IoT Module Market Size, Share, Trends, Industry Analysis Report: By Component (Hardware, Software, and Services), Deployment Type, Security Features, Industry Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5425

- Base Year: 2024

- Historical Data: 2020-2023

IoT Module Market Overview

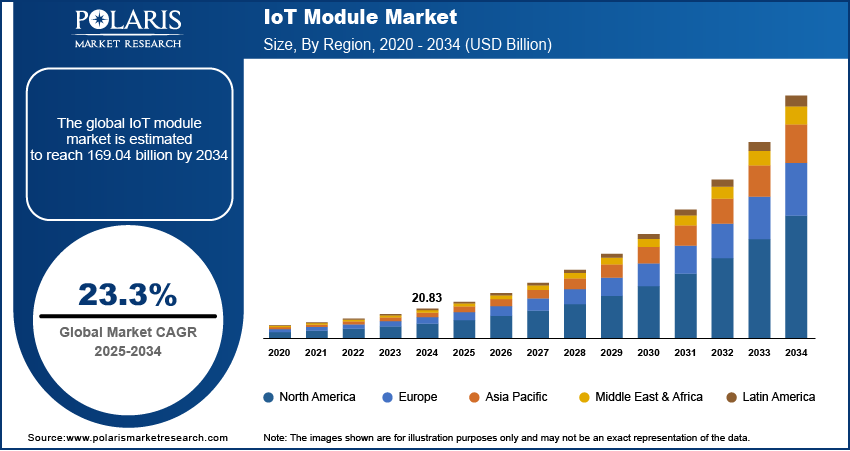

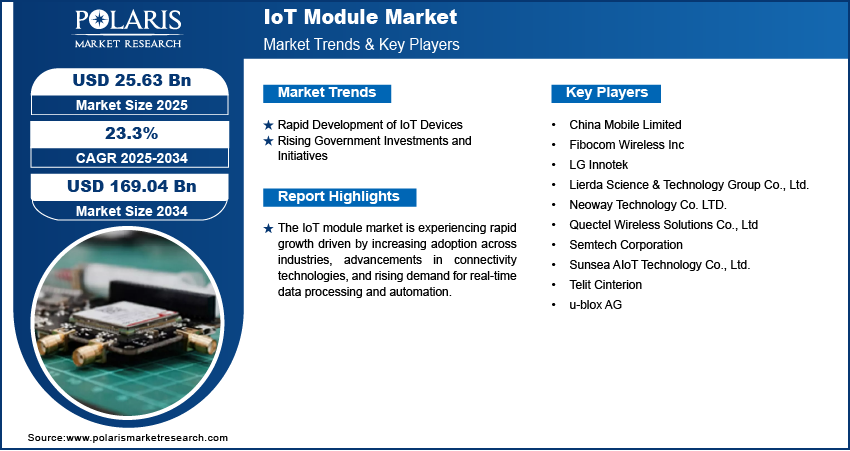

The global IoT module market size was valued at USD 20.83 billion in 2024. It is expected to grow from USD 25.63 billion in 2025 to USD 169.04 billion by 2034, at a CAGR of 23.3% during 2025–2034.

An Internet of Things (IoT) module is a small electronic device embedded in objects, machines, and things to enable wireless communication over networks. The increasing integration of IoT in 5G networks is driving the IoT module market growth. According to a report published by Ericsson in 2023, the number of cellular IoT connections reached 3.4 billion, showcasing the rapid adoption of IoT technologies worldwide. IoT modules are becoming more advanced, supporting higher data speeds, ultra-low latency, and improved connectivity with the introduction of 5G technology. The ability of 5G services to handle a massive number of devices has accelerated the deployment of IoT modules across various industries such as healthcare for remote patient monitoring and manufacturing for smart factory automation and predictive maintenance. This integration improves real-time data transmission and also facilitates smart city developments, industrial automation, and advanced healthcare systems by ensuring reliable and efficient communication. As a result, the demand for IoT modules is experiencing a robust surge, aligning with the rapid expansion of 5G infrastructure globally.

To Understand More About this Research: Request a Free Sample Report

The need for improved communication is driving the IoT module market expansion. The demand for modules capable of supporting high-bandwidth applications and ensuring secure and stable connections has intensified as industries adopt IoT solutions. Enhanced communication capabilities in IoT modules allow seamless data exchange between devices, which is critical for applications such as autonomous vehicles, remote healthcare monitoring, and precision agriculture. The ability to manage high data throughput with minimal disruptions is becoming indispensable, prompting manufacturers to innovate IoT modules with advanced communication protocols and security features. For instance, in July 2024, Moxa launched the MRX Series Layer 3 rackmount Ethernet switches, supporting 64 ports with up to 16 ports of 10GbE speed, to enhance industrial network infrastructure and enable IT/OT convergence for IoT and AI-driven digital transformation. This development highlights the growing focus on high-performance networking solutions to meet the demands of modern IoT applications. Consequently, the growing emphasis on efficient and secure data communication continues to elevate the significance of IoT modules in the evolving technological landscape.

IoT Module Market Dynamics

Rapid Development of IoT Devices

The rapid development of IoT devices accelerates the need for advanced and efficient modules to support diverse applications. There is a rising demand for modules that offer seamless connectivity, low power consumption, and improved processing capabilities as industries such as healthcare, manufacturing, and transportation increasingly adopt IoT solutions. In January 2024, Wi-Fi CERTIFIED 7 was launched by Wi-Fi alliance with advanced features such as 320 MHz channels; multi-link operation; and 4K QAM to enhance performance, reliability, and latency. This advancement underscores the growing need for robust connectivity solutions to support next-generation IoT applications. It supports innovations in AR/VR, Industrial IoT (IIoT), and automotive, with rapid adoption expected across devices. The increasing innovation in IoT devices also drives manufacturers to develop modules with greater compatibility and scalability to accommodate evolving requirements. This continuous expansion of IoT ecosystems makes the IoT module a crucial element in enabling smart and interconnected environments. Thus, the rapid development of IoT devices fuels the IoT module market demand.

Rising Government Investments and Initiatives

Governments across the world are increasingly focusing on smart infrastructure projects, digital transformation, and Industry 4.0, which rely heavily on IoT technology. As of September 2024, India’s Smart Cities Mission completed over 90% of its 8,000 projects worth USD 19.2 billion. This demonstrates how public investments in smart infrastructure directly contribute to the expansion of IoT ecosystems. Furthermore, favorable government policies, funding, incentives, and regulatory support for IoT adoption in smart cities, energy management, connected healthcare systems, and others accelerate the deployment of IoT networks and boost the demand for IoT modules that can ensure secure and reliable data transmission. Hence, the rising government investments and initiatives play an important role in driving the IoT module market development.

IoT Module Market Segment Assessment

IoT Module Market Assessment by Component Outlook

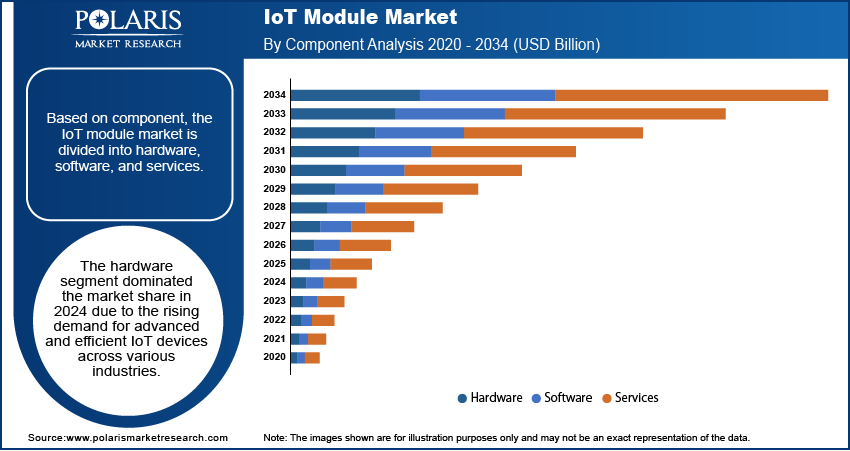

The global IoT module market segmentation, based on components, includes hardware, software, and services. The hardware segment dominated the IoT module market share in 2024 due to the rising demand for advanced and efficient IoT devices across various industries. Hardware components such as sensors, processors, and connectivity modules are fundamental to enabling IoT systems to collect, process, and transmit data effectively. The continuous innovation in hardware technology, focusing on miniaturization, power efficiency, and improved processing capabilities, has greatly boosted its adoption. Additionally, the expansion of smart devices and increased investments in industrial IoT applications have solidified the dominance of the hardware segment, making it a crucial pillar in the IoT ecosystem.

IoT Module Market Evaluation by Deployment Type Outlook

The global IoT module market segmentation, based on deployment type, includes on-premises, cloud-based, and hybrid. The cloud-based segment is expected to witness the fastest market growth during the forecast period, primarily due to its scalability, flexibility, and cost-effectiveness. Cloud-based deployments enable seamless data storage, management, and analytics, which are essential for real-time decision-making in IoT applications. The ability to integrate vast amounts of data from distributed IoT devices without extensive on-premises infrastructure has made cloud solutions particularly attractive to businesses. Furthermore, the adoption of cloud-native technologies and the expansion of cloud infrastructure are driving the rapid growth of this segment, positioning it as a critical enabler for scalable IoT deployments.

IoT Module Market Regional Analysis

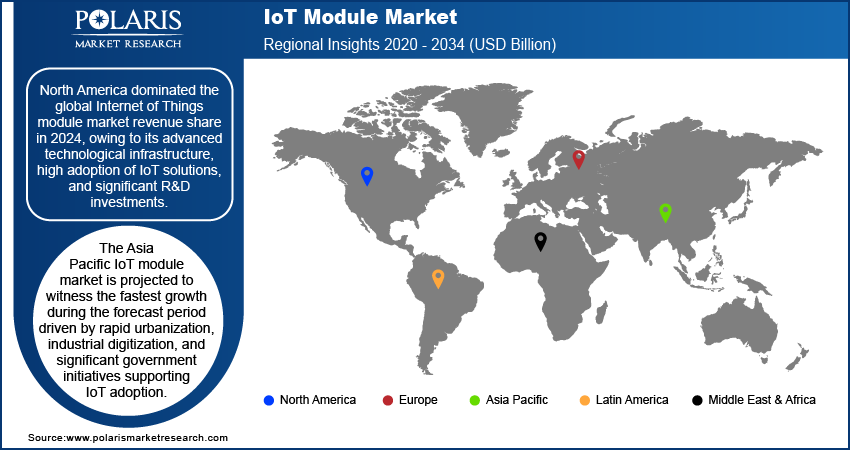

By region, the report provides the Internet of Things (IoT) module market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the IoT module market revenue share in 2024, owing to its advanced technological infrastructure, high adoption of IoT solutions, and significant investments in research and development. The presence of key market players and a strong focus on smart cities, industrial automation, and connected healthcare have reinforced the region’s leadership. Additionally, favorable regulatory policies and a well-established 5G network have accelerated the deployment of IoT modules across various sectors such as healthcare and manufacturing. According to a July 2024 report by 5G Americas, North America’s 5G adoption represents 32% of all wireless cellular connections, which is double the global average. This marks an 11% growth and adds 22 million new connections. These factors, combined with a mature digital ecosystem, have enabled North America to capture a substantial IoT module market share.

The Asia Pacific IoT module market demand is projected to witness the fastest growth during the forecast period, driven by rapid urbanization, industrial digitization, and significant government initiatives supporting IoT adoption. The expansion of smart city projects, coupled with increasing investments in 5G infrastructure, is creating a conducive environment for IoT module deployment. Moreover, the rising adoption of connected devices and the growing demand for automation in manufacturing hubs such as China, Japan, and South Korea are propelling the Internet of Things module market expansion. In February 2025, India’s Union Budget allocated USD 2.30 billion to boost R&D, focusing on AI and geospatial initiatives and establishing 50,000 Atal Tinkering Labs to boost innovation and strengthen industry-academia collaboration for digital transformation and technological growth. This investment highlights the region’s commitment to advancing IoT and related technologies. As a result, Asia Pacific is emerging as a hotspot for IoT innovation and deployment, promising substantial IoT module market opportunities.

Internet of Things (IoT) Module Market – Key Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for significant IoT module market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Internet of Things module market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies address localized needs by offering cost-effective solutions and leveraging economic landscapes. Competitive benchmarking in the market includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with IoT module market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. In conclusion, the market growth is driven by technological innovation, market adaptability, and regional investments. Major players focus on strategic developments, market penetration, and competitive benchmarking to address economic and geopolitical shifts, ensuring sustained growth in a hypercompetitive global market. A few key major players are China Mobile Limited; Fibocom Wireless Inc.; LG Innotek; Lierda Science & Technology Group Co., Ltd.; Neoway Technology Co. LTD.; Quectel Wireless Solutions Co., Ltd; Semtech Corporation; Sunsea AIoT Technology Co., Ltd.; Telit Cinterion; and u-blox AG.

Fibocom Wireless Inc., founded in 1999, is a global provider of IoT wireless solutions and communication modules. The company is headquartered in Shenzhen, China, and has established itself as a pioneer in the IoT industry by offering a wide range of wireless modules. Fibocom's product portfolio includes 5G, 4G, 3G, 2G, LPWA cellular modules, automotive-grade modules, smart modules, GNSS modules, and antenna services. These modules are designed to enable efficient and intelligent connectivity across various industries such as smart cities, smart agriculture, smart home, telemedicine, and industrial IoT. The company has a strong focus on innovation, having launched the world's first 5G module for commercial use, which has greatly contributed to the industry's adoption of 5G technology. Fibocom's modules are optimized for global connectivity, power efficiency, and compact form factors, making them ideal for diverse IoT applications. The company's global presence includes over 30 subsidiaries and regional operation centers across China, the Americas, EMEA, and Asia Pacific, serving more than 100 countries. Fibocom's commitment to digital transformation is evident in its strategic collaborations and investments in emerging technologies such as C-V2X and AI solutions.

LG Innotek, established in 1970, is a global materials and components company and an affiliate of the LG Group. Headquartered in Seoul, South Korea, it specializes in producing core components for mobile devices, automotive displays, semiconductors, and smart products. The company is renowned for its innovative technologies, particularly in 3D sensing modules and ultra-slim high-pixel camera modules used in mobile devices. Additionally, LG Innotek plays a noteworthy role in the automotive sector with solutions such as connectivity, autonomous driving, electrification, and lighting modules. In the realm of IoT (Internet of Things), LG Innotek offers a range of electronic components and solutions. These include power and smart connectivity solutions that cater to various IoT applications. The company's product portfolio encompasses camera modules, 3D sensing modules, radar modules, photomasks, tape substrates, semiconductors, and LEDs, which are integral to IoT devices and systems. LG Innotek's IoT modules are designed to enhance connectivity and functionality across different sectors, from mobile devices to home appliances and automotive systems.

List of Key Companies in IoT Module Market

- China Mobile Limited

- Fibocom Wireless Inc.

- LG Innotek

- Lierda Science & Technology Group Co., Ltd.

- Neoway Technology Co. LTD.

- Quectel Wireless Solutions Co., Ltd

- Semtech Corporation

- Sunsea AIoT Technology Co., Ltd.

- Telit Cinterion

- u-blox AG

IoT Module Industry Development

March 2025: Cavli Wireless launched the smart module series, including the CQS29X, CQS315, and CQS325. These modules enhance IoT connectivity and are suitable for automotive, industrial, and healthcare applications, providing advanced performance for various use cases.

February 2025: Globalstar launched a two-way satellite IoT solution with the RM200M module, featuring integrated GNSS, Bluetooth, and an accelerometer for global monitoring.

November 2024: Qualcomm launched the QCC730M and QCC74xM IoT modules, offering micro-power Wi-Fi 4 and support for multiple connectivity options such as Bluetooth and Zigbee.

IoT Module Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Deployment Type Outlook (Revenue, USD Billion, 2020–2034)

- On-Premises

- Cloud-Based

- Hybrid

By Security Features Outlook (Revenue, USD Billion, 2020–2034)

- Secure Elements (SE) Modules

- Trusted Platform Modules (TPM)

- Encryption-Enabled Modules

- Others

By Industry Use Outlook (Revenue, USD Billion, 2020–2034)

- Smart Home

- Industrial Automation

- Healthcare

- Financial Services

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

IoT Module Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 20.83 billion |

|

Market Size Value in 2025 |

USD 25.63 billion |

|

Revenue Forecast by 2034 |

USD 169.04 billion |

|

CAGR |

23.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Internet of Things module market size was valued at USD 20.83 billion in 2024 and is projected to grow to USD 169.04 billion by 2034.

The global market is projected to register a CAGR of 23.3% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are China Mobile Limited; Fibocom Wireless Inc.; LG Innotek; Lierda Science & Technology Group Co., Ltd.; Neoway Technology Co. LTD.; Quectel Wireless Solutions Co., Ltd; Semtech Corporation; Sunsea AIoT Technology Co., Ltd.; Telit Cinterion; and u-blox AG.

The hardware segment dominated the market share in 2024

The cloud-based segment is expected to witness the fastest growth during the forecast period.