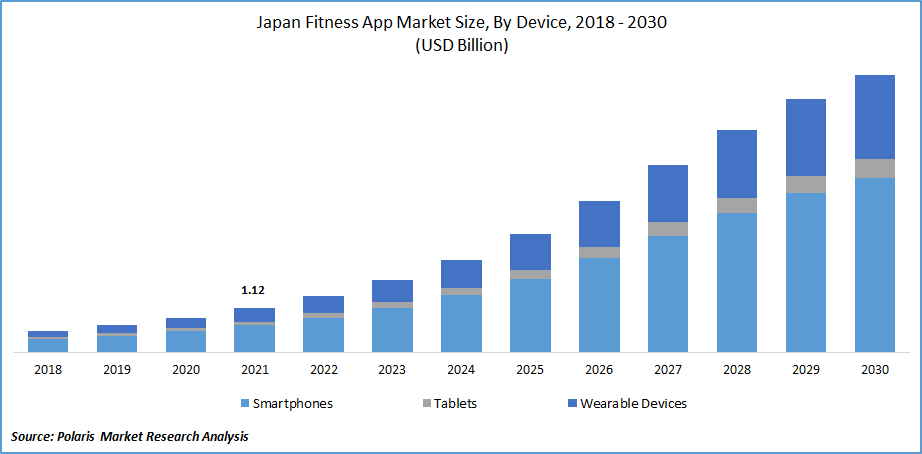

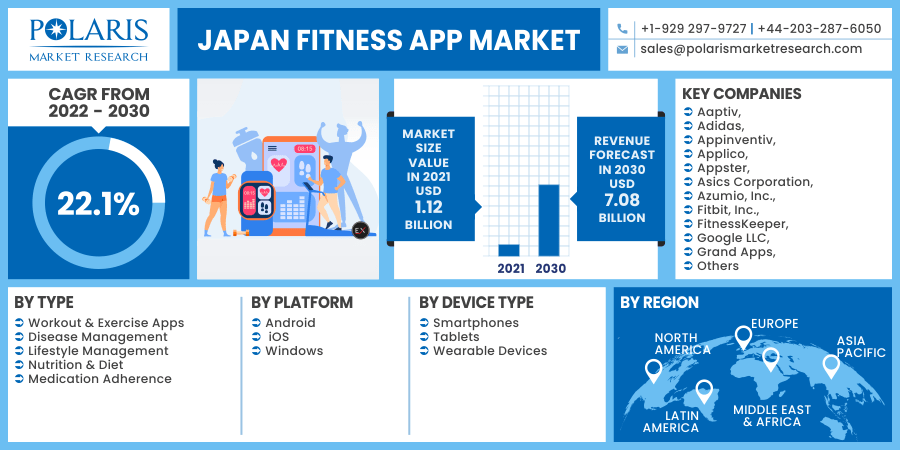

Japan Fitness App Market Share, Size, Trends, Industry Analysis Report, By Device Type (Smartphones, Tablets, Wearable Devices); By Platform (iOS, Android, Windows); By Type; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 118

- Format: PDF

- Report ID: PM2150

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

The Japan fitness app market size was valued at USD 1.12 billion in 2021 and is expected to grow at a CAGR of 22.1% during the forecast period. Increasing health issues due to the increasing geriatric population is expected to boost the market growth over the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Moreover, technological advancements, such as the use of machine learning, as well as ongoing research & innovation, have raised the demand for internet training, which has aided Japan's fitness app market expansion. In the wake of the Covid-19 outbreak, Japanese government officials have issued cautions recommending individuals to limit and avoid non-essential public movement. With COVID-19 being recognized as impacting the older faster than other age categories and Japan's exercise business focusing on that population, most of them avoided gyms and clubs over the fear of spreading infection.

Staying indoors has boosted the demand for home exercise applications, propelling the sector forward. Increasing adoption of these apps and rising awareness regarding these apps' benefits is expected to boost the Japan health app market growth over the forecast period.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Government efforts, the expansion of exercise gadgets, the rise of health clubs, increased health consciousness, and a significant improvement in exercise investment are some of the major reasons which are expected to propel the exercise software market in Japan forward.

Furthermore, the increasing smartphone penetration in Japan has contributed majorly to the adoption of health software among interested users. The availability of a large number of health software across multiple categories provides overwhelming options for users as per their fitness/health goals.

Health software is further gaining popularity in Japan due to recent technology adoption trends, especially from senior citizens, who comprise the majority of the population. This growing penetration has positively impacted the overall Japan fitness app market growth.

Restraints

Data security is a major concern for consumers, which is likely to hamper the widespread use of this software as well as the growth of the market in Japan. The leaking of data is the central issue behind losing the customers and damaging the brand image, which in turn is expected to hinder the product demand in Japan over the forecast period.

Report Segmentation

The global market is segmented on the basis of type, platform, and device type.

|

By Type |

By Platform |

By Device Type |

|

|

|

Know more about this report: request for sample pages

Insight by Type

The workout & exercise software segment dominated the global market in 2021 and is expected to maintain its dominance over the forecast period due to increasing concerns related to health and health along with technology advancement in these softwares.

Innumerous factors such as poor diet, smoking, consuming alcohol, and lack of physical exercise, have led to the increase in the prevalence of chronic diseases, such as cancer, diabetes, diseases of the heart, obesity, and arthritis.

Chronic diseases are the major cause of death among humans and are responsible for rising healthcare costs. Increasing chronic diseases among the population led to growing interest in workouts and health, which is expected to boost the segment share over the forecast period.

Insight by Platform

Android operating system-based smart mobile devices are most popular and widely adopted globally and are expected to grow at a considerable pace over the forecast period due to more android users than others. The IOS platform segment is expected to grow at the fastest rate over the forecast period due to the increasing adoption of iOS devices as Japan is one of the technologies advanced along with economically stable countries worldwide.

For instance, worldwide the number of registered Apple product users increased from 1.4 billion during the first financial quarter of 2019 to 1.5 billion during the first financial quarter of 2020, as per Apple Inc., which in turn is expected to boost the segment growth over the forecast period.

Windows operating system is expected to grow at a steady pace over the forecast period and accounts for a tiny portion of the market share due to the popularity of windows operating system-based smart tablet devices in several regions.

Insight by Device Type

Smartphones segment holds the major share in 2021 and is expected to maintain to hold its share over the forecast period due to the increasing use of smartphones worldwide. For instance, in 2020, more than 6 billion smartphone users are present in the world. On the other hand, wearable devices are expected to grow at a significant pace over the forecast period due to increasing features such as glucose monitors and heartrate monitors.

Competitive Landscape

Some of the major market players operating in the Japan fitness app market include Aaptiv, Adidas, Appinventiv, Applico, Appster, Asics Corporation, Azumio, Inc., Fitbit, Inc., FitnessKeeper, Google LLC, Grand Apps, Lenovo Group Limited, MyFitnessPal Inc., Nike, Noom, Samsung Electronics Co., Ltd., TomTom International BV, Under Armour, Inc., and Wahoo Fitness.

To grow their customer base, these big companies are spending in R&D and pursuing tactics such as mergers, acquisitions, new product introductions, and others. For instance, in December 2020, Fitness+ was the first workout experience created around Apple Watch, according to Apple. Apple Fitness+ is a subscription service that provides studio-style exercises to your iPhone, iPad, and Apple TV.

Japan Fitness App Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.12 billion |

|

Revenue forecast in 2030 |

USD 7.08 billion |

|

CAGR |

22.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Platform, By Device Type |

|

Key Companies |

Aaptiv, Adidas, Appinventiv, Applico, Appster, Asics Corporation, Azumio, Inc., Fitbit, Inc., FitnessKeeper, Google LLC, Grand Apps, Lenovo Group Limited, MyFitnessPal Inc., Nike, Noom, Samsung Electronics Co., Ltd., TomTom International BV, Under Armour, Inc., and Wahoo Fitness. |