Inverter Market Share, Size, Trends, Industry Analysis Report

By Type (Vehicle, Solar, Others); By Connection Type (On grid, Off-grid); By Phase; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 115

- Format: PDF

- Report ID: PM2547

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

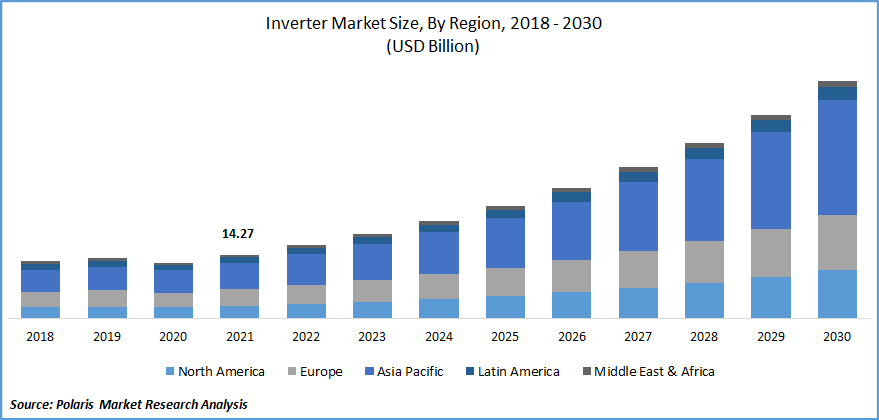

The global inverter market was valued at USD 14.27 billion in 2021 and is expected to grow at a CAGR 15.8% during the forecast period. It is a device that converts direct current into alternating current. North America & Asia-Pacific serve as the main regions in the industry. This is attributed to the rise in demand for electricity from building & construction, automotive, oil & gas, and other manufacturing industries in the regions, which has fueled the demand for renewable power.

Know more about this report: Request for sample pages

Automakers are steadily switching their production from conventional engine vehicles to hybrid and electric vehicles in response to increasingly strict emission rules around the world. Governments have also introduced incentives, including reduced vehicle taxes, bonus payments, and premiums, to encourage the purchase of electric vehicles in their individual countries.

In addition, the expansion of charging station infrastructure across the globe has contributed to the rise in the sales of electric vehicles. Manufacturers operating in the industry constantly attempt to increase the size and efficiency of their devices. Automakers are paying increased attention to the trend of coupling an inverter with a motor or converter.

The raw components needed for the manufacturing of products are provided by the component suppliers. Furthermore, products manufactured are distributed through distribution channels across various end users.

These are mainly used in construction, automotive, oil & gas, manufacturing, residential, commercial, utilities, and other end users. Consequently, post-sale services such as maintenance and fixing problems associated with products are provided by service companies that operate in the industry.

The COVID-19 pandemic affected the global inverter market and associated opportunities. A huge impact has been witnessed on the countries that import solar components such as inverters and solar modules from the largest producer of solar equipment, such as China, owing to the lockdown in economies across the globe.

For instance, India imports almost 85.0% of the solar components from China every year; thus, there was a huge impact on the solar projects scheduled in India in the year 2020-2021. These solar projects faced delays in the installations and construction, which further affected the solar market in India.

Moreover, distribution companies delayed payments of renewable energy projects owing to delays in payments by various consumers affected due to the COVID-19 scenario, including manufacturing units, railways, commercial complexes, metro rail, corporate offices, and others.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growth of the global market is primarily driven by the easy installation of micro and string inverters. An increase in investment toward the construction of renewable power infrastructure, owing to the rise in demand for electricity from various applications, has fueled the growth of the market. The surge in investment in the rural electrification and renewable energy sector is anticipated to create lucrative opportunities for players in the industry.

With the increase in usage of large-sized string inverters in the utility system and other commercial & industrial sectors, installation for the large solar systems is easier as it can connect multiple solar panels; thereby fueling the growth of the industry globally.

Report Segmentation

The market is primarily segmented based on type, connection type, phase, end-use, and region.

|

By Type |

By Connection Type |

By Phase |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Vehicle segment is expected to be the fastest growing during the forecast period

The market for the vehicle segment is expected to be the fastest growing during the forecast period. It is used in battery electric vehicles to converting direct current into alternating current and is used in the motors of electric vehicles. It also increases or decreases engine output or torque by adjusting the signal amplitude.

Manufacturers strive to deliver such systems that are more efficient and reliable to contribute to a cleaner and more sustainable world. For instance, in June 2022, GKN Automotive launched a new inverter that provides OEMs 800V electric vehicle technology. It provides faster charging times, larger battery sizes, and better electric vehicle performance in the future.

On-grid accounted for the largest market share

By connection type, the market is segmented on-grid and off-grid. Among these, on-grid is expected to be the largest market. On-grid is grid-tied, which is used to feed the energy converted into the main grid. Feeding of energy converted is possible by matching their phase and frequency.

The main power grid is used to supply power to consumers ranging from residential to industrial applications. On-grid solar inverters offer ease of installation and affordability while addressing high electricity.

Single phase is expected to be the fastest growing segment during the forecast period

By phase, the market is categorized into a single phase and three phases. The single-phase segment is expected to be the fastest-growing segment during the forecast period. Single-phase inverters are increasingly used in residential & small commercial applications to power home appliances, parking lights, and commercial buildings.

An increase in demand for single-phase inverters from residential and small commercial & industrial applications, along with a reduction in the cost of the battery, drives the growth of the solar market. Nowadays, streetlights, signals, and other appliances are increasingly powered with the help of solar energy, which requires a solar inverter to convert DC power into AC power for energizing these appliances.

Solar string inverters are used in energizing agricultural applications, including motors, pumps, and others, which in turn boosts the demand for single-phase inverters, thereby fueling the growth of the industry during the forecast period.

Residential segment accounted for the largest market share

By end-use, the market is categorized into residential, commercial, and industrial. The residential segment is expected to account for the largest share during the forecast period. Solar panels can be installed on the rooftops of the building, and hence they can get consistent sun energy throughout the day. Owing to this, there is an increase in demand for solar inverters from the residential sector.

Moreover, rapid growth in the solar energy industry over the last decade is projected to continue in the upcoming years, owing to increased investments in renewable energy across the globe. In addition, an increase in investment toward rural & remote area electrification further fuels the growth of the industry during the forecast period.

The decline in prices of components and a surge in awareness toward renewable sources of energy to reduce environmental pollution are anticipated to drive the growth of the industry in the upcoming years.

Asia-Pacific region will lead the global inverter market by 2030

The Asia-Pacific region is expected to account for a larger share in the inverter market. The inverter market in Asia-Pacific is mainly driven by developing economies such as China, Japan, India, and Australia, as there is rapid growth in the energy sectors. This is owing to a large number of key players and the availability of manufacturing facilities in these countries.

Moreover, the increase in the use of inverters in the commercial & industrial sectors has fueled the growth of the industry. According to the International Renewable Energy Agency (IRENA), in the Asia-Pacific region, China, Japan, India, and Australia are among the top ten countries in the world with solar energy installed, which in turn drives the growth of the inverter market globally.

Competitive Insight

Some major players operating in the global market include Aptiv PLC, Changsha BYD, Continental AG, Delta Electronics, Inc., DENSO Corporation, FIMER S.P.A, Hitachi Astemo Ltd, Huawei Technologies Co. Ltd., Lear Corporation, Mitsubishi Electric Corporation, Nissan Motor Co., Ltd., Robert Bosch GmbH, Siemens AG, SMA Solar Technology AG, and Sungrow Power Supply Co. Ltd.

Recent Developments

In June 2021, Sungrow entered into a partnership with Krannich Solar for expanding its European product portfolio for economic decarbonization.

In April 2021, Mitsubishi Electric Corporation developed its seven new X-series products including HVIGBT and HVDIODEs to meet demands for smaller and robust inverter systems in large equipment.

Inverter Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 14.27 billion |

|

Revenue forecast in 2030 |

USD 52.90 billion |

|

CAGR |

15.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Connection Type, By Phase, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Aptiv PLC, Changsha BYD, Continental AG, Delta Electronics, Inc., DENSO Corporation, FIMER S.P.A, Hitachi Astemo Ltd, Huawei Technologies Co. Ltd., Lear Corporation, Mitsubishi Electric Corporation, Nissan Motor Co., Ltd., Robert Bosch GmbH, Siemens AG, SMA Solar Technology AG, and Sungrow Power Supply Co. Ltd. |