IoT Integration Market Size, Share, Trends, Industry Analysis Report: By Enterprise Size (Large Enterprises and Small and Medium Enterprises), Service, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM5295

- Base Year: 2024

- Historical Data: 2020-2023

IoT Integration Market Overview

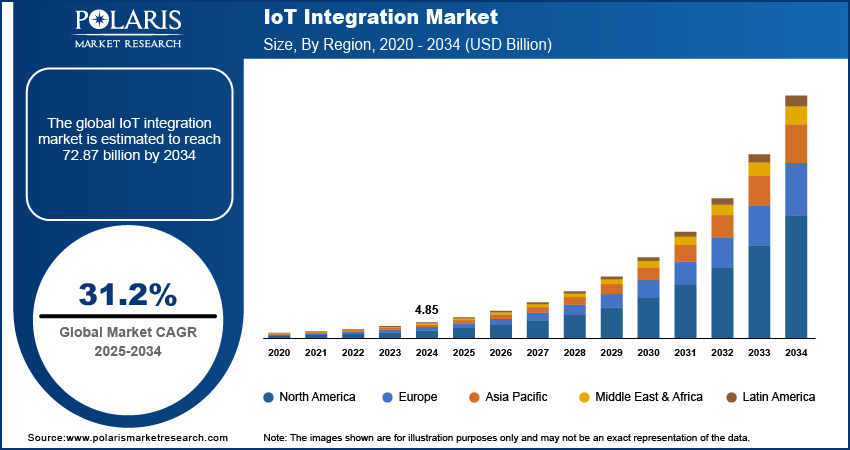

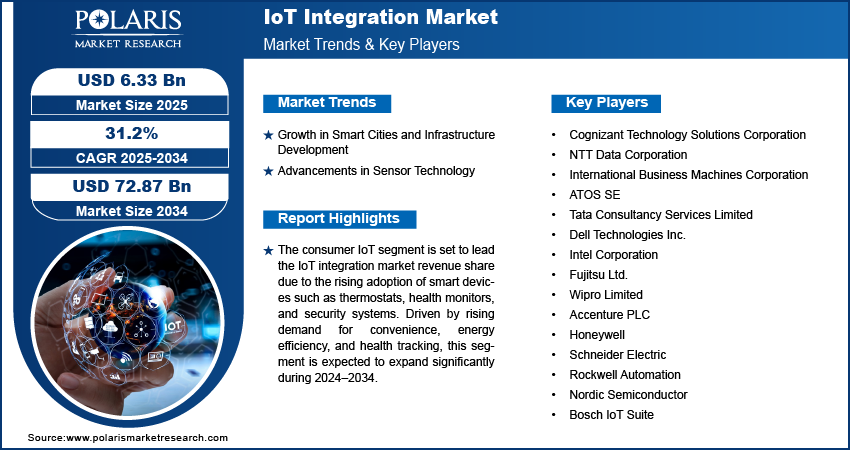

The global IoT integration market size was valued at USD 4.85 billion in 2024. The market is projected to grow from USD 6.33 billion in 2025 to USD 72.87 billion by 2034, exhibiting a CAGR of 31.2% during 2025–2034.

IoT integration involves connecting various Internet of Things (IoT) devices and systems to function together seamlessly, enabling them to share data and insights. This integration supports automated processes, boosts efficiency, and provides real-time monitoring across connected devices. A key factor driving the IoT integration market growth is the increasing demand for real-time data analytics. As businesses and organizations collect vast amounts of data from interconnected devices, there is a growing need to analyze this information instantly to make informed decisions and quickly adapt to changing conditions. Real-time data analytics allows businesses to monitor operations, detect anomalies, and identify trends in real time, rather than relying solely on historical data. This capability improves operational efficiency by enabling immediate corrective actions, optimizing processes, and enhancing overall performance. For example, in manufacturing, real-time analytics can detect equipment failures or quality issues, which can minimize downtime. In smart cities, IoT sensors provide real-time data that can help manage traffic flow, monitor air quality, and optimize resource usage. The growing volume of data generated by IoT devices is increasing the demand for advanced real-time analytics solutions and integration technologies capable of processing and analyzing this data quickly and accurately. This demand will provide the IoT integration market opportunities in the coming years.

To Understand More About this Research: Request a Free Sample Report

The increase in industrial automation is the main driver behind the IoT integration market expansion. According to the International Trade Organization, in the USA, 33,000 manufacturing industries have already integrated robotic systems and adopted industrial automation. This number is expected to grow as organizations increasingly use interconnected IoT devices. These devices bring significant improvements in efficiency and productivity by automating repetitive tasks and optimizing processes. IoT integration allows different systems and devices to communicate seamlessly, enabling automated workflows that reduce the need for manual intervention. For instance, in manufacturing, IoT sensors can monitor machinery performance in real-time, automatically adjusting operations to prevent downtime and improve output quality. In logistics, IoT systems can track inventory levels and manage supply chains autonomously, reducing delays and ensuring optimal stock levels. Furthermore, improved efficiency through IoT integration enables better resource management, energy savings, and faster response times to emerging issues. Organizations can gain actionable insights from interconnected devices, driving continuous improvements and innovation. Consequently, there is a rapidly growing demand for IoT integration solutions that support these capabilities as businesses seek to stay competitive and agile, leading to the IoT integration market development.

IoT Integration Market Driver Analysis

Rising Infrastructure Development of Smart Cities

As urban areas across the world transform into smart cities, there is an increasing need for strong IoT solutions to support interconnected infrastructure. Currently, there are ∼1.8 billion connected smart cities globally, indicating a significant trend toward using IoT technologies to improve urban living. These smart cities rely on IoT integration to manage various aspects of city life, such as traffic control, energy management, and public safety, through interconnected devices and systems. In India, this trend is particularly noticeable, with the government launching a mission to build 100 smart cities across the country. As part of this mission, 242 Application Programming Interfaces (APIs) have been introduced to facilitate better data sharing and integration between different city services and applications. Furthermore, the government announced its plans to introduce 20 additional smart cities every year. This ongoing development is creating a growing demand for IoT integration solutions that can meet the complex and changing needs of these urban environments. Therefore, the rapid expansion of smart cities and related infrastructure development boosts the IoT integration market demand.

Advancements in Sensor Technology

The IoT integration market is witnessing growth due to the advancements in the senor technology leading to the expansion of application and cost effectiveness. These advancements broaden the scope of applications and make IoT integration more cost-effective, leading to increased adoption in various industries. Modern sensors are becoming more sophisticated, compact, and affordable, allowing for the collection of precise and diverse data. This improved sensing capability enables a wider range of applications, from smart home systems that monitor and optimize energy usage to industrial IoT solutions that improve equipment maintenance and operational efficiency. Advancements in connectivity technologies, such as the deployment of 5G networks and enhancements in wireless protocols, have vastly improved the reliability and speed of data transmission. This ensures that IoT devices can communicate in real time with minimal latency, making them suitable for time-sensitive applications such as autonomous vehicles and critical infrastructure monitoring. The combination of advanced sensors and robust connectivity expands the potential uses of IoT systems and reduces costs by enabling more scalable and efficient solutions. The affordability of sensors and the widespread availability of connectivity are driving down the overall cost of implementing IoT solutions, making them more accessible to a wider range of businesses and consumers. This decrease in cost, combined with the enhanced capabilities of IoT systems, is accelerating adoption across various sectors and contributing to the IoT integration market growth.

IoT Integration Market Segment Insights

IoT Integration Market Outlook – by Enterprise Size Insights

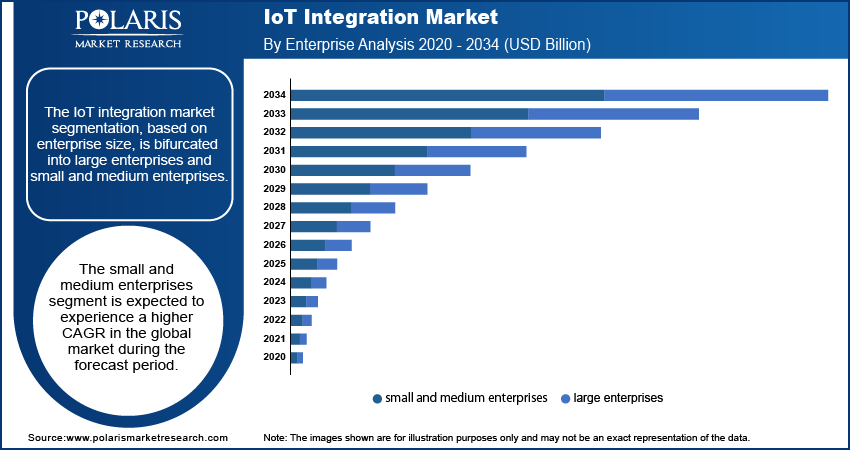

The IoT integration market segmentation, based on enterprise size, is bifurcated into large enterprises and small and medium enterprises. The small and medium enterprises segment is expected to experience a higher CAGR in the global market during the forecast period. SMEs are becoming increasingly cost-effective. Cloud-based IoT platforms, pay-per-use models, and modular solutions allow SMEs to implement IoT technology with lower upfront investments and operational costs.

IoT Integration Market Assessment – by Application Insights

The IoT integration market segmentation, based on application, includes consumer IoT, smart homes, wearables, industrial IoT, healthcare IoT, retail IoT, and others. The consumer IoT segment is expected to dominate the IoT integration market share during the forecast period. As an increasing number of consumers are adopting smart devices, there has been a proliferation of connected gadgets such as smart thermostats, wearable health monitors, and home security systems. More individuals are integrating IoT technology into their daily activities due to the growing demand for enhanced convenience, energy efficiency, and personal health monitoring. With the increasing demand for smart, interconnected solutions, the consumer IoT segment is poised for expansion in the coming years.

IoT Integration Market Regional Insights

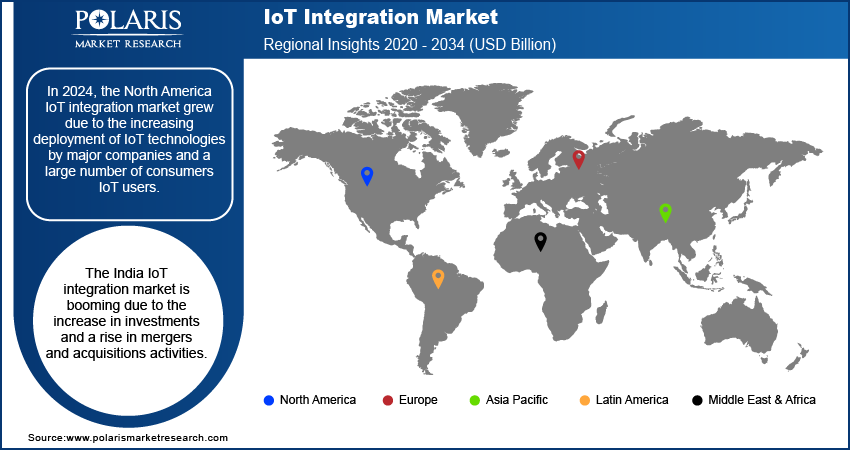

By region, the study provides the IoT integration market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share of the IoT integration market revenue. This was attributed to the increasing deployment of IoT technologies by major companies and a large number of consumer IoT users. The region leads in adopting advanced IoT solutions, with many enterprises using these technologies to improve operational efficiency. Key sectors such as manufacturing, healthcare, and transportation are particularly active in integrating IoT systems to optimize processes and enhance service delivery. Additionally, the widespread adoption of consumer IoT devices, such as smart home systems and wearable tech, contributes significantly to the market’s expansion. The economic impact of IoT is substantial. For instance, according to the US National IoT Strategy Dialogue, the revenue from IoT devices is expected to reach USD 11 trillion by 2025, representing about 11% of the world economy. As the region continues to adopt IoT innovation, the IoT integration market value in North America is expected to grow during 2025–2034.

Asia Pacific is projected to register a substantial CAGR during the forecast period due to increased automation and strategic mergers and acquisitions. Leading countries that witness market growth are China, India, and Japan, which are using IoT to improve operational efficiency in sectors such as manufacturing, healthcare, and smart cities. The shift toward automation is creating a higher demand for interconnected devices that can streamline processes and optimize resource management. Furthermore, mergers and acquisitions in the technology sector are facilitating the exchange of innovative IoT solutions and expertise, speeding up advancements and expanding market reach. These strategic partnerships allow companies to integrate advanced technologies and expand their service offerings, solidifying the region's position as a dynamic hub for IoT integration. This surge in automation and strategic partnerships is driving the Asia Pacific IoT integration market expansion.

The IoT integration market in India is experiencing significant growth due to an increase in investments and a rise in mergers and acquisitions. Investments in IoT increased to USD 15 billion in 2021 from USD 5 billion in 2019. This influx of capital is driving innovations and expanding IoT applications across industries such as manufacturing, agriculture, and smart cities. Additionally, the merger and acquisition activity has been significant, with a total deal volume of USD 93 billion recorded between 2020 and 2021. This trend of consolidation is enhancing technological capabilities and speeding up the adoption of advanced IoT solutions. These factors combined are boosting the IoT integration market development in India.

IoT Integration Market – Key Players and Competitive Insights

The IoT integration market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, advanced software technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

The competitive landscape of the IoT Integration Market is driven by new companies introducing innovative solutions, catering to the specific needs of various sectors. This dynamic environment is further intensified by ongoing advancements in product offerings, the development of new components, and a growing focus on sustainability. Additionally, the increasing demand for customized solutions across industries fuels competition. Companies are striving to meet the evolving needs of customers by offering IoT-enabled technologies that enhance efficiency, connectivity, and automation, while focusing on delivering tailored, scalable, and eco-friendly products. This competition is leading to rapid growth and innovation within the IoT integration sector. A few major players in the IoT integration market are Cognizant Technology Solutions Corporation, NTT Data Corporation, International Business Machines Corporation, ATOS SE, Tata Consultancy Services Limited, Dell Technologies Inc., Intel Corporation, Fujitsu Ltd., Wipro Limited, Accenture PLC, Honeywell, Schneider Electric, Rockwell Automation, Nordic Semiconductor, and Bosch IoT Suite.

IBM, International Business Machines Corporation, is a global American multinational technology company operating in over 75 countries. It is the largest technology firm globally and the second most valuable brand worldwide. The company generates 29% of its revenue from software, 37% from infrastructure services, 8% from hardware, and 23% from IT services. With a network of 80,000 business associates, IBM serves 5,200 clients, including 95% of the Fortune 500. While primarily a B2B (business-to-business) firm, IBM has a significant impact beyond just business clients, contributing to 50% of all wireless transactions and 90% of all credit card transactions. IBM’s IoT integration leverages its vast cloud, analytics, and AI capabilities to connect and manage IoT devices efficiently. The IBM Watson IoT Platform provides comprehensive tools for device management, data collection, and real-time analytics, enabling businesses to derive actionable insights from their IoT systems. IBM's solutions support industries such as manufacturing, automotive, and healthcare by combining IoT data with AI-driven analytics to improve operational efficiency, enable predictive maintenance, and enhance decision-making. Through its expansive ecosystem, IBM helps organizations build scalable and secure IoT solutions that foster innovation and drive operational excellence.

Honeywell International Inc. is a multinational conglomerate corporation based in Charlotte, North Carolina. The company operates in four main areas: building technologies, aerospace, safety & productivity solutions (SPS), and performance materials and technologies (PMT). One of its divisions, Honeywell Aerospace, provides aircraft engines, avionics, flight management systems, and services to airlines, airports, manufacturers, space programs, and militaries. In 2020, the company acquired Ballard Unmanned Systems to broaden its aerospace product portfolio. Honeywell serves various industries such as aerospace and travel, commercial real estate, energy, healthcare, life sciences, logistics & warehouse, retail, and utilities. Honeywell's IoT integration offers advanced solutions for smart building management, industrial operations, and safety. Its IoT platforms and devices facilitate real-time monitoring, automation, and data-driven insights across sectors such as energy management, manufacturing, and healthcare. By integrating IoT technology with Honeywell's automation and control systems expertise, businesses can improve operational efficiency, reduce costs, and enhance overall performance.

List of Key Companies in IoT Integration Market

- Cognizant Technology Solutions Corporation

- NTT Data Corporation

- International Business Machines Corporation

- ATOS SE

- Tata Consultancy Services Limited

- Dell Technologies Inc.

- Intel Corporation

- Fujitsu Ltd.

- Wipro Limited

- Accenture PLC

- Honeywell

- Schneider Electric

- Rockwell Automation

- Nordic Semiconductor

- Bosch IoT Suite

IoT Integration Industry Developments

July 2024: Arduino launched its latest innovation, the Plug and Make Kit, to make electronics more accessible and engaging for all ages. Announced by CEO Fabio Violante, the kit allowed users to create smart devices quickly and easily without soldering. Featuring projects such as a weather report device and a touchless lamp, it integrated seamlessly with Arduino Cloud for intuitive control. The kit’s release was expected to inspire countless creative projects due to its compatibility with Arduino’s comprehensive ecosystem.

June 2023: Qualcomm Technologies, Inc. announced the launch of two new modems—Qualcomm 212S and Qualcomm 9205S, in collaboration with Skylo. These modems, compliant with 3GPP Release 17 standards, were designed to provide superior connectivity for IoT devices across satellite and cellular networks. The Qualcomm 212S Modem, tailored for off-grid, stationary use, and the Qualcomm 9205S Modem, supporting hybrid connectivity, were introduced to enhance real-time tracking and device management. Both modems are integrated with the Qualcomm Aware platform for advanced asset monitoring.

October 2022: Bharti Airtel announced the launch of its “Always On” IoT connectivity solution in India. The new solution featured dual profile M2M eSIMs, enabling devices to stay connected across multiple mobile networks. Compliant with the Automotive Research Association of India’s AIS-140 standards, it met mandatory requirements for GPS tracking and connectivity in passenger vehicles, buses, and hazardous goods transport. The solution, supported by Airtel’s GSMA-compliant platform and IoT Hub, aimed to lead the market in connectivity and reliability.

IoT Integration Market Segmentation

By Enterprises Size Outlook (USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium Enterprises

By Service Outlook (USD Billion, 2020–2034)

- Device and Platform Management

- Advisory Service

- Testing Service

- Network Management Service

- System Design and Architecture

- Other Services

By Application Outlook (USD Billion, 2020–2034)

- Consumer IoT

- Smart Homes

- Wearables

- Industrial IoT

- Healthcare IoT

- Retail IoT

- Other

By Regional Outlook (USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

IoT Integration Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.85 Billion |

|

Market Size Value in 2025 |

USD 6.33 Billion |

|

Revenue Forecast by 2034 |

USD 72.87 Billion |

|

CAGR |

31.2% from 2024 to 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 4.85 billion in 2024 and is projected to grow to USD 72.87 billion by 2034.

The global market is projected to grow at a CAGR of 31.2% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are Cognizant Technology Solutions Corporation, NTT Data Corporation, International Business Machines Corporation, ATOS SE, Tata Consultancy Services Limited, Dell Technologies Inc., Intel Corporation, Fujitsu Ltd., Wipro Limited, Accenture PLC, Honeywell, Schneider Electric, Rockwell Automation, Nordic Semiconductor, and Bosch IoT Suite.

The small and medium enterprises segment is anticipated to experience a significant CAGR in the global market during the forecast period due to the increasing demand from small and medium enterprises.

The consumer IoT segment accounted for the largest revenue share of the market in 2024 due to the increasing number of consumers adopting smart devices.