Isostatic Pressing Market Size, Share, Trends, Industry Analysis Report: By Type (Hot Isostatic Pressing and Cold Isostatic Pressing); Application; Offering; and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 117

- Format: PDF

- Report ID: PM5081

- Base Year: 2023

- Historical Data: 2019-2022

Isostatic Pressing Market Overview

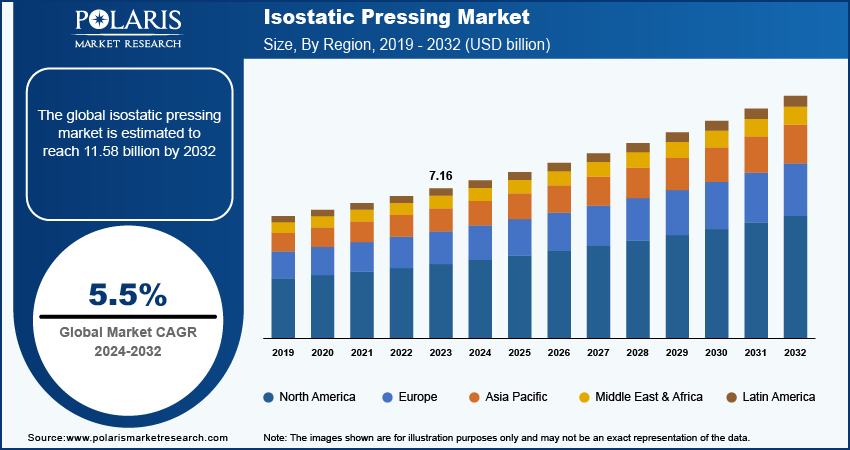

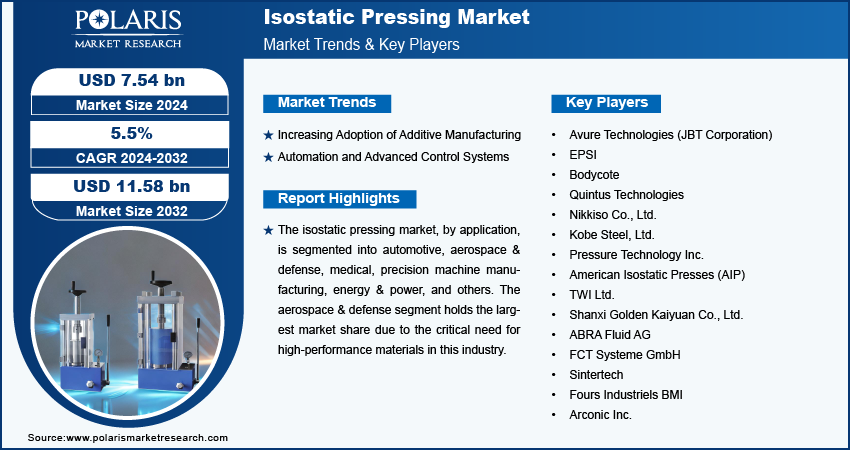

The global isostatic pressing market size was valued at USD 7.16 billion in 2023. The market is projected to grow from USD 7.54 billion in 2024 to USD 11.58 billion by 2032, exhibiting a CAGR of 5.5% during 2024–2032.

The global isostatic pressing market refers to the industry centered around the use of isostatic pressing technology, which applies equal pressure from all directions to compact materials into a solid form. This technique is widely utilized in sectors such as aerospace, automotive, medical, and energy, primarily due to its ability to produce high-density components with uniform properties. Factors such as the growing demand for advanced materials with superior mechanical properties and the increasing adoption of additive manufacturing drive the market growth. Emerging future trends in the market include the integration of automation in isostatic pressing processes and the development of cost-effective and energy-efficient systems.

To Understand More About this Research: Request a Free Sample Report

Isostatic Pressing Market Drivers and Trends

Increasing Adoption of Additive Manufacturing

A significant trend in the isostatic pressing market is expected to be the growing integration of additive manufacturing (AM), also known as 3D printing. The compatibility of isostatic pressing with AM has proven advantageous, particularly in industries requiring high-performance materials, such as aerospace and medical devices. This synergy allows manufacturers to produce complex, high-density components with enhanced mechanical properties. According to a study by Wohlers Associates, the AM market grew by 21% in 2022, with a notable portion of this growth attributed to the adoption of isostatic pressing for post-processing AM parts. This trend is expected to continue as more companies recognize the benefits of combining these technologies for improved product quality.

Automation and Advanced Control Systems

The implementation of automation and advanced control systems in isostatic pressing processes would be a key future trend. These technological advancements enable greater precision, consistency, and efficiency in the production of high-density materials. Automated systems reduce human error, ensure uniform pressure application, and optimize cycle times, leading to increased productivity and cost savings. A 2023 report by the International Federation of Robotics highlighted a 13% increase in the adoption of industrial robots in manufacturing, reflecting the broader shift toward automation. This trend is particularly relevant in the isostatic pressing market, where precision and repeatability are critical to meeting industry standards.

Development of Energy-Efficient Systems

The development of energy-efficient isostatic pressing systems is expected to become a notable trend in the coming years owing to growing environmental concerns and the rising cost of energy. Manufacturers are focusing on designing equipment that reduces energy consumption without compromising performance. Innovations in this area include the use of advanced insulation materials and optimized heating and cooling systems. A study by the US Department of Energy in 2023 emphasized the potential for energy savings in industrial processes, including isostatic pressing, through the adoption of more efficient technologies. This trend aligns with global sustainability goals and is likely to drive further innovation in the market during the forecast period.

Isostatic Pressing Market – Segment Insights

Isostatic Pressing Market Breakdown – Type-Based Insights

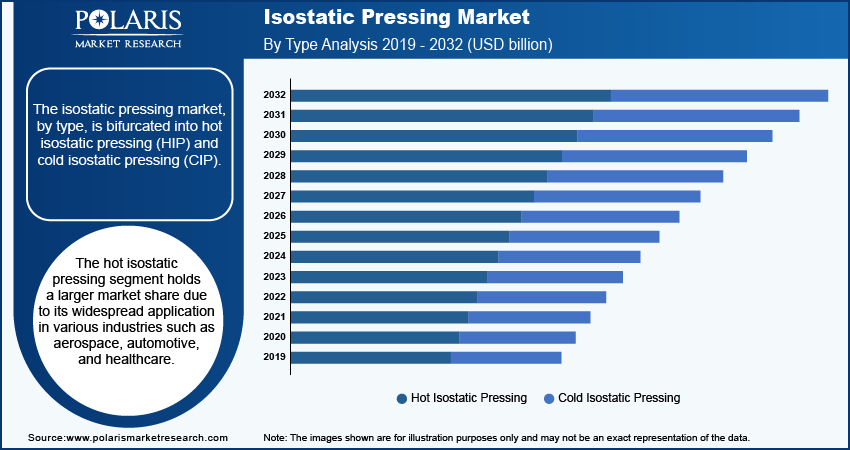

The isostatic pressing market, by type, is bifurcated into hot isostatic pressing (HIP) and cold isostatic pressing (CIP). The hot isostatic pressing segment holds a larger market share due to its widespread application in various industries such as aerospace, automotive, and healthcare. HIP is particularly valued for its ability to improve the mechanical properties of metals and alloys, including eliminating porosity and enhancing material strength. This process is crucial for the production of high-performance components where material integrity is paramount. As the demand for advanced materials continues to rise, HIP is expected to maintain its dominant position in the market.

The cold isostatic pressing segment, although holding a smaller share, is experiencing significant growth, driven by its applications in the manufacturing of ceramics, powder metallurgy, and refractory materials. CIP is favored for its ability to produce components with complex geometries and uniform density, especially in the production of large-sized parts. The increasing demand for these materials in various sectors such as electronics and energy are contributing to the growth of the CIP segment. Additionally, the cost-effectiveness and lower operational requirements of CIP are appealing to manufacturers seeking efficient production methods for specific applications.

Isostatic Pressing Market Breakdown – Application-Based Insights

The isostatic pressing market, by application, is segmented into automotive, aerospace & defense, medical, precision machine manufacturing, energy & power, and others. The aerospace & defense segment holds the largest market share due to the critical need for high-performance materials in this industry. Isostatic pressing is extensively used in the production of aircraft engines, structural components, and defense equipment, where the materials must exhibit superior strength, durability, and resistance to extreme conditions. The increasing investments in aerospace and defense, particularly in the development of next-generation aircraft and military technology, are driving the demand for isostatic pressing technologies. This segment's dominance is expected to continue as advancements in aerospace materials and technologies progress.

The medical segment is registering the highest growth rate in the market, fueled by the rising demand for advanced medical devices and implants. Isostatic pressing plays a key role in manufacturing high-density, biocompatible materials used in orthopedic implants, dental products, and other medical devices. The growing aging population with increasing prevalence of chronic diseases are leading to a higher demand for medical implants, thereby boosting the adoption of isostatic pressing in this sector. Additionally, the continuous innovation in medical materials and the expansion of healthcare infrastructure are contributing to the rapid growth of this segment.

Isostatic Pressing Market Breakdown – Offering-Based Insights

The isostatic pressing market, by offering, is bifurcated into services and systems. The systems segment holds a larger market share, driven by the increasing demand for advanced isostatic pressing equipment across various industries. Hot and cold isostatic pressing machines are essential for producing high-density materials with uniform properties. The growing adoption of automation and the need for precision manufacturing propel the demand for these systems. Industries such as aerospace, automotive, and medical are investing heavily in state-of-the-art isostatic pressing systems to enhance production efficiency and material quality, thereby sustaining the dominance of this segment.

The services segment is registering a higher growth rate, largely due to the rising need for maintenance, repair, and operational support for isostatic pressing systems. As more companies adopt advanced isostatic pressing technologies, the demand for specialized services to ensure optimal performance and longevity of the equipment is increasing. This includes routine maintenance and the provision of technical expertise and support for system upgrades. Additionally, as the market expands, there is a growing trend toward outsourcing isostatic pressing services, especially among small and medium-sized enterprises that prefer to leverage external expertise rather than invest in in-house capabilities.

Isostatic Pressing Market Breakdown – Regional Insights

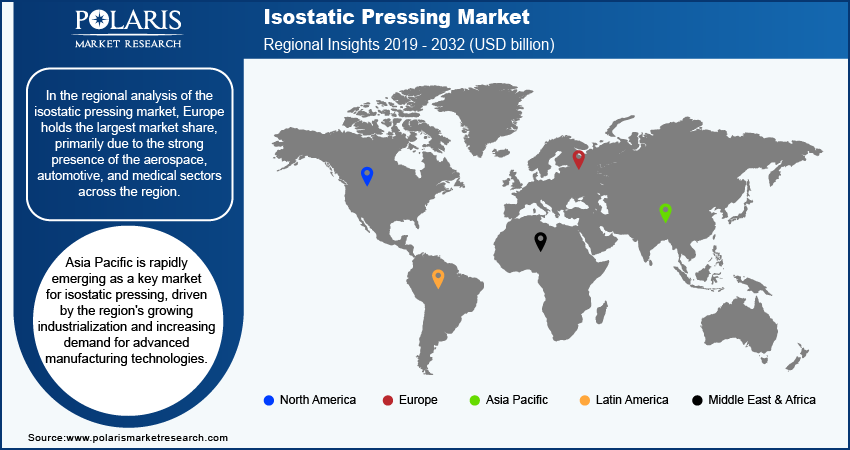

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In the regional analysis of the isostatic pressing market, Europe holds the largest market share, primarily due to the strong presence of the aerospace, automotive, and medical sectors across the region. Countries such as Germany, the UK, and France are at the forefront of adopting advanced manufacturing technologies, including isostatic pressing, driven by the high demand for high-performance materials and components. The well-established industrial base, combined with continuous investments in research and development, supports Europe's dominance in the market. Additionally, the region's stringent quality standards and emphasis on precision manufacturing contribute to the widespread adoption of isostatic pressing technologies. North America and Asia Pacific are also significant markets, with growing investments in these technologies, particularly in aerospace and automotive manufacturing.

Asia Pacific is rapidly emerging as a key market for isostatic pressing, driven by the region's growing industrialization and increasing demand for advanced manufacturing technologies. The expansion of the automotive, aerospace, and electronics sectors in countries such as China, Japan, and South Korea is fueling the adoption of isostatic pressing technologies. In particular, China is investing heavily in upgrading its manufacturing capabilities to produce high-quality components for domestic and international markets. The region also benefits from a growing focus on innovation and technological advancements, with several countries in Asia-Pacific enhancing their capabilities in precision manufacturing. Additionally, the rising healthcare infrastructure in the region is contributing to the increased use of isostatic pressing in the medical sector, particularly for the production of implants and other high-density medical devices.

Isostatic Pressing Market – Key Players and Competitive Insights

The isostatic pressing market features several key players that are actively contributing to the industry's growth through the development and provision of advanced isostatic pressing systems and services. These companies include Avure Technologies (now part of JBT Corporation); EPSI; Bodycote; Quintus Technologies; and Nikkiso Co., Ltd. Additionally, companies such as Kobe Steel, Ltd.; Pressure Technology Inc.; American Isostatic Presses (AIP); and TWI Ltd. are also significant players in the market. Other notable companies such as Shanxi Golden Kaiyuan Co., Ltd.; ABRA Fluid AG; FCT Systeme GmbH; Sintertech; Fours Industriels BMI; and Arconic Inc. focus on the production of advanced materials using isostatic pressing technologies.

In terms of competitive analysis, these companies are focusing on innovation, expansion of product offerings, and the integration of advanced technologies to strengthen their market position. Avure Technologies, under JBT Corporation, continues to leverage its expertise in hot isostatic pressing (HIP) and high-pressure technologies, catering to industries such as aerospace and medical. Quintus Technologies is known for its strong portfolio in hot and cold isostatic pressing systems, emphasizing the development of efficient, energy-saving solutions. Bodycote, a significant player in thermal processing services, has a broad global presence and offers extensive HIP services, which are crucial for enhancing the mechanical properties of materials. Kobe Steel, Ltd. and Nikkiso Co., Ltd. are also expanding their isostatic pressing capabilities, particularly in Asia Pacific, to meet the rising demand from the automotive and electronics sectors.

The companies operating in the market are actively engaging in partnerships, mergers, and acquisitions to expand their market reach and enhance their technological capabilities. For instance, EPSI and American Isostatic Presses focus on custom-designed systems and services, allowing them to cater to specific industry needs, while FCT Systeme GmbH and Shanxi Golden Kaiyuan Co., Ltd. are expanding their presence in emerging markets. The competition is intense as these companies strive to offer cutting-edge solutions and maintain a competitive edge through continuous innovation and customer-focused strategies. As a result, the market is characterized by a mix of established players and emerging companies, each contributing to the overall growth and technological advancement of the isostatic pressing industry.

Avure Technologies, now part of JBT Corporation, is a notable player in the isostatic pressing market, particularly recognized for its expertise in hot isostatic pressing (HIP) technology. The company provides advanced solutions that cater to industries requiring high-performance materials such as aerospace, medical, and automotive. Avure's systems are designed to enhance the mechanical properties of metals and alloys, making them crucial for the production of high-density components.

Quintus Technologies is another significant player in the isostatic pressing market, known for its comprehensive range of hot and cold isostatic pressing systems. The company serves a diverse set of industries, including aerospace, energy, and precision manufacturing, offering solutions that ensure uniform density and improved material properties. Quintus is particularly active in developing systems that integrate automation and advanced control features, enhancing productivity and consistency in manufacturing processes.

Key Companies in Isostatic Pressing Market

- Avure Technologies (JBT Corporation)

- EPSI

- Bodycote

- Quintus Technologies

- Nikkiso Co., Ltd.

- Kobe Steel, Ltd.

- Pressure Technology Inc.

- American Isostatic Presses (AIP)

- TWI Ltd.

- Shanxi Golden Kaiyuan Co., Ltd.

- ABRA Fluid AG

- FCT Systeme GmbH

- Sintertech

- Fours Industriels BMI

- Arconic Inc

Isostatic Pressing Industry Developments

- In June 2023, Quintus Technologies reported a new partnership with a major aerospace manufacturer to supply a series of isostatic pressing systems tailored to the production of next-generation aircraft components, underscoring its role in advancing aerospace manufacturing capabilities.

- In May 2023, Avure Technologies announced the launch of a new HIP system designed to improve energy efficiency and reduce operational costs, reflecting the company's focus on innovation and sustainability.

Isostatic Pressing Market Segmentation

By Type Outlook

- Hot Isostatic Pressing

- Cold Isostatic Pressing

By Application Outlook

- Automotive

- Aerospace & Defense

- Medical

- Precision Machine Manufacturing

- Energy & Power

- Others

By Offering Outlook

- Services

- Systems

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Isostatic Pressing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 7.16 billion |

|

Market Size Value in 2024 |

USD 7.54 billion |

|

Revenue Forecast in 2032 |

USD 11.58 billion |

|

CAGR |

5.5% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global isostatic pressing market size was valued at USD 7.16 billion in 2023 and is projected to grow to USD 11.58 billion by 2032.

The global market is projected to register a CAGR of 5.5% during 2024–2032.

Europe accounted for the largest share of the global market in 2023

The isostatic pressing market features several key players that are actively contributing to the its growth through the development and provision of advanced isostatic pressing systems and services. These companies include Avure Technologies (now part of JBT Corporation); EPSI; Bodycote; Quintus Technologies; and Nikkiso Co., Ltd

The hot isostatic pressing segment accounted for a larger share of the global market.

The aerospace & defense segment accounted for the largest share of the global market

Isostatic pressing is a manufacturing process used to compact and shape materials by applying equal pressure from all directions. This technique, which includes both hot and cold isostatic pressing methods, is employed to produce high-density components with uniform properties. In hot isostatic pressing (HIP), materials are subjected to high temperatures and pressure to enhance their mechanical properties and eliminate porosity. Cold isostatic pressing (CIP) applies pressure at room temperature, often used for materials such as ceramics and powders to achieve desired shapes and densities.

A few key trends in the isostatic pressing market are described below: Integration with Additive Manufacturing: The combination of isostatic pressing with additive manufacturing technologies to enhance material properties and production efficiency. Automation and Advanced Control Systems: The increasing use of automation and sophisticated control systems to improve precision, consistency, and operational efficiency in isostatic pressing processes. Development of Energy-Efficient Systems: Innovations aimed at reducing energy consumption and operational costs through advanced insulation materials and optimized heating and cooling systems. Growing Demand in Medical Sector: Rising use of isostatic pressing in the production of high-density, biocompatible materials for medical implants and devices.

For a new company entering the isostatic pressing market, focusing on technological innovation and niche applications could provide a competitive edge. Emphasizing the development of advanced automation and energy-efficient systems can address growing demands for cost-effective and sustainable solutions. Additionally, targeting emerging sectors such as medical devices and additive manufacturing, where precision and high-quality materials are crucial, would create significant opportunities in the coming years

Companies producing isostatic pressing and related products and other consulting firms must buy the report.