IoT Technology Market Size, Share, Trends, Industry Analysis Report: By Platform, Services, Software Solution, Node Component, End-use Application (Industrial and Consumer), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 – 2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5223

- Base Year: 2024

- Historical Data: 2020-2023

IoT Technology Market Overview

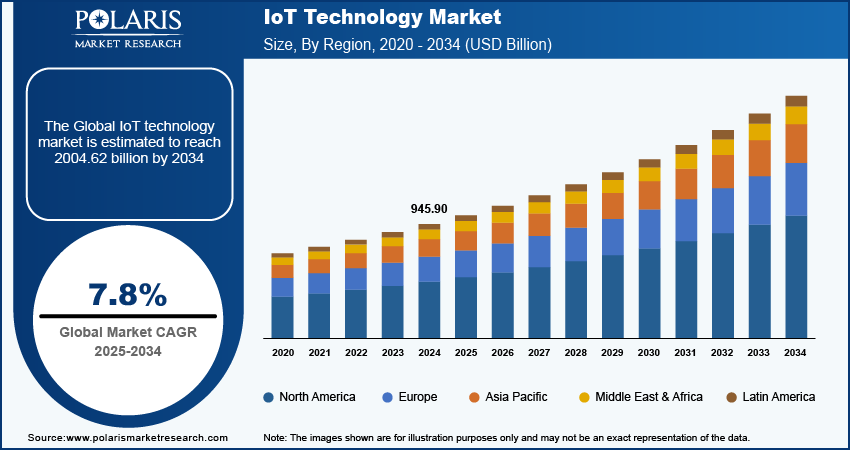

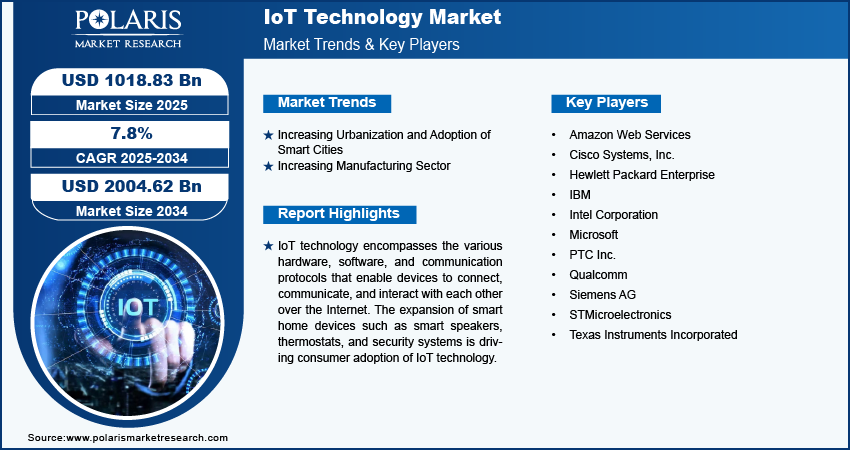

Global IoT technology market size was valued at USD 945.90 billion in 2024. The market is projected to grow from USD 1018.83 billion in 2025 to USD 2004.62 billion by 2034, exhibiting a CAGR of 7.8% during the forecast period.

IoT technology encompasses the various hardware, software, and communication protocols that enable devices to connect, communicate, and interact with each other over the Internet. It involves a combination of several technologies to make the concept of the Internet of Things functional and effective.

The expansion of smart home devices such as smart speakers, thermostats, and security systems is driving consumer adoption of IoT technology, thereby fueling market growth. Furthermore, industrial IoT is gaining traction as companies in manufacturing, logistics, and other sectors adopt IoT solutions to improve operational efficiency, predictive maintenance, and supply chain management, which is significantly propelling the market share.

To Understand More About this Research: Request a Free Sample Report

IoT solutions are increasingly being used to monitor and manage energy consumption in buildings, industries, and cities. This focus on energy efficiency and sustainability is driving the adoption of IoT technologies that help reduce energy costs and environmental impact, thereby fueling market growth. Moreover, the development and deployment of advanced wireless technologies such as 5G are enhancing IoT connectivity, providing faster and more reliable data transfer. This improvement is crucial for the functioning of IoT devices that require real-time data processing and communication. The rising adoption of advanced technology is driving the demand for IoT solutions, thereby driving the IoT technology market.

IoT Technology Market Drivers and Trends Analysis

Increasing Urbanization and Adoption of Smart Cities

The urbanization accelerates globally, nations are increasingly adopting smart city initiatives and deploying advanced smart city solutions to enhance resource management and operational efficiency. The proliferation of connected devices such as sensors, smart meters, and intelligent lighting systems is pivotal in advancing the functionality and efficiency of urban infrastructure and services.

The rise of smart homes, Industry 4.0, smart manufacturing, and advanced infrastructure development is anticipated to drive significant transformation across various business sectors, thereby propelling the growth of the IoT technology market. For instance, according to the World Economic Forum, 1.3 million people relocate to urban areas each week, and by 2040, it is projected that 65% of the global population will reside in cities. This shift towards urbanization and increased adoption of smart technologies is fueling the escalating demand for IoT technology.

Increasing Manufacturing Sector

The manufacturing sector is undergoing significant global expansion as companies seek operational scaling and market diversification. Emerging economies are experiencing a surge in industrialization, while established markets are investing in facility modernization. For instance, in 2022, the manufacturing sector contributed USD 2.3 trillion to the U.S. GDP, representing 11.4% of the total GDP, highlighting the sector's pivotal role in economic growth; the rising manufacturing sector is utilizing IoT technology, which is significantly driving market growth.

IoT Technology Market Segment Analysis

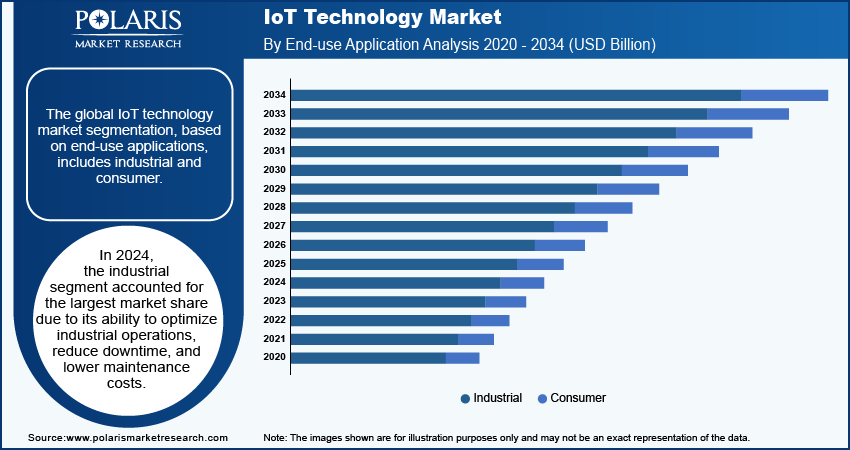

IoT Technology Market Breakdown by End-use Application Insights

The global IoT technology market segmentation, based on end-use application, includes industrial and consumer. In 2024, the industrial segment accounted for the largest market share. Industrial IoT solutions enable companies to optimize their operations, reduce downtime, and lower maintenance costs. The rising e-commerce platform is enhancing the adoption of IoT technology. For instance, according to the US Department of Commerce, US retail e-commerce sales reached USD 289.2 billion in the first quarter of 2024, marking a 2.1 percent increase from the fourth quarter of 2023. These advancements in e-commerce, driven by IoT technology, are significantly contributing to the growth of the IoT technology market. The integration of IoT technology into e-commerce is revolutionizing the industry by enhancing operational efficiency, improving customer experiences, and optimizing supply chain management.

IoT Technology Market Breakdown by Platform Outlook

The global IoT technology market segmentation, based on platform, includes device management, application management, and network management. The device management segment is expected to grow at the highest CAGR during the forecast period. The rising number of connected devices across various industries is driving the need for effective device management solutions to handle the scale and complexity of these networks. The launch and integration of device management solutions with cloud platforms, such as AWS IoT Device Management, provide seamless access to advanced analytics, machine learning, and data storage capabilities. For instance, in June 2024, Amazon Web Services IoT Device Management launched a new connectivity metrics dashboard, allowing customers to configure operational alarms and identify connectivity patterns easily for their device fleets through a suitable view. This integration enhances the value of device management solutions. Thus, the market segment is anticipated to grow during the forecast period.

IoT technology Market Breakdown by Regional Outlook

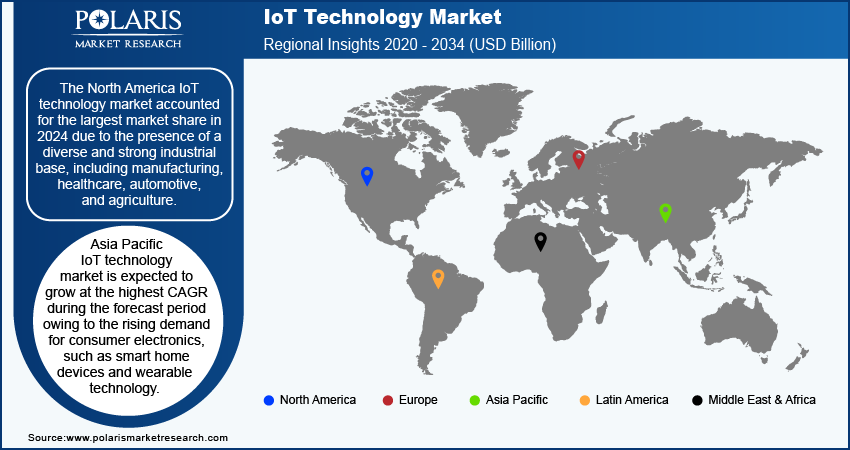

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America IoT technology market accounted for the largest market share in 2024. North America has a diverse and strong industrial base, including manufacturing, healthcare, automotive, and agriculture. These sectors are increasingly adopting IoT technologies to improve efficiency, reduce costs, and drive innovation. Especially the US, is a hub for technological innovation. The region has a high concentration of leading tech companies such as AWS, Microsoft, Google, IBM, and others that are launching platforms and constantly developing and deploying advanced IoT solutions. For instance, Microsoft launched two accelerators for industrial transformation: Azure IoT Operations (preview) and Azure’s adaptive cloud approach. This innovation ecosystem accelerates the adoption of IoT technologies across various industries, further fueling the market in the region.

The US IoT technology market accounted for the largest market share in 2024. It benefits from a robust technological infrastructure, including widespread high-speed internet, advanced data centers, and early adoption of 5G networks. This infrastructure facilitates the efficient deployment and operation of IoT devices and services, thereby propelling the market.

Asia Pacific IoT technology market is expected to grow at the highest CAGR during the forecast period. The demand for consumer electronics, such as smart home devices and wearable technology, is rising in Asia Pacific. Furthermore, governments across the region are encouraging IoT adoption through supportive policies and funding. For instance, China’s “Made in China 2025” initiative focuses on advancing technology, including IoT, in various industries. Such policies create a favorable environment for IoT market expansion. IoT applications in healthcare and agriculture are gaining traction. In countries including Australia and Thailand, IoT is used for telemedicine, remote monitoring, and precision agriculture, which contributes to the rapid growth in the IoT technology market.

China's IoT technology market is expected to experience the fastest growth during the forecast period. It is rapidly adopting IoT technology across its semiconductor and manufacturing industries. The country’s focus on advancing its semiconductor capabilities and integrating IoT solutions into manufacturing processes is driving significant market growth.

IoT Technology Key Market Players & Competitive Insights

Major market players are investing heavily in research and development in order to expand their product lines, which will help the IoT technology market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the IoT technology industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global IoT technology industry to benefit clients and increase the market sector. In recent years, the IoT technology market has offered some technological advancements. Major players in the market include Amazon Web Services; Cisco Systems, Inc.; Hewlett Packard Enterprise; IBM; Intel Corporation; Microsoft; PTC Inc.; Qualcomm; Siemens AG; STMicroelectronics; and Texas Instruments Incorporated.

Cisco Systems, Inc. designs, manufactures, and markets Internet Protocol-based networking solutions and related products across Europe, the Americas, the Middle East, Africa, and Asia Pacific. The company offers a comprehensive switching portfolio that includes both campus and data center switching solutions. Additionally, Cisco provides an integrated portfolio featuring the Cisco Unified Computing System and advanced software management capabilities. This combination delivers a unified approach to managing computing, networking, storage infrastructure, and virtualization. In February 2023, Cisco partnered with Intel to accelerate engineering creation and drive the adoption of Cisco Private 5G powered by Intel technology. This collaboration develops reference architectures for various Internet of Things industries, including supply chain, manufacturing, and smart venues.

Siemens AG specializes in electrification, automation, and digitalization and operates in a diverse range of industries, such as energy, healthcare, financing, building technology, transportation, and manufacturing. The company provides a comprehensive range of products and services, including power generation systems, turbines, medical imaging equipment, trains, and automation software, as well as building technologies and smart grid solutions. In March 2023, Siemens launched the Connect Box, a smart IoT solution designed for managing smaller buildings.

List of Key Companies in IoT Technology Industry Outlook

- Amazon Web Services

- Cisco Systems, Inc.

- Hewlett Packard Enterprise

- IBM

- Intel Corporation

- Microsoft

- PTC Inc.

- Qualcomm

- Siemens AG

- STMicroelectronics

- Texas Instruments Incorporated

IoT Technology Industry Developments

April 2024: Qualcomm launched new Wi-Fi technologies and IoT tailored for industrial applications. The latest Wi-Fi solution and platform enhancements enable on-device AI and provide significant improvements in IoT connectivity.

November 2023: Amazon Web Services and Siemens extended their partnership to streamline the relationship of physical devices with the cloud. The enhanced collaboration, Amazon Web Services IoT SiteWise Edge software is now directly installed from Siemens' Industrial Edge Marketplace.

June 2023: PTC and Rockwell Automation extended their partnership to advance IoT and augmented reality solutions in manufacturing. Under this extended patnership, Rockwell Automation continues to resell PTC's Digital Performance Management manufacturing solution and ThingWorx IoT platform, including, as well as Vuforia AR software.

IoT Technology Market Segmentation

By Platform Outlook (Revenue - USD Billion, 2020 - 2034)

- Device Management

- Application Management

- Network Management

By Services Outlook (Revenue - USD Billion, 2020 - 2034)

- Professional Services

- Managed Services

By Software Solution Outlook (Revenue - USD Billion, 2020 - 2034)

- Data Management

- Real-Time Streaming Analytics

- Network Bandwidth Management

- Remote Monitoring

- Security Solution

By Node Component Outlook (Revenue - USD Billion, 2020 - 2034)

- Processor

- Connectivity IC

- Sensor

- Memory Device

- Logic Device

By End Use Application Outlook (Revenue - USD Billion, 2020 - 2034)

- Industrial

- Consumer

By Regional Outlook (Revenue - USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

IoT Technology Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 945.90 Billion |

|

Market Size Value in 2025 |

USD 1018.83 Billion |

|

Revenue Forecast in 2034 |

USD 2004.62 Billion |

|

CAGR |

7.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global IoT technology market size was valued at USD 945.90 billion in 2024.

The global market is projected to register a CAGR of 7.8% during the forecast period 2025-2034.

North America had the largest share of the global market

The key players in the market are Amazon Web Services; Cisco Systems, Inc.; Hewlett Packard Enterprise; IBM; Intel Corporation; Microsoft; PTC Inc.; Qualcomm; Siemens AG; STMicroelectronics; and Texas Instruments Incorporated.

The industrial category dominated the market in 2024.

Device management had the fastest share in the global market.