IT Services Market Size, Share, Trends, Industry Analysis Report: By Type (Design & Implementation and Operations & Maintenance); Technology, Application, Approach, Deployment, Enterprise Size, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2024 - 2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5121

- Base Year: 2023

- Historical Data: 2019-2022

IT Services Market Overview

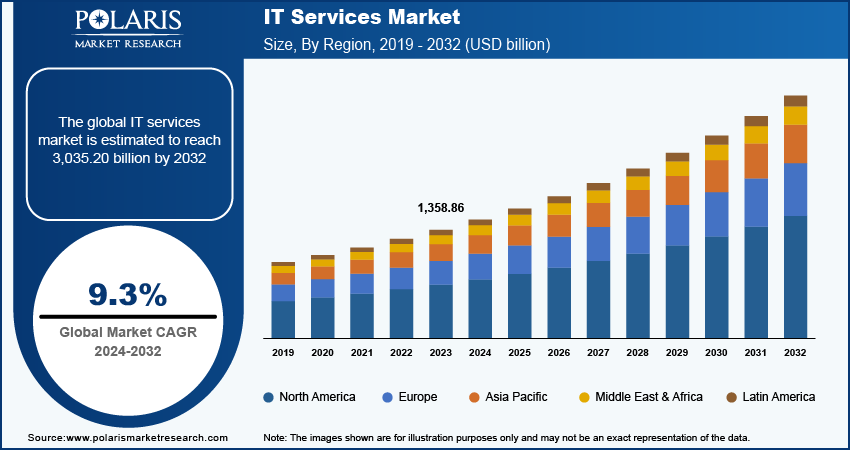

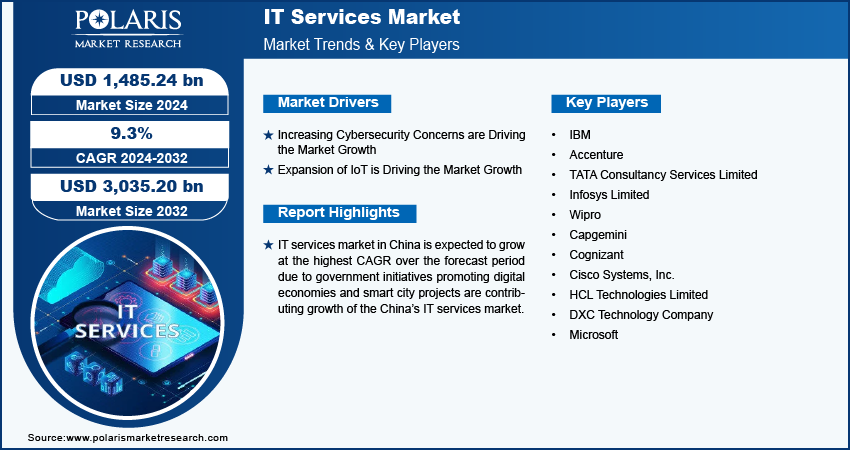

The global IT services market size was valued at USD 1,358.86 billion in 2023. The market is projected to grow from USD 1,485.24 billion in 2024 to USD 3,035.20 billion by 2032, exhibiting a CAGR of 9.3% during the forecast period.

Information technology service refers to the organization's activities involved in designing, building, delivering, operating, and controlling IT services for customers. Organizations across various sectors are adopting digital technologies to improve operations, enhance customer experiences, and stay competitive. This transformation requires robust IT infrastructure, applications, and support, leading to increased investment in IT services., thereby contributing to the market growth. Furthermore, the shift towards cloud-based solutions allows businesses to scale their IT resources quickly and cost-effectively. Therefore, more companies are migrating to the cloud for data storage, software, and infrastructure, leading to increased demand for cloud services and expertise, which in turn fuels the IT services market.

To Understand More About this Research: Request a Free Sample Report

Technologies such as blockchain technology, edge computing, and quantum computing are gaining traction. The IT industry is evolving to incorporate emerging innovations which is driving demand for specialized IT services, thereby contributing to the market growth. Furthermore, the rise of remote and hybrid work models has led to increased reliance on IT solutions that support collaboration, communication, and productivity. Tools like video conferencing, project management software, and secure remote access are in high demand, which is significantly driving the IT services market growth.

IT Services Market Drivers and Trends

Increasing Cybersecurity Concerns

Cybersecurity concerns have become a top priority for businesses as cyber threats and data breaches continue to rise. For instance, the 2023 Annual Data Breach Report documented a 78% surge in data compromises in 2023 (3,205) compared to 2022 (1,801), marking a new record for the ITRC and representing a 72% increase from the previous high in 2021 (1,860). As a result, companies are increasingly investing in comprehensive cybersecurity solutions, ranging from risk management and compliance tools to managed security services. This growing need for robust protection against cyber risks is driving demand across the IT services sector which is significantly contributing to IT services market growth.

Expansion of IoT

IoT expansion is transforming industries as more connected devices are deployed across various sectors, generating vast amounts of data. This proliferation opens up significant opportunities for IT services, as businesses need specialized solutions to manage IoT devices, ensure seamless data collection, and perform real-time data analysis. For instance, in October 2024, TEAL and Three Group Solutions partnered to expedite the global adoption of IoT eSIM technology. Effective IoT management requires robust network infrastructure, security protocols, and analytics platforms, thereby driving demand for advanced IT services. These developments are playing a pivotal role in enhancing operational efficiency and innovation, contributing to IT services market growth.

IT Services Market Segment Insights

IT Services Market Breakdown by Approach Insights

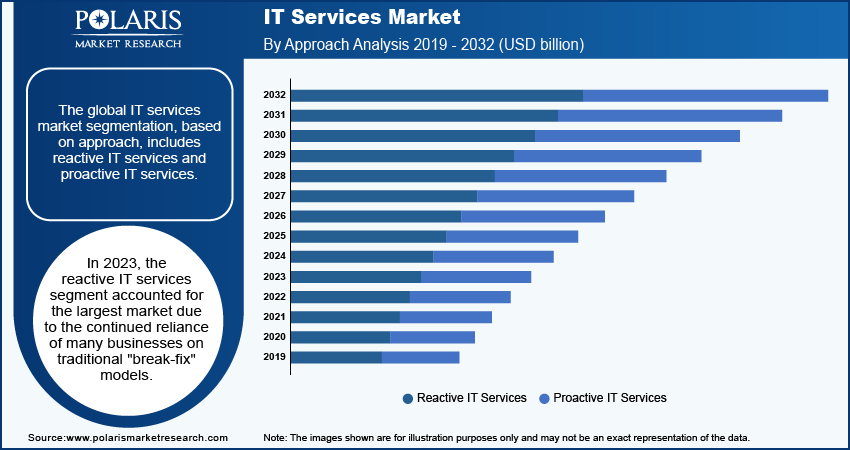

The global IT services market segmentation, based on approach, includes reactive IT services and proactive IT services. In 2023, the reactive IT services segment accounted for the largest market due to the continued reliance of many businesses on traditional "break-fix" models. Many small and medium-sized enterprises (SMEs) often lack the resources for in-house IT teams or comprehensive preventative measures and tend to choose reactive services to address issues. Additionally, organizations with limited IT budgets prefer reactive services due to the lower upfront costs compared to proactive management solutions. Thus, this segment remains strong as many companies prioritize immediate, cost-effective fixes over long-term system optimization and monitoring, contributing to its dominance in the IT services market.

IT Services Market Breakdown by End-use Insights

The global IT services market segmentation, based on end use, includes BFSI, government, healthcare, manufacturing, media & communications, retail, IT & telecom, and others. The IT & telecom category is expected to grow at the highest CAGR over the forecast period due to increasing demand for advanced communication technologies and digital transformation initiatives. Businesses across industries are adopting cloud computing, 5G networks, and IoT solutions, driving telecom companies to invest in upgrading their infrastructure to meet these needs. For instance, in August 2024, Accenture and Google Cloud revealed that their strategic partnership is making significant progress in developing solutions for enterprise customers, particularly in the areas of generative AI and cybersecurity. Additionally, the rise of remote work, mobile services, and data consumption has driven the need for more robust and scalable IT services.

IT Services Market Breakdown by Regional Insights

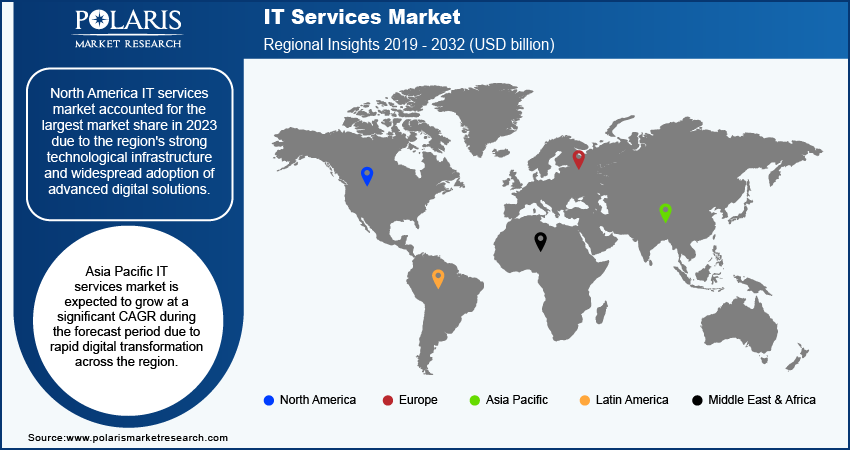

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America IT services market accounted for the largest market share in 2023. This growth is attributed to the region's strong technological infrastructure and widespread adoption of advanced digital solutions, such as cloud computing, artificial intelligence, and cybersecurity services, which have driven significant demand for IT services. Additionally, the presence of major IT service providers and partnerships among major tech-driven industries, such as finance, healthcare, and retail, are further fuelling the market growth. For instance, in June 2024, Oracle and Google Cloud partnered to offer customers the option to integrate Oracle Cloud Infrastructure with Google Cloud technologies, enabling faster application migrations and modernization. The increasing reliance on IT outsourcing and managed services by businesses to enhance operational efficiency also contributed to North America's dominance in the IT services market in 2023.

The US IT services market had the largest market share in 2023 due to the presence of numerous leading IT service providers, combined with a high demand for cloud computing, cybersecurity solutions, and managed services, significantly contributing to the market growth.

Asia Pacific IT services market is also expected to grow at a significant CAGR during the forecast period due to rapid digital transformation across the region and the increasing adoption of emerging technologies such as cloud computing, artificial intelligence, and IoT. For instance, according to NIC, in June 2021, UPI recorded over 1.49 million transactions, and in 2023, this volume reached 83.75 million transactions in India. Many businesses in the region, particularly in developing economies, are shifting towards digital solutions to enhance efficiency and competitiveness. This, in turn, contributes to the IT services market. Additionally, the region's growing IT infrastructure investments and surge in outsourcing services are driving demand for IT services.

The IT services market in China is expected to grow at the highest CAGR over the forecast period due to government initiatives promoting digital economies and smart city projects contributing to the growth of China’s IT services market.

IT Services Key Market Players & Competitive Insights

The competitive landscape of the IT services market is characterized by the presence of numerous global and regional players offering a wide range of solutions and services. Major companies such as IBM; Accenture; Tata Consultancy Services; and Cognizant dominate the market through their comprehensive service portfolios, including cloud computing, cybersecurity, IT consulting, and managed services. Major industry leaders leverage strategic partnerships, mergers, and acquisitions to expand their capabilities and enhance their market position. Additionally, the rise of smaller, specialized firms offering niche services, such as AI-driven solutions or cybersecurity, is intensifying competition. The increasing demand for innovative solutions such as automation, artificial intelligence, and the Internet of Things (IoT) has also pushed companies to invest heavily in research and development to maintain a competitive edge. Furthermore, cloud-based service providers such as AWS, Microsoft Azure, and Google Cloud are playing a pivotal role by providing scalable infrastructure that supports various IT services. Major players include IBM; Accenture; TATA Consultancy Services Limited; Infosys Limited; Wipro; Capgemini; Cognizant; Cisco Systems, Inc.; HCL Technologies Limited; DXC Technology Company; and Microsoft.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. The company is in the business of software which generates 29% of its revenue. Infrastructure services hold 37%, the hardware segment has 8%, and IT services hold 23%. The organization has an extensive network of 80,000 business associates who help it handle 5,200 clients, including 95% of the Fortune 500. Although IBM is a B2B firm, it has a significant external influence. In January 2024, IBM expanded its IBM Quantum Data Center in New York, making it the location with the largest number of available utility-scale quantum computers worldwide. The new IBM Quantum Heron processor provides up to 16 times the performance and a 25-fold improvement in speed compared to previous IBM quantum computers.

Google LLC, a subsidiary of Alphabet Inc., operates in two major reportable segments including Google Services and Google Cloud. The "Google Services" segment comprises a wide range of core products and platforms, including Android, Ads, Hardware, Chrome, Google Drive, Gmail, Google Photos, Google Maps, Google Play, YouTube, and Search. The segment's hardware products are also characterized by various products such as Pixel 5a 5G, Pixel 6 phones, Chromecast with Google TV, the Fitbit Charge 5, Google Nest Cams, and Nest Doorbells. In August 2023, Google Cloud and NVIDIA launched advanced AI infrastructure and software aimed at enabling customers to create and implement large-scale generative AI models and accelerate data science workloads.

List of Key Companies in IT Services Market

- IBM

- Accenture

- TATA Consultancy Services Limited

- Infosys Limited

- Wipro

- Capgemini

- Cognizant

- Cisco Systems, Inc.

- HCL Technologies Limited

- DXC Technology Company

- Microsoft

IT Services Industry Developments

February 2024: Wipro and IBM broadened their partnership to provide clients with new AI and support.

December 2023: IBM unveiled Hybrid Cloud Mesh Networking to dissolve the isolation between different IT operations teams.

October 2024: AWS launched Amazon DataZone, a new data management service that enables customers to govern, catalog, and share data within their organization.

IT Services Market Segmentation

By Type Outlook (Revenue - USD billion, 2019 - 2032)

- Design & Implementation

- Operations & Maintenance

By Technology Outlook (Revenue - USD billion, 2019 - 2032)

- AI & Machine Learning

- Big Data Analytics

- Threat Intelligence

- Others

By Application Outlook (Revenue - USD billion, 2019 - 2032)

- Systems & Network Management

- Data Management

- Application Management

- Security & Compliance Management

- Others

By Approach Outlook (Revenue - USD billion, 2019 - 2032)

- Reactive IT Services

- Proactive IT Services

By Deployment Outlook (Revenue - USD billion, 2019 - 2032)

- On-premises

- Cloud

By Enterprise Size Outlook (Revenue - USD billion, 2019 - 2032)

- Large Enterprise

- Small & Medium Enterprise

By End-use Outlook (Revenue - USD billion, 2019 - 2032)

- BFSI

- Government

- Healthcare

- Manufacturing

- Media & Communications

- Retail

- IT & Telecom

- Others

By Regional Outlook (Revenue - USD billion, 2019 - 2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

IT Services Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1,358.86 billion |

|

Market Size Value in 2024 |

USD 1,485.24 billion |

|

Revenue Forecast in 2032 |

USD 3,035.20 billion |

|

CAGR |

9.3% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global IT services market size was valued at USD 1,358.86 billion in 2023 and is projected to grow to USD 3,035.20 billion by 2032.

The global market registers at a CAGR of 9.3% during the forecast period.

North America had the largest share of the global market in 2023 due to the region's strong technological infrastructure and widespread adoption of advanced digital solutions.

The key players in the market August IBM; Accenture; TATA Consultancy Services Limited; Infosys Limited; Wipro; Capgemini; Cognizant; Cisco Systems, Inc.; HCL Technologies Limited; DXC Technology Company; and Microsoft.

The reactive IT services segment category dominated the market in 2023 due to the continued reliance of many businesses on traditional "break-fix" models.

The IT & telecom category is expected to grow at the highest CAGR over the forecast period due to increasing demand for advanced communication technologies.